Question: Finance Help please thumbs up for all correct answers . 2 part question. plaase use average sample not population please answer question i zoom on

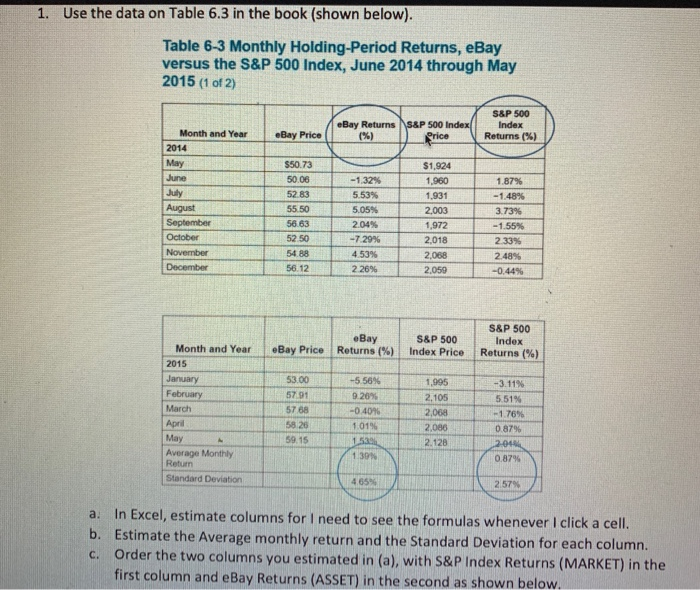

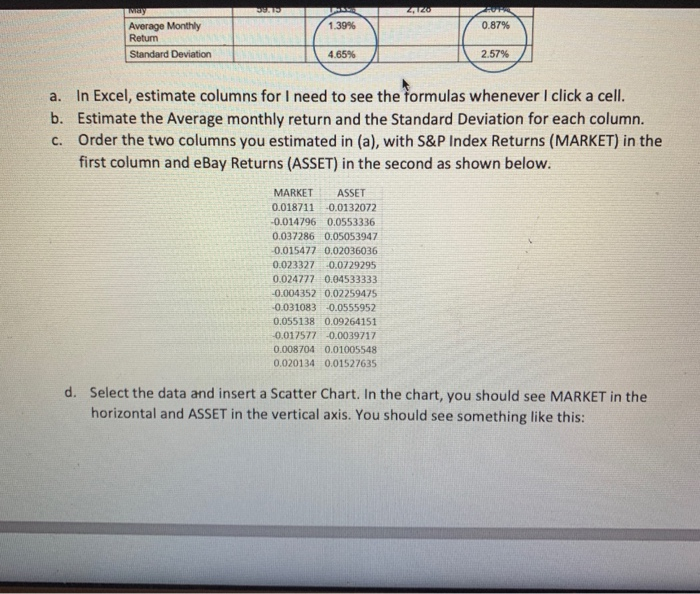

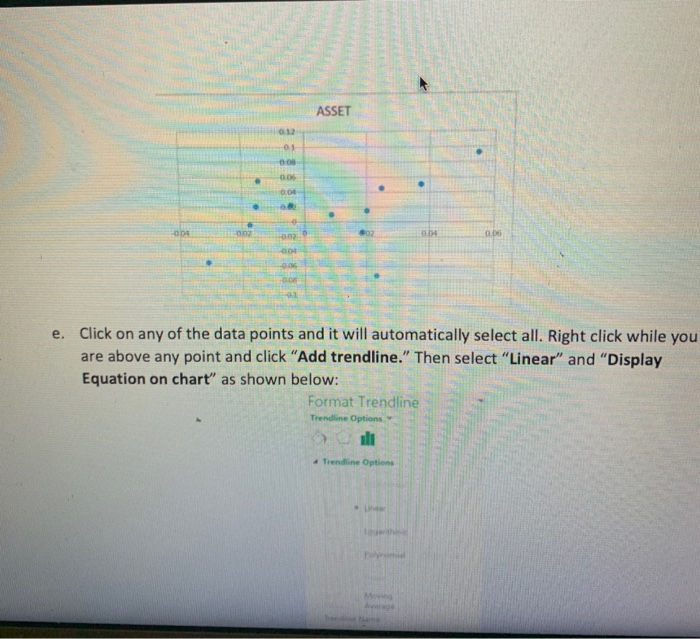

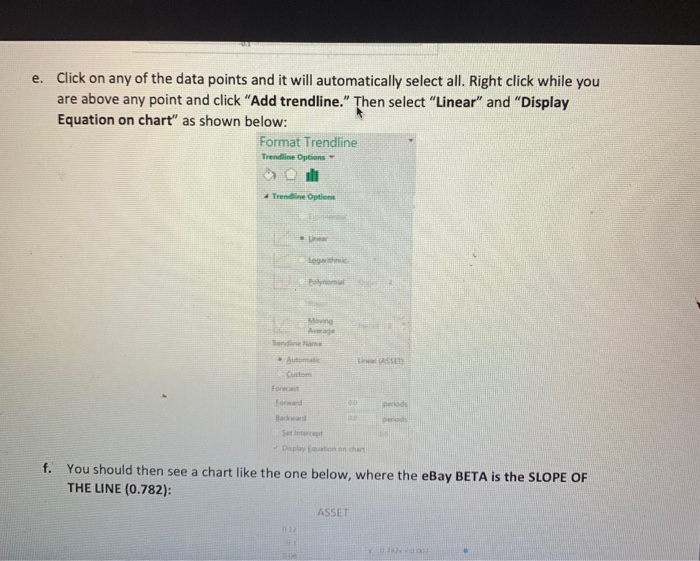

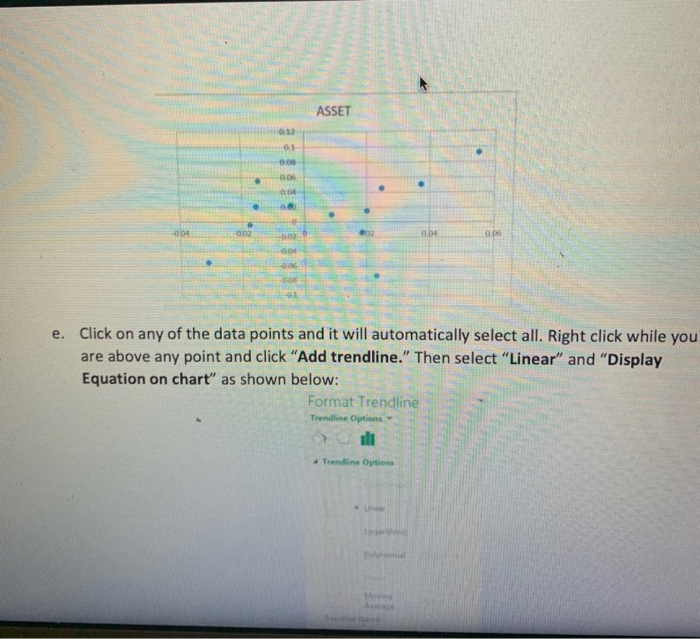

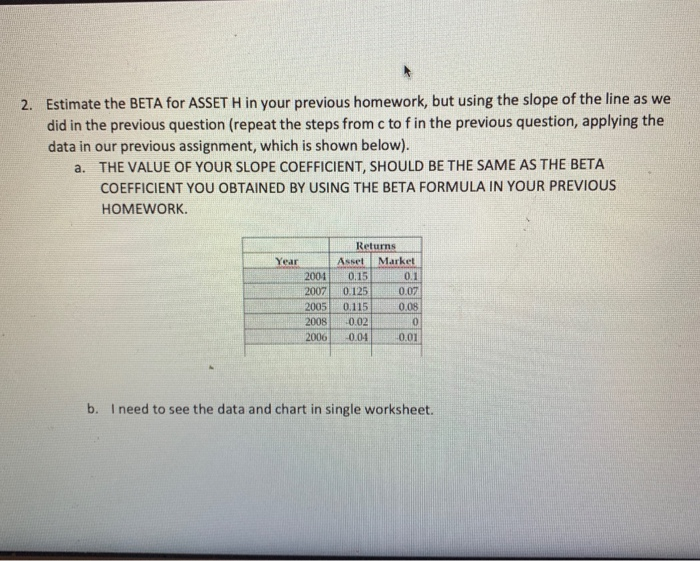

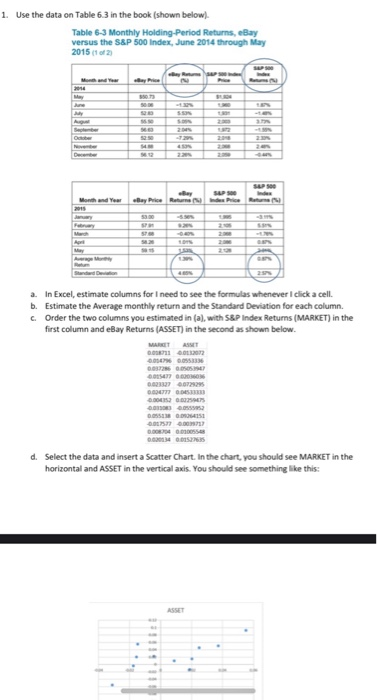

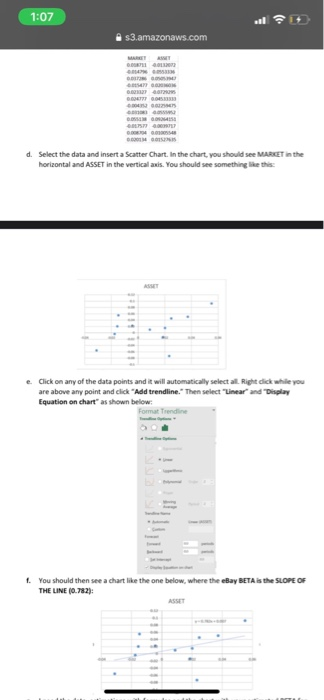

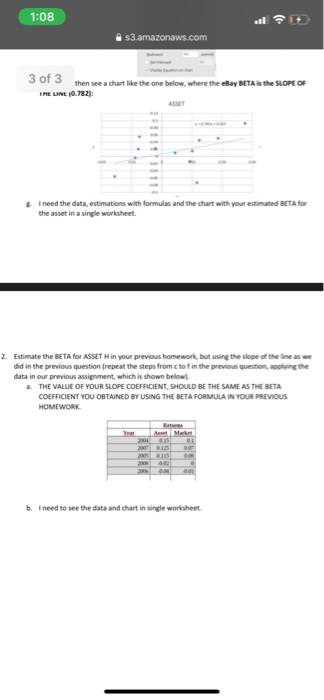

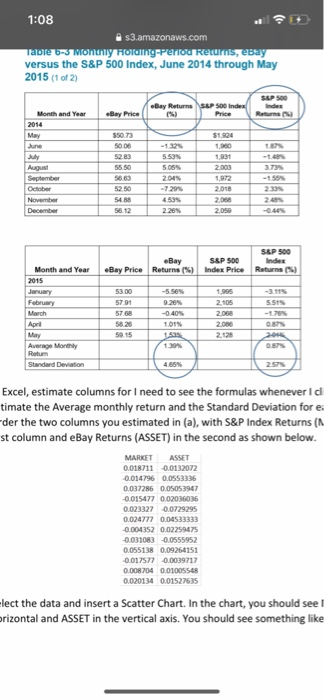

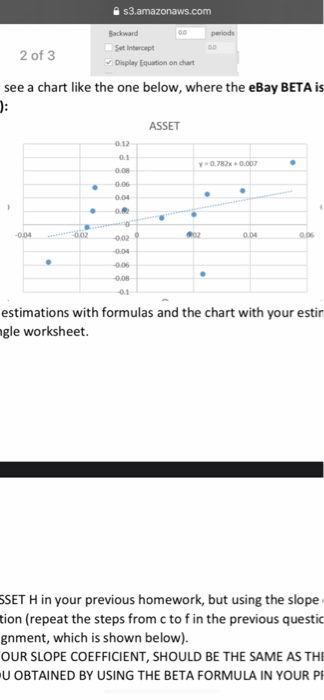

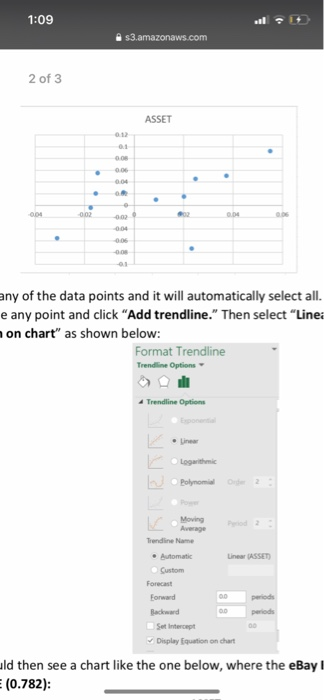

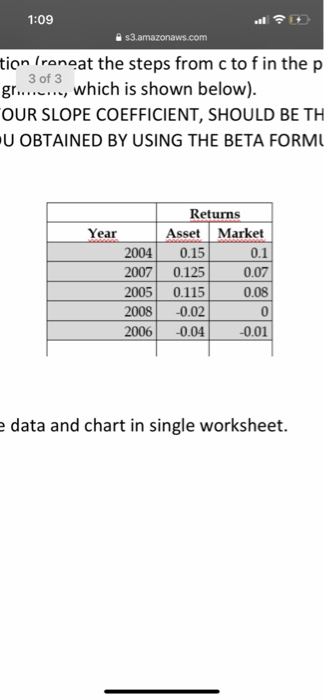

1. Use the data on Table 6.3 in the book (shown below). Table 6-3 Monthly Holding-Period Returns, eBay versus the S&P 500 Index, June 2014 through May 2015 (1 of 2) S&P 500 Index Returns (%) eBay Returns S&P 500 Index Price eBay Price Month and Year 2014 May June July August September October November December $50.73 50.06 52.83 55.50 56.63 52 50 54.88 56.12 -1.32% 5.53% 5.05% 2.04% -7.29% 4.53% 2.26% $1.924 1,960 1,931 2.003 1,972 2,018 2.068 2.059 1.87% -1.48% 3.73% -1.55% 2 33% 2.48% -0.44% eBay Returns (%) eBay Price S&P 500 Index Returns (%) S&P 500 Index Price Month and Year 2015 January February March April May Average Monthly Return Standard Deviation 53.00 57.91 57 68 58 26 59.15 -5.56% 9.26% -0.4096 1.0196 1.531 1 39 1,995 2,105 2,068 2,086 2.128 -3.11% 5.51% -1.76% 0.87% 2.046 0.87% 4.65% 2.57% a. In Excel, estimate columns for I need to see the formulas whenever I click a cell. b. Estimate the Average monthly return and the Standard Deviation for each column. Order the two columns you estimated in (a), with S&P Index Returns (MARKET) in the first column and eBay Returns (ASSET) in the second as shown below. c. ZZO 1.39% 0.87% way Average Monthly Return Standard Deviation 4.65% 2.57% a. In Excel, estimate columns for I need to see the formulas whenever I click a cell. b. Estimate the Average monthly return and the Standard Deviation for each column. c. Order the two columns you estimated in (a), with S&P Index Returns (MARKET) in the first column and eBay Returns (ASSET) in the second as shown below. MARKET ASSET 0.018711 0.0132072 -0.014796 0.0553336 0.037286 0.05053947 -0.015477 0.02036036 0.023327 -0.0729295 0.024777 0.04533333 -0.004352 0.02259475 -0.031083 -0.0555952 0.055138 0.09264151 -0.017577 -0.0039717 0.008704 0.01005548 0.020134 0.01527635 d. Select the data and insert a Scatter Chart. In the chart, you should see MARKET in the horizontal and ASSET in the vertical axis. You should see something like this: ASSET 0.12 01 00 005 004 0102 02 0 0.014 010 004 e. Click on any of the data points and it will automatically select all. Right click while you are above any point and click "Add trendline." Then select "Linear" and "Display Equation on chart" as shown below: Format Trendline Trendline Options ili Trendline Options e. Click on any of the data points and it will automatically select all. Right click while you are above any point and click "Add trendline." Then select "Linear" and "Display Equation on chart" as shown below: Format Trendline Trendline Options Trendline Options Login Potom Moving Trending BASED periode Forecast tornard Baward Set intercept Display Equation on dat f. You should then see a chart like the one below, where the eBay BETA is the SLOPE OF THE LINE (0.782): ASSET 12 27 ASSET 01 00 00 0.04 OD 102 004 004 e. Click on any of the data points and it will automatically select all. Right click while you are above any point and click "Add trendline." Then select "Linear" and "Display Equation on chart" as shown below: Format Trendline Trendline Options Trendline Options 2. Estimate the BETA for ASSET H in your previous homework, but using the slope of the line as we did in the previous question (repeat the steps from c to f in the previous question, applying the data in our previous assignment, which is shown below). a. THE VALUE OF YOUR SLOPE COEFFICIENT, SHOULD BE THE SAME AS THE BETA COEFFICIENT YOU OBTAINED BY USING THE BETA FORMULA IN YOUR PREVIOUS HOMEWORK. Year 2004 2007 2005 2008 2006 Returns Asset Market 0.15 0.1 0.125 0.07 0.115 0.08 0.02 0 -0.04 0.01 b. I need to see the data and chart in single worksheet. 