Answered step by step

Verified Expert Solution

Question

1 Approved Answer

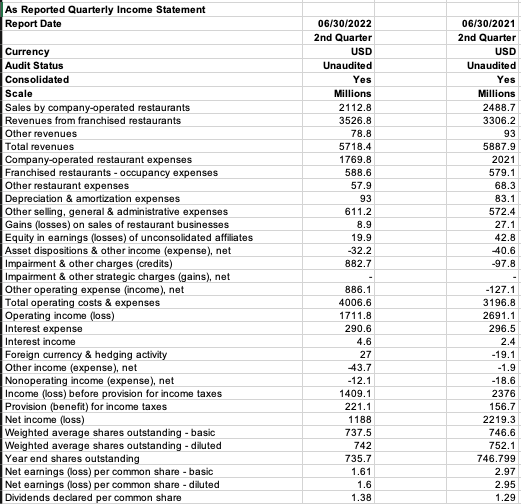

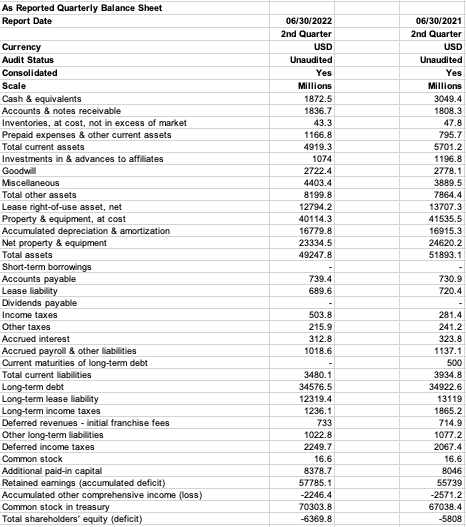

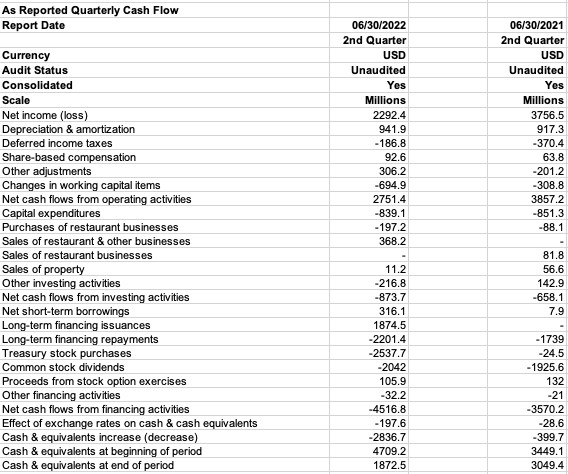

Financial Calculations. I am in need of assistance calculating accurate financial formulas to assess McDonald's for quarter 2 in 2022 and 2021 (See below attached

Financial Calculations. I am in need of assistance calculating accurate financial formulas to assess McDonald's for quarter 2 in 2022 and 2021 (See below attached balance sheet, income statement, and cash flow images): (Quarter 2 ending 2022)

- Working capital (current assets - current liabilities)

- Current ratio (current assets / current liabilities)

- Debt ratio (total liabilities / total assets)

- Earnings per share (net income / weighted average common shares outstanding)

- Price/earnings ratio (share price (end of 2nd quarter 2022 / EPS)

- Total asset turnover ratio (total revenue / total assets)

- Financial leverage (total assets / shareholder's equity)

- Net profit margin (net income / total revenue)

- Return on assets (net income / total assets)

- Return on equity (net income - preferred dividends / shareholder's equity)

(Quarter 2 ending 2021)

- Working capital (current assets - current liabilities)

- Current ratio (current assets / current liabilities)

- Debt ratio (total liabilities / total assets)

- Earnings per share (net income / weighted average common shares outstanding)

- Price/earnings ratio (share price (end of 2nd quarter 2021 / EPS)

- Total asset turnover ratio (total revenue / total assets)

- Financial leverage (total assets / shareholder's equity)

- Net profit margin (net income / total revenue)

- Return on assets (net income / total assets)

- Return on equity (net income - preferred dividends / shareholder's equity)

As Reported Quarterly Income Statement Report Date Currency Audit Status Consolidated Scale Sales by company-operated restaurants Revenues from franchised restaurants Other revenues Total revenues Company-operated restaurant expenses Franchised restaurants occupancy expenses Other restaurant expenses Depreciation & amortization expenses Other selling, general & administrative expenses Gains (losses) on sales of restaurant businesses Equity in earnings (losses) of unconsolidated affiliates Asset dispositions & other income (expense), net Impairment & other charges (credits) Impairment & other strategic charges (gains), net Other operating expense (income), net Total operating costs & expenses Operating income (loss) Interest expense Interest income Foreign currency & hedging activity Other income (expense), net Nonoperating income (expense), net Income (loss) before provision for income taxes Provision (benefit) for income taxes Net income (loss) Weighted average shares outstanding - basic Weighted average shares outstanding - diluted Year end shares outstanding Net earnings (loss) per common share-basic Net earnings (loss) per common share - diluted Dividends declared per common share 06/30/2022 2nd Quarter USD Unaudited Yes Millions 2112.8 3526.8 78.8 5718.4 1769.8 588.6 57.9 93 611.2 8.9 19.9 -32.2 882.7 886.1 4006.6 1711.8 290.6 4.6 27 -43.7 -12.1 1409.1 221.1 1188 737.5 742 735.7 1.61 1.6 1.38 06/30/2021 2nd Quarter USD Unaudited Yes Millions 2488.7 3306.2 93 5887.9 2021 579.1 68.3 83.1 572.4 27.1 42.8 -40.6 -97.8 -127.1 3196.8 2691.1 296.5 2.4 -19.1 -1.9 -18.6 2376 156.7 2219.3 746.6 752.1 746.799 2.97 2.95 1.29

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the calculations for the requested financial ratios for McDonalds for Q2 2022 and Q2 2021 Q...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started