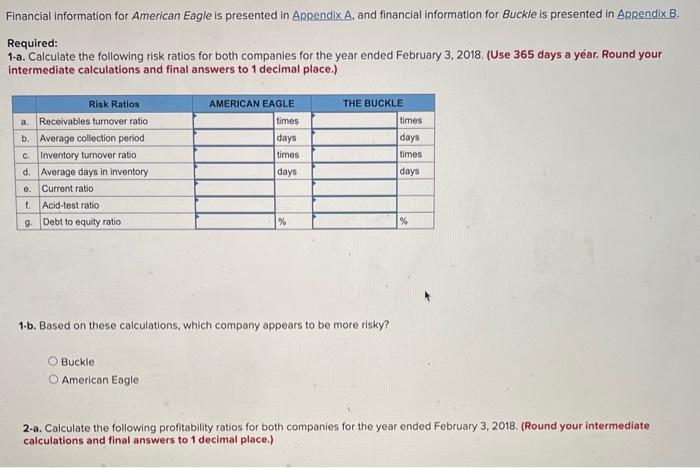

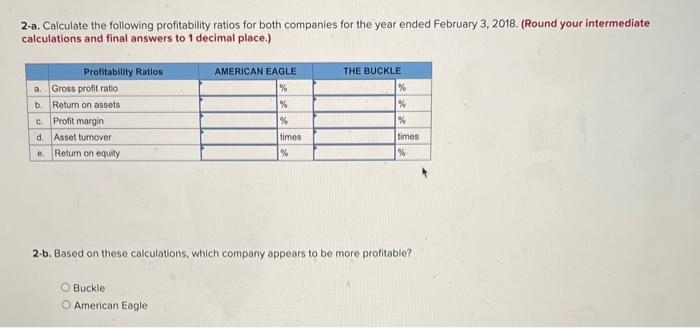

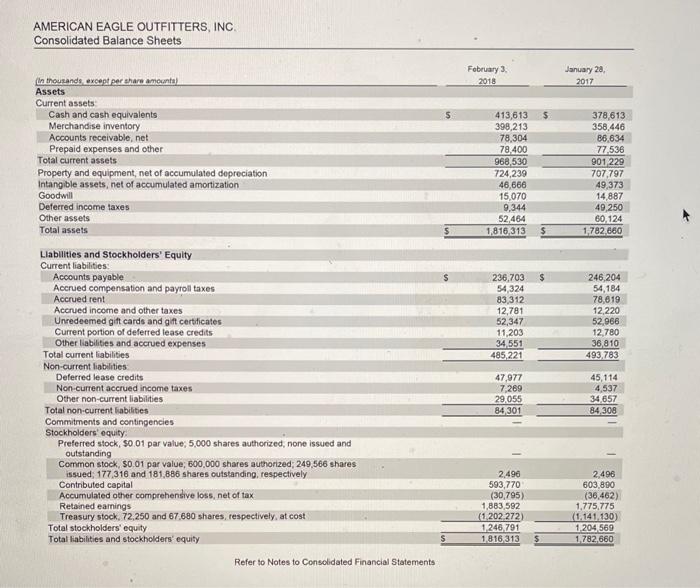

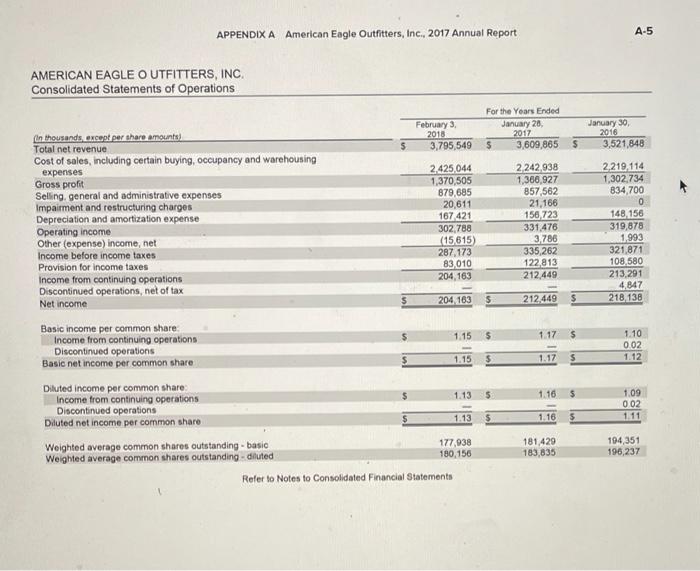

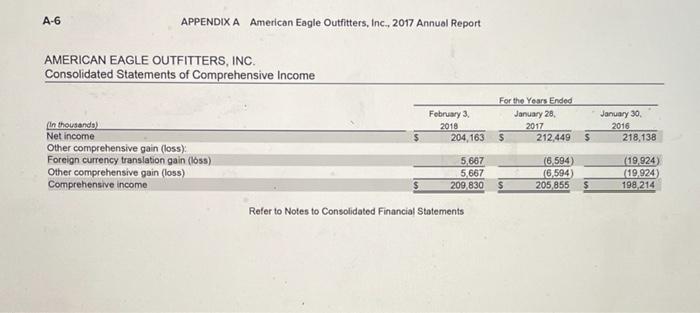

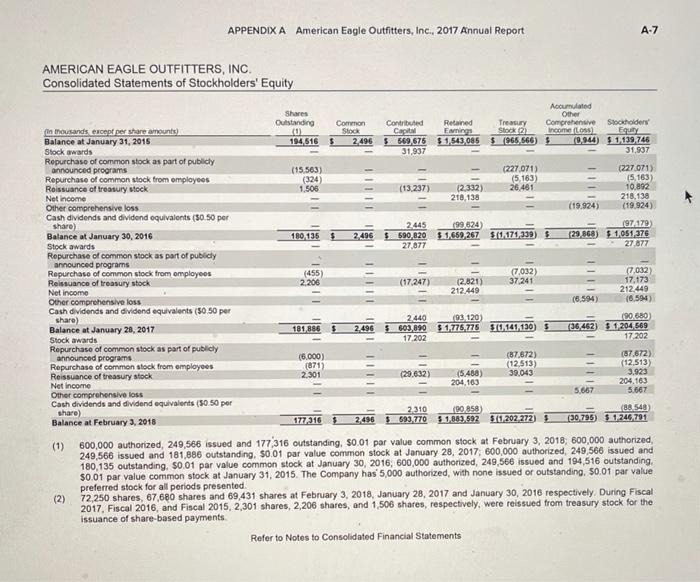

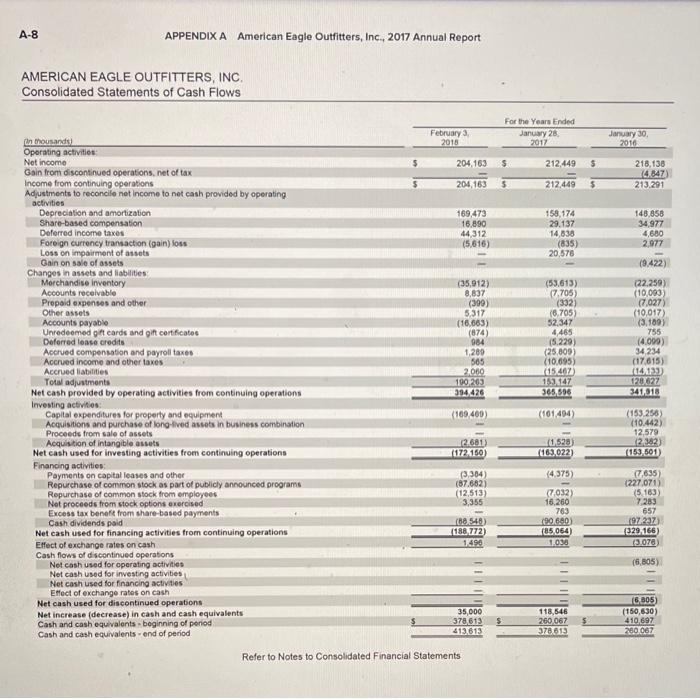

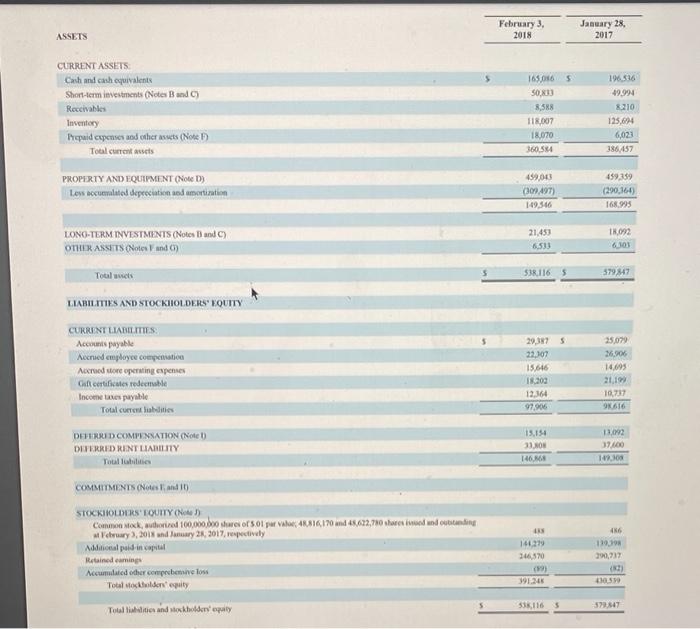

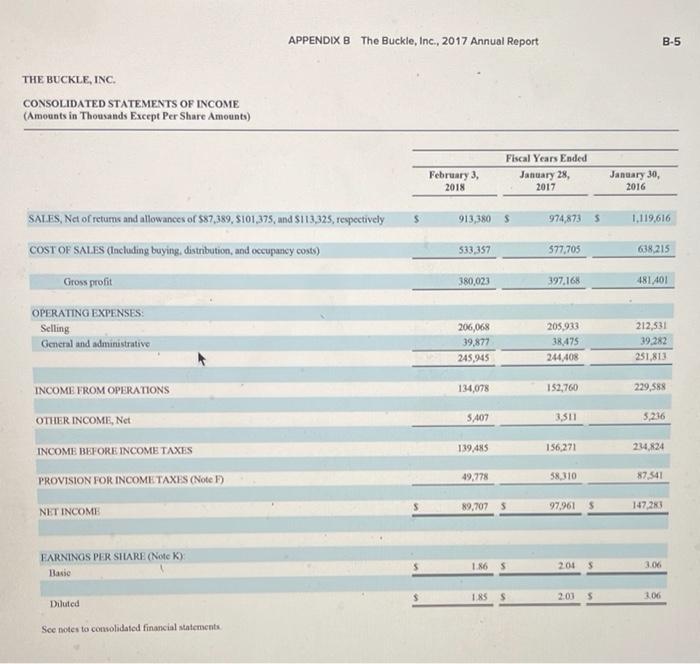

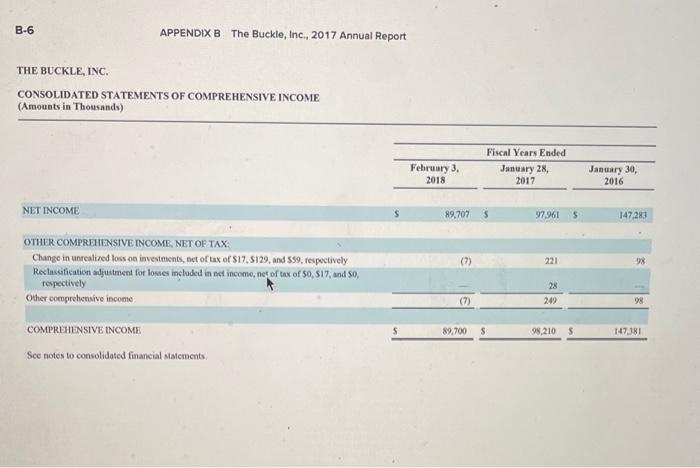

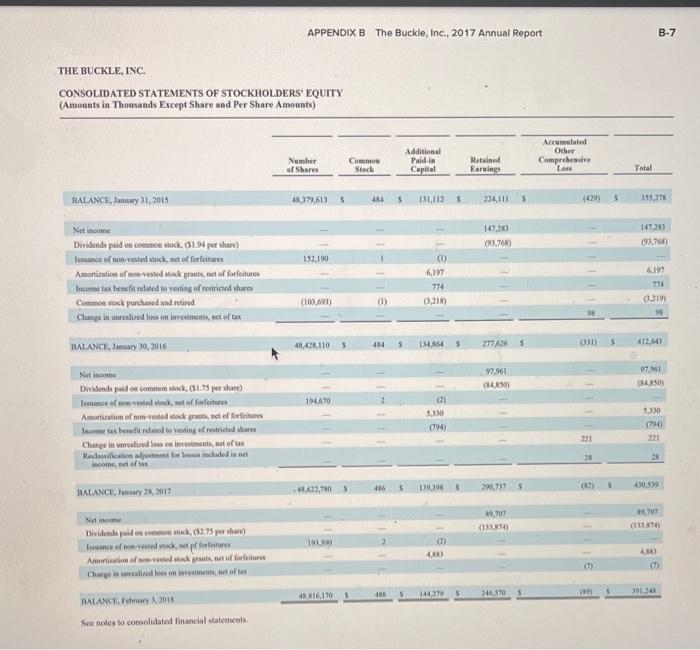

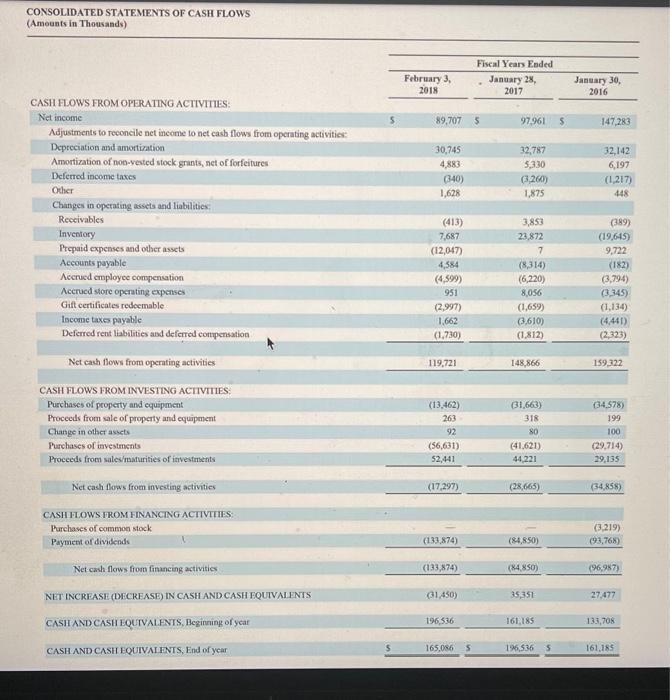

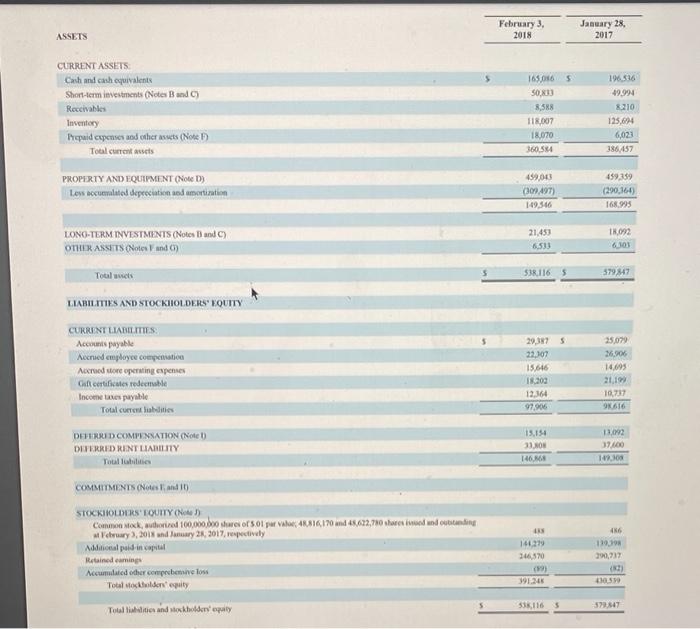

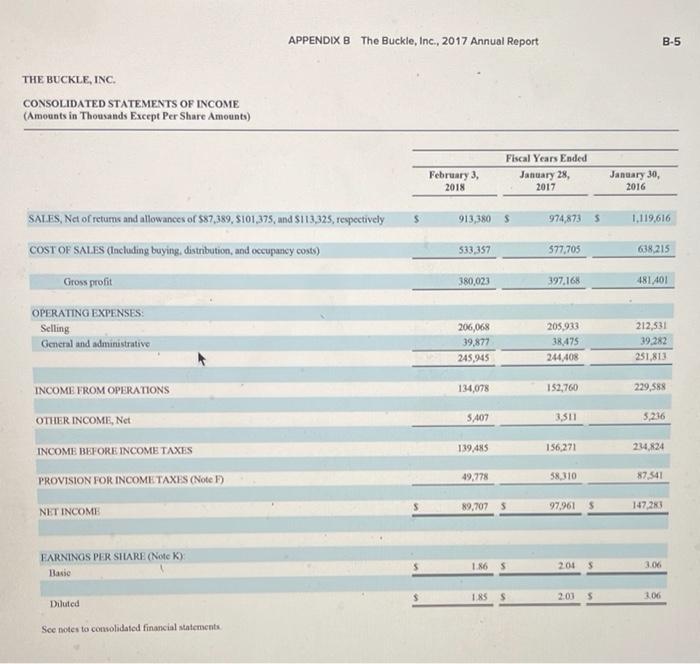

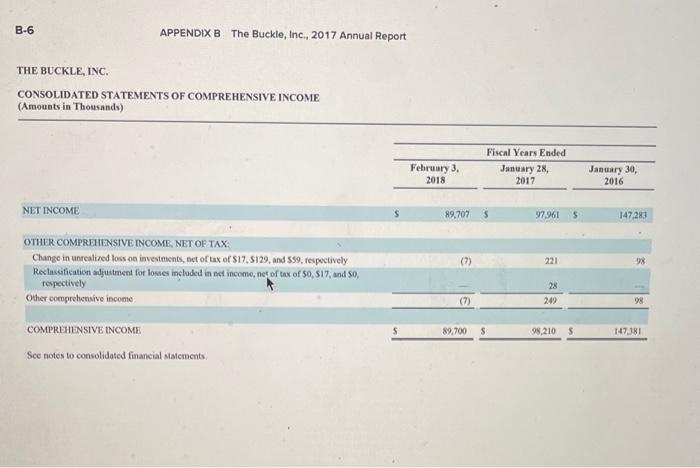

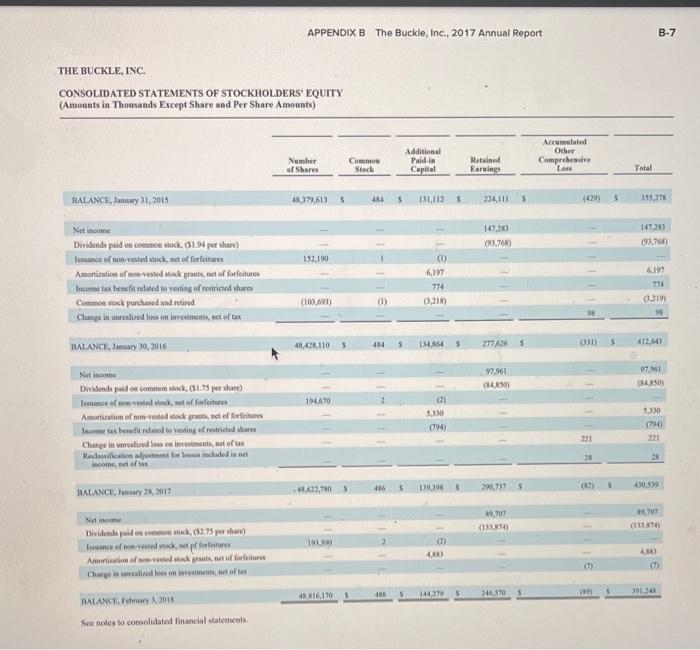

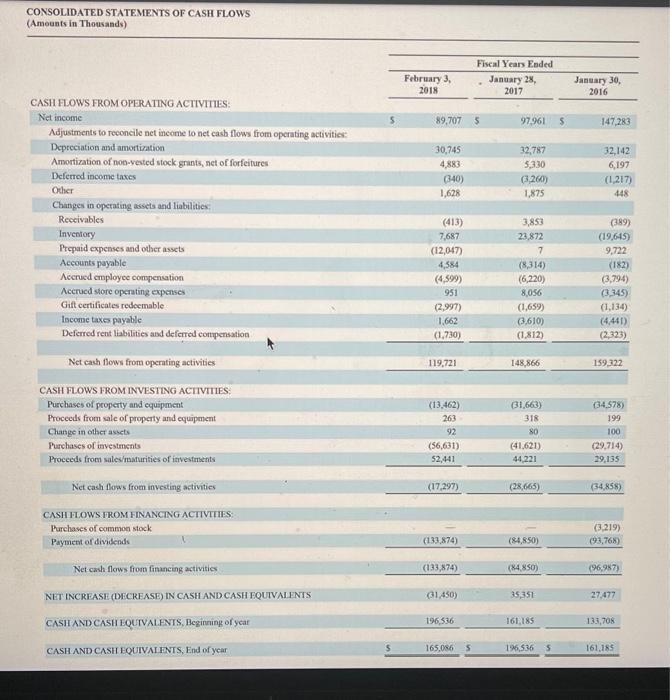

Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix B. Required: 1-a. Calculate the following risk ratios for both companies for the year ended February 3, 2018. (Use 365 days a year. Round your Intermediate calculations and final answers to 1 decimal place.) THE BUCKLE Risk Ratios a Receivables turnover ratio b. Average collection period c. Inventory turnover ratio d. Average days in inventory Current ratio Acid-test