Financial information for American Eagle is presented in Appendix A.

Required:

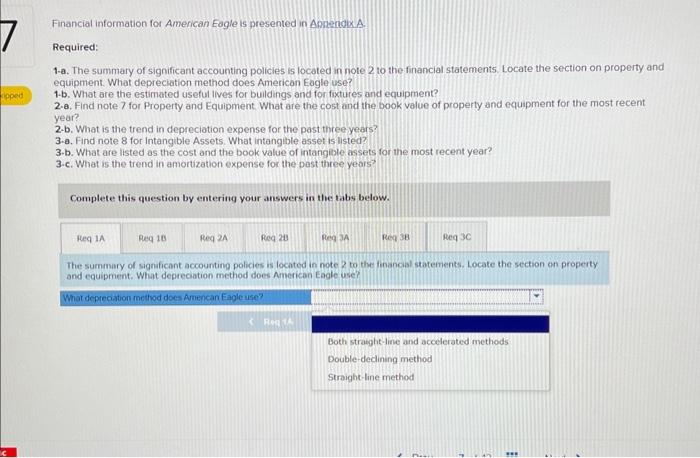

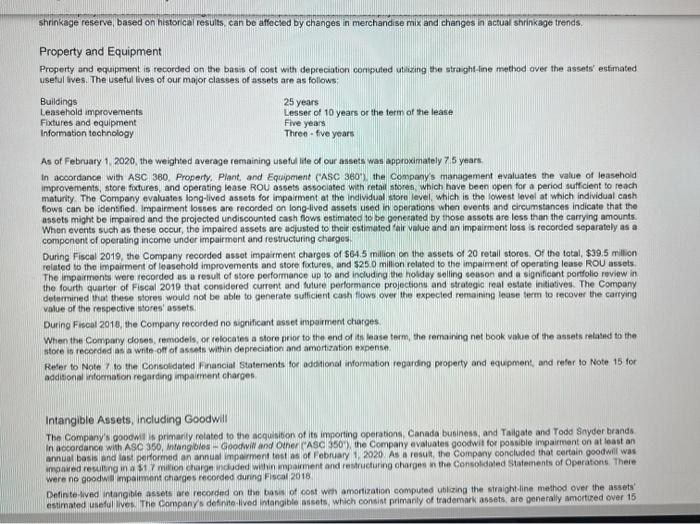

1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use?

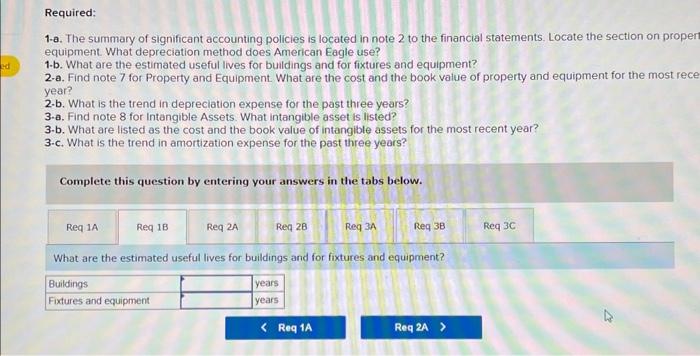

1-b. What are the estimated useful lives for buildings and for fixtures and equipment?

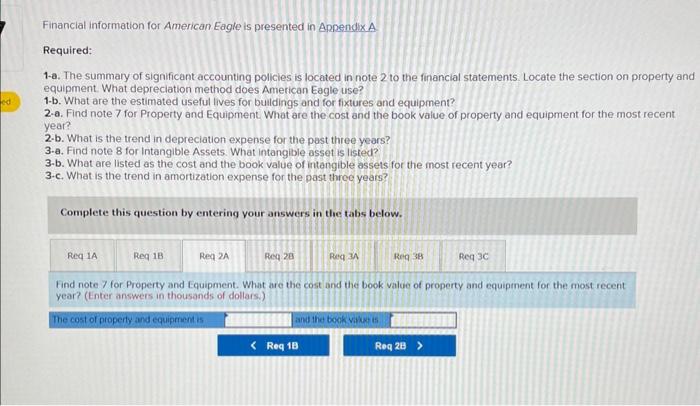

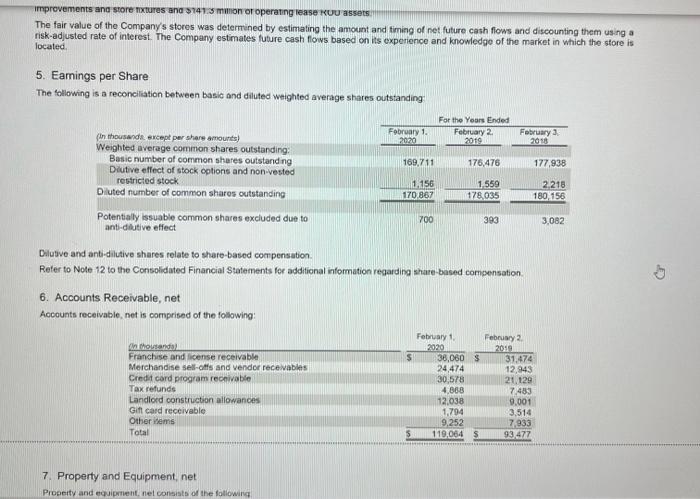

2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year?

