Question

Finance 9: Please answer all. Please show all your work in details together with formula, etc, and ensure that your calculations are correct. Thank you

Finance 9: Please answer all. Please show all your work in details together with formula, etc, and ensure that your calculations are correct. Thank you very much

Question 6: Use the accompanying data to estimate the beta of Shoe Company stock using linear regression.

| Date | Value Weighted Market | Shoe Company |

| Jan-02 | -1.5574 | 6.417 |

| Feb-02 | -2.106 | -1.8415 |

| Mar-02 | 3.5174 | 1.9515 |

| Apr-02 | -6.2894 | -11.2889 |

| May-02 | -0.8441 | 0.5546 |

| Jun-02 | -7.3271 | -0.2001 |

| Jul-02 | -7.8394 | -8.2199 |

| Aug-02 | 0.5002 | -12.5803 |

| Sep-02 | -11.0694 | 0.1556 |

| Oct-02 | 8.641 | 9.1284 |

| Nov-02 | 5.8495 | -5.2265 |

| Dec-02 | -6.0593 | -0.5475 |

| Jan-03 | -2.6388 | 0.0848 |

| Feb-03 | -1.5753 | 4.1082 |

| Mar-03 | 0.8501 | 11.1581 |

| Apr-03 | 8.13 | 4.018 |

| May-03 | 5.1083 | 4.4106 |

| Jun-03 | 1.1488 | -4.2249 |

| Jul-03 | 1.6041 | -3.294 |

| Aug-03 | 1.9626 | 10.0993 |

| Sep-03 | -1.1053 | 6.8208 |

| Oct-03 | 5.6364 | 4.906 |

| Nov-03 | 0.7434 | 5.0675 |

| Dec-03 | 5.1531 | 2.0948 |

| Jan-04 | 1.6689 | 1.7393 |

| Feb-04 | 1.2128 | 5.053 |

| Mar-04 | -1.5398 | 6.5318 |

| Apr-04 | -1.6966 | -7.6307 |

| May-04 | 1.2892 | -1.1639 |

| Jun-04 | 1.7955 | 6.5555 |

| Jul-04 | -3.4476 | -4.0706 |

| Aug-04 | 0.2068 | 3.3801 |

| Sep-04 | 0.968 | 4.8291 |

| Oct-04 | 1.4703 | 2.9405 |

| Nov-04 | 3.9228 | 3.9505 |

| Dec-04 | 3.2299 | 7.2991 |

| Jan-05 | -2.7372 | -4.6474 |

| Feb-05 | 1.9447 | 0.1711 |

| Mar-05 | -1.9396 | -4.1897 |

| Apr-05 | -2.0791 | -8.0876 |

| May-05 | 2.8541 | 6.8211 |

| Jun-05 | -0.1896 | 5.3735 |

| Jul-05 | 3.3446 | -3.6072 |

| Aug-05 | -1.1195 | -6.1982 |

| Sep-05 | 0.586 | 3.5763 |

| Oct-05 | -2.0088 | 2.5185 |

| Nov-05 | 3.4951 | 1.2649 |

| Dec-05 | -0.2411 | 1.7644 |

| Jan-06 | 2.3273 | -7.1601 |

| Feb-06 | -0.1789 | 6.7907 |

| Mar-06 | 0.9358 | -1.8851 |

| Apr-06 | 0.8969 | -4.2955 |

| May-06 | -3.1966 | -2.1797 |

| Jun-06 | -0.3517 | 0.871 |

| Jul-06 | 0.224 | -2.902 |

| Aug-06 | 2.0398 | 1.812 |

| Sep-06 | 2.2218 | 8.4189 |

| Oct-06 | 2.8809 | 4.4056 |

| Nov-06 | 1.4366 | 7.2146 |

| Dec-06 | 0.952 | 0.1484 |

What is the beta? (Round to decimal places)

Question 7:

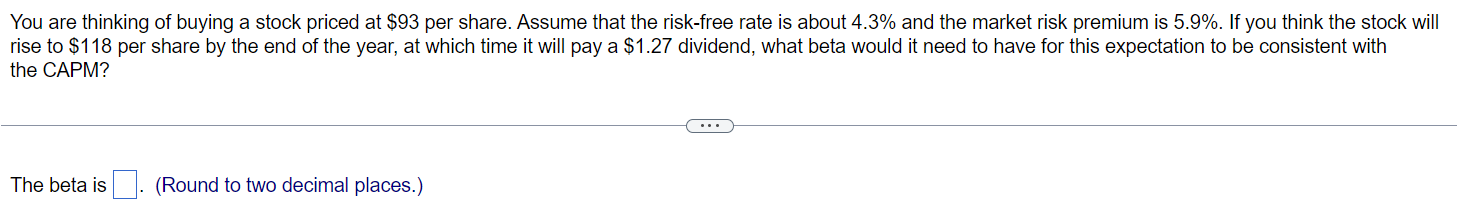

7.1 What is the beta? Round to 2 decimal places

7.2. At which time it will pay a $1.27 dividend? What beta would it need to have for this expectation to be consistent with the CAPM?

