Answered step by step

Verified Expert Solution

Question

1 Approved Answer

financial accounting Use the following information for questions 7-8. On 1 January 20X1 entities A and Beach acquired 30 per cent of the ordinary shares

financial accounting

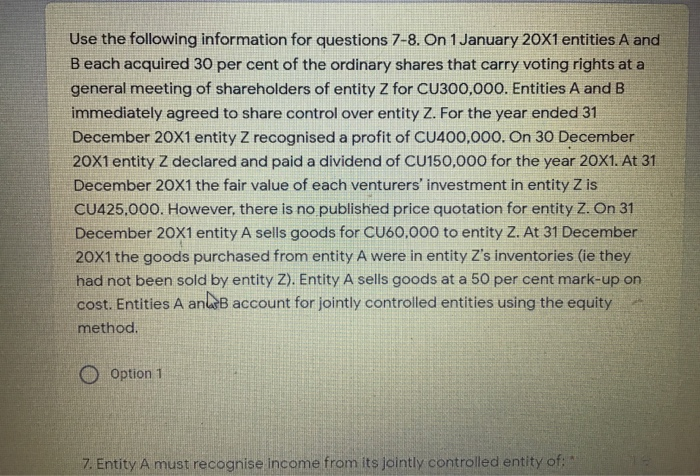

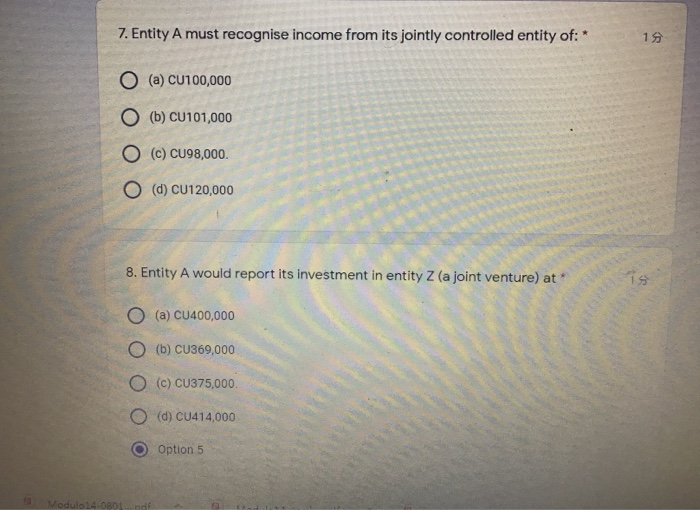

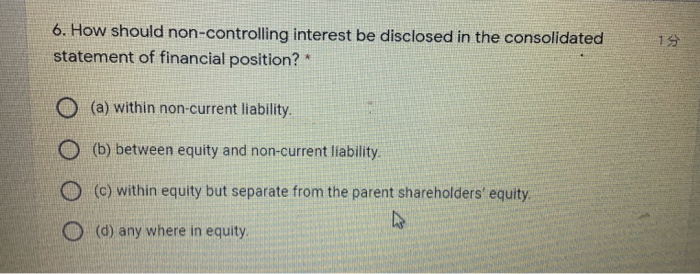

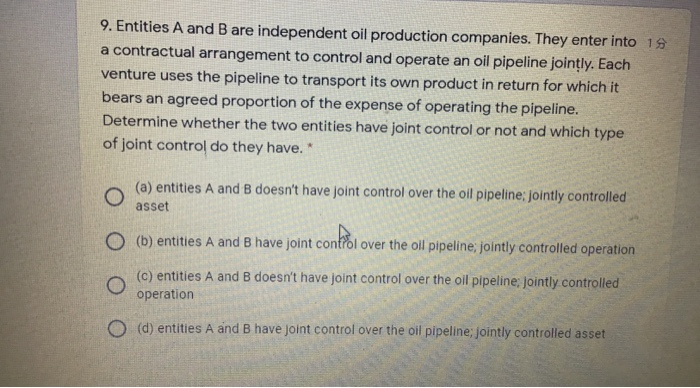

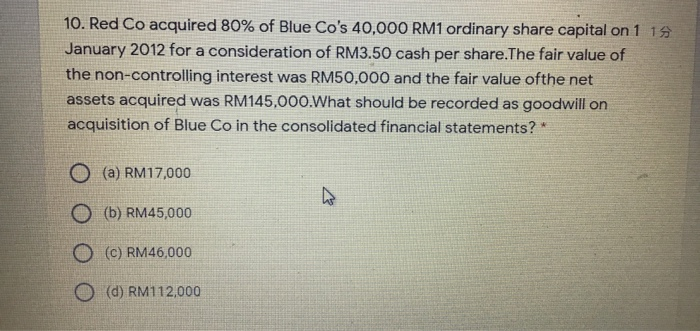

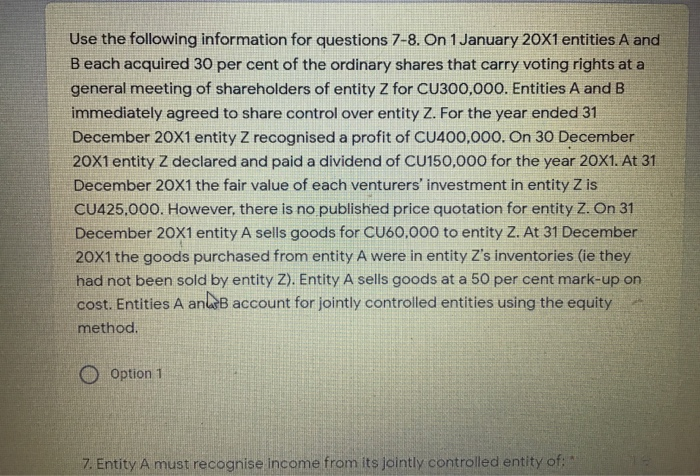

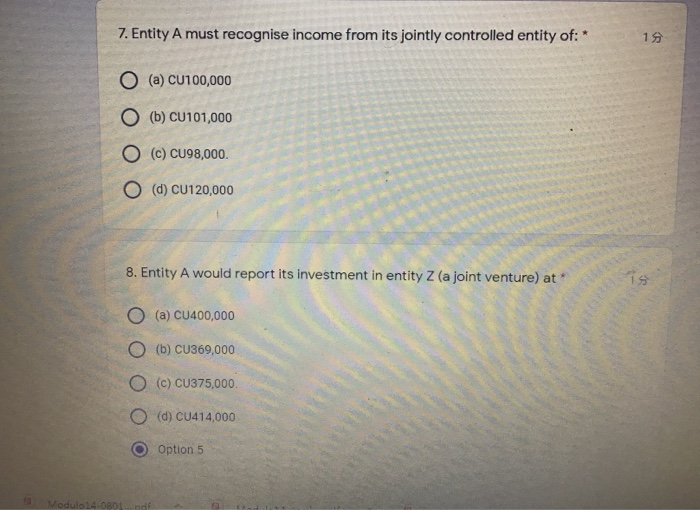

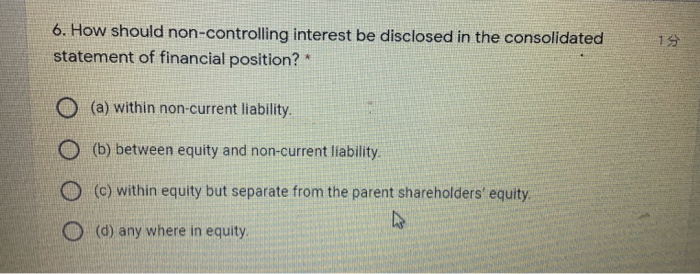

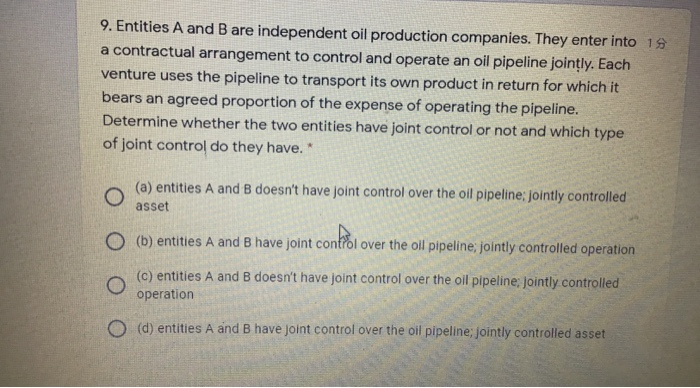

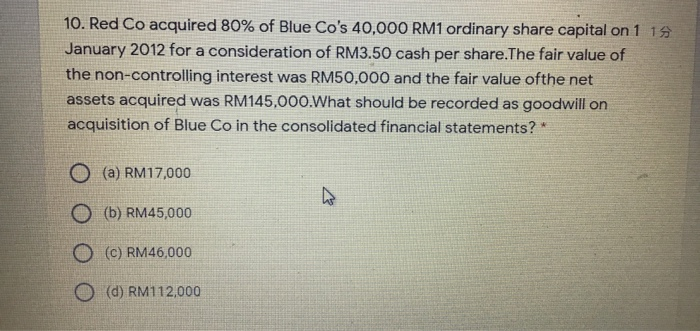

Use the following information for questions 7-8. On 1 January 20X1 entities A and Beach acquired 30 per cent of the ordinary shares that carry voting rights at a general meeting of shareholders of entity Z for CU300,000. Entities A and B immediately agreed to share control over entity Z. For the year ended 31 December 20X1 entity Z recognised a profit of CU400,000. On 30 December 20X1 entity Z declared and paid a dividend of CU150,000 for the year 20X1. At 31 December 20X1 the fair value of each