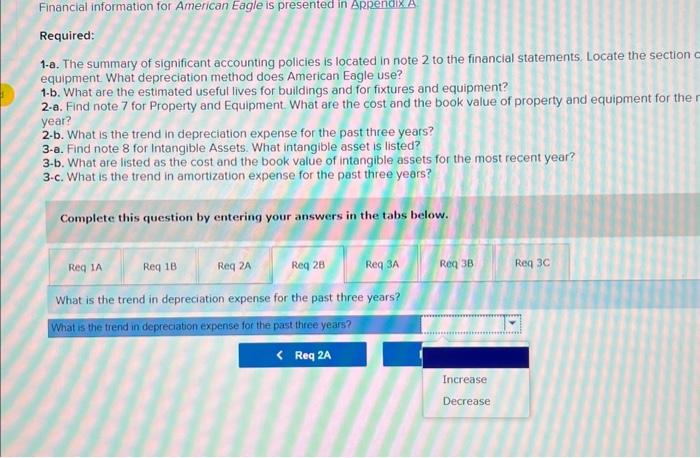

2-b. What is the trend in depreciation expense for the past three years?

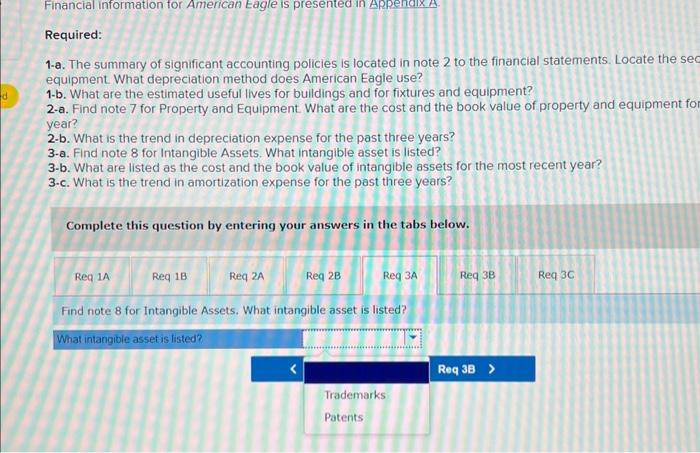

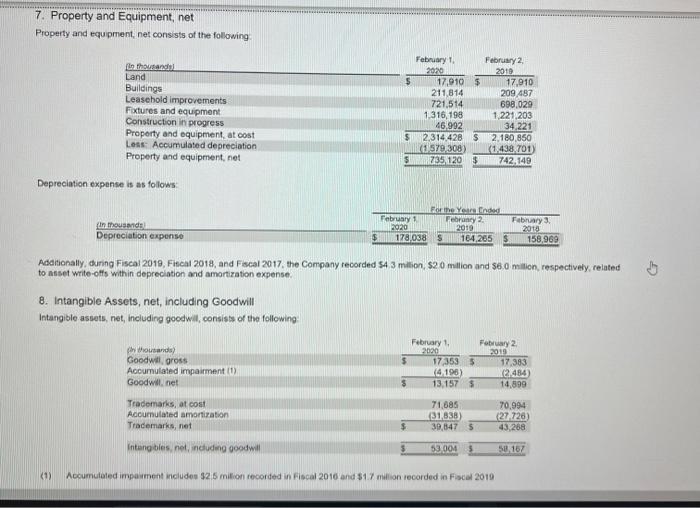

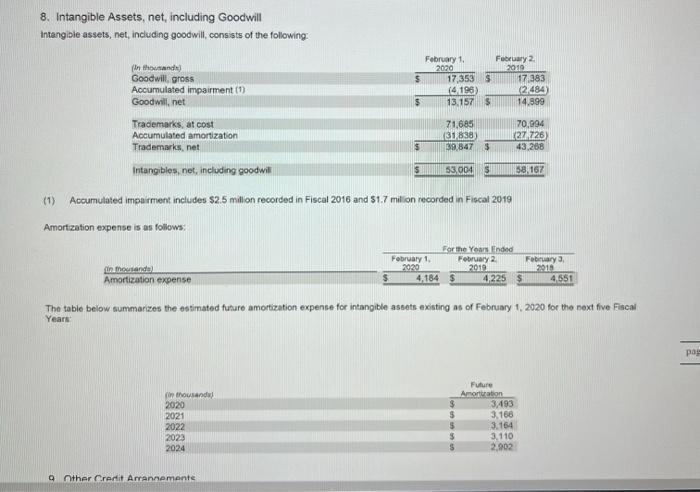

3-a. Find note 8 for Intangible Assets. What intangible asset is listed?

