Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FINANCIAL PLANNING TIME VALUE OF MONEY Ambrose Studebaker received his Ph.D in history from a well-known Ivy League school at the age of 22.

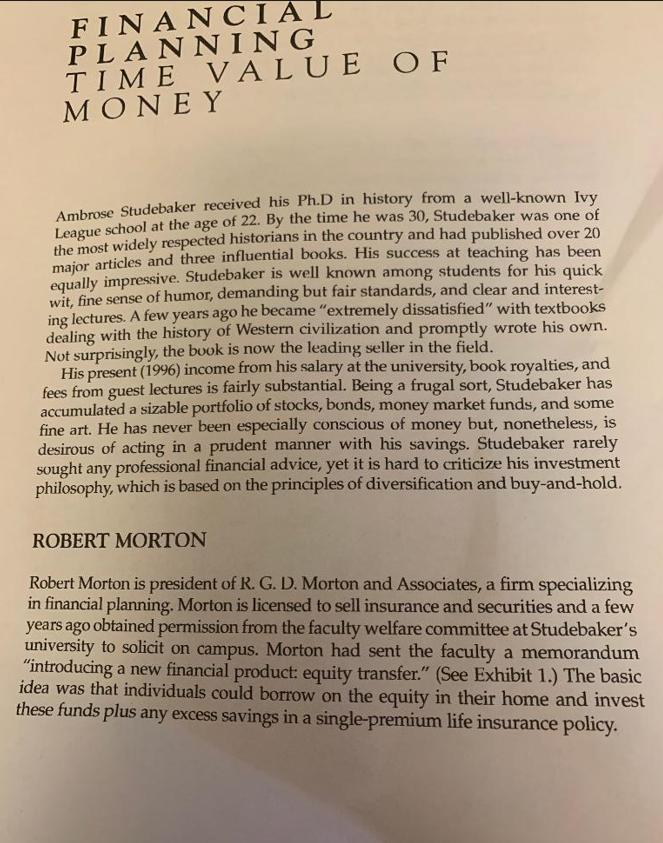

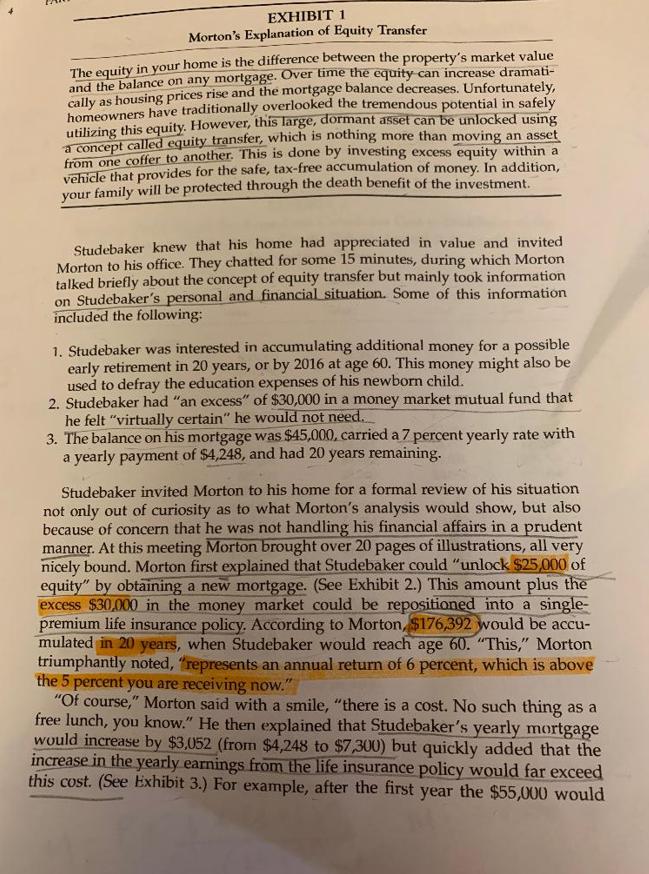

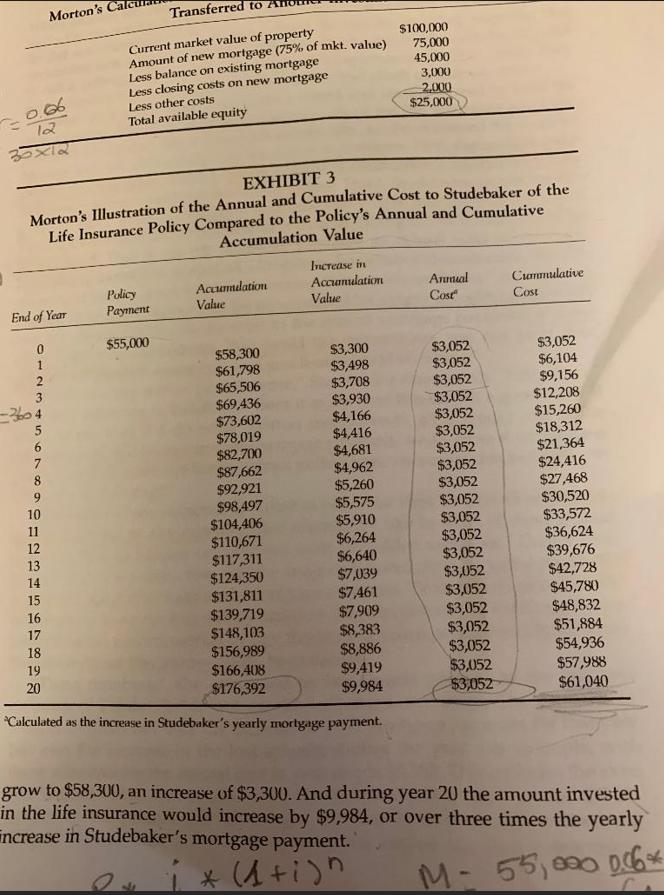

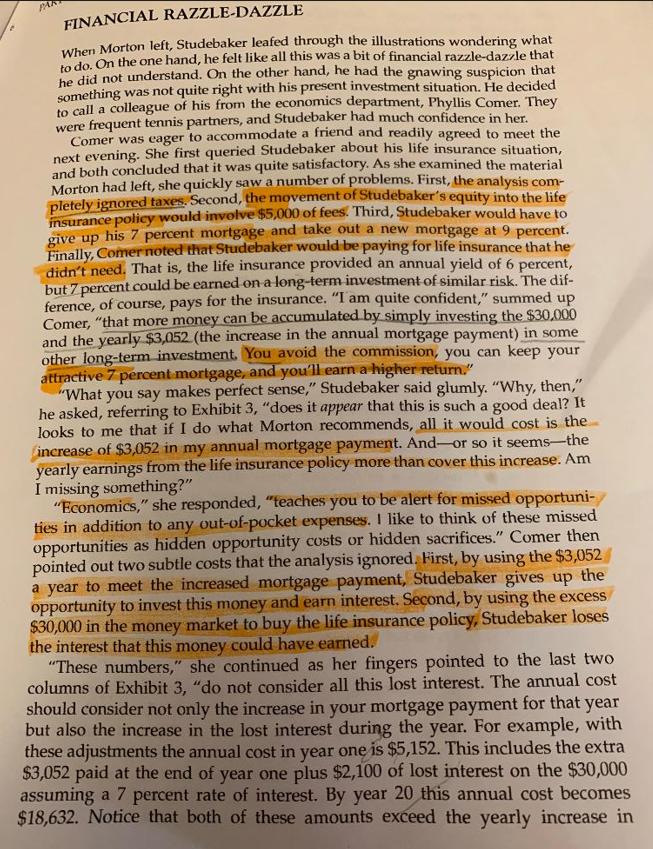

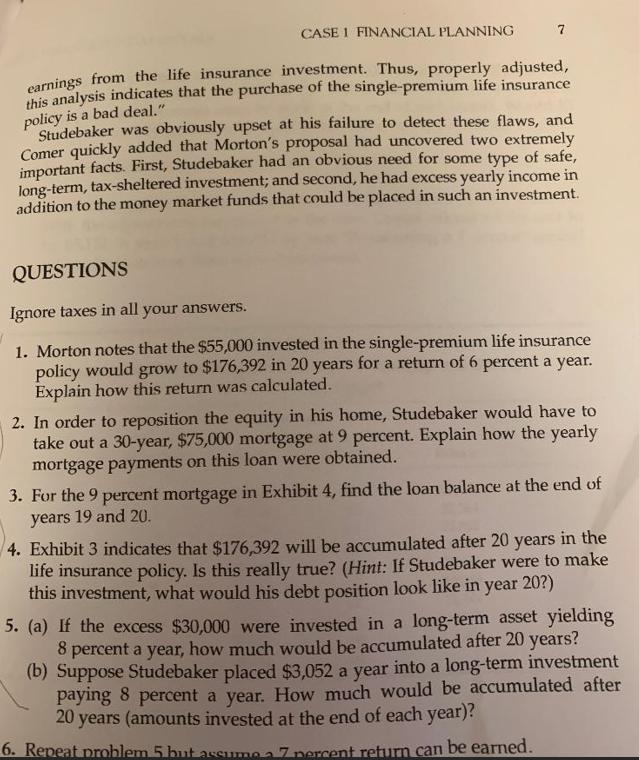

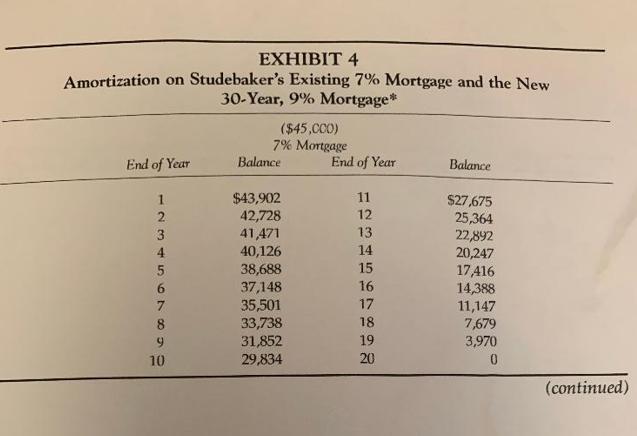

FINANCIAL PLANNING TIME VALUE OF MONEY Ambrose Studebaker received his Ph.D in history from a well-known Ivy League school at the age of 22. By the time he was 30, Studebaker was one of the most widely respected historians in the country and had published over 20 major articles and three influential books. His success at teaching has been equally impressive. Studebaker is well known among students for his quick wit, fine sense of humor, demanding but fair standards, and clear and interest- ing lectures. A few years ago he became "extremely dissatisfied" with textbooks dealing with the history of Western civilization and promptly wrote his own. Not surprisingly, the book is now the leading seller in the field. His present (1996) income from his salary at the university, book royalties, and fees from guest lectures is fairly substantial. Being a frugal sort, Studebaker has accumulated a sizable portfolio of stocks, bonds, money market funds, and some fine art. He has never been especially conscious of money but, nonetheless, is desirous of acting in a prudent manner with his savings. Studebaker rarely sought any professional financial advice, yet it is hard to criticize his investment philosophy, which is based on the principles of diversification and buy-and-hold. ROBERT MORTON Robert Morton is president of R. G. D. Morton and Associates, a firm specializing in financial planning. Morton is licensed to sell insurance and securities and a few years ago obtained permission from the faculty welfare committee at Studebaker's university to solicit on campus. Morton had sent the faculty a memorandum "introducing a new financial product: equity transfer." (See Exhibit 1.) The basic idea was that individuals could borrow on the equity in their home and invest these funds plus any excess savings in a single-premium life insurance policy. EXHIBIT 1 Morton's Explanation of Equity Transfer The equity in your home is the difference between the property's market value and the balance on any mortgage. Over time the equity can increase dramati- cally