Answered step by step

Verified Expert Solution

Question

1 Approved Answer

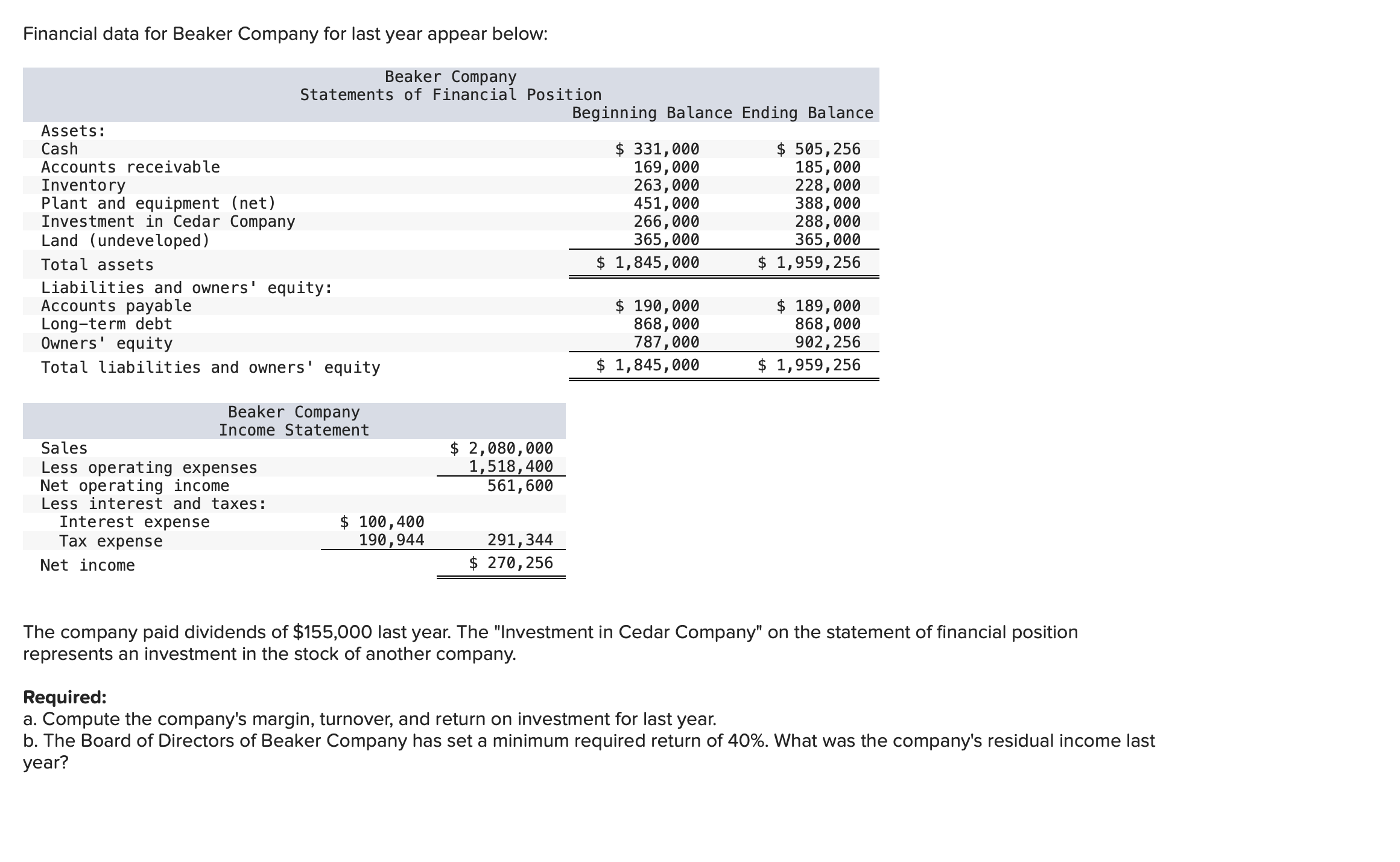

Financial data for Beaker Company for last year appear below: Beaker Company Statements of Financial Position Beginning Balance Ending Balance Assets: Cash Accounts receivable

Financial data for Beaker Company for last year appear below: Beaker Company Statements of Financial Position Beginning Balance Ending Balance Assets: Cash Accounts receivable Inventory Plant and equipment (net) Investment in Cedar Company Land (undeveloped) Total assets Liabilities and owners' equity: Accounts payable Long-term debt Owners' equity Total liabilities and owners' equity Beaker Company Income Statement $ 2,080,000 1,518,400 Sales Less operating expenses Net operating income Less interest and taxes: Interest expense Tax expense Net income 561,600 $ 100,400 190,944 291,344 $ 270,256 $ 331,000 $ 505,256 169,000 185,000 263,000 228,000 451,000 388,000 266,000 288,000 365,000 365,000 $ 1,845,000 $ 1,959,256 $ 190,000 868,000 787,000 $ 189,000 868,000 902,256 $ 1,845,000 $ 1,959,256 The company paid dividends of $155,000 last year. The "Investment in Cedar Company" on the statement of financial position represents an investment in the stock of another company. Required: a. Compute the company's margin, turnover, and return on investment for last year. b. The Board of Directors of Beaker Company has set a minimum required return of 40%. What was the company's residual income last year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Compute the companys margin turnover and return on investment ROI for last year 1 Margin Margin is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started