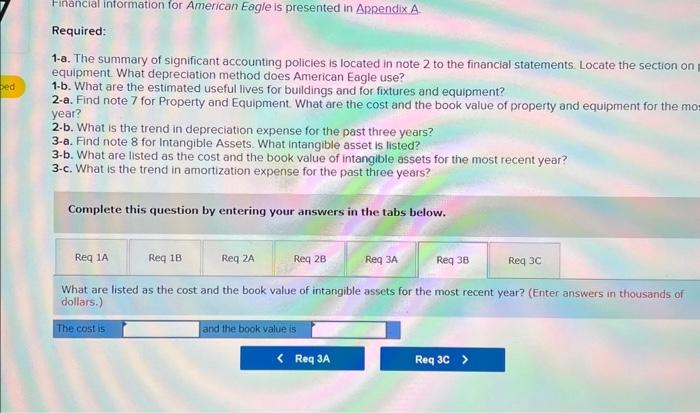

3-b. What are listed as the cost and the book value of intangible assets for the most recent year?

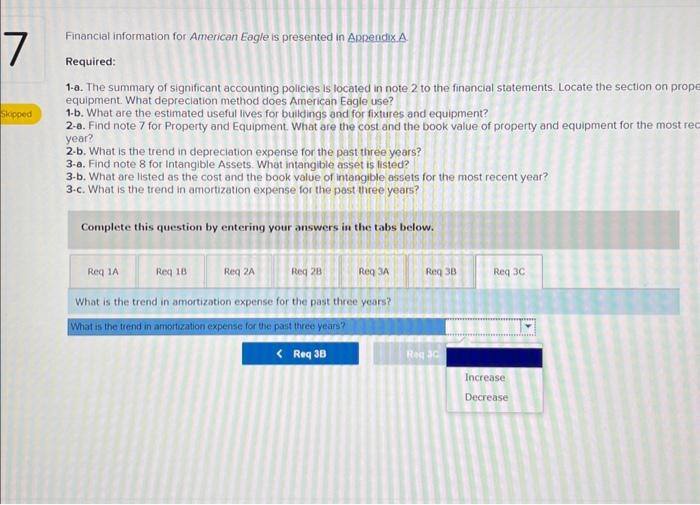

3-c. What is the trend in amortization expense for the past three years?