1. Use the data on Table 6.3 in the book (shown below). Table 6-3 Monthly Holding-Period Returns, eBay versus the S&P 500 Index, June 2014 through May 2015 (1 of 2 My 20 SEPS Month and a a. In Excel, estimate columns for I need to see the formulas whenever I click a cell. b. Estimate the average monthly return and the Standard Deviation for each column. c. Order the two columns you estimated in in (a), with S&P Index Returns (MARKET) in the first column and eBay Returns (ASSET) in the second as shown below. METANET 2012 0037286 0050397 2017 22 DOS OBSES OS 0.00757700717 0.008.204.2005 2013 22:35 d. Select the data and insert a Scatter Chart. In the chart, you should see MARKET in the horizontal and ASSET in the vertical axis. You should see something like this: ASSET 1:07 s3.amazonaws.com DUR SER DETRO OM OSS ESTE 00064 d. Select the data and insert a Scatter Chart. In the chart, you should see MARKET in the horizontal and ASSET in the vertical axis. You should see something like this: e. Click on any of the data points and it will automatically select all Right dick while you are above any point and click "Add trendline." Then select "Linearand "Display Equation on chart" as shown below: Format Trendine 1. You should then see a chart like the one below, where the eBay BETA is the SLOPE OF THE LINE (0.782); ASSET 1:08 s3.amazonaws.com 3 of 3 then see a chart like the one below, where the eBay BETA is the SLOPE OF IMELINE (0.782) ASSET I need the data, estimations with formulas and the chart with your estimated BETA for the asset in a single worksheet. 2. Estimate the BETA for ASSET H in your previous homework, but using the slope of the line as we did in the previous question (repeat the steps from tof in the previous question applying the data in our previous assignment, which is shown below) 2. THE VALUE OF YOUR SLOPE COEFFICIENT, SHOULD BE THE SAME AS THE BETA COEFFICIENT YOU OBTAINED BY USING THE BETA FORMULA IN YOUR PREVIOUS HOMEWORK AM 01 b. I need to see the data and chart in single worksheet. 