Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Functions on Excel A Use the FV function to calculate the following: A1 If you start saving at age 25 and earn 8% per

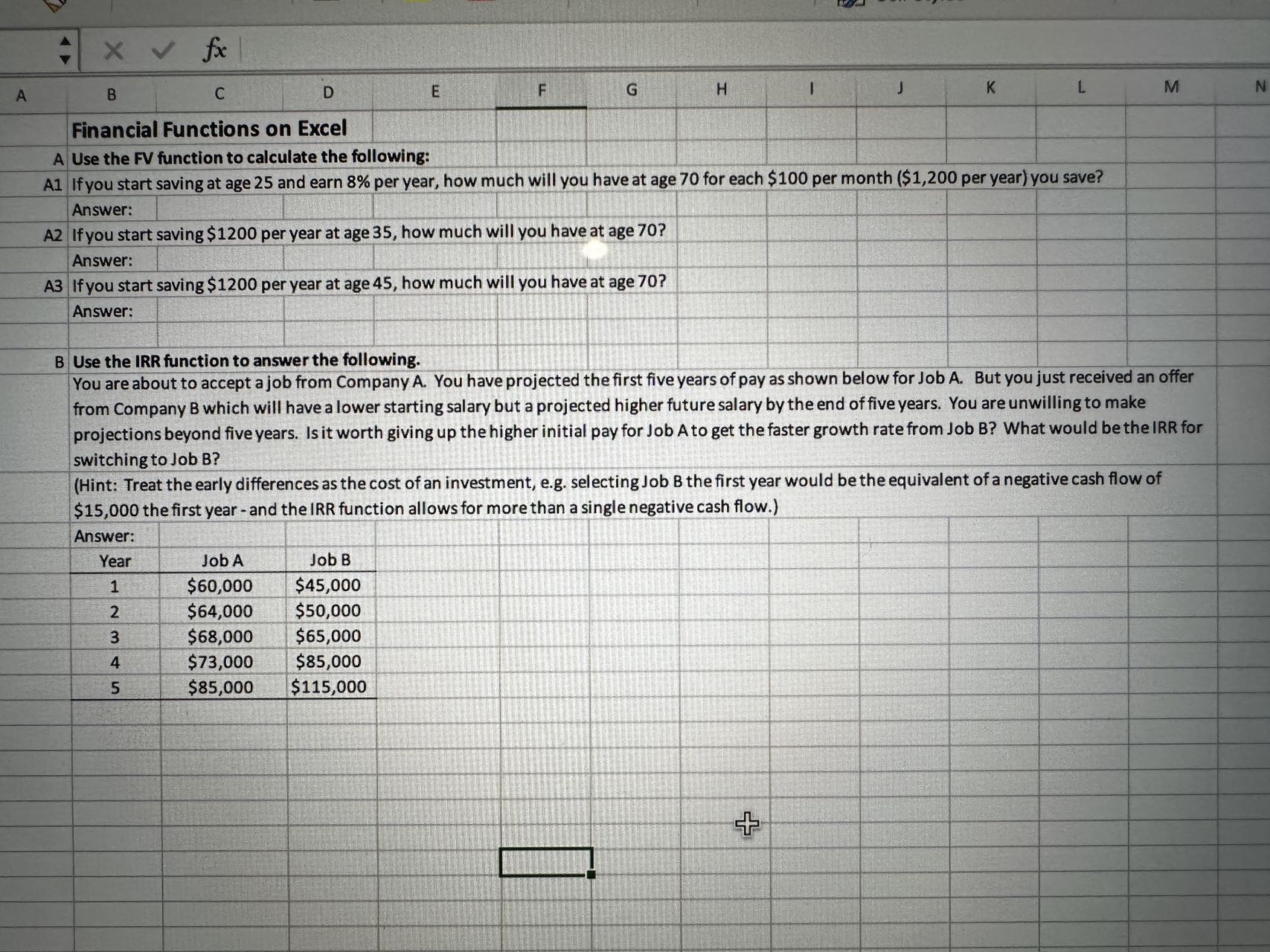

Financial Functions on Excel A Use the FV function to calculate the following: A1 If you start saving at age 25 and earn 8% per year, how much will you have at age 70 for each $100 per month (\$1,200 per year) you save? Answer: A2 If you start saving $1200 per year at age 35 , how much will you have at age 70 ? Answer: A3 If you start saving $1200 per year at age 45 , how much will you have at age 70 ? Answer: B Use the IRR function to answer the following. You are about to accept a job from Company A. You have projected the first five years of pay as shown below for Job A. But you just received an offer from Company B which will have a lower starting salary but a projected higher future salary by the end of five years. You are unwilling to make projections beyond five years. Is it worth giving up the higher initial pay for Job A to get the faster growth rate from Job B? What would be the IRR for switching to Job B ? (Hint: Treat the early differences as the cost of an investment, e.g. selecting Job B the first year would be the equivalent of a negative cash flow of $15,000 the first year - and the IRR function allows for more than a single negative cash flow.) Answer: \begin{tabular}{|ccc|} \hline Year & Job A & Job B \\ \hline 1 & $60,000 & $45,000 \\ \hline 2 & $64,000 & $50,000 \\ \hline 3 & $68,000 & $65,000 \\ \hline 4 & $73,000 & $85,000 \\ \hline 5 & $85,000 & $115,000 \\ \hline \end{tabular} Financial Functions on Excel A Use the FV function to calculate the following: A1 If you start saving at age 25 and earn 8% per year, how much will you have at age 70 for each $100 per month (\$1,200 per year) you save? Answer: A2 If you start saving $1200 per year at age 35 , how much will you have at age 70 ? Answer: A3 If you start saving $1200 per year at age 45 , how much will you have at age 70 ? Answer: B Use the IRR function to answer the following. You are about to accept a job from Company A. You have projected the first five years of pay as shown below for Job A. But you just received an offer from Company B which will have a lower starting salary but a projected higher future salary by the end of five years. You are unwilling to make projections beyond five years. Is it worth giving up the higher initial pay for Job A to get the faster growth rate from Job B? What would be the IRR for switching to Job B ? (Hint: Treat the early differences as the cost of an investment, e.g. selecting Job B the first year would be the equivalent of a negative cash flow of $15,000 the first year - and the IRR function allows for more than a single negative cash flow.) Answer: \begin{tabular}{|ccc|} \hline Year & Job A & Job B \\ \hline 1 & $60,000 & $45,000 \\ \hline 2 & $64,000 & $50,000 \\ \hline 3 & $68,000 & $65,000 \\ \hline 4 & $73,000 & $85,000 \\ \hline 5 & $85,000 & $115,000 \\ \hline \end{tabular}

