Answered step by step

Verified Expert Solution

Question

1 Approved Answer

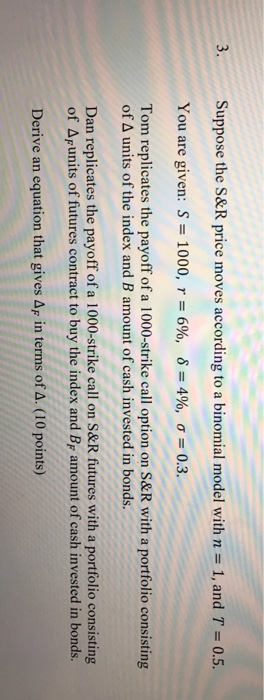

Financial economics Suppose the S&R price moves according to a binomial model with n = 1, and T = 0.5. You are given: S =

Financial economics

Suppose the S&R price moves according to a binomial model with n = 1, and T = 0.5. You are given: S = 1000, r = 6%, 8 = 4%, o = 0.3. Tom replicates the payoff of a 1000-strike call option on S&R with a portfolio consisting of A units of the index and B amount of cash invested in bonds. Dan replicates the payoff of a 1000-strike call on S&R futures with a portfolio consisting of Apunits of futures contract to buy the index and Bp amount of cash invested in bonds. Derive an equation that gives Ap in terms of A. (10 points) Suppose the S&R price moves according to a binomial model with n = 1, and T = 0.5. You are given: S = 1000, r = 6%, 8 = 4%, o = 0.3. Tom replicates the payoff of a 1000-strike call option on S&R with a portfolio consisting of A units of the index and B amount of cash invested in bonds. Dan replicates the payoff of a 1000-strike call on S&R futures with a portfolio consisting of Apunits of futures contract to buy the index and Bp amount of cash invested in bonds. Derive an equation that gives Ap in terms of A. (10 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started