1:08 s3.amazonaws.com Table 6-3 Tonny Holding Perlu Returns, eBay versus the S&P 500 Index, June 2014 through May 2015 (1 of 2) S&P 500 eBay Price Bay Returns S&P 500 Index Price $1,224 50.00 Month and Year 2014 May June July August September October November December 55.50 3.73% 5.50N 5.05 2005 -7.204 450N 2.20 1.31 2.000 1.972 2.018 2.068 2.050 52.50 5488 56.12 2. S&P 500 eBay S&P 500 eBay Price Returns (5) Index Price Returns 53.00 5701 5.51 - Month and Year 2015 January February March April May Average Monthly Rotum Standard Deviation -0.40% 101% 2.105 2.068 2.000 2.126 58.26 50.15 4.85% 257% Excel, estimate columns for I need to see the formulas whenever I di timate the Average monthly return and the Standard Deviation for e der the two columns you estimated in (a), with S&P Index Returns ( st column and eBay Returns (ASSET) in the second as shown below. MARKET ASSET 0.018711 0.0132072 0.014796 0.0553336 0.037286 0.05053947 -0.015477 0.02036016 0.023327 0.0729295 0.024777 0.04533333 -0.004352 0.02259475 -0.031083 -0.0555952 0.055138 0.09264151 0.017577 0.0039717 0.008704 0.01005548 0.020134 0.01527635 lect the data and insert a Scatter Chart. In the chart, you should see orizontal and ASSET in the vertical axis. You should see something like periods s3.amazonaws.com Backward Set intercept 2 of 3 Display Equation on chart see a chart like the one below, where the eBay BETA is .: ASSET 0.12 0.1 O.OR Y-0.720.00 . . 0.04 . -0.04 0.02 90 0.04 -0.04 0.06 -0.08 -01 estimations with formulas and the chart with your estin ngle worksheet. SSET H in your previous homework, but using the slope tion (repeat the steps from c to fin the previous questic gnment, which is shown below). OUR SLOPE COEFFICIENT, SHOULD BE THE SAME AS THE U OBTAINED BY USING THE BETA FORMULA IN YOUR P 1:09 s3.amazonaws.com 2 of 3 ASSET 0.1 0.1 00 006 . 004 . . . 004 -0.02 -0.02 -0.06 any of the data points and it will automatically select all. e any point and click "Add trendline." Then select "Linea on chart" as shown below: Format Trendline Trendline Options Trendline Options . Logarithmic Polynomial Moving Average Trendine Name Automatic Custom Forecast Forward Linear ASSET OD periods periods Set intercept Display Equation on chart uld then see a chart like the one below, where