ratio 9 Debt to equity ratio AMERICAN EAGLE times days times days times days times days e. 1 % % 1-b. Based on these calculations, which company appears to be more risky? Buckle O American Eagle 2-a. Calculate the following profitability ratios for both companies for the year ended February 3, 2018. (Round your intermediate calculations and final answers to 1 decimal place.) 2-a. Calculate the following profitability ratios for both companies for the year ended February 3, 2018. (Round your intermediate calculations and final answers to 1 decimal place.) Profitability Ratios a. Gross profit ratio b. Return on assets c. Profit margin Asset turnover e. Return on equity AMERICAN EAGLE % % % times % THE BUCKLE % % % times % d 2.b. Based on these calculations, which company appears to be more profitable? Buckle American Eagle AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets February 3 2018 January 20, 2017 $ in thousands except per share amounta) Assets Current assets Cash and cash equivalents Merchandise inventory Accounts receivable, net Prepaid expenses and other Total current assets Property and equipment, net of accumulated depreciation Intangible assets, net of accumulated amortization Goodwill Deferred income taxes Other assets Total assets 413,613 398,213 78,304 78.400 968,530 724,239 46,666 15,070 9,344 52,464 1,816,313 378,613 358.446 86,634 77536 901 229 707,797 49,373 14,887 49 250 60 124 1,782.860 $ $ $ 236,703 54 324 83,312 12,781 52,347 11,203 34,551 485,221 246,204 54,184 78,619 12,220 52,966 12.780 36,810 493,783 Liabilities and Stockholders' Equity Current liabilities Accounts payable Accrued compensation and payroll taxes Accrued rent Accrued income and other taxes Unredeemed gift cards and gift certificates Current portion of deferred lease credits Other liabilities and accrued expenses Total current liabilities Non-current liabilities Deferred lease credits Non-current accrued income taxes Other non-current liabilities Total non-current liabilities Commitments and contingencies Stockholders equity Preferred stock. $0.01 par value, 5,000 shares authorized, none issued and outstanding Common stock, 50.01 par value; 600,000 shares authorized; 249,566 shares issued, 177,316 and 181,886 shares outstanding, respectively Contbuted capital Accumulated other comprehensive loss, net of tax Retained earnings Treasury stock. 