Finance problem. I am not sure how to answer this problem.this is the complete problem

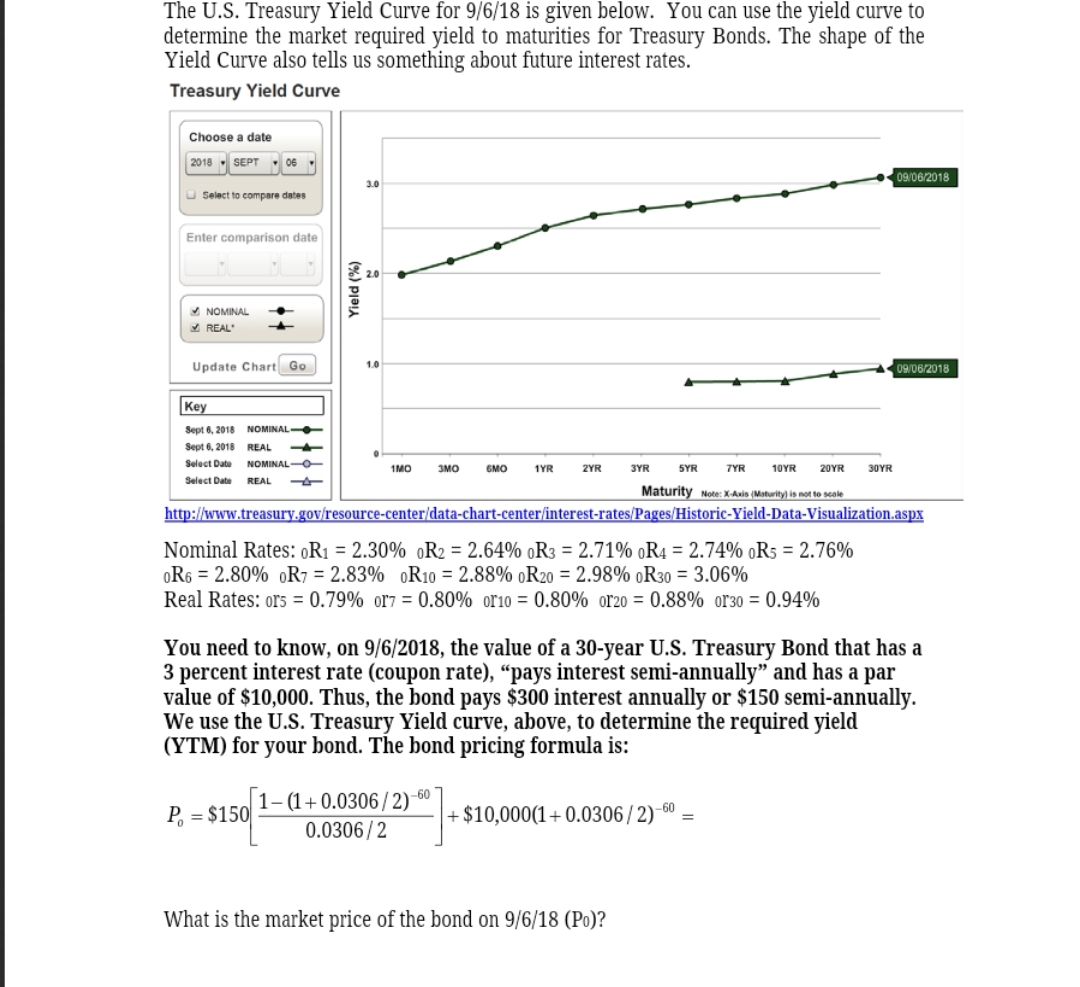

by! CC]! ICIIIJJCI. DU 10 Quiz 0 5 (10 points) Name: The U.S. Treasury Yield Curve for 9/6/18 is given below. You can use the yield curve to determine the market required yield to maturities for Treasury Bonds. The shape of the Yield Curve also tells us something about future interest rates. Treasury Yield Curve Entetr comparison dale .5 mm + ii in: + Update Chan, Bo ___ . - i'l' m 11\"! m m Ila-1m I-IOII- ll : . nter datachm-center term-ta ' orie-Yield-DalaVisualizatiomu Nominal Rates: 0R1 = 2.30% 0R2 = 2.64% 0R3 = 231% 0R4 = 2.74% 0R5 = 2.?6% 0R5 = 2.80% 0R1 = 2.83% 0R10 = 2.88% 0R20 = 2.98% 0R30 = 3.06% Real Rates: ors = 0.79% or\".r = 0.80% em = 0.80% one = 0.88% 01'30 = 0.94% You need to know, on 9I6l2018, the value of a 30-year U.S. Treasury Bond that has a 3 percent interest rate (coupon rate), \"pays interest semi-annually\" and has a par value of $10,000. Thus, the bond pays $300 interest annually or $150 semi-annually. We use the us. Treasury Yield curve. above, to determine the required yield (YTM) for your bond. The bond pricing formula is: 1 (1 + 0.0300! 2)\" _ _Eu _ H. $150[ 0.030612 ]+ $10,000(1+ 0.0306] 2) _ What is the market price of the bond on 9M 18 (P0)? The U.S. Treasury Yield Curve for 9/6/18 is given below. You can use the yield curve to determine the market required yield to maturities for Treasm'y Bonds. The shape of the Yield Curve also tells us something about future interest rates. Treasury Yield Curve Enter an mpnrison dale tum-m + dial: + Update Chant Bo Nominal Rates: 0R1 = 2.30% 0R2 = 2.64% 0R3 = 2.71% 0R4 = 2.74% 0R5 = 2.715% 0R5 = 2.80% 0R7 \"' 2.83% oRm = 2.88% oRzo = 2.98% oRao = 3.06% Real Rates: ors = 0.79% ur'.r = 0.80% arm = 0.80% one = 0.88% area = 0.94% You need to know, on 916l2018, the value of a 30-year U.S. Treasury Band that has a 3 percent interest rate (coupon rate). \"pays interest semi-annually\" and has a par value of $10,000. Thus. the bond pays $300 interest annually or $150 semi-annually. We use the us. Treasury Yield curve. above, to determine the required yield (YTM) for your bond. The bond pricing formula is: 1 (1 + 0.0306! 2)'Eu EI} H. $150[ 0.030612 ]+ $10,000(1+ 0.030612) _ What is the market price of the bond on 9M 18 (Po)