Answered step by step

Verified Expert Solution

Question

1 Approved Answer

finance coorporation A firm plans to build a plant on land it owns. The firm paid $200,000 for the land 30 years ago. Its current

finance coorporation

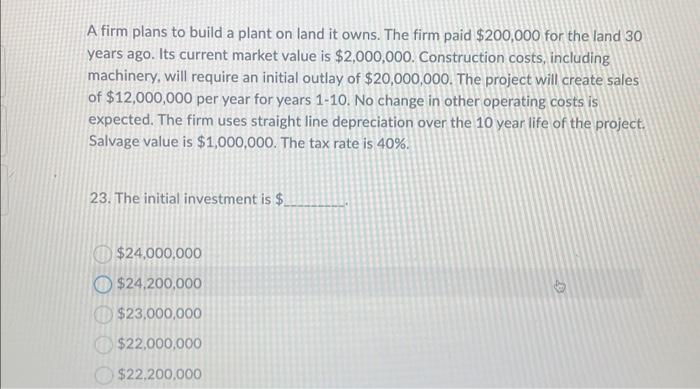

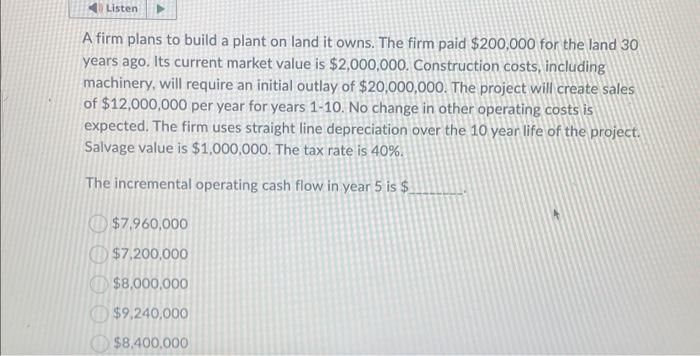

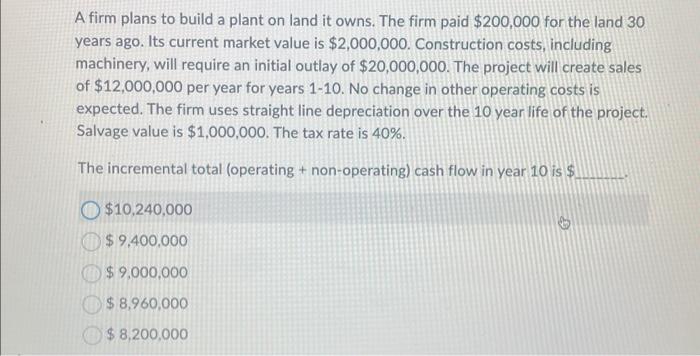

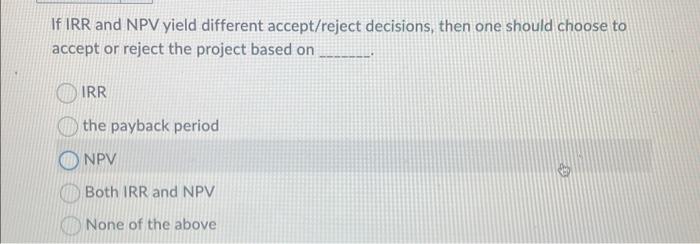

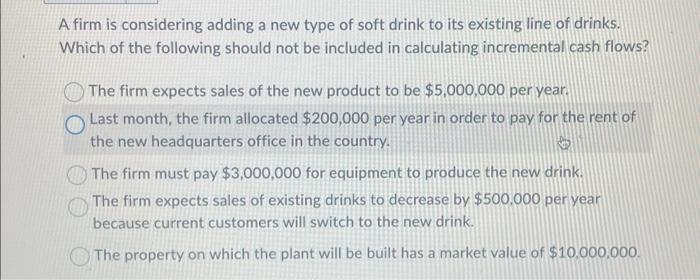

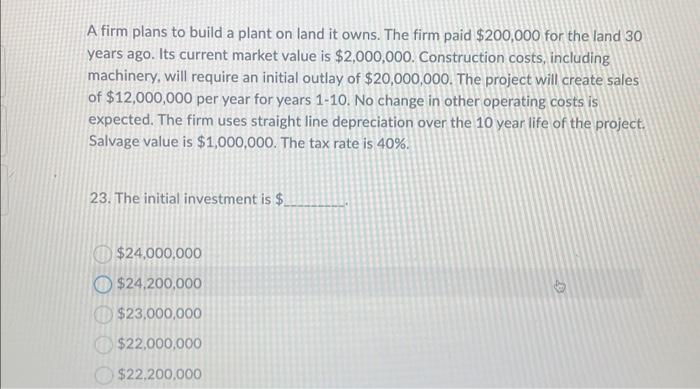

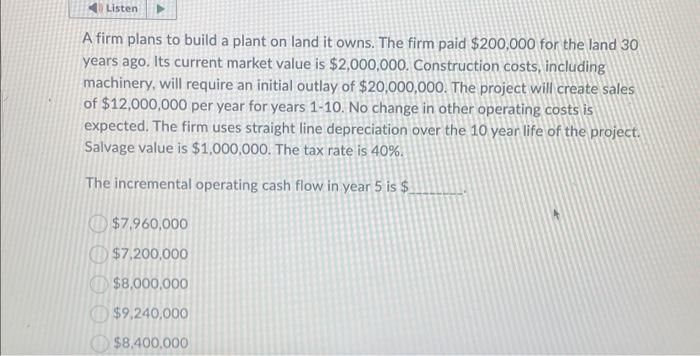

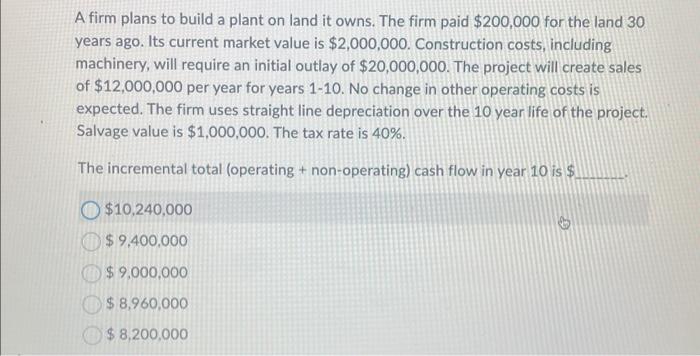

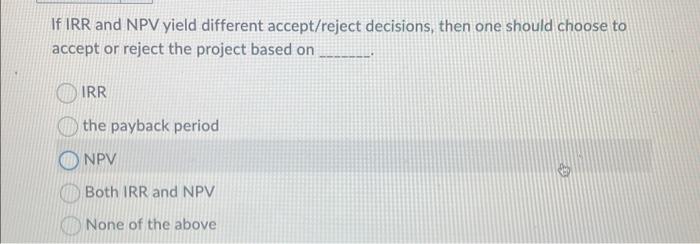

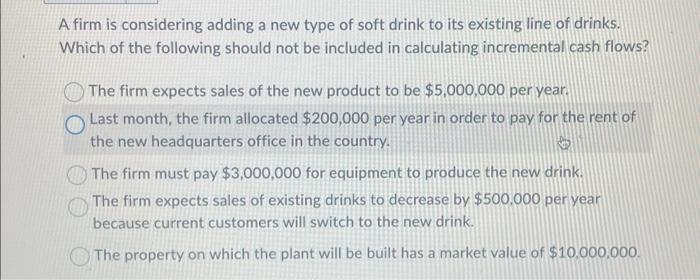

A firm plans to build a plant on land it owns. The firm paid $200,000 for the land 30 years ago. Its current market value is $2,000,000. Construction costs, including machinery, will require an initial outlay of $20,000,000. The project will create sales of $12,000,000 per year for years 1-10. No change in other operating costs is expected. The firm uses straight line depreciation over the 10 year life of the project. Salvage value is $1,000,000. The tax rate is 40%. 23. The initial investment is $ $24,000,000 $24,200,000 $23,000,000 $22,000,000 $22,200,000 A firm plans to build a plant on land it owns. The firm paid $200,000 for the land 30 years ago. Its current market value is $2,000,000. Construction costs, including machinery, will require an initial outlay of $20,000,000. The project will create sales of $12,000,000 per year for years 1-10. No change in other operating costs is expected. The firm uses straight line depreciation over the 10 year life of the project. Salvage