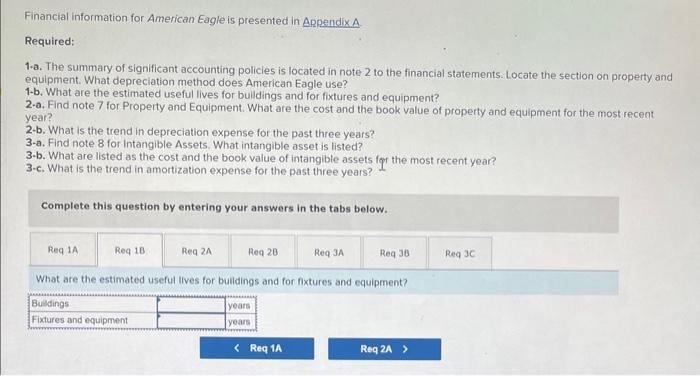

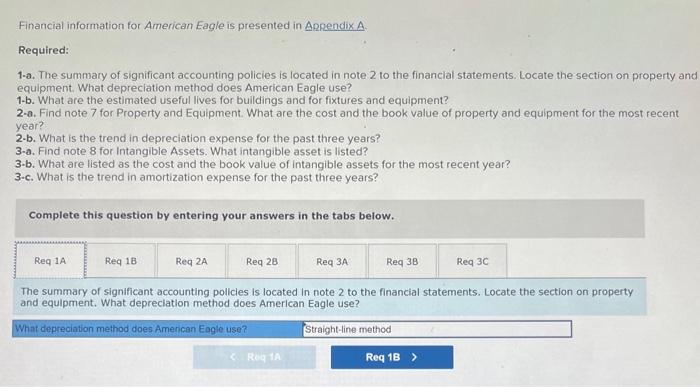

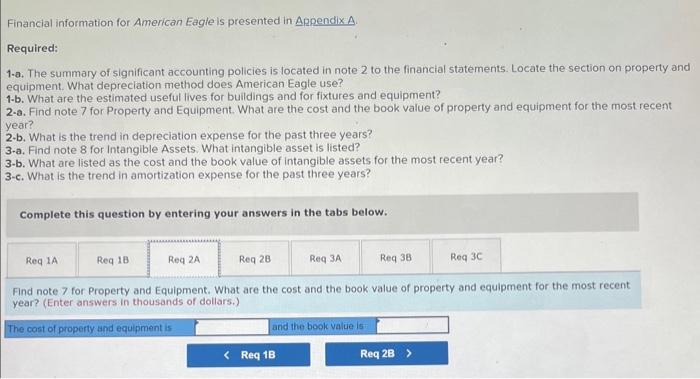

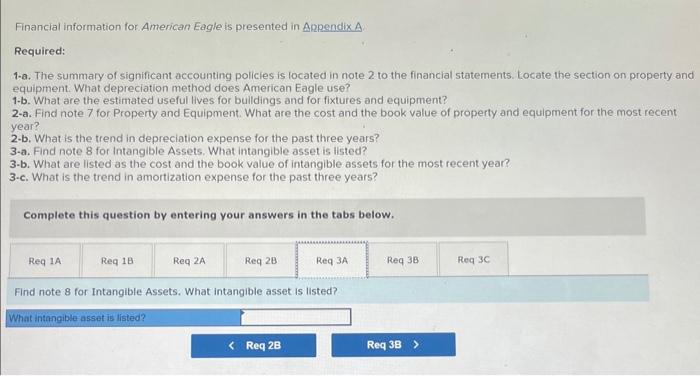

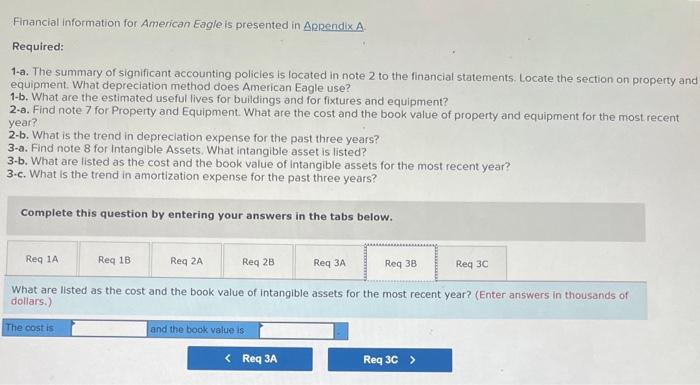

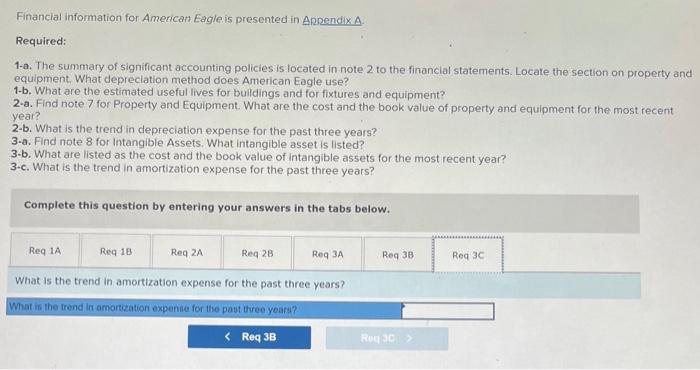

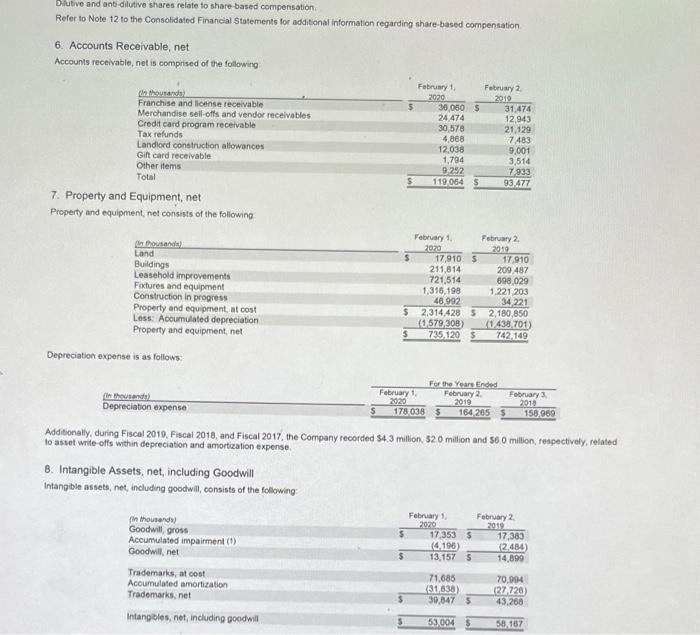

Financial information for American Eagle is presented in Appendix A. Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for bulidings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets fgr the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. What are the estimated useful lives for bulidings and for fixtures and equipment? Financial information for American Eagle is presented in Appendix A. Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property anc equlpment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? Financial information for American Eagle is presented in ppendixA. Required: 1.a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for bulidings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? (Enter answers in thousands of dollars.) Financial information for American Eagle is presented in Aprendix A Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. What is the trend in depreciation expense for the past three years? What is the trend in depreciation expense for the past three years? Financial information for American Eagle is presented in Appendix A Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3.c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. Find note 8 for intangible Assets. What intangible asset is listed? Financial information for American Eagle is presented in ppendixA Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property an equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. What are listed as the cost and the book value of intangible assets for the most recent year? (Enter answers in thousands of dollars.) Financial information for American Eagle is presented in ARendix A. Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3.c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. What is the trend in amortization expense for the past three years? What is the trend in amortization expense for the patit three yoaft? Diutve and ant-dilutive shares relate to share-based compensation. Refer to Note 12 to the Consolidaled Financial Statements for additonal information regarding share-based compensation. 6. Accounts Receivable, net Accounts receivable, net is comprised of the following 7. Property and Equipment, net Property and equipment, net consists of the following Depreciation expense is as follows: Additionally, during Fiscal 2019, Fiscal 2018, and Fiscal 2017, the Cornpany recorded $4.3 million, 520 million and $60 million, respectively, related to astet wite-offs within depreciation and amortization expense 8. Intangible Assets, net, including Goodwill Intangble assets, net, including goodwill, consists of the following Financial information for American Eagle is presented in Appendix A. Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for bulidings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets fgr the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. What are the estimated useful lives for bulidings and for fixtures and equipment? Financial information for American Eagle is presented in Appendix A. Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property anc equlpment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? Financial information for American Eagle is presented in ppendixA. Required: 1.a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for bulidings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? (Enter answers in thousands of dollars.) Financial information for American Eagle is presented in Aprendix A Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. What is the trend in depreciation expense for the past three years? What is the trend in depreciation expense for the past three years? Financial information for American Eagle is presented in Appendix A Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3.c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. Find note 8 for intangible Assets. What intangible asset is listed? Financial information for American Eagle is presented in ppendixA Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property an equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. What are listed as the cost and the book value of intangible assets for the most recent year? (Enter answers in thousands of dollars.) Financial information for American Eagle is presented in ARendix A. Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3.c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. What is the trend in amortization expense for the past three years? What is the trend in amortization expense for the patit three yoaft? Diutve and ant-dilutive shares relate to share-based compensation. Refer to Note 12 to the Consolidaled Financial Statements for additonal information regarding share-based compensation. 6. Accounts Receivable, net Accounts receivable, net is comprised of the following 7. Property and Equipment, net Property and equipment, net consists of the following Depreciation expense is as follows: Additionally, during Fiscal 2019, Fiscal 2018, and Fiscal 2017, the Cornpany recorded $4.3 million, 520 million and $60 million, respectively, related to astet wite-offs within depreciation and amortization expense 8. Intangible Assets, net, including Goodwill Intangble assets, net, including goodwill, consists of the following