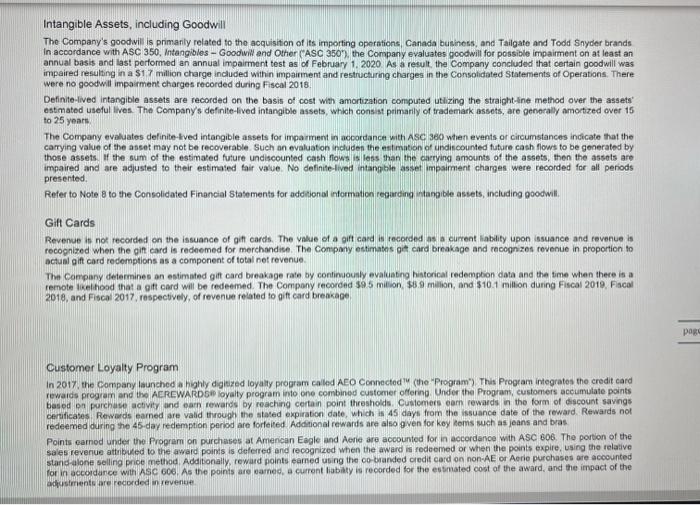

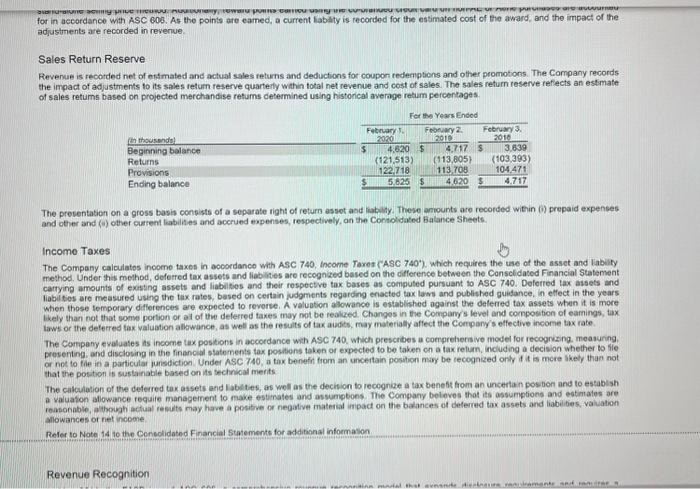

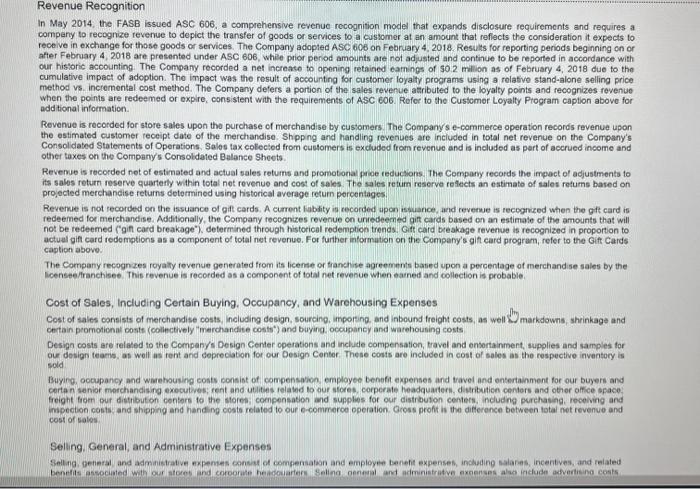

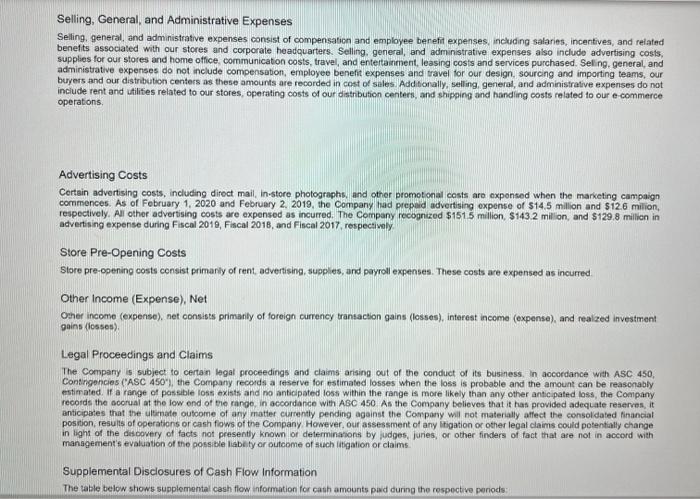

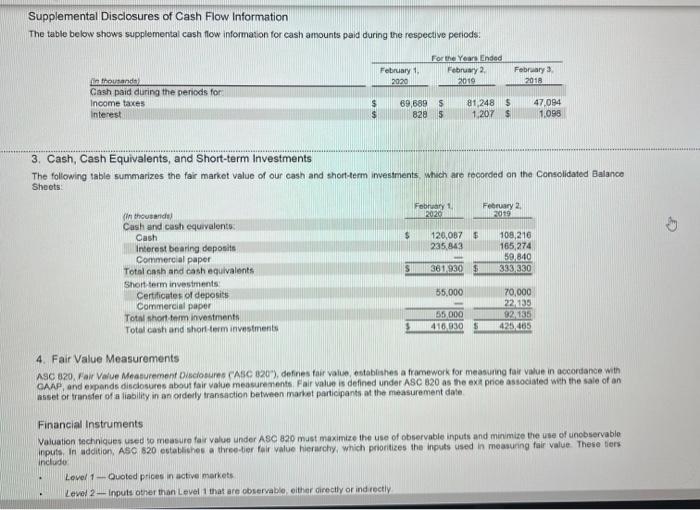

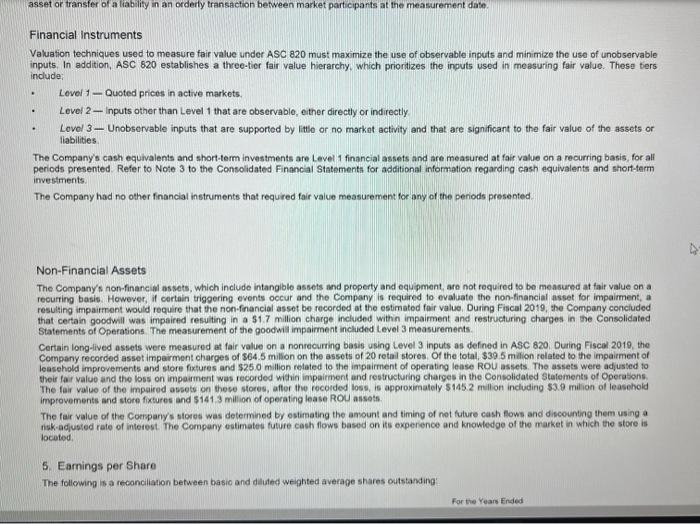

Financial information for American Eagle is presented in Amzendob A. Required: 1-a. The summary of significant accounting policies is locoted in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1.b. What are the estimated useful lives for buildings and for fixtures and equipment? 2.e. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for intangible Assets. What intangible asset is isted? 3.b. What are listed as the cost and the book value of intangible assets for the most recent year? 3.c. What is the trend in amortization expense for the post three years? Complete this question by entering your answers in the tabs below. The summary of signficant accounting polices is located in note 2 to the linancasl statements. Locate the section on property and cquipment. What depreciation method does American Eagle use? 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on propet equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most rece year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for intangible Assets. What intangible asset is Iisted? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. What are the estimated useful lives for buildings and for fixtures and equipment? Financial information for American Eagle is presented in Appendix. A Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on property and equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3.b. What are listed as the cost and the book value of intangible assets for the most recent year? 3.c. What is the trend in amortization expense for the past throe years? Complete this question by entering your answers in the tabs below. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most recent year? (Enter answers in thousands of dollars.) Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements, Locate the section equipment. What depreciation method does American Eagle use? 1.b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3.c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. What is the trend in depreciation expense for the past three years? What is the trend in depreciation expense for the past three years? Financial information for American Eagle is presented in Appencix A. Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the se equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment fo year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3-c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. Find note 8 for Intangible Assets. What intangible asset is listed? Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the mo year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3.c. What is the trend in amortization expense for the past three years? Complete this question by entering your answers in the tabs below. What are listed as the cost and the book value of intangible assets for the most recent year? (Enter answers in thousands of dollars.) Financial information for American Eagle is presented in Appendix. A Required: 1-a. The summary of significant accounting policies is located in note 2 to the financial statements. Locate the section on prop equipment. What depreciation method does American Eagle use? 1-b. What are the estimated useful lives for buildings and for fixtures and equipment? 2-a. Find note 7 for Property and Equipment. What are the cost and the book value of property and equipment for the most re year? 2-b. What is the trend in depreciation expense for the past three years? 3-a. Find note 8 for Intangible Assets. What intangible asset is listed? 3-b. What are listed as the cost and the book value of intangible assets for the most recent year? 3.c. What is the trend in amortization expense for the past tiree years? Complete this question by entering your answers in the tabs below. What is the trend in amortization expense for the past three years? What is the tiend in amprization expense for the past three years? Intangible Assets, including Goodwill The Company's goodwil is primanily related to tho acquisiton of its importing operations, Ganada businoss, and Tailgate and Todd Snyder brands In accordance with ASC 350, Intangibles - Goodwin and Other ("ASC 350), the Company evaluates goodwill for possible impairment on at least an annual basis and last porformed an annual impairmont test as of February 1. 2020 As a result, the Company concluded that certain goodwil was impaired resulting in a $17 million charge included within impoirment and restructuring charges in the Consolidated Statements of Operations. There were no goodwill impaiment charges rocorded during Fiscal 2018. Definite-lived intangible assets are recorded on the basis of cost with amortization computed utlizing the straight-line method over the assets' estmated useful lives. The Company's definite-fived intangible assets, which consist primarily of trademark assets, are generally amorized over 15 to 25 yeart The Company evaluates definite-lved intangible assets for imparment in aocordance with ASC. 360 when events or circumstances incicate that the camying value of the asset may not be recoverable. Such an evaluaton includen the entimation of undiscounted future cash flows to be generated by those assets. If the sum of the estimated future undiscounted cash fiows is lens than the carrying amounts of the assets, then the assots are