as housing prices rise and the mortgage balance decreases. Unfortunately, homeowners have traditionally overlooked the tremendous potential in safely utilizing this equity. However, this large, dormant asset can be unlocked using a concept called equity transfer, which is nothing more than moving an asset from one coffer to another. This is done by investing excess equity within a vehicle that provides for the safe, tax-free accumulation of money. In addition, your family will be protected through the death benefit of the investment. Studebaker knew that his home had appreciated in value and invited Morton to his office. They chatted for some 15 minutes, during which Morton talked briefly about the concept of equity transfer but mainly took information on Studebaker's personal and financial situation. Some of this information included the following: 1. Studebaker was interested in accumulating additional money for a possible early retirement in 20 years, or by 2016 at age 60. This money might also be used to defray the education expenses of his newborn child." 2. Studebaker had "an excess" of $30,000 in a money market mutual fund that he felt "virtually certain" he would not need. 3. The balance on his mortgage was $45,000, carried a 7 percent yearly rate with a yearly payment of $4,248, and had 20 years remaining. Studebaker invited Morton to his home for a formal review of his situation not only out of curiosity as to what Morton's analysis would show, but also because of concern that he was not handling his financial affairs in a prudent manner. At this meeting Morton brought over 20 pages of illustrations, all very nicely bound. Morton first explained that Studebaker could "unlock $25,000 of equity" by obtaining a new mortgage. (See Exhibit 2.) This amount plus the excess $30,000 in the money market could be repositioned into a single- premium life insurance policy. According to Morton, $176,392 would be accu- mulated in 20 years, when Studebaker would reach age 60. "This," Morton triumphantly noted, "represents an annual return of 6 percent, which is above the 5 percent you are receiving now." "Of course," Morton said with a smile, "there is a cost. No such thing as a free lunch, you know." He then explained that Studebaker's yearly mortgage would increase by $3,052 (from $4,248 to $7,300) but quickly added that the increase in the yearly earnings from the life insurance policy would far exceed this cost. (See Exhibit 3.) For example, after the first year