Answered step by step

Verified Expert Solution

Question

1 Approved Answer

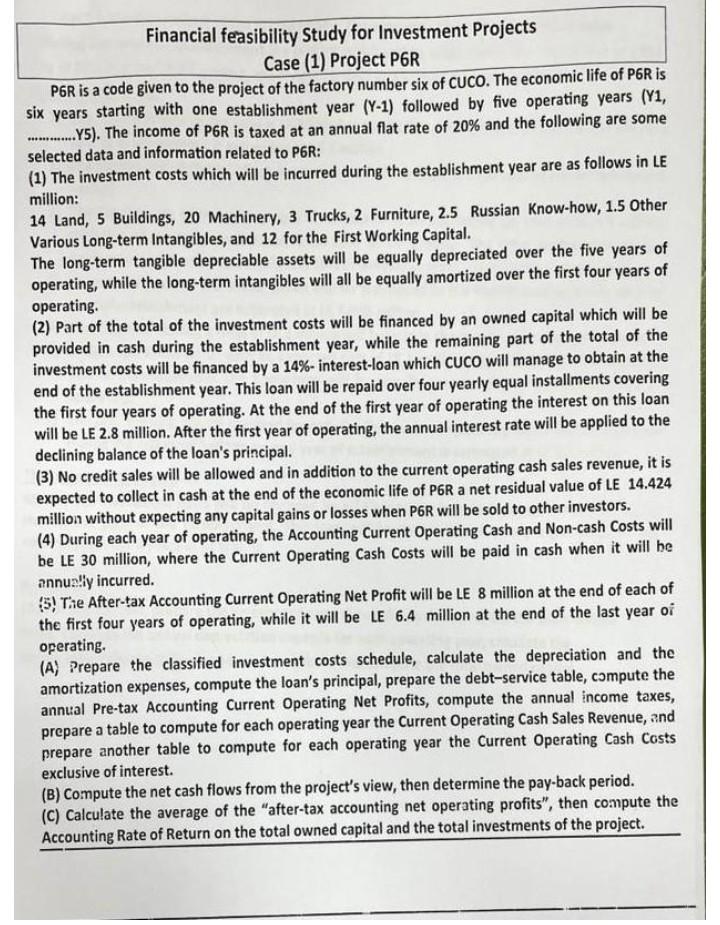

Financial feasibility Study for Investment Projects Case (1) Project P6R P6R is a code given to the project of the factory number six of CUCO.

Financial feasibility Study for Investment Projects Case (1) Project P6R P6R is a code given to the project of the factory number six of CUCO. The economic life of P6R is six years starting with one establishment year (Y1) followed by five operating years (Y1, .Y5). The income of P6R is taxed at an annual flat rate of 20% and the following are some selected data and information related to P6R : (1) The investment costs which will be incurred during the establishment year are as follows in LE million: 14 Land, 5 Buildings, 20 Machinery, 3 Trucks, 2 Furniture, 2.5 Russian Know-how, 1.5 Other Various Long-term Intangibles, and 12 for the First Working Capital. The long-term tangible depreciable assets will be equally depreciated over the five years of operating, while the long-term intangibles will all be equally amortized over the first four years of operating. (2) Part of the total of the investment costs will be financed by an owned capital which will be provided in cash during the establishment year, while the remaining part of the total of the investment costs will be financed by a 14% - interest-loan which CUCO will manage to obtain at the end of the establishment year. This loan will be repaid over four yearly equal installments covering the first four years of operating. At the end of the first year of operating the interest on this loan will be LE 2.8 million. After the first year of operating, the annual interest rate will be applied to the declining balance of the loan's principal. (3) No credit sales will be allowed and in addition to the current operating cash sales revenue, it is expected to collect in cash at the end of the economic life of P6R a net residual value of LE 14.424 million without expecting any capital gains or losses when P6R will be sold to other investors. (4) During each year of operating, the Accounting Current Operating Cash and Non-cash Costs will be LE 30 million, where the Current Operating Cash Costs will be paid in cash when it will be annualiy incurred. \{5) The After-tax Accounting Current Operating Net Profit will be LE 8 million at the end of each of the first four years of operating, while it will be LE 6.4 million at the end of the last year of operating. (A) Prepare the classified investment costs schedule, calculate the depreciation and the amortization expenses, compute the loan's principal, prepare the debt-service table, compute the annual Pre-tax Accounting Current Operating Net Profits, compute the annual income taxes, prepare a table to compute for each operating year the Current Operating Cash Sales Revenue, and prepare another table to compute for each operating year the Current Operating Cash Costs exclusive of interest. (B) Compute the net cash flows from the project's view, then determine the pay-back period. (C) Calculate the average of the "after-tax accounting net operating profits", then compute the Accounting Rate of Return on the total owned capital and the total investments of the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started