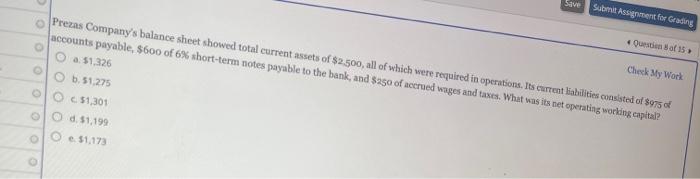

Finance grew out of economics and accounting, and it is generally divided into three areas. decisions about acquiring assets, raising capital; and running the firm so as to maximize its varue and stock and bond prices are determined. market analysis. These areas are ciosely invercontiected. invelve decisions concerning stocks ang nonds and holu de security aralysis, poctfoic theory, and Which of the following statements is CORRECT? a. The threat of takeover generally increases potential conflicts between stockholders and managers. b. The creation of the Securites and Exchange Commission (SEOQ has elimnated conflicts between managers and stockholders. c. The threat of takeovers tends to reduce potential conflicts between stockholders and managers d. Managerial compensation plans cannot be used to reduce potential confilicts between stockholders and manager. Which of the following statements is CORRECT? a. The threat of takeover generally increases potential conlicts between stockholders and manages. b. The creation of the Securities and Exchange Commisaion (SEO has eliminated conficts beiween managen and stockholders. d. Managerial compensation plans cannot be used to reduce potential conficts between stockholders and managers. e. One of the way capital structure. capital structure. Which of the following statements is CORRECT? a. The threat of takeover generally ncreases potentiat conticts between stockolders and managers. b. The creation of the securities and Exchange Commission (SEO) has eliminated conflicts between manigers and stockholders c. The threat of takeovers tends to reduce potential confilcts between stockholders and managors. d. Managerlal compensation plans cannot be used to reduce potential conflicts between stockholders and managers. e. One of the ways in which firms can mitigate or reduce potential conflcts between bondholders and stockholders is by increasing the athoure af dett in the firms capital structure. b. 51,275 c. $1,301 d. $1,199 c. $1,173 Finance grew out of economics and accounting, and it is generally divided into three areas. decisions about acquiring assets, raising capital; and running the firm so as to maximize its varue and stock and bond prices are determined. market analysis. These areas are ciosely invercontiected. invelve decisions concerning stocks ang nonds and holu de security aralysis, poctfoic theory, and Which of the following statements is CORRECT? a. The threat of takeover generally increases potential conflicts between stockholders and managers. b. The creation of the Securites and Exchange Commission (SEOQ has elimnated conflicts between managers and stockholders. c. The threat of takeovers tends to reduce potential conflicts between stockholders and managers d. Managerial compensation plans cannot be used to reduce potential confilicts between stockholders and manager. Which of the following statements is CORRECT? a. The threat of takeover generally increases potential conlicts between stockholders and manages. b. The creation of the Securities and Exchange Commisaion (SEO has eliminated conficts beiween managen and stockholders. d. Managerial compensation plans cannot be used to reduce potential conficts between stockholders and managers. e. One of the way capital structure. capital structure. Which of the following statements is CORRECT? a. The threat of takeover generally ncreases potentiat conticts between stockolders and managers. b. The creation of the securities and Exchange Commission (SEO) has eliminated conflicts between manigers and stockholders c. The threat of takeovers tends to reduce potential confilcts between stockholders and managors. d. Managerlal compensation plans cannot be used to reduce potential conflicts between stockholders and managers. e. One of the ways in which firms can mitigate or reduce potential conflcts between bondholders and stockholders is by increasing the athoure af dett in the firms capital structure. b. 51,275 c. $1,301 d. $1,199 c. $1,173