finance project/ quantitative reasoning

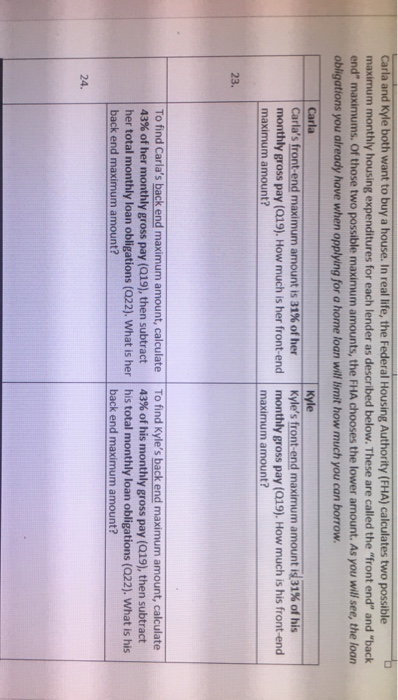

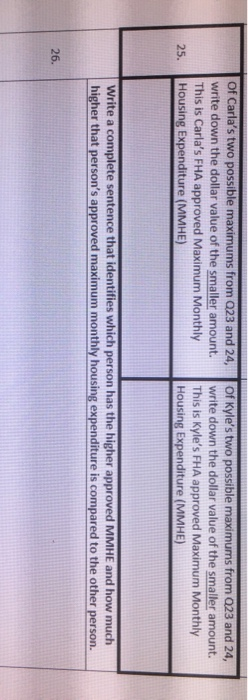

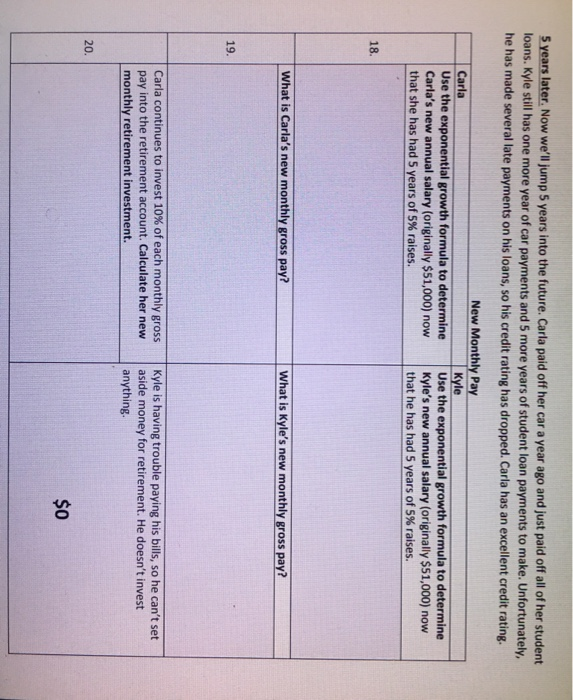

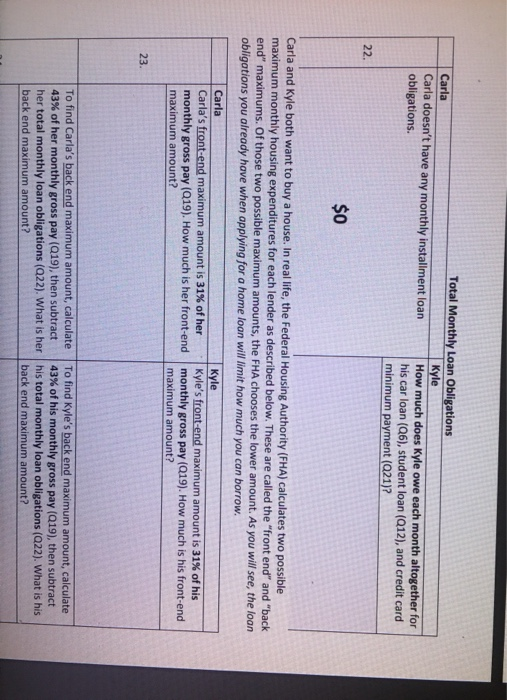

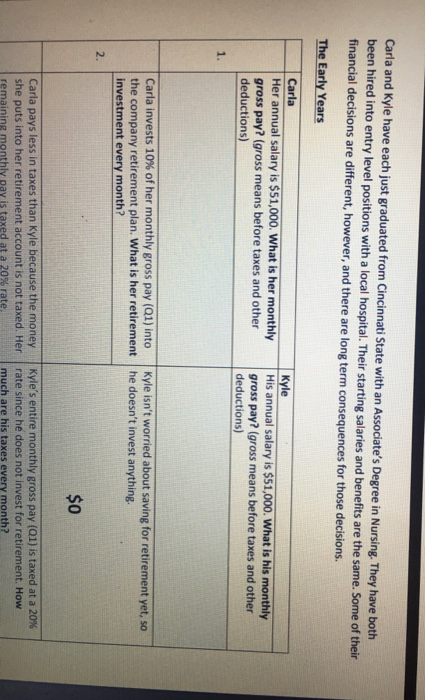

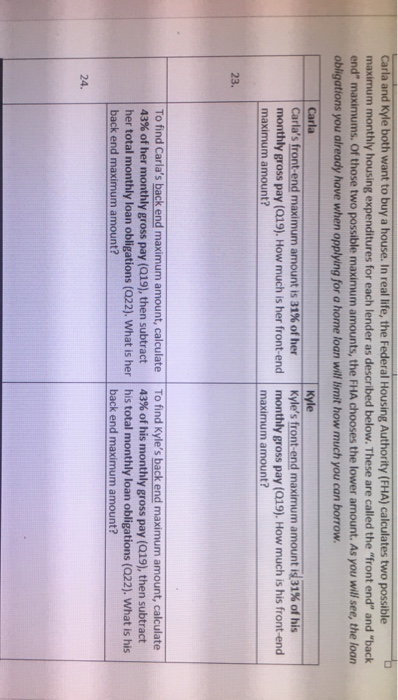

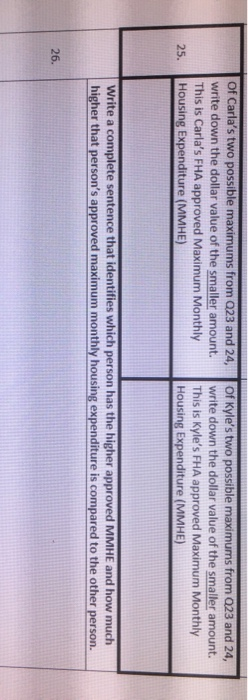

Carla and Kyle both want to buy a house. In real life, the Federal Housing Authority (FHA) calculates two possible maximum monthly housing expenditures for each lender as described below. These are called the "front end" and "back end" maximums. Of those two possible maximum amounts, the FHA chooses the lower amount. As you will see, the loan obligations you already have when applying for a home loan will limit how much you can borrow. Carla Carla's front-end maximum amount is 31% of her monthly gross pay (019). How much is her front-end maximum amount? Kyle Kyle's front-end maximum amount is 31% of his monthly gross pay (019). How much is his front-end maximum amount? 23. To find Carla's back end maximum amount, calculate To find Kyle's back end maximum amount, calculate 43% of her monthly gross pay (219), then subtract 43% of his monthly gross pay (919), then subtract her total monthly loan obligations (022). What is her his total monthly loan obligations (222). What is his back end maximum amount? back end maximum amount? 24. Of Carla's two possible maximums from 023 and 24, write down the dollar value of the smaller amount. This is Carla's FHA approved Maximum Monthly Housing Expenditure (MMHE) of Kyle's two possible maximums from 023 and 24, write down the dollar value of the smaller amount. This is Kyle's FHA approved Maximum Monthly Housing Expenditure (MMHE) 25. Write a complete sentence that identifies which person has the higher approved MMHE and how much higher that person's approved maximum monthly housing expenditure is compared to the other person. 26. 5 years later. Now we'll jump 5 years into the future. Carla paid off her car a year ago and just paid off all of her student loans. Kyle still has one more year of car payments and 5 more years of student loan payments to make. Unfortunately, he has made several late payments on his loans, so his credit rating has dropped. Carla has an excellent credit rating. New Monthly Pay Carla Kyle Use the exponential growth formula to determine Use the exponential growth formula to determine Carla's new annual salary (originally $51,000) now Kyle's new annual salary (originally $51,000) now that she has had 5 years of 5% raises. that he has had 5 years of 5% raises. 