impaired and are adjusted to their estimated fair value. No definite-lived intannhile asset impaiment oharges were reoorded for all penods presented. Refer to Note 8 to the Consolidated Financial Stasements for addional information regarding intangible assets, including goodwill. Gift Cards Revenue is not recorded on the issuance of giff cards. The value of a gift card is recorded as a current liabdity upon issuance and revenue is recognized when the gift card is redeemed for merchandise. The Company estimates gim card breakage and recognzes revenue in proportion to actual gift card redemptions as a component of total net revenue. The Company determines an estimated gift card breakage rate by continuously evaluabing historical redempton data and the time when there is a remote likelhood that a gift card will be fedeemed. The Compony recorced 59.5 milion, \$6.9 milian, and $10.1 million during Fiscal 2019 . Facal 2018, and Fiscal 2017, respectively, of revenue related to giff card breakage Customer Loyalty Program In 2017, the Company launched a highly digiszed loyally program called AEO Connected th (the "Program") This Program integrates the credit card revaids progrem and the AEREWARDSil loyalty program into one combined customer otfering. Under the Progam, customers aceumulate points based pn parchuse activity and oarn rewards by reaching certain point thresholds. Customers earn rewards in the form of discount savings certificates. Remwards earned are valid throuph the stated expirabion date, which is 45 days from the issuance date of the reward. Rewards not redeemed during the 45 -day redemption period are forfeited Addional rewards are also g gen for key sems muth as jeans and bras Points eamod unded the Program on purchases at Amencan Eagle and Aerie are accountod for in accordance with ASC Bob. The porton of the sales reverue attribuced to the award points is deferred and recognized when the award it rodeemed or when the points expire, using the relative standalone selling prioe method. Addibonally, reward points camed using the oo-taanded oredit card on non-AE or Aerie purohases are accounted for in accordance with Asc G06. As the points are earned, a curent liabily is reoorded for the estiated cost af the award, and the impact of the ahystmente are recorded in revenite. for in aceordance with ASC OOS. As the points are eamed, a current liablity is recorded for the estimated cost of the award, and the impact of the adjustments are recorded in revenue. Sales Return Reserve Revenue is recorded net of ehtmated and actual sales retums and deductions for coupon redemptions and other promotions. The Company records the impact of adjustments to its sales retum reserve quarterly within total net revenue and cost of sales. The sales return reserve refects an estimate of sales retums based on projected merchandise returns determined using historical average retim percertages The preventation on a gross basis consists of a separate right of return assot and liabily. These ariounts are recorded within (0) prepaid expenses and other and (a) other ourrent laabilies and accrued expenses, respectively, an the Contiolidaked Batance Sheets. Income Taxes The Company calculatos income taxes in accordance with ASC 740, income Tanea (ASC 740'). which recuires the tase of the asset and labily method, Under this method, deferred tax assets and liabiltes are recogniked based on the difference between the Conselidated Financial Statement cattying amounts of exiting assets and liabitios and their rospective tax bases as computed pursuant to ASC 740 . Dolerred Lax assets and liabitios are measured using the tax rates, based on certain judgments regarding eracted tax laws and published guidance, in effect in the years when those lemporary difterences are expected to reverte, A valuation allowance is established against the deferied tax assets when it is more Whely than not that some portion or at of the deferred taxes may not be realued. Changes in the Company's level and composition of earnings, tux lawh or the deterred tax valuation allowance, as weth as the results of tax audits, may materially affect the Compony s effective ineome tax rate The Carnpeny evaluates is income tax, positions in accordance with ASC 740 . which prescribes a compreherise model for recognang. measung. prosenting, and disclosing in the financial statements tas positons taken or expected to be taken co a tax relum, inciuding a decision whether to file or not to the in a particular junsdiction. Under ASC 7.10 , a thx benefit from an uncertain position may be tecognized orly it it is mere lkeby than not that the position is sustainable based on its tecliniod merits. The calculation of the deferred tax assets and labltes, ar woll as the decinion to recogriae a tax benefit from an uncertain pos bon and to establah a valuaton allowance reguie management to make estimates and assumpoons. The Company beloves that its assumptions and eatimates are allowances or net income. Refer to Note 14 to the Coneolidated Financial 5 tavements for additional informalion Revenue Recognition In May 2014, the FASB issued ASC, 606, a comprehensive revenue recognition model that expands disclosure requirements and requires a company to recognize revenue to depict the transfer of goods or services to a customer at an amount that reflects the consideration it expects to receive in exchange for those goods or services. The Company adopted ASC, 606 on February 4 , 2018. Results for reporting periods beginning on or after February 4, 2018 are presented