Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Accounting Question 6 6. (a) On 1 January 2018, Fairy Sdn. Bhd. acquired an intangible asset which has a fair value of RM4,000,000 at

Financial Accounting

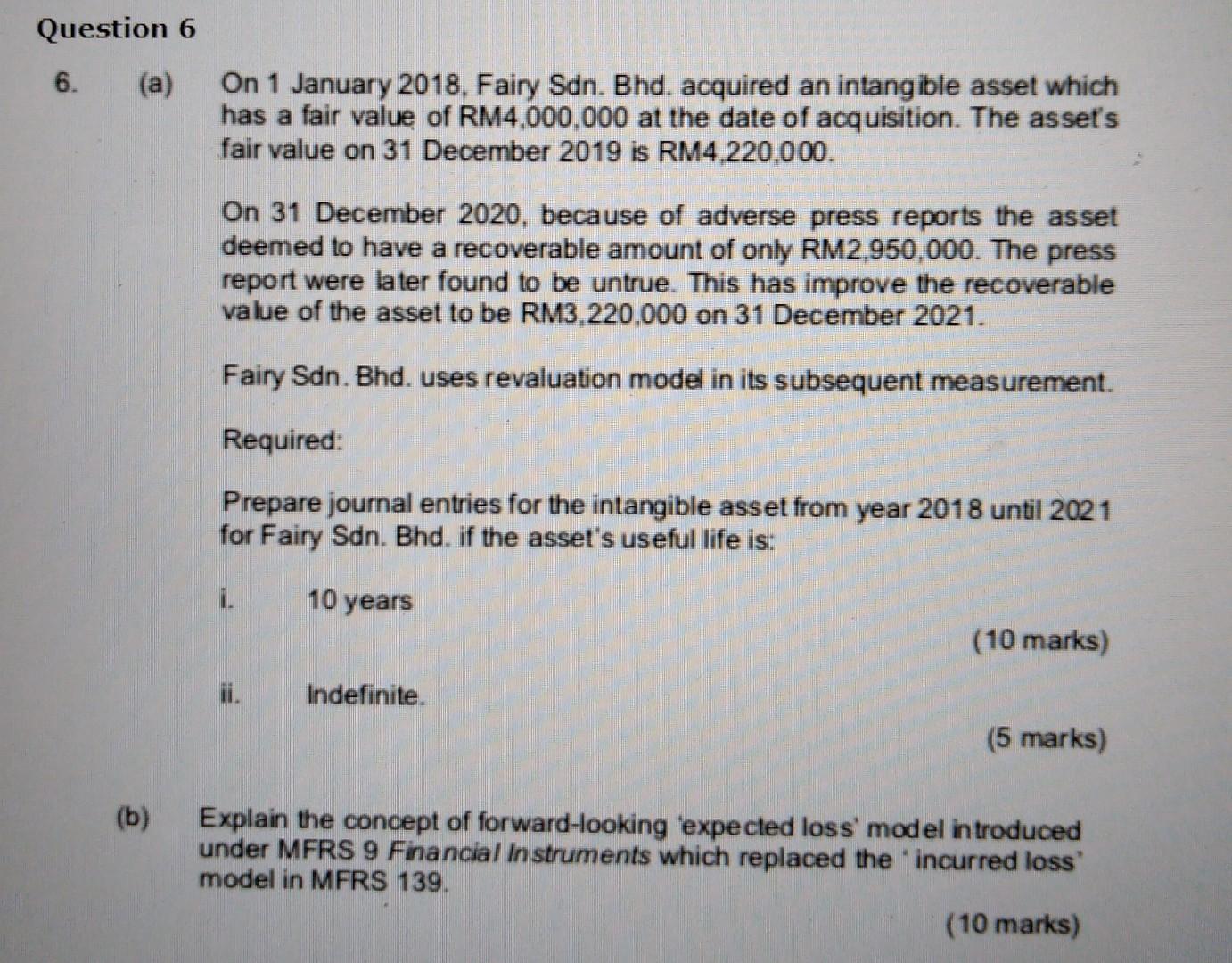

Question 6 6. (a) On 1 January 2018, Fairy Sdn. Bhd. acquired an intangible asset which has a fair value of RM4,000,000 at the date of acquisition. The asset's fair value on 31 December 2019 is RM4,220,000. On 31 December 2020, because of adverse press reports the asset deemed to have a recoverable amount of only RM2,950,000. The press report were later found to be untrue. This has improve the recoverable value of the asset to be RM3,220,000 on 31 December 2021. Fairy Sdn. Bhd. uses revaluation model in its subsequent measurement. Required: Prepare journal entries for the intangible asset from year 2018 until 2021 for Fairy Sdn. Bhd. if the asset's useful life is: 1. 10 years (10 marks) ii. Indefinite. (5 marks) (b) Explain the concept of forward-looking expected loss' model introduced under MFRS 9 Financial Instruments which replaced the 'incurred loss' model in MFRS 139. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started