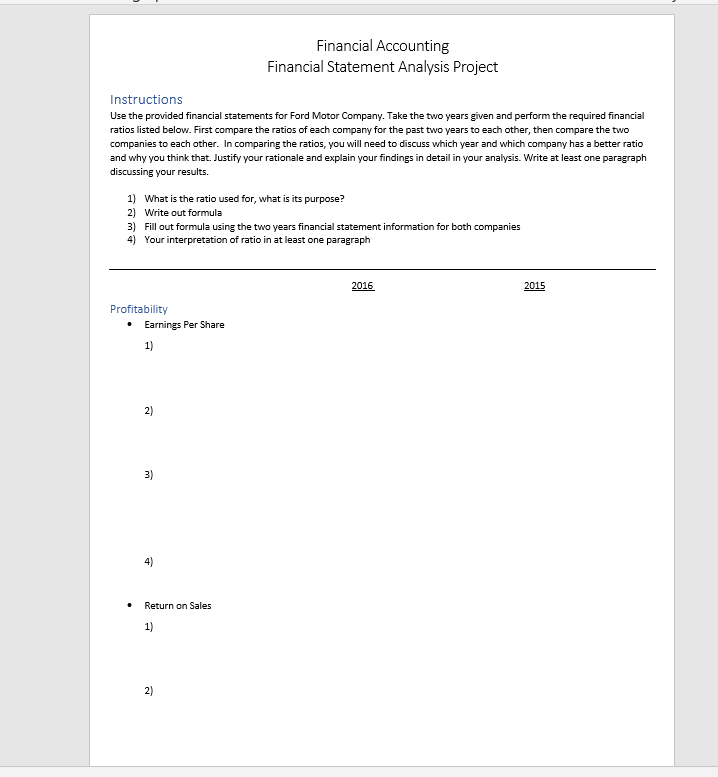

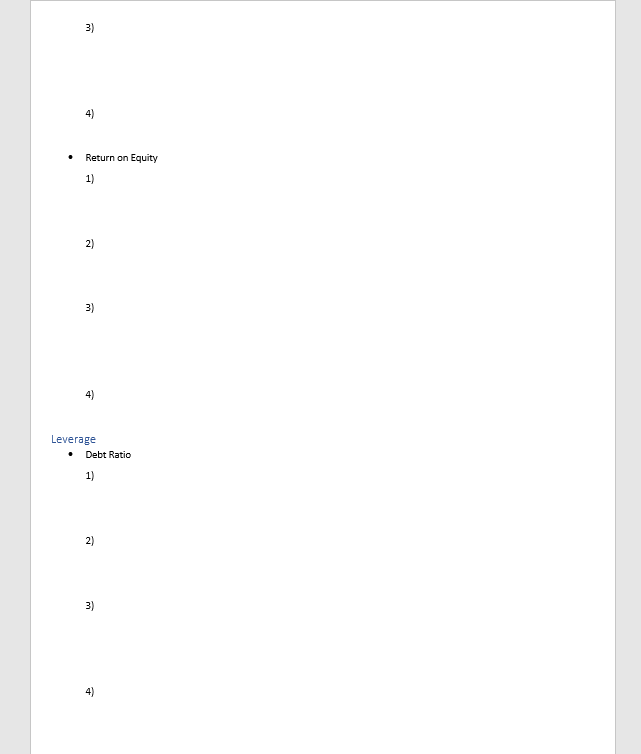

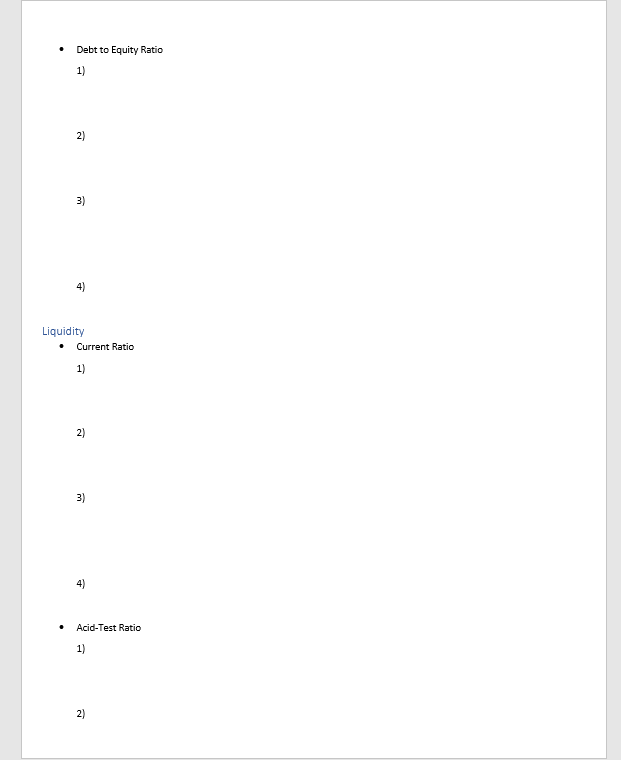

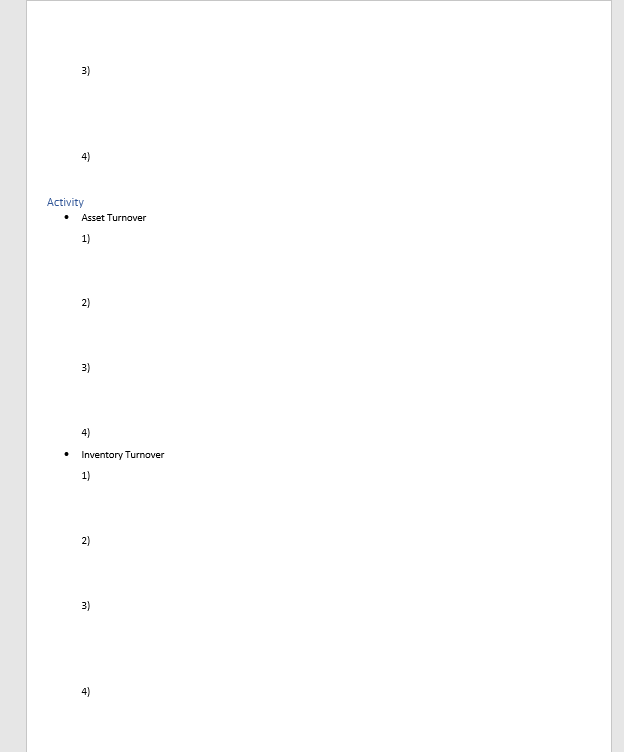

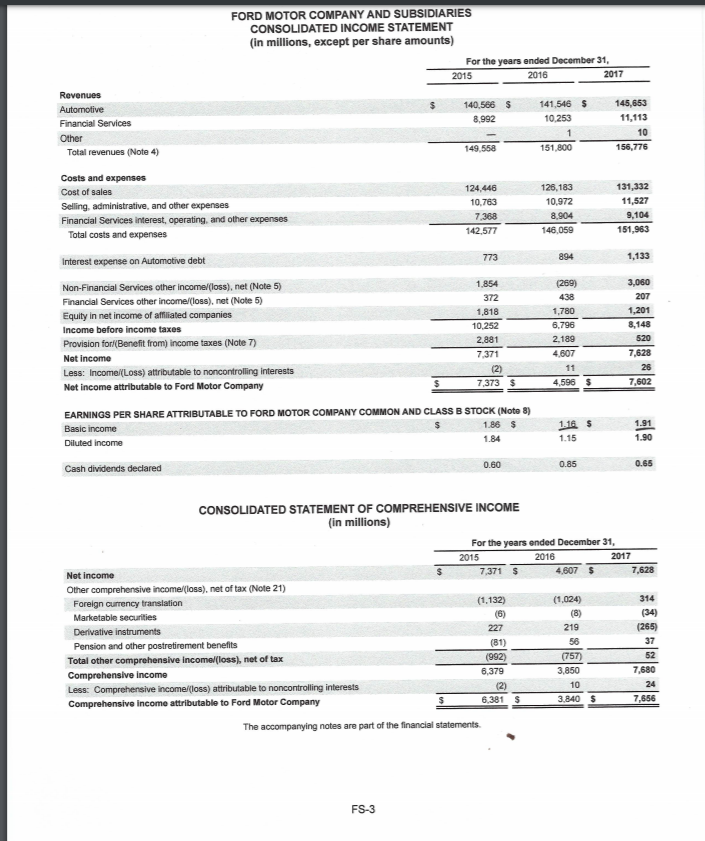

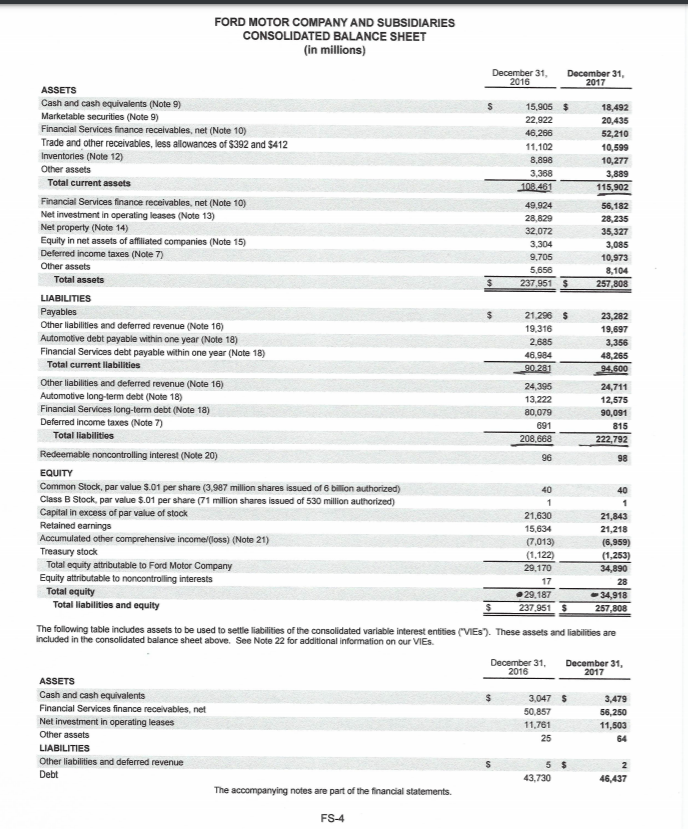

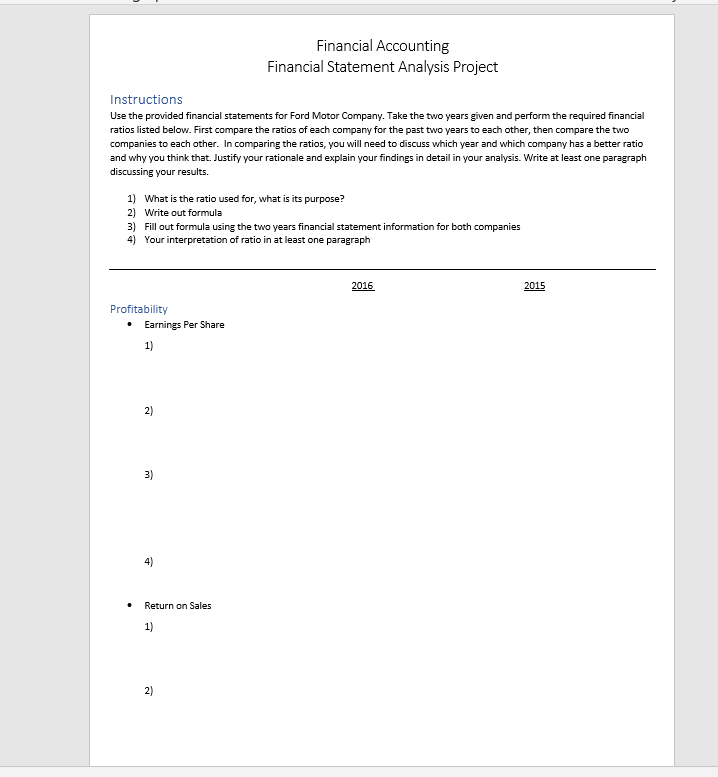

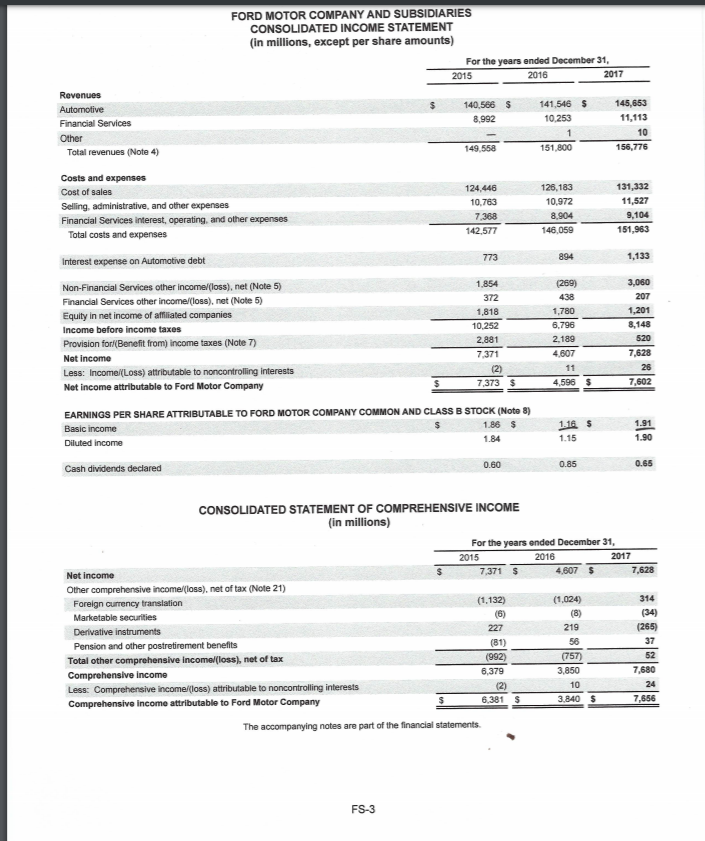

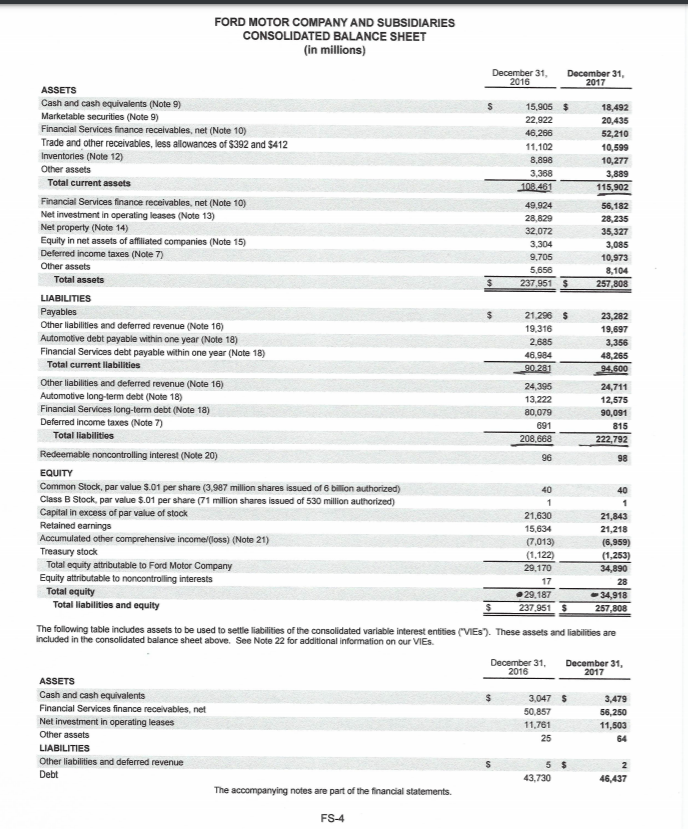

Financial Accounting Financial Statement Analysis Project Instructions Use the provided financial statements for Ford Motor Company. Take the two years given and perform the required financial ratios listed below. First compare the ratios of each company for the past two years to each other, then compare the two companies to each other. In comparing the ratios, you will need to discuss which year and which company has a better ratio and why you think that. Justify your rationale and explain your findings in detail in your analysis. Write at least one paragraph discussing your results 1) What is the ratio used for, what is its purpose? 