Question 8:

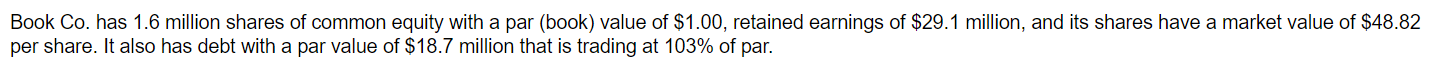

8a. What is the market value of its equity? The market value of the equity is how many million dollars?. (Round to two decimal places.)

8b. What is the market value of its debt? The market value of the debt is how many million dollars?. (Round to two decimal places.)

8c. What weights should it use in computing its WACC?

Round to 2 decimal places

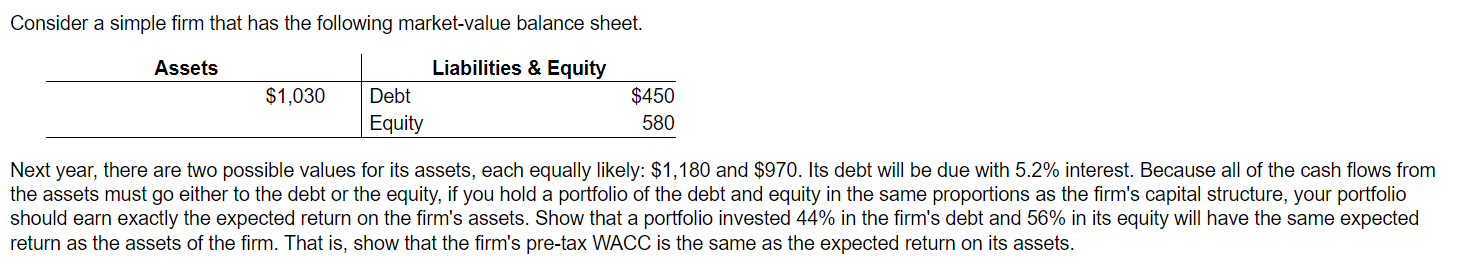

Question 9

9.1) If the assets will be worth $1,180 in one year, the expected return on assets will be how many percents? (round to 1 decimal place)

9.2) If the assets will be worth $970 in one year, the expected return on assets will be how many percents? (round to 1 decimal place)

9.3) Show that a portfolio invested 44% in the firm's debt and 56% in its equity will have the same expected return as the assets of the firm. That is, show that the firm's pre-tax WACC is the same as the expected return on its assets.

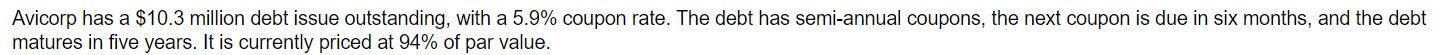

Question 10:

10a) The cost of debt is how many percents per year (round to decimal places)

10b) What is Avicorp's pre-tax cost of debt? Note: Compute the effective annual return.

10c) If Avicorp faces a 40% tax rate, what is its after-tax cost of debt?

Note: Assume that the firm will always be able to utilize its full interest tax shield.

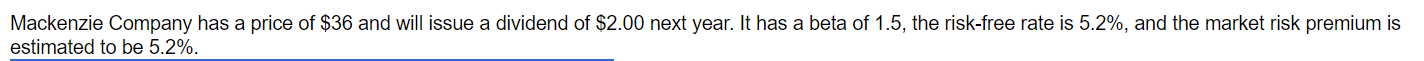

Question 11:

11a. Use the CAPM to estimate the equity cost of capital for Mackenzie. The equity cost of capital for Mackenzie is how many percent? (Round to two decimal places.)

11b. Under the CDGM, at what rate do you need to expect Mackenzie's dividends to grow to get the same equity cost of capital as in part 11(a)?

You are thinking of buying a stock priced at $93 per share. Assume that the risk-free rate is about 4.3% and the market risk premium is 5.9%. If you think the stock will rise to $118 per share by the end of the year, at which time it will pay a $1.27 dividend, what beta would it need to have for this expectation to be consistent with the CAPM? The beta is (Round to two decimal places.) Book Co. has 1.6 million shares of common equity with a par (book) value of $1.00, retained earnings of $29.1 million, and its shares have a market value of $48.82 per share. It also has debt with a par value of $18.7 million that is trading at 103% of par. Consider a simple firm that has the following market-value balance sheet. Next year, there are two possible values for its assets, each equally likely: $1,180 and $970. Its debt will be due with 5.2% interest. Because all of the cash flows from the assets must go either to the debt or the equity, if you hold a portfolio of the debt and equity in the same proportions as the firm's capital structure, your portfolio should earn exactly the expected return on the firm's assets. Show that a portfolio invested 44% in the firm's debt and 56% in its equity will have the same expected return as the assets of the firm. That is, show that the firm's pre-tax WACC is the same as the expected return on its assets. Avicorp has a $10.3 million debt issue outstanding, with a 5.9% coupon rate. The debt has semi-annual coupons, the next coupon is due in six months, and the debt matures in five years. It is currently priced at 94% of par value. Mackenzie Company has a price of $36 and will issue a dividend of $2.00 next year. It has a beta of 1.5 , the risk-free rate is 5.2%, and the market risk premium is estimated to be 5.2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started