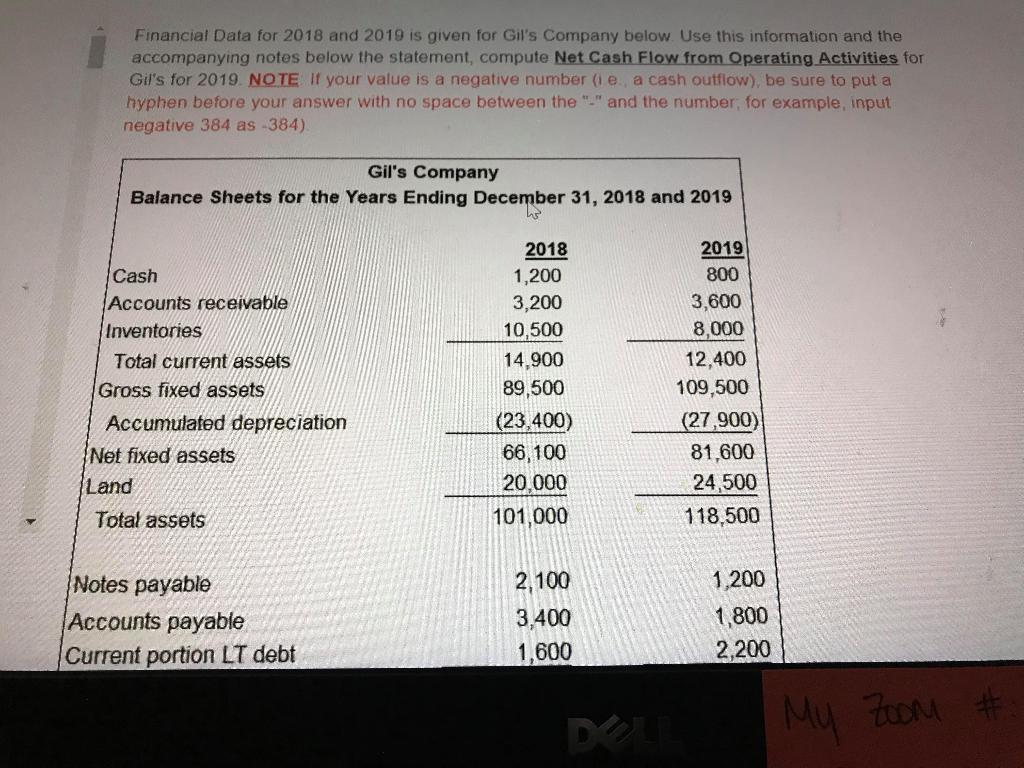

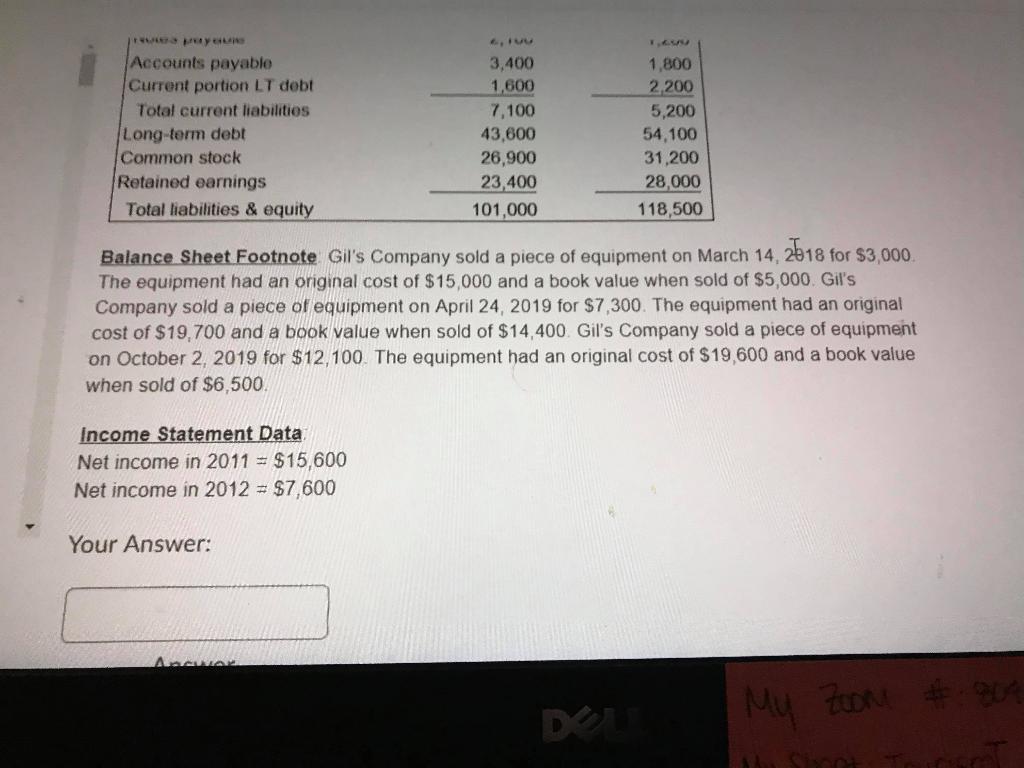

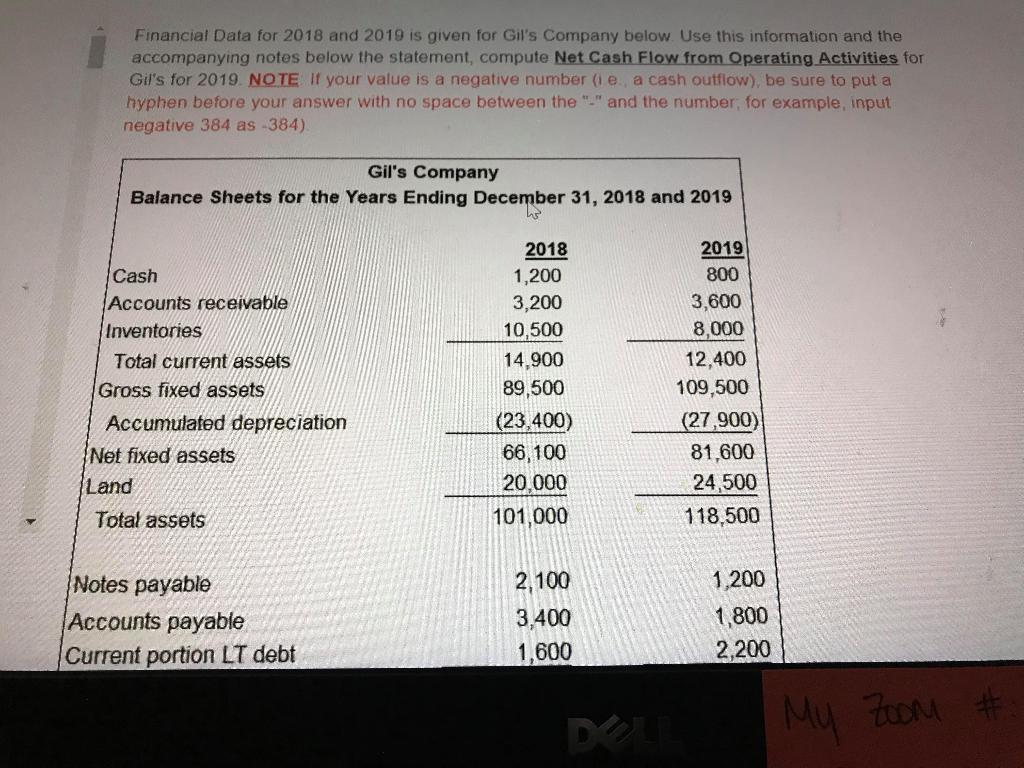

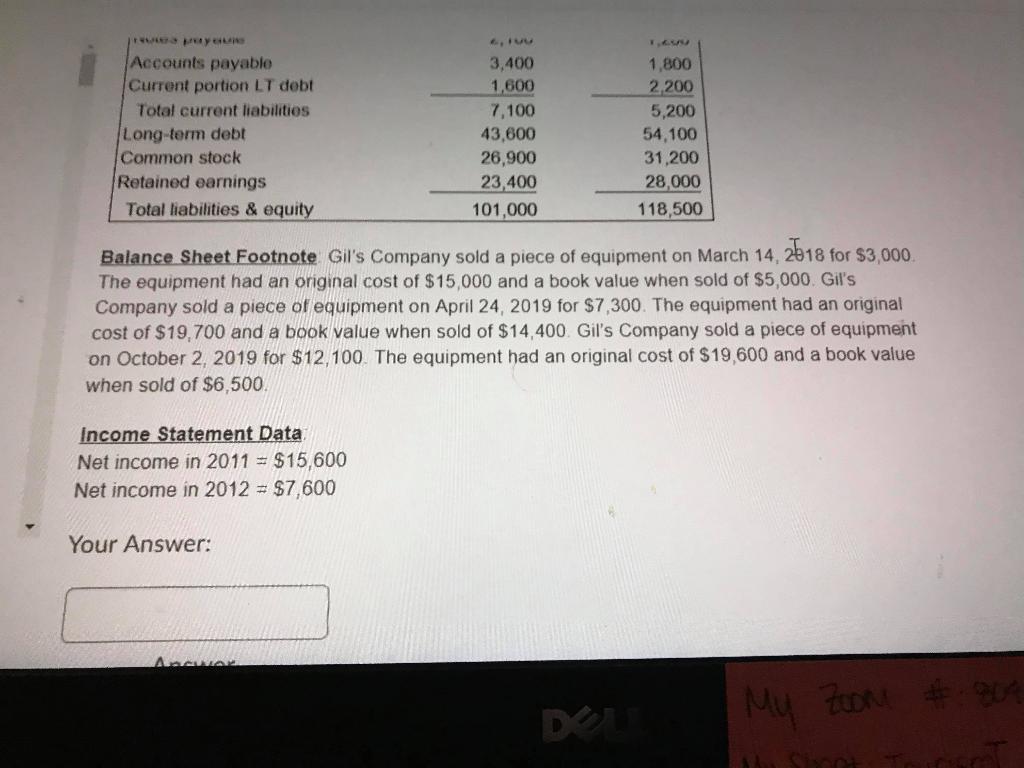

Financial Data for 2018 and 2019 is given for Gil's Company below. Use this information and the accompanying notes below the statement, compute Net Cash Flow from Operating Activities for Gil's for 2019. NOTE If your value is a negative number ( e a cash outflow), be sure to put a hyphen before your answer with no space between the ""and the number, for example, input negative 384 as -384) Gil's Company Balance Sheets for the Years Ending December 31, 2018 and 2019 Cash Accounts receivable Inventories Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Land 2018 1,200 3,200 10,500 14,900 89,500 (23,400) 66,100 20.000 101,000 2019 800 3,600 8,000 12,400 109,500 (27,900) 81,600 24,500 118,500 Total assets Notes payable Accounts payable Current portion LT debt 2,100 3.400 1,600 1,200 1,800 2,200 My Zoom # # Accounts payable 3,400 1.800 Current portion LT debt 1,600 2,200 Total current liabilities 7,100 5,200 Long-term debt 43,600 54,100 Common stock 26,900 31,200 