under ASC 606, while prior perod amounts are not adjusted and continue to be reported in accordance with our his/oric accounting. The Company recorded a net increase to opening retained eamings of 50.2 million as of February 4 , 2018 due to the cumulative impact of adoption. The impact was the result of accounting for customer loyalty programs using a relative stand-alone selling price method vs. incremental cost method. The Company defers a portion of the sales revenue atmributed to the loyalty points and recognizes revenue when the points are redeemed or expire, consistent with the requirements of AsC 606. Refer to the Customer Loyalty Ptogram caption above for addional information. Revenue is recorded for store sales upon the purchase of merchandise by customers . The Company's e-commerce operation records revenue upon the estimated customer receipt date of the merchandise. Shipping and handling revenues are inciuded in total net revenue on the Company's Consolidated Statements of Operations, Sales tax colectod from cuetomers is exchuded from revenue and is included as pert of accrued income and other taxes on the Company's Consoldated Balance Sheets. Revemue is recorded not of estimated and actual sales return and promotonal prioe reducions. The Company records the impact of adjustments to its sales returm reserve quarterly within total net revenue and cost of sales. The sales retum reserve reflects an estimate of sales refums based on pro,ected merchancise returns determined using historical average retum percentages. Revenue is not recordedd on the issuance of git cards. A comrent kabdity is cecorded apon isulance, ard reverue is recogrkeed when the git card is redeemed for merchandise. Additionally, the Company recognizes revenue on uniedeemed git cards based on an estimate of the amounts that will not be redeemed ("gif card breakage"). determined through historical redemption trends. Gift card breakage revenue is recognized in proportion to actual gifl card redemptions as a component of total net revenue. For further informution on the Company's gifl card program, refer to the Gift Cards caption above. The Company recognzes royally fevence generated from its licente or franchise agreements batied upon a percentage of merchand se sales by the licenseefranchises. This revenue is recorded as a component of total net revenue When earned and collection is probable. Cost of Sales, Including Certain Buying. Occupancy, and Warehousing Expenses Cost of sales consists of merchandise costs, including design, sourcing. imporfing. and inbound freight costs, as well fly markdowns, shrinkage and centain peomotional coste (collectively lmerchandice costs") and biying. ocoupancy and warehouning costs Design costs are related to the Company's. Design Center operations and include compensation, travel and ensortainment, supplies and samples for our dosign tearns, as woil as rent and depreclation for our Design Center. These costs are included in cost of sales as the respective inventory is sold Buying, oocupancy and warehousing costs consist of compensaivon. employee beneft expenses and travel and ontertainment for our buyers and certan senior mprchandising executyes; rent and utlites related to our stores. corperate headquateri. d. Aributice centers and other office opace. freight from our distributof centore to the storesi compensation and supples for our distrbuton centers. including purchasing. receiving and insection costs, and shipping and handing coste related to our e-commeroe operation. Gross profit is the difierence between total net revenue and cost of sales: Selling. General, and Administrative Expenses Selling, General, and Administrative Expenses Selling, general, and administrative expenses consist of compensation and employee berefit expenses, including salaries, incentives, and related benelits associated with our stores and corporate headquarters. Selling. general, and administrative expenses also include advertising costs, supplies for our stores and home office, communicaton costs, travel, and entertainment, leasing cosis and services purchased. Seling. general, and administrative expenses do not include compensation, employee benefit expenses andi travel for our design. sourchg and importing teams, our buyers and our distribution centers as these amounts are recorded in cost of sales. Additionally, selling. general, and administrative expenses do not include rent and utilites related to our stores, operating costs of our distnbution centers, and shipging and handing costs related fo our e-commerce operations, Advertising Costs Certain advertising costs, including diroct mail, in-store photographs. and othor promotonal costs aro oxponsed when the marketing campaign commences. As of Fobruary 1, 2020 ard February 2, 2019, the Company had prepaid advertising oxpense of 514.5 million and $12.6 milion, respectively. All other advertising costs are expensed as incurred. The Company recognized $151.5 million, $143.2 million, and $129.8 millicn in advertising expense during Fiscal 2019, Fiscal 2018, and Fiscal 2017, respectivoly Store Pre-Opening Costs Store pre-opening costs consist primarily of rent, advertising, supplies, and payroll expenses. These costs are expensed as incurred Other income (Expense), Net Other income (expense). net consists primarily of foreign currency transaction gains (losses), interest income (expense), and realzed investment gains (icsses). Legal Proceedings and Claims The Company is subject to certan legal proceedings and claims arising