Finance

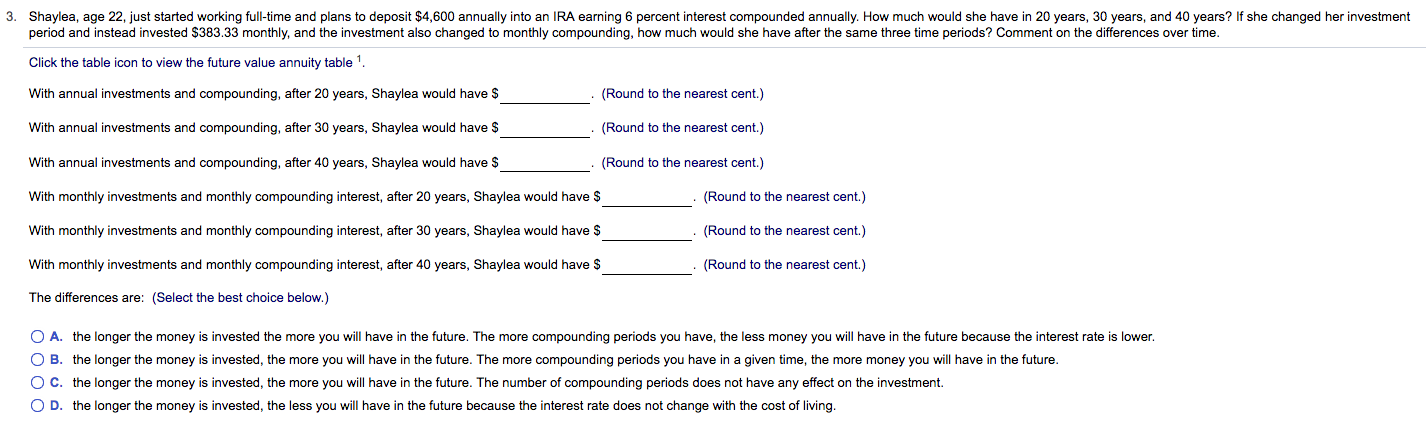

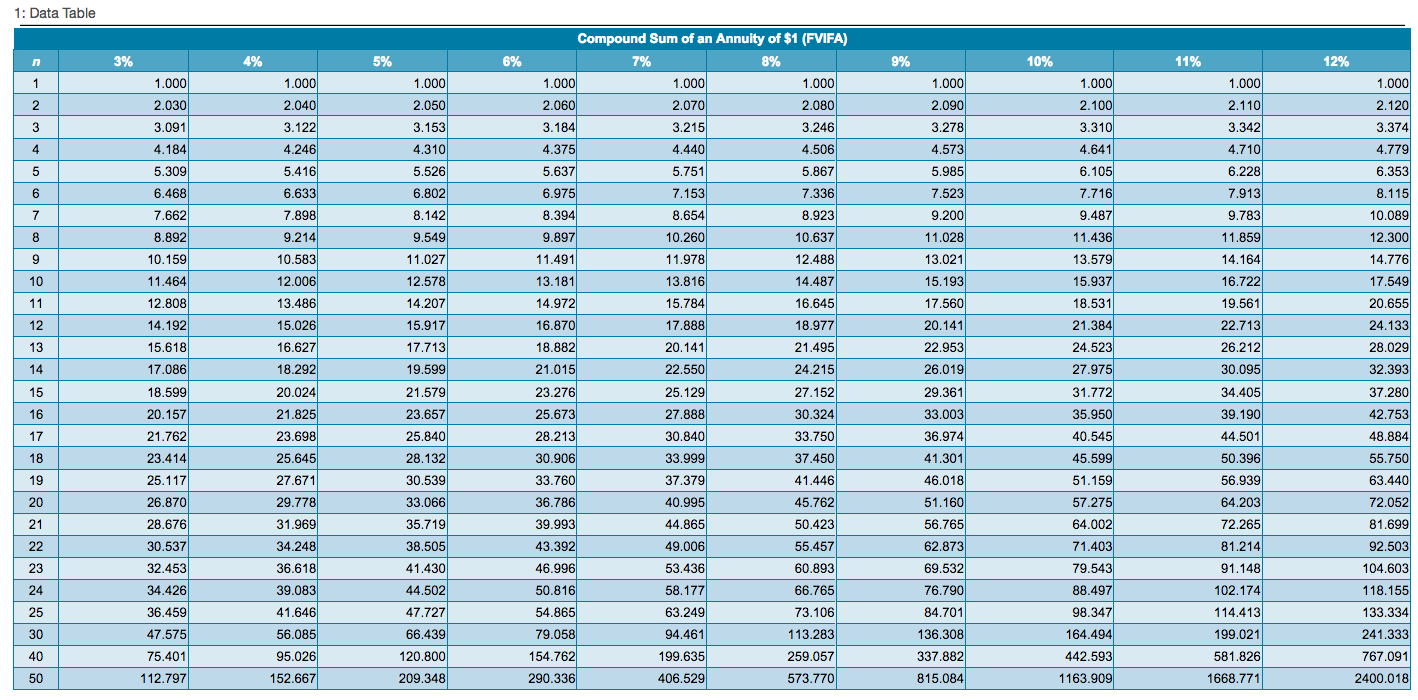

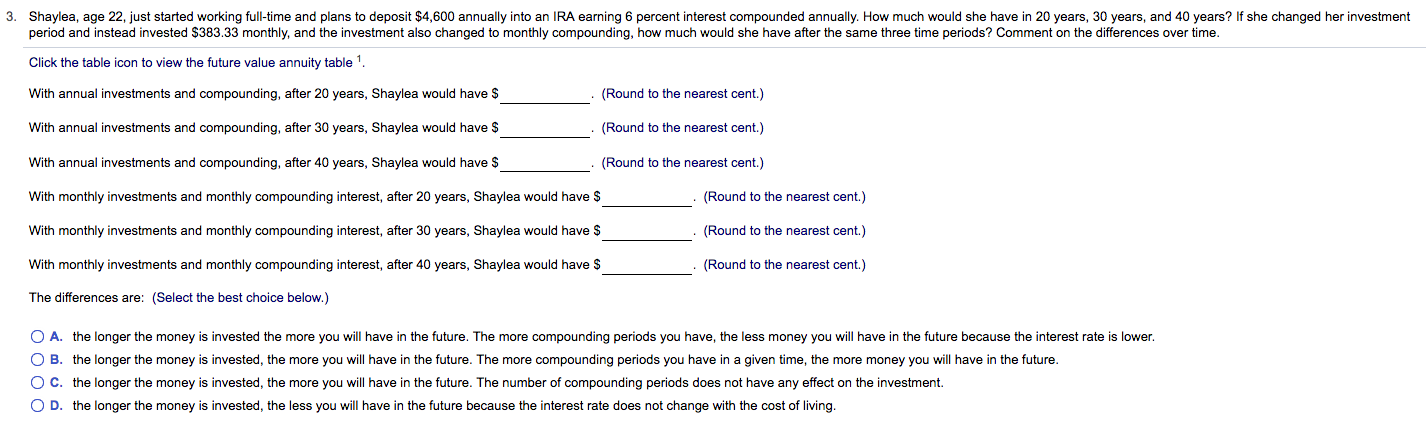

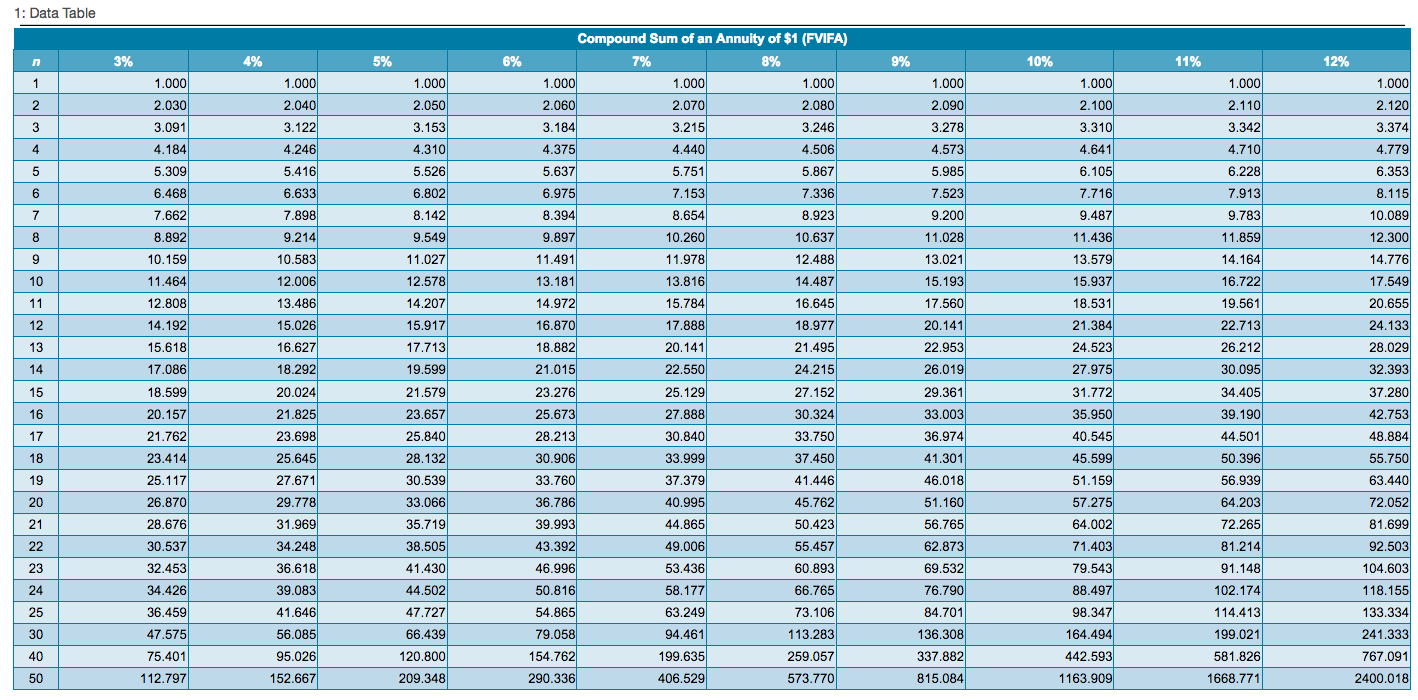

3. Shaylea, age 22, just started working full-time and plans to deposit $4,600 annually into an IRA earning 6 percent interest compounded annually. How much would she have in 20 years, 30 years, and 40 years? If she changed her investment period and instead invested $383.33 monthly, and the investment also changed to monthly compounding, how much would she have after the same three time periods? Comment on the differences over time. Click the table icon to view the future value annuity table 1 With annual investments and compounding, after 20 years, Shaylea would have $ (Round to the nearest cent.) With annual investments and compounding, after 30 years, Shaylea would have $ (Round to the nearest cent.) With annual investments and compounding, after 40 years, Shaylea would have $ (Round to the nearest cent.) With monthly investments and monthly compounding interest, after 20 years, Shaylea would have $ (Round to the nearest cent.) With monthly investments and monthly compounding interest, after 30 years, Shaylea would have $ (Round to the nearest cent) With monthly investments and monthly compounding interest, after 40 years, Shaylea would have $ (Round to the nearest cent.) The differences are: (Select the best choice below.) O A. the longer the money is invested the more you will have in the future. The more compounding periods you have, the less money you will have in the future because the interest rate is lower. O B. the longer the money is invested, the more you will have in the future. The more compounding periods you have in a given time, the more money you will have in the future. O C. the longer the money is invested, the more you will have in the future. The number of compounding periods does not have any effect on the investment. OD. the longer the money is invested, the less you will have in the future because the interest rate does not change with the cost of living. 1: Data Table n 3% 4% 5% 6% 9% 10% 11% 12% 1 1.000 1.000 1.000 1.000 1.000 2.090 2 2.110 1.000 2.030 3.091 4.184 3 2.040 3.122 4.246 1.000 2.050 3.153 4.310 5.526 3.278 3.342) 2.100 3.310 4.641 6.105 2.120 3.374 4.779 6.353 4 4.573 4.710 5 5.309 5.416 5.985 6.228 6 6.468 7.662 Compound Sum of an Annuity of $1 (FVIFA) 7% 8% 1.000 1.000 1.000 2.060 2.070 2.080 3.184 3.215 3.246 4.375 4.440 4.506 5.637 5.751 5.867 6.975 7.153 7.336 8.394 8.654 8.923 9.897 10.260 10.637 11.491 11.978 12.488 13.181 13.816 14.487 14.972 15.784 16.645 16.870 17.888 18.977 18.882 20.141 21.495 21.015 22.550 24.215 6.802 8.142 9.549 7.913 9.783 8.115 10.089 7 6.633 7.898 9.214 10.583 12.006 7.716 9.487 11.436 