Answered step by step

Verified Expert Solution

Question

1 Approved Answer

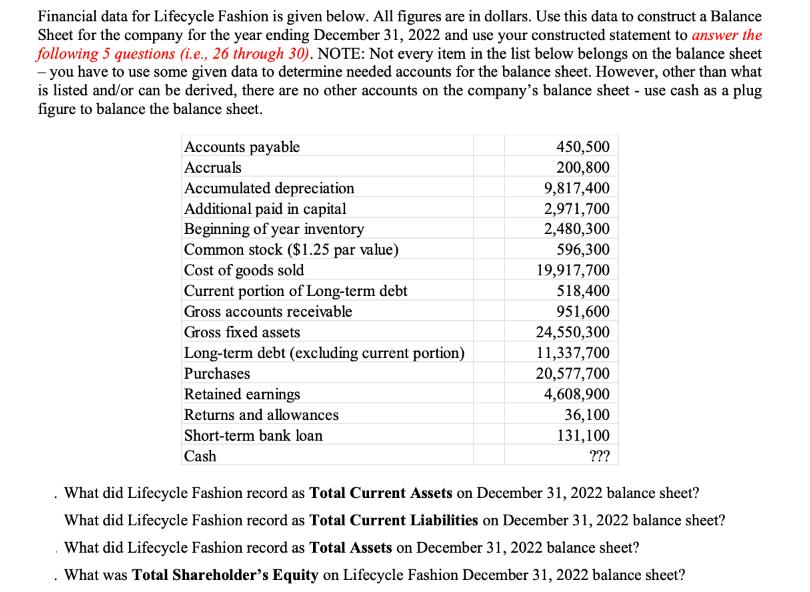

Financial data for Lifecycle Fashion is given below. All figures are in dollars. Use this data to construct a Balance Sheet for the company