2) Write out formula 3) Fill out formula using the two years financial statement information for both companies 4) Your interpretation of ratio in at least one paragraph 2016 2015 Profitability Earnings Per Share 1) 2) 3) 4) . Return on Sales 1) 2) 3) 4) Return on Equity 1) 2) 3) 4) Leverage Debt Ratio 1) 2) 3) 4) Debt to Equity Ratio 1) 2) 3) Liquidity Current Ratio 1) 2) 3) 4) Acid-Test Ratio 1) 2) 3) 4) Activity Asset Turnover 1) 2) 3) 4) Inventory Turnover 1) 2) 3) 4) FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENT (in millions, except per share amounts) For the years ended December 31, 2015 2016 2017 140,566 $ 8,992 Revenues Automotive Financial Services Other Total revenues (Note 4) 141,546 5 10.253 1 151,800 145,653 11,113 10 156,776 149,558 Costs and expenses Cost of sales Selling, administrative, and other expenses Financial Services interest, operating, and other expenses Total costs and expenses 124.446 10.763 7368 142.577 126,183 10.972 8.904 146,059 131,332 11,527 9,104 151,963 894 1,133 Interest expense on Automotive debt 773 Non-Financial Services other income/(loss), net (Note 5) 1.854 Financial Services other income/(loss), net (Note 5) 372 Equity in net income of affiliated companies 1,818 Income before income taxes 10.252 Provision for(Benefit from) income taxes (Note 7) 2.881 Net income 7,371 Less: Income (Loss) attributable