Answered step by step

Verified Expert Solution

Question

1 Approved Answer

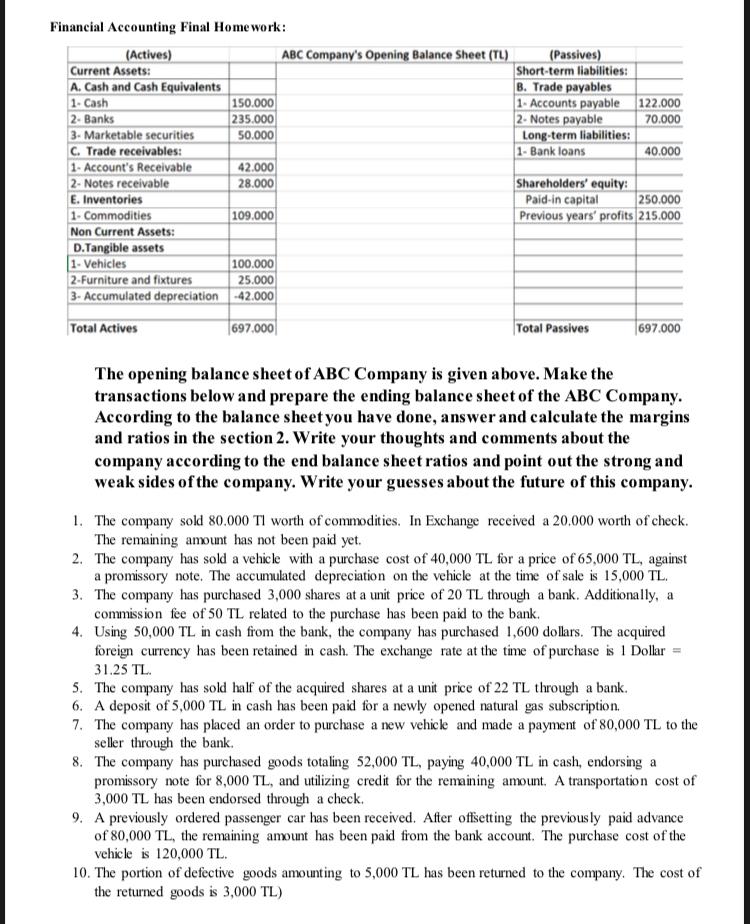

Financial Accounting Final Homework: (Actives) Current Assets: A. Cash and Cash Equivalents 1- Cash 2- Banks 3- Marketable securities C. Trade receivables: 1- Account's

Financial Accounting Final Homework: (Actives) Current Assets: A. Cash and Cash Equivalents 1- Cash 2- Banks 3- Marketable securities C. Trade receivables: 1- Account's Receivable 2- Notes receivable E. Inventories 1- Commodities Non Current Assets: D.Tangible assets 1- Vehicles 2-Furniture and fixtures 150.000 235.000 50.000 Total Actives 42.000 28.000 109.000 100.000 25.000 3- Accumulated depreciation -42.000 697.000 ABC Company's Opening Balance Sheet (TL) (Passives) Short-term liabilities: B. Trade payables 1- Accounts payable 2- Notes payable Long-term liabilities: 1- Bank loans 122.000 70.000 Total Passives 40.000 Shareholders' equity: Paid-in capital 250.000 Previous years' profits 215.000 697.000 The opening balance sheet of ABC Company is given above. Make the transactions below and prepare the ending balance sheet of the ABC Company. According to the balance sheet you have done, answer and calculate the margins and ratios in the section 2. Write your thoughts and comments about the company according to the end balance sheet ratios and point out the strong and weak sides of the company. Write your guesses about the future of this company. 1. The company sold 80.000 Tl worth of commodities. In Exchange received a 20.000 worth of check. The remaining amount has not been paid yet. 2. The company has sold a vehicle with a purchase cost of 40,000 TL for a price of 65,000 TL, against a promissory note. The accumulated depreciation on the vehicle at the time of sale is 15,000 TL. 3. The company has purchased 3,000 shares at a unit price of 20 TL through a bank. Additionally, a commission fee of 50 TL related to the purchase has been paid to the bank. 4. Using 50,000 TL in cash from the bank, the company has purchased 1,600 dollars. The acquired foreign currency has been retained in cash. The exchange rate at the time of purchase is 1 Dollar = 31.25 TL. 5. The company has sold half of the acquired shares at a unit price of 22 TL through a bank. 6. A deposit of 5,000 TL in cash has been paid for a newly opened natural gas subscription. 7. The company has placed an order to purchase a new vehicle and made a payment of 80,000 TL to the seller through the bank. 8. The company has purchased goods totaling 52,000 TL, paying 40,000 TL in cash, endorsing a promissory note for 8,000 TL, and utilizing credit for the remaining amount. A transportation cost of 3,000 TL has been endorsed through a check. 9. A previously ordered passenger car has been received. After offsetting the previously paid advance of 80,000 TL, the remaining amount has been paid from the bank account. The purchase cost of the vehicle is 120,000 TL. 10. The portion of defective goods amounting to 5,000 TL has been returned to the company. The cost of the returned goods is 3,000 TL)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the ending balance sheet of ABC Company we need to account for the given transactions Lets go through each transaction and adjust the balance sheet accordingly 1 The company sold commoditie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started