72.250 and 67.680 shares, respectively, at cost Total stockholders' equity Total liabilities and stockholders' equity 47,977 7.269 29.055 84 301 45,114 4,537 34 657 84,308 2.496 593,770 (30,795) 1,883,592 (1 202 272) 1,246,791 1.816 313 2,496 603.890 (36.462) 1,775,775 (1.141.130) 1204 569 1.782.660 $ Refer to Notes to Consolidated Financial Statements APPENDIX A American Eagle Outfitters, Inc., 2017 Annual Report A-5 AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Operations For the Years Ended February 3 January 28, 2013 2017 3,795,5495 3,609,865 January 30, 2016 3,521,848 $ In thousands, except par share amounts) Total net revenue Cost of sales, including certain buying, occupancy and warehousing expenses Gross profit Selling, general and administrative expenses Impairment and restructuring charges Depreciation and amortization expense Operating income Other (expense) income, net Income before income taxes Provision for income taxes Income from continuing operations Discontinued operations, net of tax Net income 2.425,044 1,370,505 879,685 20,611 167 421 302.788 (15615) 287, 173 83010 204,163 2 242.938 1,366,927 857,562 21,166 156,723 331,476 3,786 335,262 122 813 212.449 2.219.114 1,302.734 834,700 0 148 156 319,878 1993 321,871 108,580 213.291 4,847 218 138 204 163 $ 212 449 $ 1.15 $ 1.17 $ Basic income per common share Income from continuing operations Discontinued operations Basic net income per common share 1.10 002 1.12 1.15 $ 1.17 5 1.13 $ 1.16 5 Diluted income per common share Income from continuing operations Discontinued operations Diluted net income per common share 1.09 002 111 1.13 1.16 181429 183,835 194,351 196,237 Weighted average common shares outstanding - basic 177,938 Weighted average common shares outstanding-diluted 180 156 Refer to Notes to Consolidated Financial Statements A-6 APPENDIX A American Eagle Outfitters, Inc., 2017 Annual Report AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Comprehensive Income February 3, 2018 204,163 For the Years Ended January 28, 2017 $ 212.449 January 30, 2016 218,138 $ $ In thousando) Net income Other comprehensive gain (lossy Foreign currency translation gain (loss) Other comprehensive gain (loss) Comprehensive income 5.687 5,667 209,830 (6594 16.594 205,855 (19,924) (19,924) 198,214 $ $ Refer to Notes to Consolidated Financial Statements APPENDIX A American Eagle Outfitters, Inc., 2017 Annual Report A-7 AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Stockholders' Equity Shares Outstanding 10 194,516 Common Stock $ 2.496 (15.563) (324) 1.506 III Accumulated Other Contributed Retained Treasury Comprehensive Stockholders Capital Earning Sok 2) Incomalo Equity $ 669,675 $1,543,085 $ (965.566) $ (9.944) 91139746 31,937 31,937 (227.071) (227.071) (5.163) (5.163) (13.237) (2 332) 26.481 10,892 218,138 218,138 (19.924) (19.924) 2445 199.624 197479) $. 590,820 5.1.659, 267 $11.171,339) $ (29,868) $1.051,376 27.877 27 877 21 11 180.135 2,496 I fin tousands of per share amounts) Balance at January 31, 2015 Stock awards Ropurchase of common stock as part of publicly announced programs Repurchase of common stock from employees Roissuance of treasury stock Net Income Other comprehensive loss Cash dividends and dividend equivalents (50.50 per sharo) Balance at January 30, 2016 Stock