to noncontrolling interests (2) Net income attributable to Ford Motor Company 7,373 EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK (Note 8) Basic income 1.86 $ Diluted income 1.84 (269) 438 1,780 6.796 2.189 4,607 11 4,596 $ 3,060 207 1,201 8,148 520 7,628 26 7,602 1.165 1.15 1.91 1.90 0.60 Cash dividends declared 0.85 0.65 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (in millions) For the years ended December 31, 2015 2016 2017 Net income 7,371 $ 4,607 $ 7,628 Other comprehensive income (loss), net of tax (Note 21) Foreign currency translation (1,132) (1.024) 314 Marketable securities (6) (34) Derivative Instruments 219 (265) Pension and other postretirement benefits (81) 56 37 Total other comprehensive Income (loss), net of tax (992) (757) 52 Comprehensive income 6,379 3,850 7,680 Less: Comprehensive income (loss) attributable to noncontrolling interests (2) 10 24 Comprehensive income attributable to Ford Motor Company 6.381 $ 3.840 $ 7,656 The accompanying notes are part of the financial statements 227 FS-3 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET (in millions) December 31, December 31, 2016 2017 ASSETS Cash and cash equivalents (Note 9) 15,905 $ 18,492 Marketable securities (Note 9) 22,922 20,435 Financial Services finance receivables, net (Note 10) 46.266 52,210 Trade and other receivables, less allowances of $392 and $412 11.102 10,599 Inventories (Note 12) 8,898 10,277 Other assets 3,368 3,889 Total current assets 108.461 115,902 Financial Services finance receivables, net (Note 10) 49.924 56,182 Net investment in operating leases (Note 13) 28,829 28,235 Net property (Note 14) 32,072 35,327 Equity in net assets of affiliated companies (Note 15) 3,304 3,085 Deferred income taxes (Note 7) 9,705 10,973 Other assets 5,656 8,104 Total assets 237,951 $ 257,808 LIABILITIES Payables 21.296 5 23,282 Other liabilities and deferred revenue (Note 16) 19,316 19,697 Automotive debt payable within one year (Note 18) 2.685 3,356 Financial Services debt payable within one year (Note 18) 46,984 48,265 Total current liabilities 90.281 94.600 Other liabilities and deferred revenue (Note 16) 24,395 24,711 Automotive long-term debt (Note 18) 13,222 12,575 Financial Services long-term debt (Note 18) 80,079 90,091 Deferred income taxes (Note 7) 691 815 Total liabilities 208.668 222,792 Redeemable noncontrolling interest (Note 20) 96 98 EQUITY Common Stock, par value 8.01 per share (3,987 million shares issued of 6 billion authorized) 40 40 Class B Stock, par value $.01 per share (71 million shares issued of 530 million authorized) 1 Capital in excess of par value of stock 21,630 21,843 Retained earnings 15,634 21,218 Accumulated other comprehensive income (loss) (Note 21) (7,013) (6,959) Treasury stock (1.122 (1,253) Total equity attributable to Ford Motor Company 29,170 34,890 Equity attributable to noncontrolling interests 17 28 Total equity .29.187 34,918 Total liabilities and equity 237,951 $ 257,808 The following table includes assets to be used to settle liabilities of the consolidated variable interest entities (VIES). These assets and liabilities are included in the consolidated balance sheet above. See Note 22 for additional information on our VIES. December 31 December 31, 2016 2017 ASSETS Cash and cash equivalents 3,047 $ 3,479 Financial Services finance receivables, net 50,857 56,250 Net investment in operating leases 11,761 11,503 Other assets 25 64 LIABILITIES Other liabilities and deferred revenue 5 $ 2 Debt 43.730 46,437 The accompanying notes are part of the financial statements 1 FS-4