Answered step by step

Verified Expert Solution

Question

1 Approved Answer

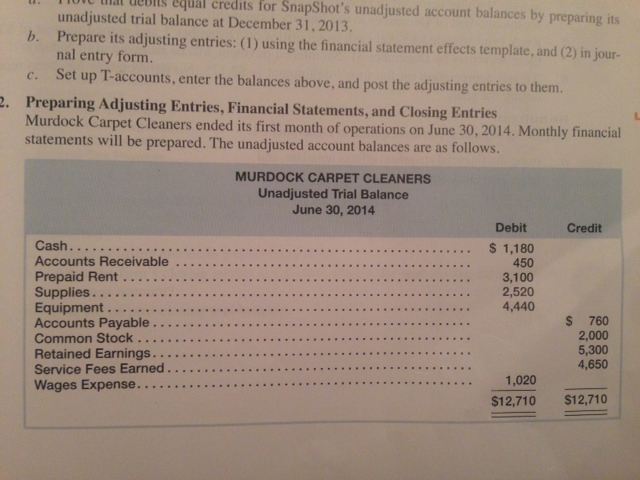

Financial Accouting 4th Edition Dyckman, Magee, Pfeiffer Chapter 3 Question P3-42 Preparing Adjusting Entries, Financial Statements, and Closing entries. Murdock Carpet Cleaners ended its first

Financial Accouting 4th Edition Dyckman, Magee, Pfeiffer

Chapter 3

Question P3-42

Preparing Adjusting Entries, Financial Statements, and Closing entries.

Murdock Carpet Cleaners ended its first month of operations on June 30, 2014. Month;y financial statements will be prepared. The unadjusted account balances are as follows.

This class is giving me a really hard time. I have been working on this question for over 4 hours and can not figure out how to complete it.

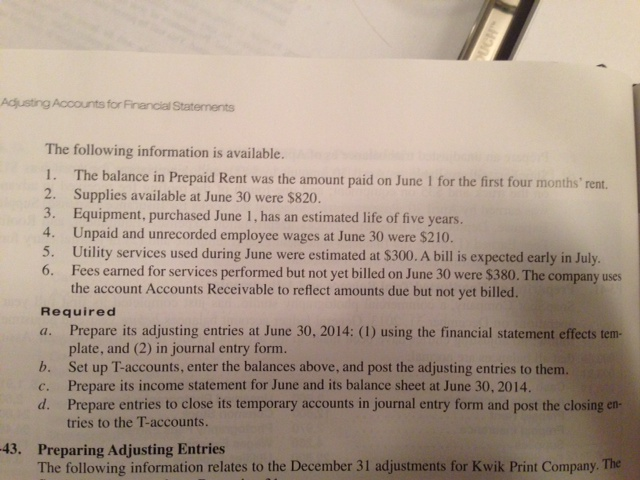

Prepare its adjusting entries:(1) using the financial statement effects template, and (2) its journal entry form. Set up T-accounts, enter the balances above, and post the adjusting entries to them. Preparing Adjusting Entries, Financial Statements, and Closing Entries Murdock Carpet Cleaners ended its first month of operations on June 3,214. Monthly financial statements will be prepared. The unadjusted account balances are as follows. The following information is available. The balance in Prepaid Rent was the amount paid on June I for the first four months rent. Supplies available at June 3 were $82. Equipment, purchased June I, has an estimated life of five years. Unpaid and unrecorded employee wages at June 3 were $21. Utility services used during June were estimated at $3. A bill is expected early in July. Fees earned for services performed but not yet billed on June 3 were $38. The company uses the account Accounts Receivable to reflect amounts due but not yet billed. Required Prepare its adjusting entries at June 3. 214: (1) using the financial statement effects template. and (2) in journal entry form. Set up T-accounts, enter the balances above, and post the adjusting entries to them. Prepare its income statement for June and its balance sheet at June 3,214. Prepare entries to close its temporary accounts in journal entry form and post the closing entries to the T-accounts. Preparing Adjusting Entries The following information relates to the December 31 adjustments for Kwik Print Company. Prepare its adjusting entries:(1) using the financial statement effects template, and (2) its journal entry form. Set up T-accounts, enter the balances above, and post the adjusting entries to them. Preparing Adjusting Entries, Financial Statements, and Closing Entries Murdock Carpet Cleaners ended its first month of operations on June 3,214. Monthly financial statements will be prepared. The unadjusted account balances are as follows. The following information is available. The balance in Prepaid Rent was the amount paid on June I for the first four months rent. Supplies available at June 3 were $82. Equipment, purchased June I, has an estimated life of five years. Unpaid and unrecorded employee wages at June 3 were $21. Utility services used during June were estimated at $3. A bill is expected early in July. Fees earned for services performed but not yet billed on June 3 were $38. The company uses the account Accounts Receivable to reflect amounts due but not yet billed. Required Prepare its adjusting entries at June 3. 214: (1) using the financial statement effects template. and (2) in journal entry form. Set up T-accounts, enter the balances above, and post the adjusting entries to them. Prepare its income statement for June and its balance sheet at June 3,214. Prepare entries to close its temporary accounts in journal entry form and post the closing entries to the T-accounts. Preparing Adjusting Entries The following information relates to the December 31 adjustments for Kwik Print CompanyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started