Question

Financial Analysis of the Firm You will perform an in depth analysis, where you apply financial statement tools to significant company activities, using applicable financial

Financial Analysis of the Firm

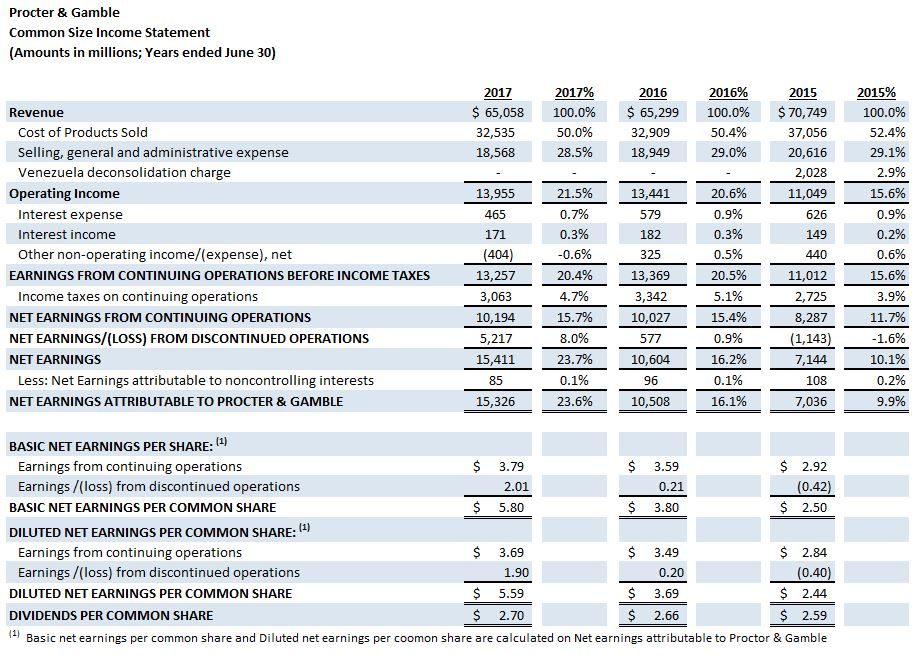

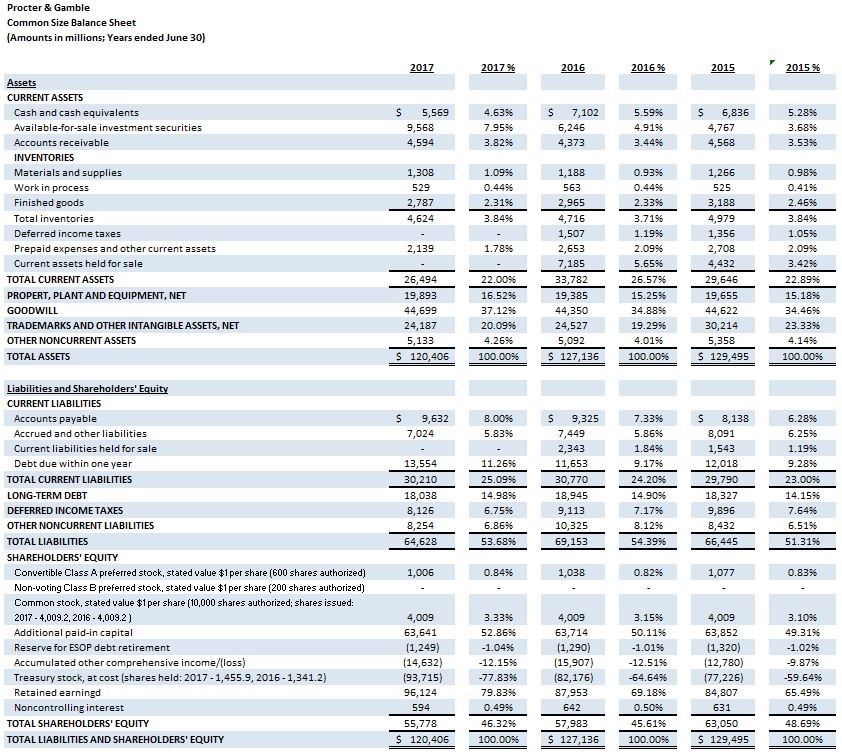

You will perform an in depth analysis, where you apply financial statement tools to significant company activities, using applicable financial ratios and common size statement analysis for your company over the last three years.

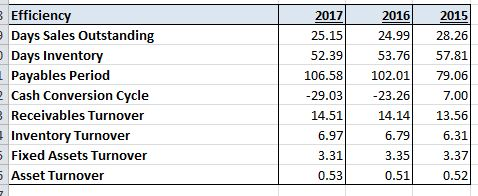

Evaluate the efficiency of the companys asset utilization by using meaningful financial ratios.

Using the efficiency ratios above, I need to explain what is happening with the company. (i.e. Despite a revenue decrease of -0.14% YoY to $65,058, P&Gs asset turnover ratio improved to 0.53 to end fiscal 2017. This was in part due to more efficient use of their assets.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started