the $55,000 would Morton's Ca Transferred to Current market value of property $100,000 Amount of new mortgage (75% of mkt. value) 75,000 =0.66 12 35x12 Less other costs Total available equity Less balance on existing mortgage 45,000 Less closing costs on new mortgage 3,000 2,000 $25,000 EXHIBIT 3 Morton's Illustration of the Annual and Cumulative Cost to Studebaker of the Life Insurance Policy Compared to the Policy's Annual and Cumulative Accumulation Value Increase in Policy Accumulation Accumulation Annual Cummulative End of Year Payment Value Value Cost Cost $55,000 -2604 5 10 11 13 01234567890123 $58,300 $3,300 $3,052 $3,052 $61,798 $3,498 $3,052 $6,104 $65,506 $3,708 $3,052 $9,156 $69,436 $3,930 $3,052 $12,208 $73,602 $4,166 $3,052 $15,260 6 $78,019 $4,416 $3,052 $18,312 $82,700 $4,681 $3,052 $21,364 $87,662 $4,962 $3,052 $24,416 $92,921 $5,260 $3,052 $27,468 $98,497 $5,575 $3,052 $30,520 $104,406 $5,910 $3,052 $33,572 $110,671 $6,264 $3,052 $36,624 $117,311 $6,640 $3,052 $39,676 14 $124,350 $7,039 $3,052 $42,728 15 $131,811 $7,461 $3,052 $45,780 16 $139,719 $7,909 $3,052 $48,832 17 $148,103 $8,383 $3,052 $51,884 18 $156,989 $8,886 $3,052 $54,936 19 $166,408 $9,419 $3,052 $57,988 20 $176,392 $9,984 $3,052 $61,040 "Calculated as the increase in Studebaker's yearly mortgage payment. grow to $58,300, an increase of $3,300. And during year 20 the amount invested in the life insurance would increase by $9,984, or over three times the yearly increase in Studebaker's mortgage payment. 0 i *(1+i) n M- 55,000 0.06% PA FINANCIAL RAZZLE-DAZZLE When Morton left, Studebaker leafed through the illustrations wondering what to do. On the one hand, he felt like all this was a bit of financial razzle-dazzle that he did not understand. On the other hand, he had the gnawing suspicion that something was not quite right with his present investment situation. He decided to call a colleague of his from the economics department, Phyllis Comer. They were frequent tennis partners, and Studebaker had much confidence in her. Comer was eager to accommodate a friend and readily agreed to meet the next evening. She first queried Studebaker about his life insurance situation, and both concluded that it was quite satisfactory. As she examined the material Morton had left, she quickly saw a number of problems. First, the analysis com- pletely ignored taxes. Second, the movement of Studebaker's equity into the life insurance policy would involve $5,000 of fees. Third, Studebaker would have to