Financial Functions on Excel A Use the FV function to calculate the following: A1 If you start saving at age 25 and earn 8% per year, how much will you have at age 70 for each $100 per month (\$1,200 per year) you save? Answer: A2 If you start saving $1200 per year at age 35 , how much will you have at age 70 ? Answer: A3 If you start saving $1200 per year at age 45 , how much will you have at age 70 ? Answer: B Use the IRR function to answer the following. You are about to accept a job from Company A. You have projected the first five years of pay as shown below for Job A. But you just received an offer from Company B which will have a lower starting salary but a projected higher future salary by the end of five years. You are unwilling to make projections beyond five years. Is it worth giving up the higher initial pay for Job A to get the faster growth rate from Job B? What would be the IRR for switching to Job B ? (Hint: Treat the early differences as the cost of an investment, e.g. selecting Job B the first year would be the equivalent of a negative cash flow of $15,000 the first year - and the IRR function allows for more than a single negative cash flow.) Answer: \begin{tabular}{|ccc|} \hline Year & Job A & Job B \\ \hline 1 & $60,000 & $45,000 \\ \hline 2 & $64,000 & $50,000 \\ \hline 3 & $68,000 & $65,000 \\ \hline 4 & $73,000 & $85,000 \\ \hline 5 & $85,000 & $115,000 \\ \hline \end{tabular} Financial Functions on Excel A Use the FV function to calculate the following: A1 If you start saving at age 25 and earn 8% per year, how much will you have at age 70 for each $100 per month (\$1,200 per year) you save? Answer: A2 If you start saving $1200 per year at age 35 , how much will you have at age 70 ? Answer: A3 If you start saving $1200 per year at age 45 , how much will you have at age 70 ? Answer: B Use the IRR function to answer the following. You are about to accept a job from Company A. You have projected the first five years of pay as shown below for Job A. But you just received an offer from Company B which will have a lower starting salary but a projected higher future salary by the end of five years. You are unwilling to make projections beyond five years. Is it worth giving up the higher initial pay for Job A to get the faster growth rate from Job B? What would be the IRR for switching to Job B ? (Hint: Treat the early differences as the cost of an investment, e.g. selecting Job B the first year would be the equivalent of a negative cash flow of $15,000 the first year - and the IRR function allows for more than a single negative cash flow.) Answer: \begin{tabular}{|ccc|} \hline Year & Job A & Job B \\ \hline 1 & $60,000 & $45,000 \\ \hline 2 & $64,000 & $50,000 \\ \hline 3 & $68,000 & $65,000 \\ \hline 4 & $73,000 & $85,000 \\ \hline 5 & $85,000 & $115,000 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started