13.579 8 8.892 12.300 14.776 9 11.027 7.523 9.200 11.028 13.021 15.193 17.560 20.141 22.953 10.159 11.464 12.808 14.192 15.618) 10 11 17.549 11.859 14.164 16.722 19.561 22.713 12.578 14.207 20.655) 24.133 12 13 13.486 15.026 16.627 18.292 20.024 21.825 15.917 17.713 19.599 26.212 28.029 32.393 17.086 26.019 14 15 16 23.276 18.599 20.157 27.152 30.324 33.750 29.361 33.003 37.280 42.753 48.884 17 21.762 23.698 21.579 23.657 25.840 28.132 30.539 33.066 25.129 27.888 30.840 33.999 37.379) 40.995 18 25.673 28.213 30.906 33.760 36.786 25.645 27.671 37.450 41.446 45.762 19 15.937 18.531 21.384 24.523 27.975 31.772 35.950 40.545 45.599 51.159 57.275 64.002 71.403 79.543 88.497 98.347 164.494 30.095 34.405 39.190 44.501 50.396 56.939 64.203 72.265 81.214 91.148 20 36.974 41.301 46.018 51.160 56.765 62.873 69.532 76.790 55.750 63.440 72.052 81.699 92.503 21 39.993 43.392 23.414 25.117 26.870 28.676 30.537 32.453 34.426 36.459 47.575 75.401 112.797 50.423 55.457 22 44.865 49.006 53.436 35.719 38.505 41.430 44.502 23 29.778 31.969 34.248 36.618 39.083 41.646 56.085 95.026 46.996 60.893 66.765 24 50.816 25 47.727 66.439 54.865 79.058 58.177 63.249 94.461 73.106 113.283 84.701 136.308 102.174 114.413 199.021 104.603 118.155 133.334 241.333 767.091 2400.018 30 40 154.762 199.635 337.882 442.593 581.826 120.800 209.348 259.057 573.770 50 152.667 290.336 406.529 815.084 1163.909 1668.771