Answered step by step

Verified Expert Solution

Question

1 Approved Answer

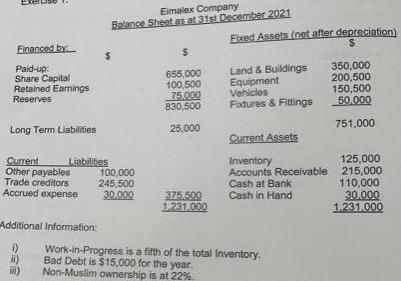

Financed by: Paid-up: Share Capital Retained Earnings Reserves Long Term Liabilities Current Other payables Trade creditors Accrued expense Liabilities Eimalex Company Balance Sheet as

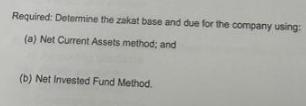

Financed by: Paid-up: Share Capital Retained Earnings Reserves Long Term Liabilities Current Other payables Trade creditors Accrued expense Liabilities Eimalex Company Balance Sheet as at 31st December 2021 100,000 245,500 30,000 $ 655,000 100,500 75.000 830,500 25,000 375.500 1.231.000 Fixed Assets (net after depreciation) S Land & Buildings Equipment Vehicles Fixtures & Fittings Current Assets Inventory Accounts Receivable Cash at Bank Cash in Hand Additional Information: i) Work-in-Progress is a fifth of the total Inventory. Bad Debt is $15,000 for the year. Non-Muslim ownership is at 22% iii) 350,000 200,500 150,500 50,000 751,000 125,000 215,000 110,000 30.000 1.231.000 Required: Determine the zakat base and due for the company using: (a) Net Current Assets method; and (b) Net Invested Fund Method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the Zakat base and due for Eimalex Company using the Net Current Assets Method and the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started