Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finance Portfolio Construction need full answers thanks You are approached by an entrepreneur couple seeking advice on their self-managed superannuation fund (SMSF) with a balance

Finance Portfolio Construction need full answers thanks

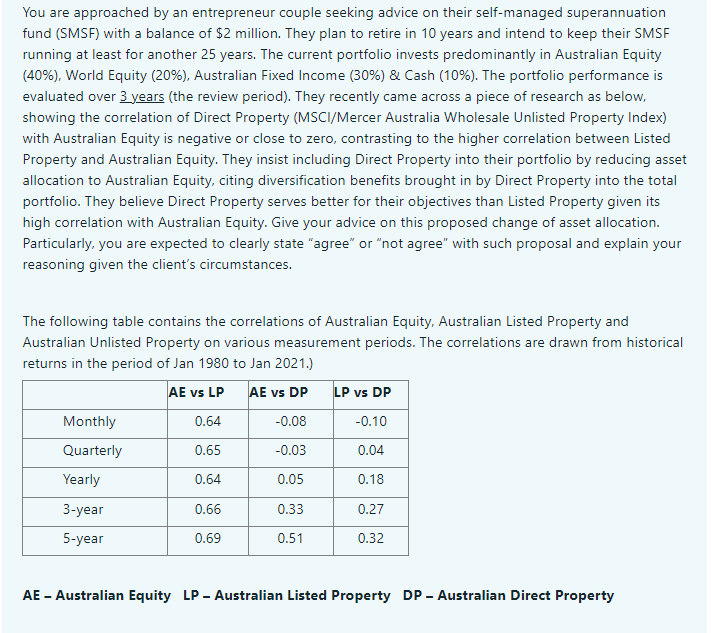

You are approached by an entrepreneur couple seeking advice on their self-managed superannuation fund (SMSF) with a balance of $2 million. They plan to retire in 10 years and intend to keep their SMSF running at least for another 25 years. The current portfolio invests predominantly in Australian Equity (40%), World Equity (20%), Australian Fixed Income (30%) & Cash (10%). The portfolio performance is evaluated over 3 years (the review period). They recently came across a piece of research as below, showing the correlation of Direct Property (MSCI/Mercer Australia Wholesale Unlisted Property Index) with Australian Equity is negative or close to zero, contrasting to the higher correlation between Listed Property and Australian Equity. They insist including Direct Property into their portfolio by reducing asset allocation to Australian Equity, citing diversification benefits brought in by Direct Property into the total portfolio. They believe Direct Property serves better for their objectives than Listed Property given its high correlation with Australian Equity. Give your advice on this proposed change of asset allocation. Particularly, you are expected to clearly state "agree" or "not agree" with such proposal and explain your reasoning given the client's circumstances. The following table contains the correlations of Australian Equity, Australian Listed Property and Australian Unlisted Property on various measurement periods. The correlations are drawn from historical returns in the period of Jan 1980 to Jan 2021.) AE vs LP AE vs DP LP vs DP Monthly 0.64 -0.08 -0.10 Quarterly 0.65 -0.03 0.04 Yearly 0.64 0.05 0.18 3-year 0.66 0.33 0.27 5-year 0.69 0.51 0.32 AE - Australian Equity LP - Australian Listed Property DP - Australian Direct Property You are approached by an entrepreneur couple seeking advice on their self-managed superannuation fund (SMSF) with a balance of $2 million. They plan to retire in 10 years and intend to keep their SMSF running at least for another 25 years. The current portfolio invests predominantly in Australian Equity (40%), World Equity (20%), Australian Fixed Income (30%) & Cash (10%). The portfolio performance is evaluated over 3 years (the review period). They recently came across a piece of research as below, showing the correlation of Direct Property (MSCI/Mercer Australia Wholesale Unlisted Property Index) with Australian Equity is negative or close to zero, contrasting to the higher correlation between Listed Property and Australian Equity. They insist including Direct Property into their portfolio by reducing asset allocation to Australian Equity, citing diversification benefits brought in by Direct Property into the total portfolio. They believe Direct Property serves better for their objectives than Listed Property given its high correlation with Australian Equity. Give your advice on this proposed change of asset allocation. Particularly, you are expected to clearly state "agree" or "not agree" with such proposal and explain your reasoning given the client's circumstances. The following table contains the correlations of Australian Equity, Australian Listed Property and Australian Unlisted Property on various measurement periods. The correlations are drawn from historical returns in the period of Jan 1980 to Jan 2021.) AE vs LP AE vs DP LP vs DP Monthly 0.64 -0.08 -0.10 Quarterly 0.65 -0.03 0.04 Yearly 0.64 0.05 0.18 3-year 0.66 0.33 0.27 5-year 0.69 0.51 0.32 AE - Australian Equity LP - Australian Listed Property DP - Australian Direct Property

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started