Answered step by step

Verified Expert Solution

Question

1 Approved Answer

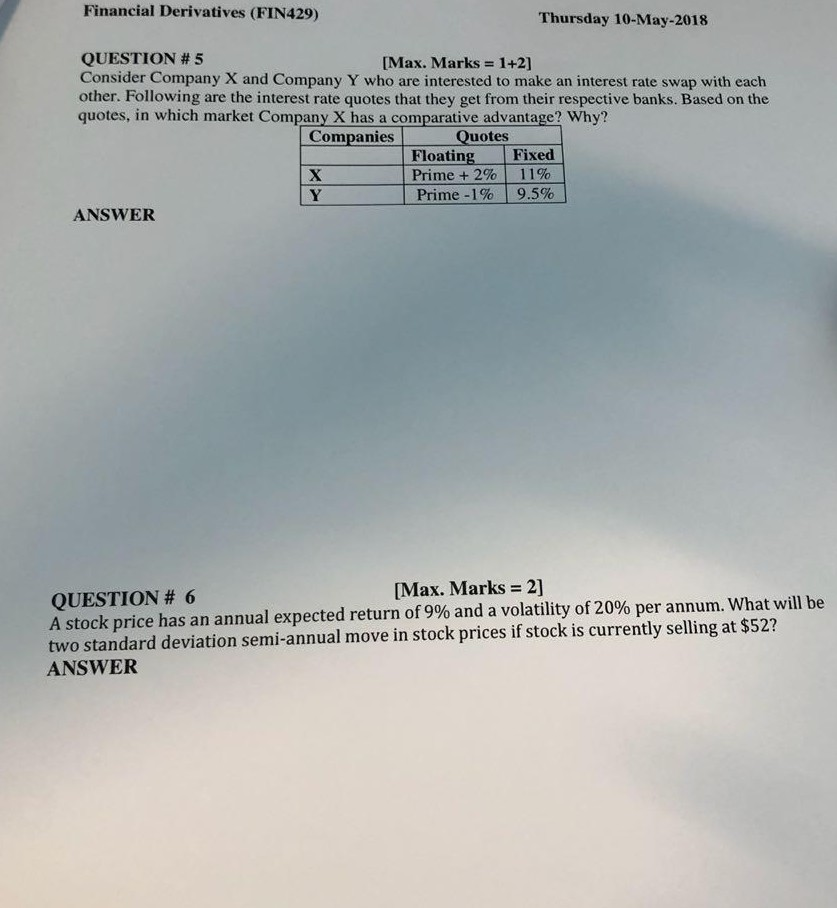

Financial Derivatives (FIN429) Thursday 10-May-2018 QUESTION # 5 Consider Company X and Company Y who are interested to make an interest rate swap with each

Financial Derivatives (FIN429) Thursday 10-May-2018 QUESTION # 5 Consider Company X and Company Y who are interested to make an interest rate swap with each other. Following are the interest rate quotes that they get from their respective banks. Based on the quotes, in which market Company X has a comparative advantage? Why? [Max. Marks = 1+2] Companies Quotes FloatingFixed Prime + 2%-1% Prime-1 % | 9.5% ANSWER [Max. Marks 2] QUESTION # 6 A stock price has an annual expected return of 9% and a volatility of 20% per annum, what will be two standard deviation semi-annual move in stock prices if stock is currently selling at $52

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started