the eBay (0.782): 1:09 $3.amazonaws.com tion Iron at the steps from c to f in the p gr........, which is shown below). OUR SLOPE COEFFICIENT, SHOULD BE TH U OBTAINED BY USING THE BETA FORMU Year 2004 2007 2005 2008 2006 Returns Asset Market 0.15 0.1 0.125 0.07 0.115 0.08 0 -0.01 -0.02 -0.04 e data and chart in single worksheet. 1. Use the data on Table 6.3 in the book (shown below). Table 6-3 Monthly Holding-Period Returns, eBay versus the S&P 500 Index, June 2014 through May 2015 (1 of 2) S&P 500 Index Returns (%) eBay Returns S&P 500 Index Price eBay Price Month and Year 2014 May June July August September October November December $50.73 50.06 52.83 55.50 56.63 52 50 54.88 56.12 -1.32% 5.53% 5.05% 2.04% -7.29% 4.53% 2.26% $1.924 1,960 1,931 2.003 1,972 2,018 2.068 2.059 1.87% -1.48% 3.73% -1.55% 2 33% 2.48% -0.44% eBay Returns (%) eBay Price S&P 500 Index Returns (%) S&P 500 Index Price Month and Year 2015 January February March April May Average Monthly Return Standard Deviation 53.00 57.91 57 68 58 26 59.15 -5.56% 9.26% -0.4096 1.0196 1.531 1 39 1,995 2,105 2,068 2,086 2.128 -3.11% 5.51% -1.76% 0.87% 2.046 0.87% 4.65% 2.57% a. In Excel, estimate columns for I need to see the formulas whenever I click a cell. b. Estimate the Average monthly return and the Standard Deviation for each column. Order the two columns you estimated in (a), with S&P Index Returns (MARKET) in the first column and eBay Returns (ASSET) in the second as shown below. c. ZZO 1.39% 0.87% way Average Monthly Return Standard Deviation 4.65% 2.57% a. In Excel, estimate columns for I need to see the formulas whenever I click a cell. b. Estimate the Average monthly return and the Standard Deviation for each column. c. Order the two columns you estimated in (a), with S&P Index Returns (MARKET) in the first column and eBay Returns (ASSET) in the second as shown below. MARKET ASSET 0.018711 0.0132072 -0.014796 0.0553336 0.037286 0.05053947 -0.015477 0.02036036 0.023327 -0.0729295 0.024777 0.04533333 -0.004352 0.02259475 -0.031083 -0.0555952 0.055138 0.09264151 -0.017577 -0.0039717 0.008704 0.01005548 0.020134 0.01527635 d. Select the data and insert a Scatter