18 What is Carla's new monthly gross pay? What is Kyle's new monthly gross pay? 19. Carla continues to invest 10% of each monthly gross pay into the retirement account. Calculate her new monthly retirement investment. Kyle is having trouble paying his bills, so he can't set aside money for retirement. He doesn't invest anything. 20. $0 Total Monthly Loan Obligations Carla Kyle Carla doesn't have any monthly installment loan How much does Kyle owe each month altogether for obligations. his car loan (26), student loan (Q12), and credit card minimum payment (021)? 22. $0 Carla and Kyle both want to buy a house. In real life, the Federal Housing Authority (FHA) calculates two possible maximum monthly housing expenditures for each lender as described below. These are called the "front end" and "back end" maximums. Of those two possible maximum amounts, the FHA chooses the lower amount. As you will see, the loan obligations you already have when applying for a home loan will limit how much you can borrow. Carla Kyle Carla's front-end maximum amount is 31% of her Kyle's front-end maximum amount is 31% of his monthly gross pay (Q19). How much is her front-end monthly gross pay (Q19). How much is his front-end maximum amount? maximum amount? 23 To find Carla's back end maximum amount, calculate To find Kyle's back end maximum amount, calculate 43% of her monthly gross pay (919), then subtract 43% of his monthly gross pay (19), then subtract her total monthly loan obligations (922). What is her his total monthly loan obligations (922). What is his back end maximum amount? back end maximum amount? Carla and Kyle have each just graduated from Cincinnati State with an Associate's Degree in Nursing. They have both been hired into entry level positions with a local hospital. Their starting salaries and benefits are the same. Some of their financial decisions are different, however, and there are long term consequences for those decisions. The Early Years Kyle Carla Her annual salary is $51,000. What is her monthly gross pay? (gross means before taxes and other deductions) His annual salary is $51,000. What is his monthly gross pay? (gross means before taxes and other deductions) 1. Carla invests 10% of her monthly gross pay (Q1) into the company retirement plan. What is her retirement investment every month? Kyle isn't worried about saving for retirement yet, so he doesn't invest anything. 2. $0 Carla pays less in taxes than Kyle because the money she puts into her retirement account is not taxed. Her remaining monthly pay is taxed at a 20% rate Kyle's entire monthly gross pay (01) is taxed at a 20% rate since he does not invest for retirement. How much are his taxes every month