Answered step by step

Verified Expert Solution

Question

1 Approved Answer

-- finance: Investment decision in circumstances of uncertainty - conventional standards Statistical standards project for one period Question 1: The financial characteristics of a risky

--

--

finance:

Investment decision in circumstances of uncertainty - conventional standards

Statistical standards project for one period

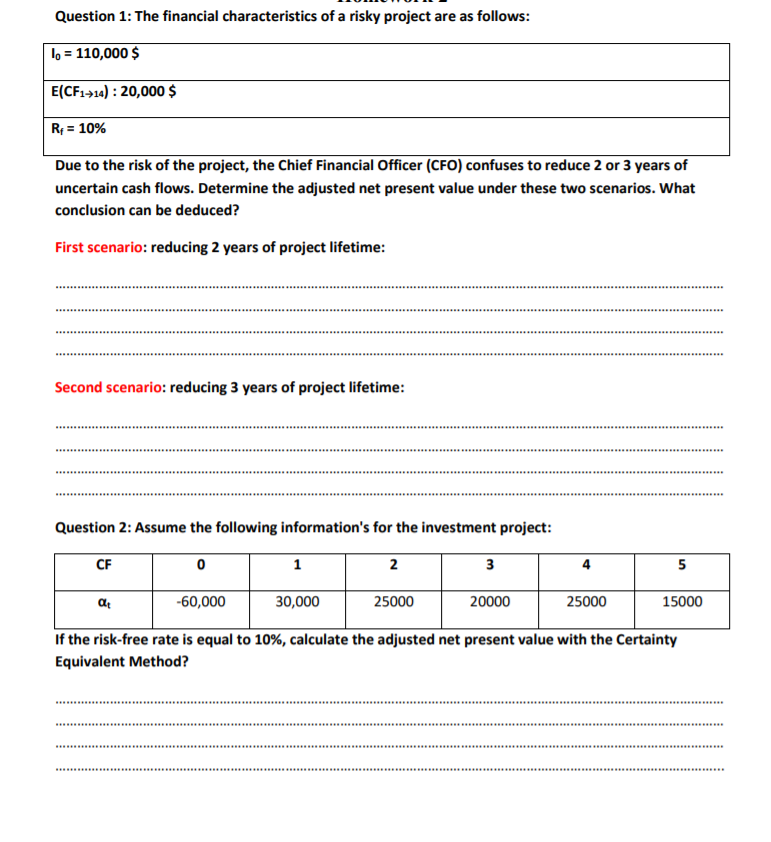

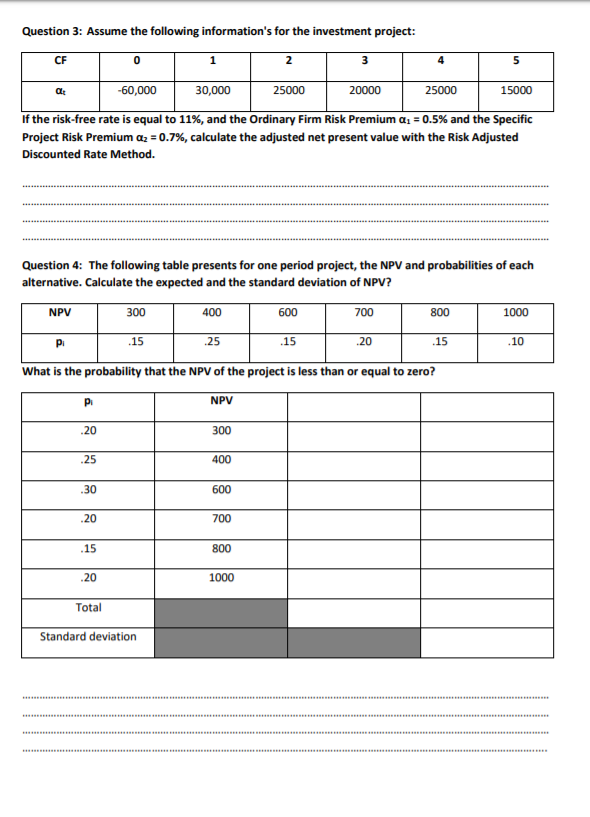

Question 1: The financial characteristics of a risky project are as follows: lo = 110,000 $ E(CF1+14) : 20,000 $ Rp = 10% Due to the risk of the project, the Chief Financial Officer (CFO) confuses to reduce 2 or 3 years of uncertain cash flows. Determine the adjusted net present value under these two scenarios. What conclusion can be deduced? First scenario: reducing 2 years of project lifetime: Second scenario: reducing 3 years of project lifetime: Question 2: Assume the following information's for the investment project: CF 01 -60,000 30,000 25000 20000 25000 15000 If the risk-free rate is equal to 10%, calculate the adjusted net present value with the Certainty Equivalent Method? .................. Question 3: Assume the following information's for the investment project: CF L 2 3 4 5 0 -60,000 30,000 25000 20000 25000 15000 If the risk-free rate is equal to 11%, and the Ordinary Firm Risk Premium a = 0.5% and the Specific Project Risk Premium Q2 = 0.7%, calculate the adjusted net present value with the Risk Adjusted Discounted Rate Method. Question 4: The following table presents for one period project, the NPV and probabilities of each alternative. Calculate the expected and the standard deviation of NPV? NPV 300 400 600 700 800 1000 pi 1 5 25 .15 . 20 1 5 What is the probability that the NPV of the project is less than or equal to zero? NPV 300 400 600 700 800 .20 1000 Total Standard deviation Question 1: The financial characteristics of a risky project are as follows: lo = 110,000 $ E(CF1+14) : 20,000 $ Rp = 10% Due to the risk of the project, the Chief Financial Officer (CFO) confuses to reduce 2 or 3 years of uncertain cash flows. Determine the adjusted net present value under these two scenarios. What conclusion can be deduced? First scenario: reducing 2 years of project lifetime: Second scenario: reducing 3 years of project lifetime: Question 2: Assume the following information's for the investment project: CF 01 -60,000 30,000 25000 20000 25000 15000 If the risk-free rate is equal to 10%, calculate the adjusted net present value with the Certainty Equivalent Method? .................. Question 3: Assume the following information's for the investment project: CF L 2 3 4 5 0 -60,000 30,000 25000 20000 25000 15000 If the risk-free rate is equal to 11%, and the Ordinary Firm Risk Premium a = 0.5% and the Specific Project Risk Premium Q2 = 0.7%, calculate the adjusted net present value with the Risk Adjusted Discounted Rate Method. Question 4: The following table presents for one period project, the NPV and probabilities of each alternative. Calculate the expected and the standard deviation of NPV? NPV 300 400 600 700 800 1000 pi 1 5 25 .15 . 20 1 5 What is the probability that the NPV of the project is less than or equal to zero? NPV 300 400 600 700 800 .20 1000 Total Standard deviation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started