Chart. In the chart, you should see MARKET in the horizontal and ASSET in the vertical axis. You should see something like this: ASSET 0.12 01 00 005 004 0102 02 0 0.014 010 004 e. Click on any of the data points and it will automatically select all. Right click while you are above any point and click "Add trendline." Then select "Linear" and "Display Equation on chart" as shown below: Format Trendline Trendline Options ili Trendline Options e. Click on any of the data points and it will automatically select all. Right click while you are above any point and click "Add trendline." Then select "Linear" and "Display Equation on chart" as shown below: Format Trendline Trendline Options Trendline Options Login Potom Moving Trending BASED periode Forecast tornard Baward Set intercept Display Equation on dat f. You should then see a chart like the one below, where the eBay BETA is the SLOPE OF THE LINE (0.782): ASSET 12 27 ASSET 01 00 00 0.04 OD 102 004 004 e. Click on any of the data points and it will automatically select all. Right click while you are above any point and click "Add trendline." Then select "Linear" and "Display Equation on chart" as shown below: Format Trendline Trendline Options Trendline Options 2. Estimate the BETA for ASSET H in your previous homework, but using the slope of the line as we did in the previous question (repeat the steps from c to f in the previous question, applying the data in our previous assignment, which is shown below). a. THE VALUE OF YOUR SLOPE COEFFICIENT, SHOULD BE THE SAME AS THE BETA COEFFICIENT YOU OBTAINED BY USING THE BETA FORMULA IN YOUR PREVIOUS HOMEWORK. Year 2004 2007 2005 2008 2006 Returns Asset Market 0.15 0.1 0.125 0.07 0.115 0.08 0.02 0 -0.04 0.01 b. I need to see the data and chart in single worksheet. 1. Use the data on Table 6.3 in the book (shown below). Table 6-3 Monthly Holding-Period Returns, eBay versus the S&P 500 Index, June 2014 through May 2015 (1 of 2 My 20 SEPS Month and a a. In Excel, estimate columns for I need to see the formulas whenever I click a cell. b. Estimate the average monthly return and the Standard Deviation for each column. c. Order the two