Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finance Portfolio Construction need full answers thanks You are hired by Westpac Employee Defined Contribution Fund to advise the trustee board on setting the optimal

Finance Portfolio Construction need full answers thanks

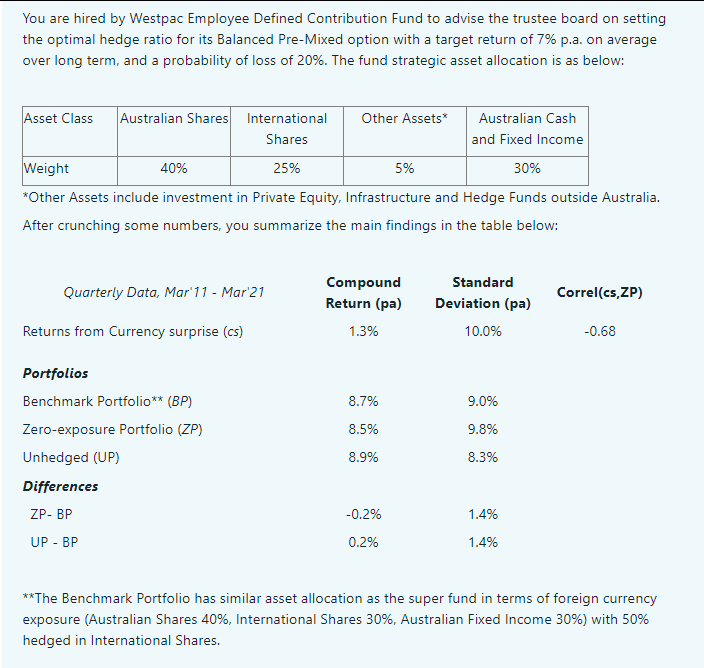

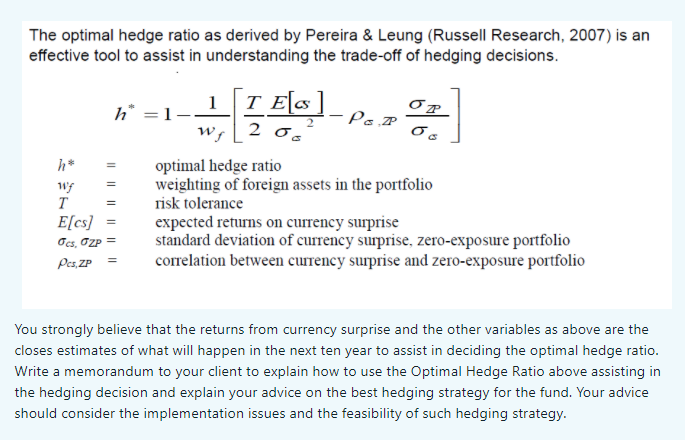

You are hired by Westpac Employee Defined Contribution Fund to advise the trustee board on setting the optimal hedge ratio for its Balanced Pre-Mixed option with a target return of 7% p.a. on average over long term, and a probability of loss of 20%. The fund strategic asset allocation is as below: Asset Class Australian Shares International Other Assets Australian Cash Shares and Fixed Income Weight 40% 25% 5% 30% *Other Assets include investment in Private Equity, Infrastructure and Hedge Funds outside Australia. After crunching some numbers, you summarize the main findings in the table below: Standard Quarterly Data, Mar'11 - Mar 21 Compound Return (pa) Correl(cs,ZP) Deviation (pa) Returns from Currency surprise (C5) 1.3% 10.0% -0.68 Portfolios Benchmark Portfolio** (BP) 8.7% 9.0% Zero-exposure Portfolio (ZP) 8.5% 9.8% Unhedged (UP) 8.9% 8.3% Differences ZP-BP -0.2% 1.4% UP-BP 0.2% 1.4% **The Benchmark Portfolio has similar asset allocation as the super fund in terms of foreign currency exposure (Australian Shares 40%, International Shares 30%, Australian Fixed Income 30%) with 50% hedged in International Shares. The optimal hedge ratio as derived by Pereira & Leung (Russell Research, 2007) is an effective tool to assist in understanding the trade-off of hedging decisions. 1 h* = 1 OP I Elos w, L2 os Psp Wf T E[cs] Ocs, Ozp = optimal hedge ratio weighting of foreign assets in the portfolio risk tolerance expected returns on currency surprise standard deviation of currency surprise, zero-exposure portfolio correlation between currency surprise and zero-exposure portfolio Pes, ZP You strongly believe that the returns from currency surprise and the other variables as above are the closes estimates of what will happen in the next ten year to assist in deciding the optimal hedge ratio. Write a memorandum to your client to explain how to use the Optimal Hedge Ratio above assisting in the hedging decision and explain your advice on the best hedging strategy for the fund. Your advice should consider the implementation issues and the feasibility of such hedging strategy. You are hired by Westpac Employee Defined Contribution Fund to advise the trustee board on setting the optimal hedge ratio for its Balanced Pre-Mixed option with a target return of 7% p.a. on average over long term, and a probability of loss of 20%. The fund strategic asset allocation is as below: Asset Class Australian Shares International Other Assets Australian Cash Shares and Fixed Income Weight 40% 25% 5% 30% *Other Assets include investment in Private Equity, Infrastructure and Hedge Funds outside Australia. After crunching some numbers, you summarize the main findings in the table below: Standard Quarterly Data, Mar'11 - Mar 21 Compound Return (pa) Correl(cs,ZP) Deviation (pa) Returns from Currency surprise (C5) 1.3% 10.0% -0.68 Portfolios Benchmark Portfolio** (BP) 8.7% 9.0% Zero-exposure Portfolio (ZP) 8.5% 9.8% Unhedged (UP) 8.9% 8.3% Differences ZP-BP -0.2% 1.4% UP-BP 0.2% 1.4% **The Benchmark Portfolio has similar asset allocation as the super fund in terms of foreign currency exposure (Australian Shares 40%, International Shares 30%, Australian Fixed Income 30%) with 50% hedged in International Shares. The optimal hedge ratio as derived by Pereira & Leung (Russell Research, 2007) is an effective tool to assist in understanding the trade-off of hedging decisions. 1 h* = 1 OP I Elos w, L2 os Psp Wf T E[cs] Ocs, Ozp = optimal hedge ratio weighting of foreign assets in the portfolio risk tolerance expected returns on currency surprise standard deviation of currency surprise, zero-exposure portfolio correlation between currency surprise and zero-exposure portfolio Pes, ZP You strongly believe that the returns from currency surprise and the other variables as above are the closes estimates of what will happen in the next ten year to assist in deciding the optimal hedge ratio. Write a memorandum to your client to explain how to use the Optimal Hedge Ratio above assisting in the hedging decision and explain your advice on the best hedging strategy for the fund. Your advice should consider the implementation issues and the feasibility of such hedging strategy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started