out of the conduct of its business. In aocordance with ASC 450 , Contirgencies ("ASC 450 ), the Company records a reserve for estimated losses when the loss is probable and the amount can be reasonably estimated. If a range of possible loss exists and no anticipated lost within the range is more likely than any other anticipated loss, the Coenpany records the scorual at the low end of the range, in acoordance with. ABC 450 . As the Company believes that it has provided adequate reserves, it anticipates that the ultimate outoome of any matter curcently pending against the Company wil not materially alfect the consoldated financial position, results of operations or casih fows of the Company. However, our assessment of any itigation or other legal claims could potentally change in light of the discovery of facts not presently known or deteminations by judges, juries, or other finders of fact that are not in accord with management's evaluation of the possible liabity or outcome of such litigation or claims. Supplemental Disclosures of Cash Flow Information The table below shows supplemental cash flow information for cash amourits paxd during the rospective periods: Supplemental Disciosures of Cash Flow Information The table below shows supplemental cash flow information for cash amounts paid during the respective periods: 3. Cash, Cash Equivalents, and Short-term Investments The foltowing table summarizes the fair market value of our cash and short-term imvestrnents, which are focorded an the Consolidated Balance Stvects: 4. Fair Value Measurements ASC 820, Fair Ve'ue Measurement Dseciosures CASC 020'), defines fair value, establiahes a framework for measuring fair value in accorsance with asset or transfer of a liability in an ondedy transaction between market participants at the measurement dale Financial Instruments Valuation technicues used to measure fai value under ASC 820 must maximize the use of observable inputs and minimize the use of unobservable inputs. In addition, ASC 820 establishes a three-tier fair yalue hierarchy, which prioritizes the inpots used in. measuring fair value. These tiers include - Lovel 1 - Quoted prices in active markets - Leved 2 - inputs other than Level 1 that are observable, either directly or ind rectiy Financial Instruments Valuation techniques used to measure fair value under ASC 820 must maximize the use of observable inputs and minimize the use of unobservable inputs. In addition, ASC 820 establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. Thesg tiers include: - Levol 1 - Quoted prices in active markets. - Level 2 - inputs other than Level 1 that are observable, either directly or indirectly - Lovel 3 - Unobservable inputs that are supported by litle or no market activity and that are significant to the fair value of tho assets or liabilities. The Company's cash equivalents and short-term investments are Level 1 financial assets and are measured at fair value on a recurring basis, for all periods presented. Refer to Note 3 to the Consolidated Financial Statementh for additional information regarding cash equivalents and short-ferm investments. The Company had no other financial instruments that required fair value measurement for any of the periods prosented. Non-Financial Assets The Company's non-finaneidl assets, which include intangible assets and property and equpment, are not required to be measured at tair value on a recurring basis. However, it certain triggering events occur and the Company is required to evaluate the non-tinancial asset for impairment, a resulting impairment would require that the non-fnancial asset be recorded at the estimated fair value, During Fiscal 2019, the Company concluded that certain goodwill was impaired resulting in a 51.7 million charge included withn impairment and restructuring charges in the Consolidated Statements of Operations. The measurement of the goodwil impaiment included Level 3 measurements. Certain long-ived assets were measured at fair value on a nonrecuring basis using Level 3 inputs as defined in Asc 820 . During Fiscal 2019 , the Company recorded asset impairment charges of $64.5 million on the assets of 20 retail stores. Of the total, $39.5 malion related to the impairment of leasehold improvements and store fixtures and $2.5.0 million retated to the inpairment of operating lease RoU assets. The assets were adiusted to their far valuo and the loss on impairment was recorded withic impairment and restructuring charges in the Consolidated 5 tatements of Operasons The fair value of the impaired assets on these stores, after the recorded loss, is approxirnately 5145.2 mellion including 53.9 milion of leasehold improvements and store fixtures and 5141,3 milion of operating lease ROU assots The fair value of the Compary's stores was determinod by estimating the anount and timing of not future cash fows and discounting them using a tisk-adjusled rate of interest. The Company estimates future cash flows based on its experience and knowledge of the market in which the store is locited. 5. Earnings per Share The following is a reconciliation between basio and diluted weighted average shares outstanding: Improvements and store fixtures and $141.5 mmon or operating tease KUU assets The fair value of the Company/s stores was determined by estimating the amount and fiming of net future cash fiows and discounting them using a risk-adjusted rate of interest. The Company estimates future cash fows based on its experience and knowledge of the market in which the store is located. 