Answered step by step

Verified Expert Solution

Question

1 Approved Answer

finance (Weighted average cost of capital) ABBC Inc. operates a very successful chain of yogurt and coffee shops spread across the southwestern part of the

finance

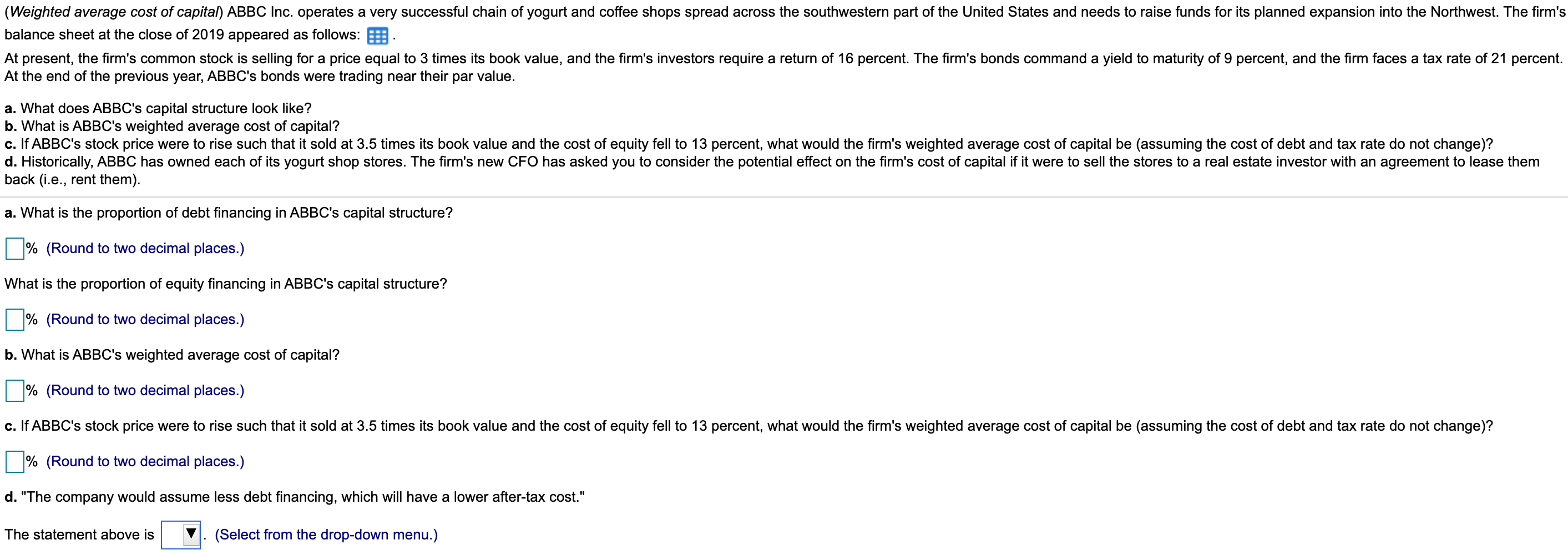

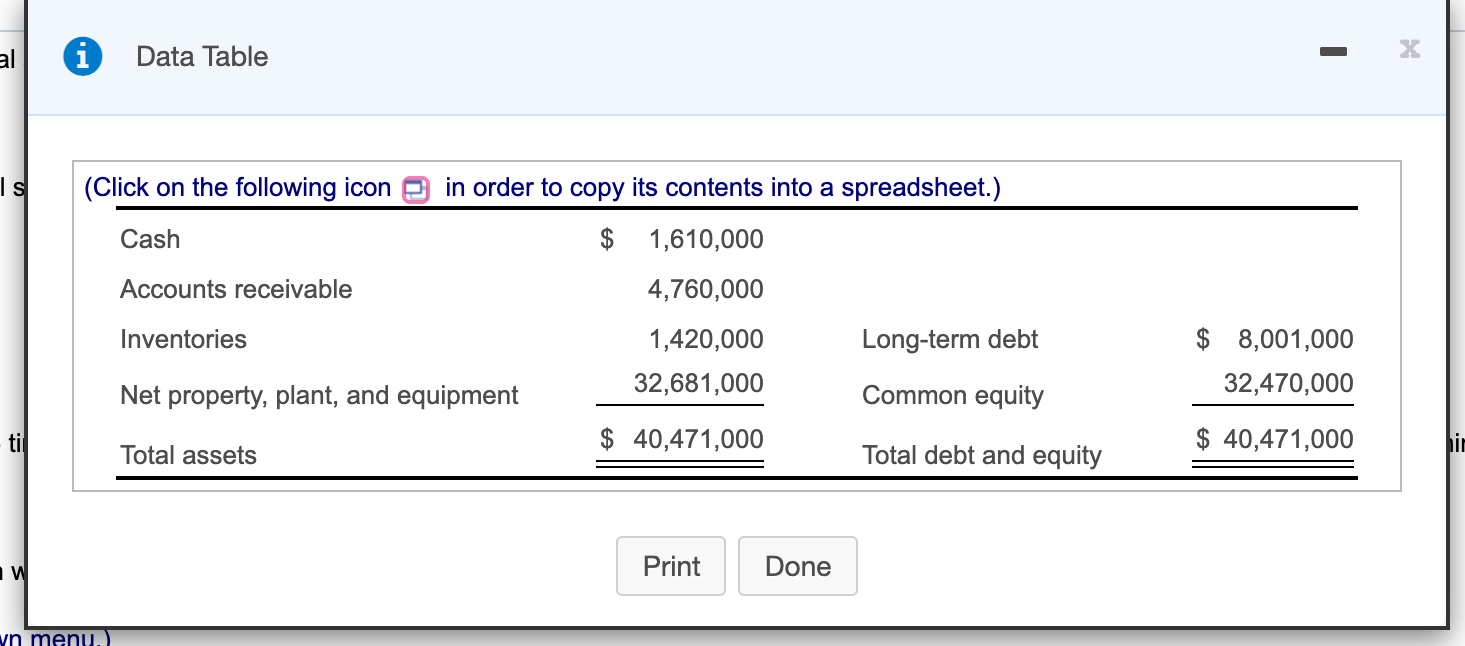

(Weighted average cost of capital) ABBC Inc. operates a very successful chain of yogurt and coffee shops spread across the southwestern part of the United States and needs to raise funds for its planned expansion into the Northwest. The firm's balance sheet at the close of 2019 appeared as follows: At present, the firm's common stock is selling for a price equal to 3 times its book value, and the firm's investors require a return of 16 percent. The firm's bonds command a yield to maturity of 9 percent, and the firm faces a tax rate of 21 percent. At the end of the previous year, ABBC's bonds were trading near their par value. a. What does ABBC's capital structure look like? b. What is ABBC's weighted average cost of capital? c. If ABBC's stock price were to rise such that it sold at 3.5 times its book value and the cost of equity fell to 13 percent, what would the firm's weighted average cost of capital be (assuming the cost of debt and tax rate do not change)? d. Historically, ABBC has owned each of its yogurt shop stores. The firm's new CFO has asked you to consider the potential effect on the firm's cost of capital if it were to sell the stores to a real estate investor with an agreement to lease them back (i.e., rent them). a. What is the proportion of debt financing in ABBC's capital structure? % (Round to two decimal places.) What is the proportion of equity financing in ABBC's capital structure? % (Round to two decimal places.) b. What is ABBC's weighted average cost of capital? % (Round to two decimal places.) c. If ABBC's stock price were to rise such that it sold at 3.5 times its book value and the cost of equity fell to 13 percent, what would the firm's weighted average cost of capital be (assuming the cost of debt and tax rate do not change)? % (Round to two decimal places.) d. "The company would assume less debt financing, which will have a lower after-tax cost." The statement above is (Select from the drop-down menu.) al Data Table IS (Click on the following icon in order to copy its contents into a spreadsheet.) Cash $ 1,610,000 Accounts receivable Inventories 4,760,000 1,420,000 32,681,000 Long-term debt $ 8,001,000 32,470,000 Net property, plant, and equipment Common equity til $ 40,471,000 Total assets Total debt and equity $ 40,471,000 IW Print Done yn menu Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started