columns you estimated in in (a), with S&P Index Returns (MARKET) in the first column and eBay Returns (ASSET) in the second as shown below. METANET 2012 0037286 0050397 2017 22 DOS OBSES OS 0.00757700717 0.008.204.2005 2013 22:35 d. Select the data and insert a Scatter Chart. In the chart, you should see MARKET in the horizontal and ASSET in the vertical axis. You should see something like this: ASSET 1:07 s3.amazonaws.com DUR SER DETRO OM OSS ESTE 00064 d. Select the data and insert a Scatter Chart. In the chart, you should see MARKET in the horizontal and ASSET in the vertical axis. You should see something like this: e. Click on any of the data points and it will automatically select all Right dick while you are above any point and click "Add trendline." Then select "Linearand "Display Equation on chart" as shown below: Format Trendine 1. You should then see a chart like the one below, where the eBay BETA is the SLOPE OF THE LINE (0.782); ASSET 1:08 s3.amazonaws.com 3 of 3 then see a chart like the one below, where the eBay BETA is the SLOPE OF IMELINE (0.782) ASSET I need the data, estimations with formulas and the chart with your estimated BETA for the asset in a single worksheet. 2. Estimate the BETA for ASSET H in your previous homework, but using the slope of the line as we did in the previous question (repeat the steps from tof in the previous question applying the data in our previous assignment, which is shown below) 2. THE VALUE OF YOUR SLOPE COEFFICIENT, SHOULD BE THE SAME AS THE BETA COEFFICIENT YOU OBTAINED BY USING THE BETA FORMULA IN YOUR PREVIOUS HOMEWORK AM 01 b. I need to see the data and chart in single worksheet. 1:08 s3.amazonaws.com Table 6-3 Tonny Holding Perlu Returns, eBay versus the S&P 500 Index, June 2014 through May 2015 (1 of 2) S&P 500 eBay Price Bay Returns S&P 500 Index Price $1,224 50.00 Month and Year 2014 May June July August September October November December 55.50 3.73% 5.50N 5.05 2005 -7.204 450N 2.20 1.31 2.000 1.972 2.018 2.068 2.050 52.50 5488 56.12 2. S&P 500 eBay S&P 500 eBay Price Returns (5) Index Price Returns 53.00 5701 5.51 - Month and Year 2015 January February March April May