value is $1,000,000. The tax rate is 40%. The incremental operating cash flow in year 5 is $ $7,960,000 $7,200,000 $8,000,000 $9,240,000 $8,400.000 A firm plans to build a plant on land it owns. The firm paid $200,000 for the land 30 years ago. Its current market value is $2,000,000. Construction costs, including machinery, will require an initial outlay of $20,000,000. The project will create sales of $12,000,000 per year for years 1-10. No change in other operating costs is expected. The firm uses straight line depreciation over the 10 year life of the project. Salvage value is $1,000,000. The tax rate is 40%. The incremental total (operating + non-operating) cash flow in year 10 is: $10,240,000$9,400,000$9,000,000$8,960,000$8,200,000 If IRR and NPV yield different accept/reject decisions, then one should choose to accept or reject the project based on IRR the payback period NPV Both IRR and NPV None of the above A firm is considering adding a new type of soft drink to its existing line of drinks. Which of the following should not be included in calculating incremental cash flows? The firm expects sales of the new product to be $5,000,000 per year. Last month, the firm allocated $200,000 per year in order to pay for the rent of the new headquarters office in the country. The firm must pay $3,000,000 for equipment to produce the new drink. The firm expects sales of existing drinks to decrease by $500,000 peryear because current customers will switch to the new drink. The property on which the plant will be built has a market value of $10.000.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started