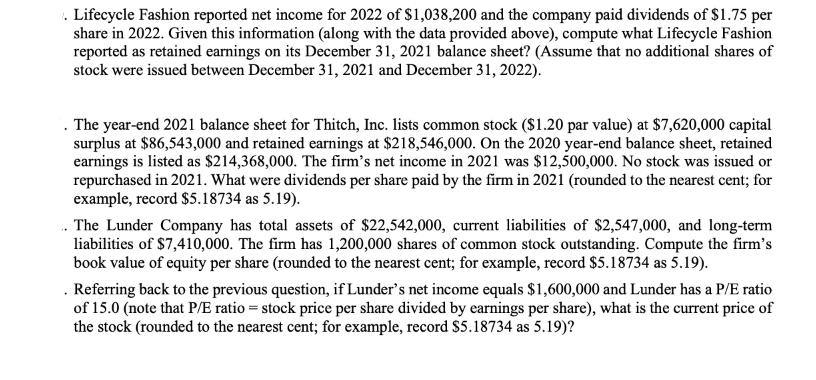

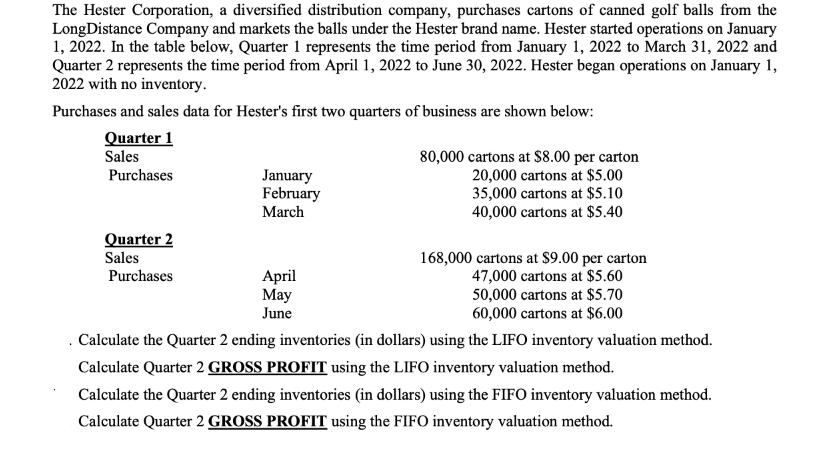

Financial data for Lifecycle Fashion is given below. All figures are in dollars. Use this data to construct a Balance Sheet for the company for the year ending December 31, 2022 and use your constructed statement to answer the following 5 questions (i.e., 26 through 30). NOTE: Not every item in the list below belongs on the balance sheet - you have to use some given data to determine needed accounts for the balance sheet. However, other than what is listed and/or can be derived, there are no other accounts on the company's balance sheet - use cash as a plug figure to balance the balance sheet. Accounts payable Accruals Accumulated depreciation Additional paid in capital Beginning of year inventory Common stock ($1.25 par value) Cost of goods sold Current portion of Long-term debt Gross accounts receivable Gross fixed assets Long-term debt (excluding current portion) Purchases Retained earnings Returns and allowances Short-term bank loan Cash 450,500 200,800 9,817,400 2,971,700 2,480,300 596,300 19,917,700 518,400 951,600 24,550,300 11,337,700 20,577,700 4,608,900 36,100 131,100 ??? What did Lifecycle Fashion record as Total Current Assets on December 31, 2022 balance sheet? What did Lifecycle Fashion record as Total Current Liabilities on December 31, 2022 balance sheet? What did Lifecycle Fashion record as Total Assets on December 31, 2022 balance sheet? What was Total Shareholder's Equity on Lifecycle Fashion December 31, 2022 balance sheet? . Lifecycle Fashion reported net income for 2022 of $1,038,200 and the company paid dividends of $1.75 per share in 2022. Given this information (along with the data provided above), compute what Lifecycle Fashion reported as retained earnings on its December 31, 2021 balance sheet? (Assume that no additional shares of stock were issued between December 31, 2021 and December 31, 2022). . The year-end 2021 balance sheet for Thitch, Inc. lists common stock ($1.20 par value) at $7,620,000 capital surplus at $86,543,000 and retained earnings at $218,546,000. On the 2020 year-end balance sheet, retained earnings is listed as $214,368,000. The firm's net income in 2021 was $12,500,000. No stock was issued or repurchased in 2021. What were dividends per share paid by the firm in 2021 (rounded to the nearest cent; for example, record $5.18734 as 5.19). The Lunder Company has total assets of $22,542,000, current liabilities of $2,547,000, and long-term liabilities of $7,410,000. The firm has 1,200,000 shares of common stock outstanding. Compute the firm's book value of equity per share (rounded to the nearest cent; for example, record $5.18734 as 5.19). . Referring back to the previous question, if Lunder's net income equals $1,600,000 and Lunder has a P/E ratio of 15.0 (note that P/E ratio = stock price per share divided by earnings per share), what is the current price of the stock (rounded to the nearest cent; for example, record $5.18734 as 5.19)? The Hester Corporation, a diversified distribution company, purchases cartons of canned golf balls from the Long Distance Company and markets the balls under the Hester brand name. Hester started operations on January 1, 2022. In the table below, Quarter 1 represents the time period from January 1, 2022 to March 31, 2022 and Quarter 2 represents the time period from April 1, 2022 to June 30, 2022. Hester began operations on January 1, 2022 with no inventory. Purchases and sales data for Hester's first two quarters of business are shown below: Quarter 1 Sales Purchases Quarter 2 Sales Purchases January February March April May June 80,000 cartons at $8.00 per carton 20,000 cartons at $5.00 35,000 cartons at $5.10 40,000 cartons at $5.40 168,000 cartons at $9.00 per carton 47,000 cartons at $5.60 50,000 cartons at $5.70 60,000 cartons at $6.00 Calculate the Quarter 2 ending inventories (in dollars) using the LIFO inventory valuation method. Calculate Quarter 2 GROSS PROFIT using the LIFO inventory valuation method. Calculate the Quarter 2 ending inventories (in dollars) using the FIFO inventory valuation method. Calculate Quarter 2 GROSS PROFIT using the FIFO inventory valuation method.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started