Average Monthly Rotum Standard Deviation -0.40% 101% 2.105 2.068 2.000 2.126 58.26 50.15 4.85% 257% Excel, estimate columns for I need to see the formulas whenever I di timate the Average monthly return and the Standard Deviation for e der the two columns you estimated in (a), with S&P Index Returns ( st column and eBay Returns (ASSET) in the second as shown below. MARKET ASSET 0.018711 0.0132072 0.014796 0.0553336 0.037286 0.05053947 -0.015477 0.02036016 0.023327 0.0729295 0.024777 0.04533333 -0.004352 0.02259475 -0.031083 -0.0555952 0.055138 0.09264151 0.017577 0.0039717 0.008704 0.01005548 0.020134 0.01527635 lect the data and insert a Scatter Chart. In the chart, you should see orizontal and ASSET in the vertical axis. You should see something like periods s3.amazonaws.com Backward Set intercept 2 of 3 Display Equation on chart see a chart like the one below, where the eBay BETA is .: ASSET 0.12 0.1 O.OR Y-0.720.00 . . 0.04 . -0.04 0.02 90 0.04 -0.04 0.06 -0.08 -01 estimations with formulas and the chart with your estin ngle worksheet. SSET H in your previous homework, but using the slope tion (repeat the steps from c to fin the previous questic gnment, which is shown below). OUR SLOPE COEFFICIENT, SHOULD BE THE SAME AS THE U OBTAINED BY USING THE BETA FORMULA IN YOUR P 1:09 s3.amazonaws.com 2 of 3 ASSET 0.1 0.1 00 006 . 004 . . . 004 -0.02 -0.02 -0.06 any of the data points and it will automatically select all. e any point and click "Add trendline." Then select "Linea on chart" as shown below: Format Trendline Trendline Options Trendline Options . Logarithmic Polynomial Moving Average Trendine Name Automatic Custom Forecast Forward Linear ASSET OD periods periods Set intercept Display Equation on chart uld then see a chart like the one below, where the eBay (0.782): 1:09 $3.amazonaws.com tion Iron at the steps from c to f in the p gr........, which is shown below). OUR SLOPE COEFFICIENT, SHOULD BE TH U OBTAINED BY USING THE BETA FORMU Year 2004 2007 2005 2008 2006 Returns Asset Market 0.15 0.1 0.125 0.07 0.115 0.08 0 -0.01 -0.02 -0.04 e data and chart in single worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts