Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finance Portfolio Construction need full answers thanks Westpac Banking Corporation is an Australian listed bank (ASX code WBC) with its principal operation in Australia and

Finance Portfolio Construction need full answers thanks

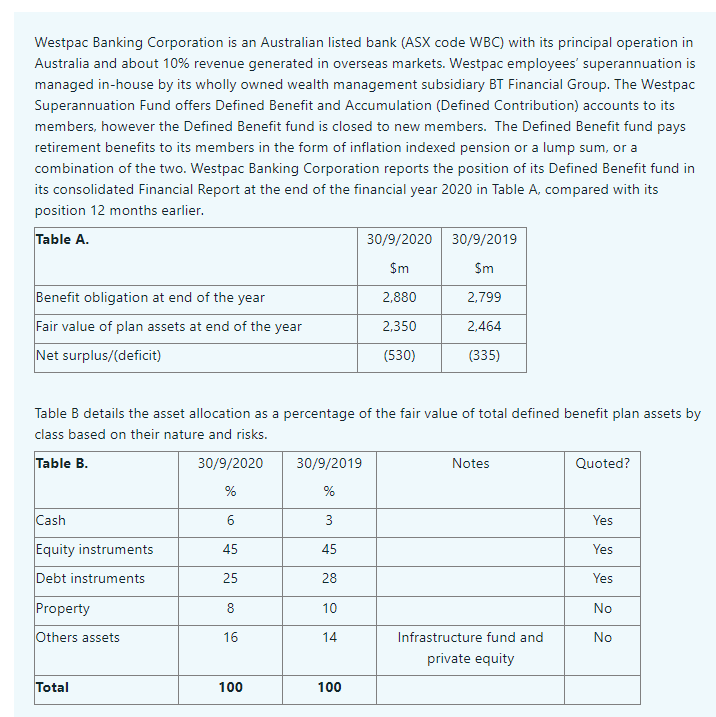

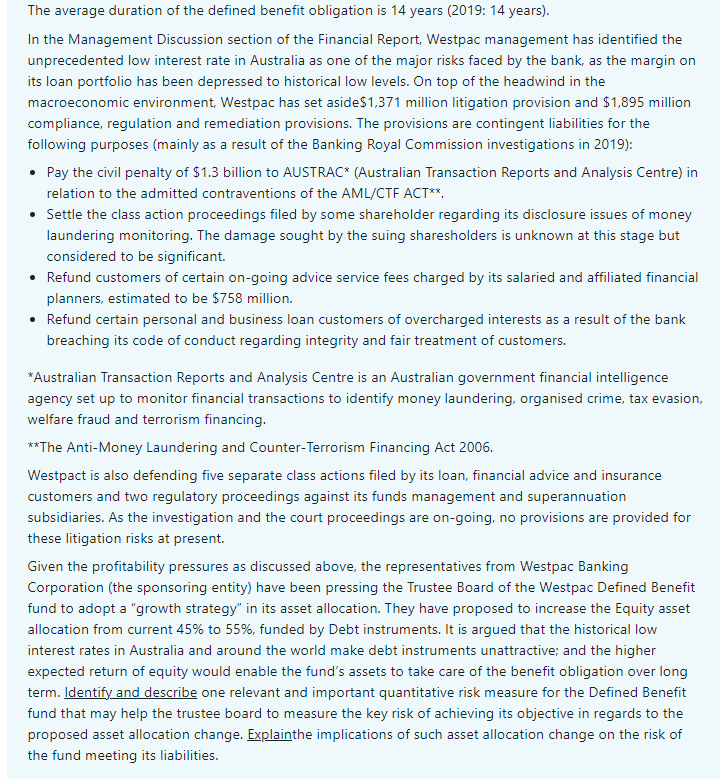

Westpac Banking Corporation is an Australian listed bank (ASX code WBC) with its principal operation in Australia and about 10% revenue generated in overseas markets. Westpac employees' superannuation is managed in-house by its wholly owned wealth management subsidiary BT Financial Group. The Westpac Superannuation Fund offers Defined Benefit and Accumulation (Defined Contribution) accounts to its members, however the Defined Benefit fund is closed to new members. The Defined Benefit fund pays retirement benefits to its members in the form of inflation indexed pension or a lump sum, or a combination of the two. Westpac Banking Corporation reports the position of its Defined Benefit fund in its consolidated Financial Report at the end of the financial year 2020 in Table A, compared with its position 12 months earlier. Table A. 30/9/2020 30/9/2019 $m $m 2.880 2,799 Benefit obligation at end of the year Fair value of plan assets at end of the year Net surplus/(deficit) 2,350 2,464 (530) (335) Table B details the asset allocation as a percentage of the fair value of total defined benefit plan assets by class based on their nature and risks. Table B. 30/9/2020 30/9/2019 Notes Quoted? % 6 3 Yes Cash Equity instruments 45 45 Yes Debt instruments 25 28 Yes Property 8 10 No Others assets 16 14 Infrastructure fund and No private equity Total 100 100 The average duration of the defined benefit obligation is 14 years (2019: 14 years). In the Management Discussion section of the Financial Report, Westpac management has identified the unprecedented low interest rate in Australia as one of the major risks faced by the bank, as the margin on its loan portfolio has been depressed to historical low levels. On top of the headwind in the macroeconomic environment, Westpac has set aside $1,371 million litigation provision and $1,895 million compliance, regulation and remediation provisions. The provisions are contingent liabilities for the following purposes (mainly as a result of the Banking Royal Commission investigations in 2019): Pay the civil penalty of $1.3 billion to AUSTRAC* (Australian Transaction Reports and Analysis Centre) in relation to the admitted contraventions of the AML/CTF ACT** Settle the class action proceedings filed by some shareholder regarding its disclosure issues of money laundering monitoring. The damage sought by the suing sharesholders is unknown at this stage but considered to be significant. Refund customers of certain on-going advice service fees charged by its salaried and affiliated financial planners, estimated to be $758 million. Refund certain personal and business loan customers of overcharged interests as a result of the bank breaching its code of conduct regarding integrity and fair treatment of customers. *Australian Transaction Reports and Analysis Centre is an Australian government financial intelligence agency set up to monitor financial transactions to identify money laundering, organised crime, tax evasion, welfare fraud and terrorism financing. **The Anti-Money Laundering and Counter-Terrorism Financing Act 2006. Westpact is also defending five separate class actions filed by its loan, financial advice and insurance customers and two regulatory proceedings against its funds management and superannuation subsidiaries. As the investigation and the court proceedings are on-going, no provisions are provided for these litigation risks at present. Given the profitability pressures as discussed above, the representatives from Westpac Banking Corporation (the sponsoring entity) have been pressing the Trustee Board of the Westpac Defined Benefit fund to adopt a "growth strategy" in its asset allocation. They have proposed to increase the Equity asset allocation from current 45% to 55%, funded by Debt instruments. It is argued that the historical low interest rates in Australia and around the world make debt instruments unattractive; and the higher expected return of equity would enable the fund's assets to take care of the benefit obligation over long term. Identify and describe one relevant and important quantitative risk measure for the Defined Benefit fund that may help the trustee board to measure the key risk of achieving its objective