give up his 7 percent mortgage and take out a new mortgage at 9 percent. Finally, Comer noted that Studebaker would be paying for life insurance that he didn't need. That is, the life insurance provided an annual yield of 6 percent, but 7 percent could be earned on a long-term investment of similar risk. The dif- ference, of course, pays for the insurance. "I am quite confident," summed up Comer, "that more money can be accumulated by simply investing the $30,000 and the yearly $3,052 (the increase in the annual mortgage payment) in some other long-term investment. You avoid the commission, you can keep your attractive 7 percent mortgage, and you'll earn a higher return." "What you say makes perfect sense," Studebaker said glumly. "Why, then," he asked, referring to Exhibit 3, "does it appear that this is such a good deal? It looks to me that if I do what Morton recommends, all it would cost is the increase of $3,052 in my annual mortgage payment. And-or so it seems-the yearly earnings from the life insurance policy more than cover this increase. Am I missing something?" "Economics," she responded, "teaches you to be alert for missed opportuni- ties in addition to any out-of-pocket expenses. I like to think of these missed opportunities as hidden opportunity costs or hidden sacrifices." Comer then pointed out two subtle costs that the analysis ignored. First, by using the $3,052 a year to meet the increased mortgage payment, Studebaker gives up the opportunity to invest this money and earn interest. Second, by using the excess $30,000 in the money market to buy the life insurance policy, Studebaker loses the interest that this money could have earned. "These numbers," she continued as her fingers pointed to the last two columns of Exhibit 3, "do not consider all this lost interest. The annual cost should consider not only the increase in your mortgage payment for that year but also the increase in the lost interest during the year. For example, with these adjustments the annual cost in year one is $5,152. This includes the extra $3,052 paid at the end of year one plus $2,100 of lost interest on the $30,000 assuming a 7 percent rate of interest. By year 20 this annual cost becomes $18,632. Notice that both of these amounts exceed the yearly increase in CASE 1 FINANCIAL PLANNING 7 earnings from the life insurance investment. Thus, properly adjusted, this analysis indicates that the purchase of the single-premium life insurance policy is a bad deal." Studebaker was obviously upset at his failure to detect these flaws, and Comer quickly added that Morton's proposal had uncovered two extremely important facts. First, Studebaker had an obvious need for some type of safe, long-term, tax-sheltered investment; and second, he had excess yearly income in addition to the money market funds that could be placed in such an investment. QUESTIONS Ignore taxes in all your answers. 1. Morton notes that the $55,000 invested in the single-premium life insurance policy would grow to $176,392 in 20 years for a return of 6 percent a year. Explain how this return was calculated. 2. In order to reposition the equity in his home, Studebaker would have to take out a 30-year, $75,000 mortgage at 9 percent. Explain how the yearly mortgage payments on this loan were obtained. 3. For the 9 percent mortgage in Exhibit 4, find the loan balance at the end of years 19 and 20. 4. Exhibit 3 indicates that $176,392 will be accumulated after 20 years in the life insurance policy. Is this really true? (Hint: If Studebaker were to make this investment, what would his debt position look like in year 20?) 5. (a) If the excess $30,000 were invested in a long-term asset yielding 8 percent a year, how much would be accumulated after 20 years? (b) Suppose Studebaker placed $3,052 a year into a long-term investment paying 8 percent a year. How much would be accumulated after 20 years (amounts invested at the end of each year)? 6. Repeat problem 5 but assume a 7 percent return can be earned. EXHIBIT 4 Amortization on Studebaker's Existing 7% Mortgage and the New 30-Year, 9% Mortgage* ($45,CCO) 7% Mortgage End of Year Balance End of Year Balance 10 1234567899 $43,902 11 $27,675 42,728 12 25,364 41,471 13 22,892 40,126 14 20,247 38,688 15 17,416 37,148 16 14,388 35,501 17 11,147 33,738 18 7,679 31,852 19 3,970 29,834 20 0 (continued) End of Year 12345 CASE 1 FINANCIAL PLANNING 9 EXHIBIT 4 (Continued) ($75,000) 9% Mortgage (selected years) Balance End of Year Balance $74,447 16 $56,839 73,848 17 54,654 73,194 18 52,273 72,482 19 71,705 20 ...... 12 63,916 28 12,841 15 245 13 62,369 29 6,697 14 60,682 30 0 58,843 "The annual payment on the 7 percent mortgage is $4,248. The annual payment on the 9 percent mortgage is $7,300.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets tackle each question step by step Question 1 Calculate the Return on the Single Premium Life Insurance Policy The 55000 will grow to 176392 over ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started