Question

FINANCIAL DECISION MAKING QUESTION 1 Nenia Limited (Nenia) is an insurance business with operations in Scotland, England and Wales. At the recent monthly Board of

FINANCIAL DECISION MAKING

QUESTION 1

Nenia Limited (Nenia) is an insurance business with operations in Scotland, England and Wales. At the recent monthly Board of Directors meeting, the CFO raised the issue of the high staff turnover rate in the claims and settlements department. In the previous year, about half of the claims and settlements staff had left, most of them citing the long working hours in the department that were caused by the inability of the existing claims and settlements computerised system to cope with the volume and complexity of claims and settlements, together with the introduction of new insurance industry standards for record keeping.

After discussing in detail what action to take, the Board of Directors agreed the CFO's request to replace the existing claims and settlements system and authorised the CFO to seek proposals from two independent system providers. Nenia has a weighted average cost of capital of 10% and a capital structure comprising both debt and equity.

Proposal 1 (Ropter)

Ropter is the market leader in insurance company systems. It is well known and has a first-class reputation for the reliability of its systems and for the quality of its implementation team.

To install the system, Nenia would need to invest 2.55m in hardware before loading the Ropter system software. A consultancy fee of 1.05m and a licence fee of 0.25m would be charged by Ropter at the start of the new system implementation project. Nenia would pay to Ropter an annual maintenance fee equivalent to 40% of the licence fee for the first four years. Although the total investment is large, the CFO estimates that savings from enhanced claims and settlements efficiency would amount to 1.25m per annum for five years. With a rapidly evolving environment, he anticipated that the new system would probably be obsolete in five years' time with no residual value.

Proposal 2 (Surgefons)

Surgefons is a relative newcomer to the insurance company systems market. In the last year, however, it has successfully added several reputable insurance companies to its client list. These companies were impressed by the innovative design and flexibility of Surgefons' systems.

Nenia would have to invest 1.50m in hardware before it could install Surgefons' software system. Surgefons' aggressive bid offers attractive pricing. It quotes an upfront consultancy fee and licence fee of 0.45m and 0.20m respectively. In each of the first four years following installation, Surgefons would charge an annual maintenance fee equivalent to 30% of the licence fee. The CFO estimates that Surgefons' system could assist the claims and settlements department to generate an operational saving of 0.75m at the end of the first year. The vendor also assured Nenia that it would invest heavily in research and development and hence is confident that savings would increase by 5% each year. To achieve these full incremental savings, however, Nenia would require an upgrade of the hardware in the third year at a cost of 0.30m. The life and residual value of Surgefons' system are expected to be the same as those of Ropter.

Whichever system is chosen, Nenia will incur a fixed maintenance fee (not a proportion of the licence fee) of only 50,000 for the last year the system is in use. The CFO has also looked at the corporate taxation implications of both proposals and has concluded that there are negligible differences between the taxation costs and taxation benefits of each proposal, and therefore that corporate taxation can be ignored in the decision over which system to choose.

Required:

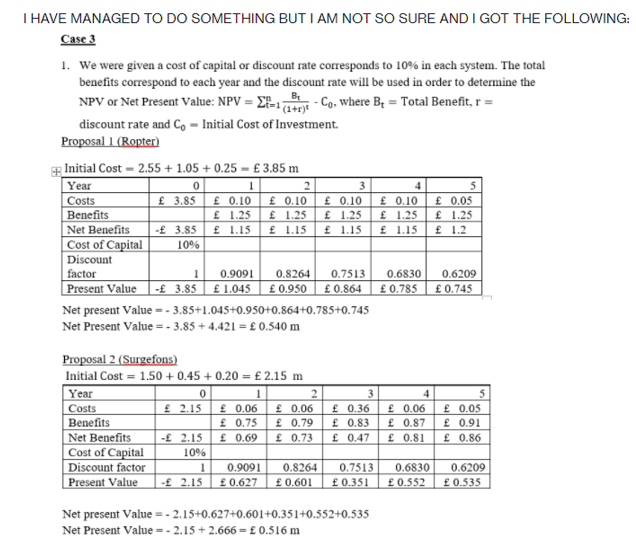

1. Calculate the net present value of each system. (Show clearly all workings.) (6 marks)

2. On the basis of your calculations in Requirement 1, state, with reasons, which of the two proposals Nenia should invest in. (4 marks -)

3. What non-financial factors might the Board of Directors consider before making its final decision on the choice of system? (7 marks -)

4. Explain what is meant by weighted average cost of capital, how this relates to the required rate of return for the investors in Nenia and explain in detail the process by which Nenia would have calculated its weighted average cost of capital. (13 marks)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started