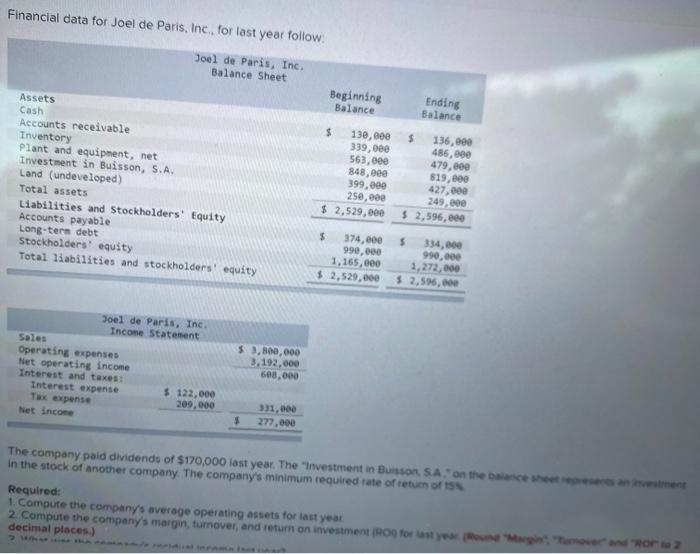

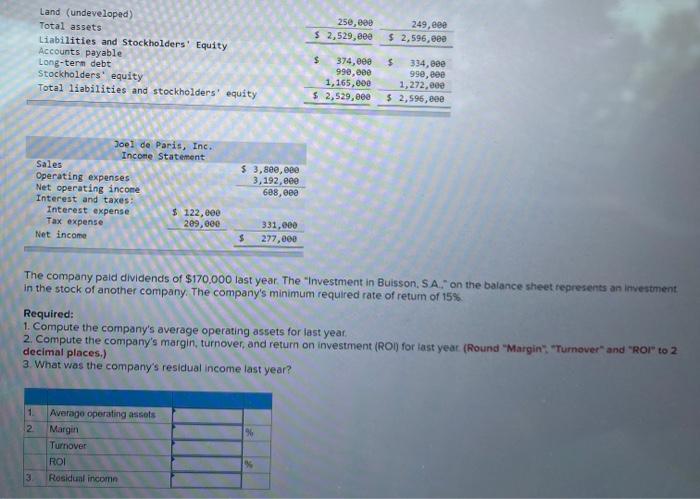

Financial data for Joel de Paris, Inc., for last year follow Joel de Paris, Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped Total assets Liabilities and Stockholders! Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity $ 130,00 339,000 563,000 848,000 399,00 25e, $ 2,529,000 $ 136,000 485,000 479.00 819,00 427,00 249,00 $ 2,595,000 $ 334,000 $ 374,000 990,000 1,165,000 $ 2,529,000 1,272,000 $ 2,596.000 Joel de Paris, Inc. Income Statement Sales Operating expenses Net operating income Interest and taxes Interest expense $ 122,000 Tax expense 209,000 het Income 53,800,000 3,192,000 600.000 331,000 277.000 $ The company paid dividends of $170,000 last year. The "Investment in Bursson SA." on the balance sheement in the stock of another company. The company's minimum required rate of return of Required: 1. Compute the company's average operating assets for last year 2. Compute the company's margin, turnover, and return on investment (RO forsty decimal places) 250,000 $ 2,529, eee 249,eee $ 2,596,eee Land (undeveloped Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity $ 374, eee 990,eee 1,165,000 $ 2,529,000 $ 334,000 990, eee 1,272,eee $ 2,596, 80e Joel de Paris, Inc. Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense $ 122, eee Tax expense Net income $ 3,800,000 3,192,800 688,000 209,000 331,000 277,000 The company paid dividends of $170.000 last year. The "Investment in Buisson, SA." on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of retum of 15% Required: 1. Compute the company's average operating assets for last year, 2. Compute the company's margin, turnover, and return on investment (RON) for last year (Round "Margin" "Turnover" and "Ror" to 2 decimal places.) 3. What was the company's residual income last year? 1 2 Average operating assets Margin Turnover ROI Rosidin incom 3