Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finance The stock price of a Fl is $70. Using the Black- Scholes model, expected return is 15% with a volatility of 25% p.a. The

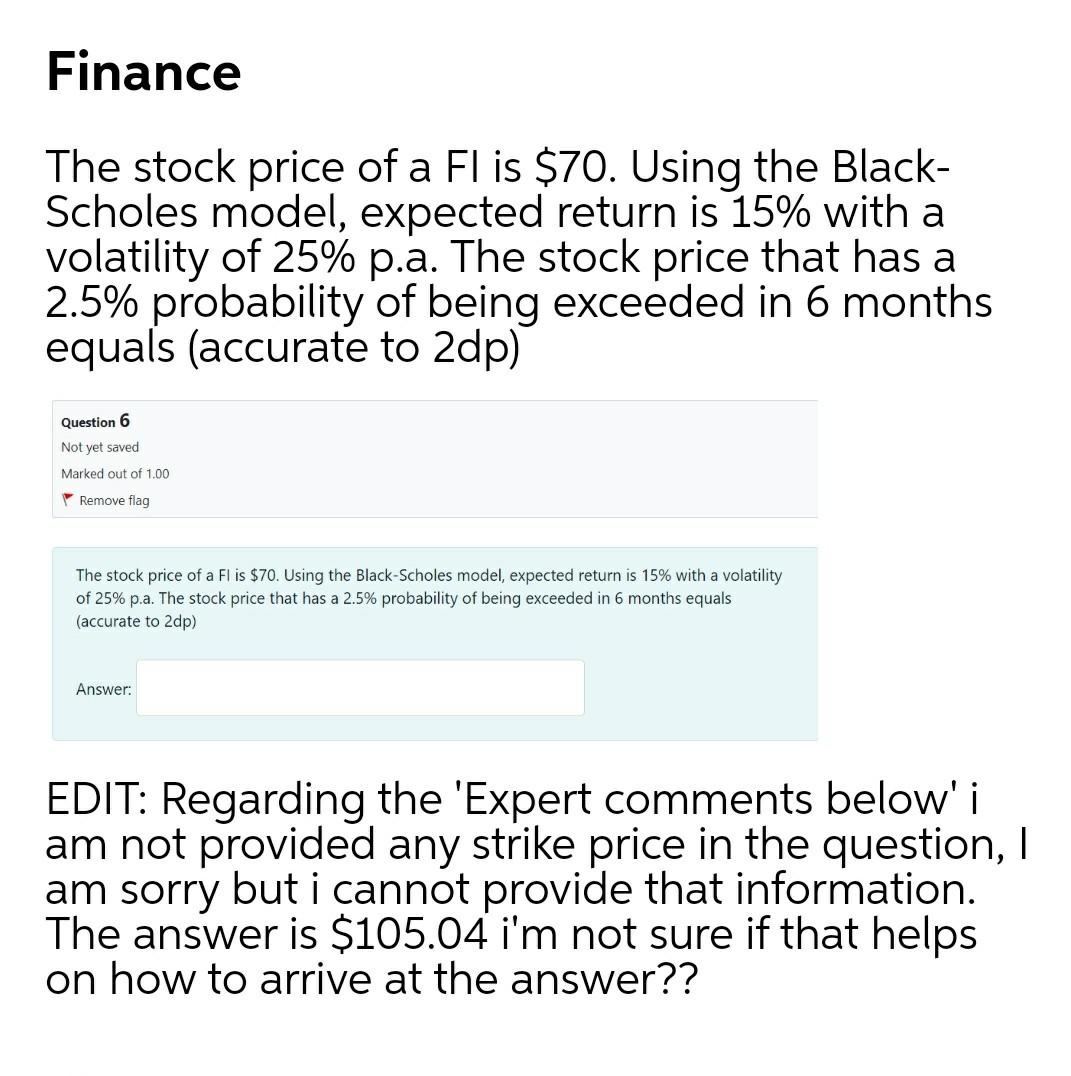

Finance The stock price of a Fl is $70. Using the Black- Scholes model, expected return is 15% with a volatility of 25% p.a. The stock price that has a 2.5% probability of being exceeded in 6 months equals (accurate to 2dp) Question 6 Not yet saved Marked out of 1.00 Remove flag The stock price of a Fl is $70. Using the Black-Scholes model, expected return is 15% with a volatility of 25% p.a. The stock price that has a 2.5% probability of being exceeded in 6 months equals (accurate to 2dp) Answer: EDIT: Regarding the 'Expert comments below'i am not provided any strike price in the question, I am sorry but i cannot provide that information. The answer is $105.04 i'm not sure if that helps on how to arrive at the answer?? Finance The stock price of a Fl is $70. Using the Black- Scholes model, expected return is 15% with a volatility of 25% p.a. The stock price that has a 2.5% probability of being exceeded in 6 months equals (accurate to 2dp) Question 6 Not yet saved Marked out of 1.00 Remove flag The stock price of a Fl is $70. Using the Black-Scholes model, expected return is 15% with a volatility of 25% p.a. The stock price that has a 2.5% probability of being exceeded in 6 months equals (accurate to 2dp) Answer: EDIT: Regarding the 'Expert comments below'i am not provided any strike price in the question, I am sorry but i cannot provide that information. The answer is $105.04 i'm not sure if that helps on how to arrive at the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started