Retained earnings 23,400 28,000 Total liabilities & equity 101,000 118,500 Balance Sheet Footnote Gil's Company sold a piece of equipment on March 14, 2018 for $3,000 The equipment had an original cost of $15,000 and a book value when sold of $5,000. Gil's Company sold a piece of equipment on April 24, 2019 for $7,300. The equipment had an original cost of $19,700 and a book value when sold of $14,400. Gil's Company sold a piece of equipment on October 2, 2019 for $12,100. The equipment had an original cost of $19,600 and a book value when sold of $6,500 Income Statement Data Net 2011 = $15,600 Net income in 2012 = $7,600 Your Answer: AVAL My Zoom Financial Data for 2018 and 2019 is given for Gil's Company below. Use this information and the accompanying notes below the statement, compute Net Cash Flow from Operating Activities for Gil's for 2019. NOTE If your value is a negative number ( e a cash outflow), be sure to put a hyphen before your answer with no space between the ""and the number, for example, input negative 384 as -384) Gil's Company Balance Sheets for the Years Ending December 31, 2018 and 2019 Cash Accounts receivable Inventories Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Land 2018 1,200 3,200 10,500 14,900 89,500 (23,400) 66,100 20.000 101,000 2019 800 3,600 8,000 12,400 109,500 (27,900) 81,600 24,500 118,500 Total assets Notes payable Accounts payable Current portion LT debt 2,100 3.400 1,600 1,200 1,800 2,200 My Zoom # # Accounts payable 3,400 1.800 Current portion LT debt 1,600 2,200 Total current liabilities 7,100 5,200 Long-term debt 43,600 54,100 Common stock 26,900 31,200 Retained earnings 23,400 28,000 Total liabilities & equity 101,000 118,500 Balance Sheet Footnote Gil's Company sold a piece of equipment on March 14, 2018 for $3,000 The equipment had an original cost of $15,000 and a book value when sold of $5,000. Gil's Company sold a piece of equipment on April 24, 2019 for $7,300. The equipment had an original cost of $19,700 and a book value when sold of $14,400. Gil's Company sold a piece of equipment on October 2, 2019 for $12,100. The equipment had an original cost of $19,600 and a book value when sold of $6,500 Income Statement Data Net 2011 = $15,600 Net income in 2012 = $7,600 Your Answer: AVAL My Zoom