Finance, Portfolio Return

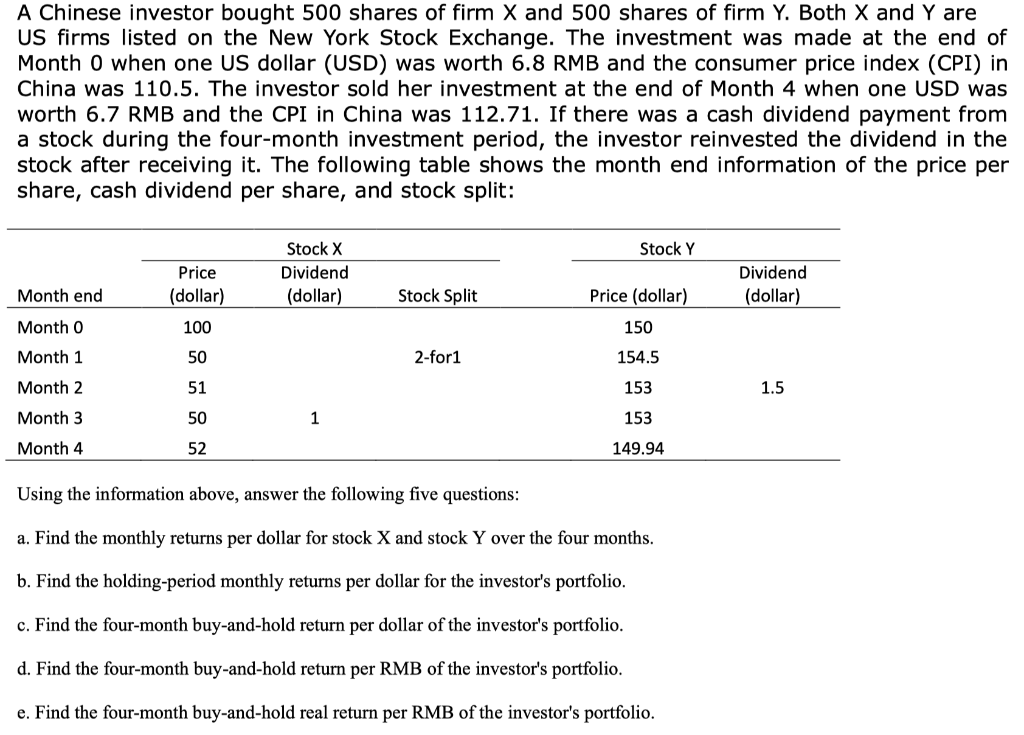

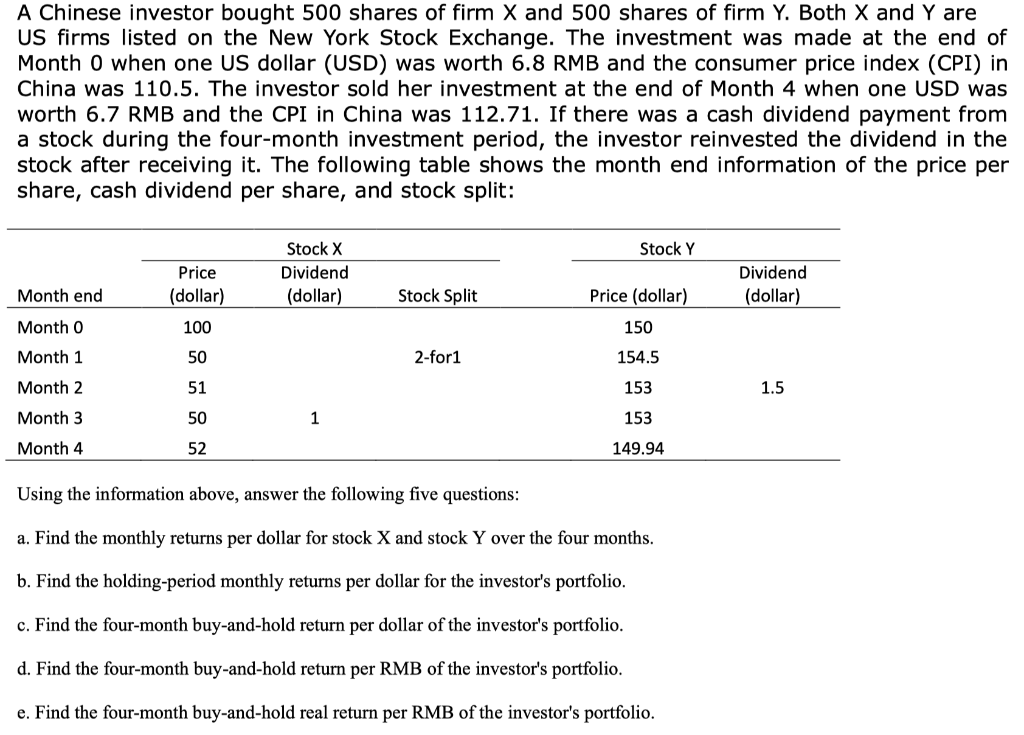

A Chinese investor bought 500 shares of firm X and 500 shares of firm Y. Both X and Y are US firms listed on the New York Stock Exchange. The investment was made at the end of Month O when one US dollar (USD) was worth 6.8 RMB and the consumer price index (CPI) in China was 110.5. The investor sold her investment at the end of Month 4 when one USD was worth 6.7 RMB and the CPI in China was 112.71. If there was a cash dividend payment from a stock during the four-month investment period, the investor reinvested the dividend in the stock after receiving it. The following table shows the month end information of the price per share, cash dividend per share, and stock split: Stock Y Stock X Dividend (dollar) Price (dollar) 100 Month end Dividend (dollar) Stock Split Price (dollar) Month 0 150 Month 1 50 2-for1 154.5 Month 2 51 153 1.5 Month 3 50 1 153 Month 4 52 149.94 Using the information above, answer the following five questions: a. Find the monthly returns per dollar for stock X and stock Y over the four months. b. Find the holding-period monthly returns per dollar for the investor's portfolio. c. Find the four-month buy-and-hold return per dollar of the investor's portfolio. d. Find the four-month buy-and-hold return per RMB of the investor's portfolio. e. Find the four-month buy-and-hold real return per RMB of the investor's portfolio. A Chinese investor bought 500 shares of firm X and 500 shares of firm Y. Both X and Y are US firms listed on the New York Stock Exchange. The investment was made at the end of Month O when one US dollar (USD) was worth 6.8 RMB and the consumer price index (CPI) in China was 110.5. The investor sold her investment at the end of Month 4 when one USD was worth 6.7 RMB and the CPI in China was 112.71. If there was a cash dividend payment from a stock during the four-month investment period, the investor reinvested the dividend in the stock after receiving it. The following table shows the month end information of the price per share, cash dividend per share, and stock split: Stock Y Stock X Dividend (dollar) Price (dollar) 100 Month end Dividend (dollar) Stock Split Price (dollar) Month 0 150 Month 1 50 2-for1 154.5 Month 2 51 153 1.5 Month 3 50 1 153 Month 4 52 149.94 Using the information above, answer the following five questions: a. Find the monthly returns per dollar for stock X and stock Y over the four months. b. Find the holding-period monthly returns per dollar for the investor's portfolio. c. Find the four-month buy-and-hold return per dollar of the investor's portfolio. d. Find the four-month buy-and-hold return per RMB of the investor's portfolio. e. Find the four-month buy-and-hold real return per RMB of the investor's portfolio