venturers' investment in entity Z is CU425,000. However, there is no published price quotation for entity Z. On 31 December 20X1 entity A sells goods for CU60,000 to entity Z. At 31 December 20X1 the goods purchased from entity A were in entity Z's inventories (ie they had not been sold by entity Z). Entity A sells goods at a 50 per cent mark-up on cost. Entities A anlab account for jointly controlled entities using the equity method. Option 1 7. Entity A must recognise income from its jointly controlled entity of: 7. Entity A must recognise income from its jointly controlled entity of: * 19 O (a) CU100,000 O (b) CU101,000 O (c) CU98,000 (d) CU120,000 8. Entity A would report its investment in entity Z (a joint venture) at is O (a) CU400,000 O (b) CU369,000 (c) CU375,000 (d) CU414,000 Option 5 Modulo 14 OBD 6. How should non-controlling interest be disclosed in the consolidated statement of financial position? 19 O(a) within non-current liability. O (b) between equity and non-current liability. O (c) within equity but separate from the parent shareholders' equity. O (d) any where in equity. 9. Entities A and B are independent oil production companies. They enter into 19 a contractual arrangement to control and operate an oil pipeline jointly. Each venture uses the pipeline to transport its own product in return for which it bears an agreed proportion of the expense of operating the pipeline. Determine whether the two entities have joint control or not and which type of joint control do they have.* (a) entities A and B doesn't have joint control over the oil pipeline; jointly controlled asset (1) entities A and B have joint confol over the oll pipeline, jointly controlled operation (c) entities A and B doesn't have joint control over the oil pipeline, jointly controlled operation (d) entities A and B have joint control over the oil pipeline; jointly controlled asset 10. Red Co acquired 80% of Blue Co's 40,000 RM1 ordinary share capital on 1 19 January 2012 for a consideration of RM3.50 cash per share.The fair value of the non-controlling interest was RM50,000 and the fair value ofthe net assets acquired was RM145,000.What should be recorded as goodwill on acquisition of Blue Co in the consolidated financial statements? * O (a) RM17,000 O (b) RM45,000 O (C) RM46,000 (d) RM112.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started