Question

finance question 3)A U.S. investor will receive dividend from a Sri Lankan coconut exporting company but worries about the depreciation of the Sri Lankan Rupee

finance question

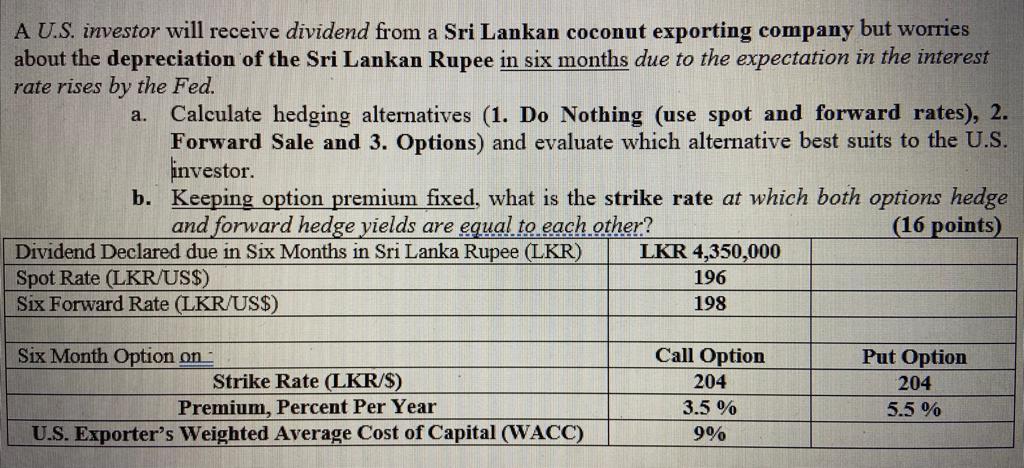

3)A U.S. investor will receive dividend from a Sri Lankan coconut exporting company but worries about the depreciation of the Sri Lankan Rupee in six months due to the expectation in the interest rate rises by the Fed. a. Calculate hedging alternatives (1. Do Nothing (use spot and forward rates), 2. Forward Sale and 3. Options) and evaluate which alternative best suits to the U.S. investor. b. Keeping option premium fixed, what is the strike rate at which both options hedge and forward hedge yields are equal to each other? (16 points) Dividend Declared due in Six Months in Sri Lanka Rupee (LKR) LKR 4,350,000 Spot Rate (LKR/US$) 196 Six Forward Rate (LKR/US$) 198 Six Month Option on : Call Option Put Option Strike Rate (LKR/$) 204 204 Premium, Percent Per Year 3.5 % 5.5 % U.S. Exporters Weighted Average Cost of Capital (WACC) 9%

a. A U.S. investor will receive dividend from a Sri Lankan coconut exporting company but worries about the depreciation of the Sri Lankan Rupee in six months due to the expectation in the interest rate rises by the Fed. Calculate hedging alternatives (1. Do Nothing (use spot and forward rates), 2. Forward Sale and 3. Options) and evaluate which alternative best suits to the U.S. investor. b. Keeping option premium fixed, what is the strike rate at which both options hedge and forward hedge yields are equal to each other? (16 points) Dividend Declared due in Six Months in Sri Lanka Rupee (LKR) LKR 4,350,000 Spot Rate (LKR/US$) 196 Six Forward Rate (LKR/US$) 198 Six Month Option on Strike Rate (LKR/S) Premium, Percent Per Year U.S. Exporter's Weighted Average Cost of Capital (WACC) Call Option 204 3.5 % 9% Put Option 204 5.5 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started