in regards to the proposed asset allocation change. Explainthe implications of such asset allocation change on the risk of the fund meeting its liabilities. Westpac Banking Corporation is an Australian listed bank (ASX code WBC) with its principal operation in Australia and about 10% revenue generated in overseas markets. Westpac employees' superannuation is managed in-house by its wholly owned wealth management subsidiary BT Financial Group. The Westpac Superannuation Fund offers Defined Benefit and Accumulation (Defined Contribution) accounts to its members, however the Defined Benefit fund is closed to new members. The Defined Benefit fund pays retirement benefits to its members in the form of inflation indexed pension or a lump sum, or a combination of the two. Westpac Banking Corporation reports the position of its Defined Benefit fund in its consolidated Financial Report at the end of the financial year 2020 in Table A, compared with its position 12 months earlier. Table A. 30/9/2020 30/9/2019 $m $m 2.880 2,799 Benefit obligation at end of the year Fair value of plan assets at end of the year Net surplus/(deficit) 2,350 2,464 (530) (335) Table B details the asset allocation as a percentage of the fair value of total defined benefit plan assets by class based on their nature and risks. Table B. 30/9/2020 30/9/2019 Notes Quoted? % 6 3 Yes Cash Equity instruments 45 45 Yes Debt instruments 25 28 Yes Property 8 10 No Others assets 16 14 Infrastructure fund and No private equity Total 100 100 The average duration of the defined benefit obligation is 14 years (2019: 14 years). In the Management Discussion section of the Financial Report, Westpac management has identified the unprecedented low interest rate in Australia as one of the major risks faced by the bank, as the margin on its loan portfolio has been depressed to historical low levels. On top of the headwind in the macroeconomic environment, Westpac has set aside $1,371 million litigation provision and $1,895 million compliance, regulation and remediation provisions. The provisions are contingent liabilities for the following purposes (mainly as a result of the Banking Royal Commission investigations in 2019): Pay the civil penalty of $1.3 billion to AUSTRAC* (Australian Transaction Reports and Analysis Centre) in relation to the admitted contraventions of the AML/CTF ACT** Settle the class action proceedings filed by some shareholder regarding its disclosure issues of money laundering monitoring. The damage sought by the suing sharesholders is unknown at this stage but considered to be significant. Refund customers of certain on-going advice service fees charged by its salaried and affiliated financial planners, estimated to be $758 million. Refund certain personal and business loan customers of overcharged interests as a result of the bank breaching its code of conduct regarding integrity and fair treatment of customers. *Australian Transaction Reports and Analysis Centre is an Australian government financial intelligence agency set up to monitor financial transactions to identify money laundering, organised crime, tax evasion, welfare fraud and terrorism financing. **The Anti-Money Laundering and Counter-Terrorism Financing Act 2006. Westpact is also defending five separate class actions filed by its loan, financial advice and insurance customers and two regulatory proceedings against its funds management and superannuation subsidiaries. As the investigation and the court proceedings are on-going, no provisions are provided for these litigation risks at present. Given the profitability pressures as discussed above, the representatives from Westpac Banking Corporation (the sponsoring entity) have been pressing the Trustee Board of the Westpac Defined Benefit fund to adopt a "growth strategy" in its asset allocation. They have proposed to increase the Equity asset allocation from current 45% to 55%, funded by Debt instruments. It is argued that the historical low interest rates in Australia and around the world make debt instruments unattractive; and the higher expected return of equity would enable the fund's assets to take care of the benefit obligation over long term. Identify and describe one relevant and important quantitative risk measure for the Defined Benefit fund that may help the trustee board to measure the key risk of achieving its objective in regards to the proposed asset allocation change. Explainthe implications of such asset allocation change on the risk of the fund meeting its liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started