5. Eamings per Share The following is a reconciliation between basid and diluted weighted average shares outstanding Dilutive and anti-dilutive shares relate to share-based compensation. Reter to Note 12 to the Consolidated Financial Statements for additional information regarding share-based compensation. 6. Accounts Receivable, net Accounts receivable, net is comprited of the following: 7. Property and Equipment, net Progerty and equipment, nel consiats of the fallowing 7. Property and Equipment, net Property and equpment, net consists of the following Depreciation expense is as follows: Additionally, duning Fiscal 2019, Fiscal 2018, and Fiscal 2017, the Company recorded 54,3 milion, $2.0 million and 56.0 milion, respectively, related to asset write-oils within depreciation and amartiration expense. 8. Intangible Assets, net, including Goodwill Intangible assets, net, including goodwil, consists of the following (1) Acoumclated impaiment ineluden $2.5 mition recorded in Fiscal 2016 and $1.7 million recorded in Fiscal 2019 8. Intangible Assets, net, including Goodwill Intangible assets, net, including goodwill, consists of the following: (1) Accumulated impairment includes $2.5 millan recorded in Fiscal 2016 and $1.7 milion recorded in Fiscal 2019 Amortization expense is as follows: The table below summarizes the estimated future amortization expense for intangible assets existing as of February 1, 2020 for the noxt five Fiscal Years a nther Credit Arrannemente 9. Other Credit Arrangements In Janvary 2019, the Company entered into an amended and restated Credit Agreement (Credit Ayreement") for five-yoar, syndicated, asset-based revolving credit facilties (the "Credit Facilies"). The Credt Agreement provides seniot secured revolving credit for loans and letters of credit up to $400 million, subject to customary borowing base limitations. The Credt Facitios provide increased financial fienbibity and take advantage of a favorable credit environiment. All obligations under the Credit Facilities are unconditionally guaranteed by certain subsidiaries. The obligations under the Credit Agreement are secured by a first-priority security interest in certain working capital assels of tho bonowers and guarantors. consisting primaelly of cash, roceivablos. inventory and certain other assefs, and will be further socured by first-priority mortpeges on certain real property. As of February 1, 2020. the Company was in compliance with the terms of the Credit Agreement and had $7.9 milion outstanding in stand-by letters of credit. No loans were outstanding under the Credit Agreement as of February 1 , 2020 of at any tirne throughout Fiscal 2019 . 10. Leases The Company leases all store premises, some of its office space and certain intormation technology and ottice equipment. These leases are gonerally classified as operating leases. Store leases gonerally provide for a combination of base rentals and contingorit ront based on store sades, Additorially, mobt leases incfude lessor incentues such as construction allowances and rent holidays. Tho Compary is froicild rosponsble for tenand occupancy costs including maintenance costs, common arca charges, real ostate taxos, and certain other expenses. Most leases inciude one or more options to renes. The exercise of leose renewal options is at the Company's discrebon and is not reasonably certain at lease commencement. When measuring operating lease ROU ansets and operating lease liabilios after the date of adoption of ASC BA2 (February 3, 2019), the Company only includes cash flows related to options to extend or terminate leases once those options are executed Sorne leases have vatiable paymente. However, because they are not based on an index or rate, they are not included in the measurement of operating lease ROU assets and operating lease liabilites When delermining the present value of future payments for an operating lease that does not have a readily determinable implicit rate, the Company ises ts incremental borrowing rate as of the date of initial possession of the leased asset. For leases that qualify for the short term lease exemplion. the Company does not record an operating tease liabaty or operating lease ROU asset Short-term lease payments are recognzed on a straight-line basis over the lease term of 12 months or less. The following table summarizes experse categories and cash paymen's for operating leases during the pericd. It also includes the total non-cash transaction aclivity for new operating lease ROU assets and related operating lease labeities entered into during the period. The foliowing table summarizes expense categories and casti payments for operating leases during the period. It also includes the total non-cash Iransection activty for new operating leaso ROU assets and related operating lease liabilitios entered into during the period. The following tabie contains the average remaining leate term and discount rate. weighted by cutstanding operating lease liability as of the end of the period: WeiWeWe The table beiow is a maturify analysis of the operating leases in effect as of the end of the period. Undiscounted cash fow for finance leases and short-lorm leases are not material fer tha poriods roporled and are excludod trom the lable below. intommation about the Compari's adoption of ASC 842 . 14 income Taxes cernpioled as acoounting for the tax efloots of the Tax Aet with no nieperal net changes lo the propisional mmousts iacordld for the one-time Iracsition tax and the re-mesurenece of defered ter assets and liabilies