awards Repurchase of common stock as part of publicly announced programs Repurchase of common stock from employees Reissuance of treasury stock Net income Other comprehensive loss Cash dividends and dividend equivalents (50 50 per sharo) Balance at January 20, 2017 Stock awards Repurchase of common stock as part of publicly announced programs Repurchase of common stock from employees Reissuance of treasury stock Net Income Other comprehensive loss Cash dividends and dividend equivalents (50.50 per Balance at February 3, 2018 (455) 2.206 (17.247) (2.821) 212.449 (7,032) 37241 (7,032) 17,173 212.449 (6.54) (5.594) 181 886 2496 2440 (93,120 603,89051776 775 17,202 $11,141,130 100.680 (36 462) $1204 569 17202 (6.000) (871) (87.672) (12,513) 39.043 2301 (20.632) (5.488) 204,163 (87.672) (12.513) 3,923 204.163 5.667 5.667 (B8 548 (30,795) 51 246,791 share) 177 210 $ 2496 2310 (90.858) $ 693,770 5 1,883,592 $(1,202,272) (1) (2) 600,000 authorized, 249,566 issued and 177,316 outstanding. $0.01 par value common stock at February 3, 2018, 600,000 authorized 249,566 issued and 181,886 outstanding, 50.01 par value common stock at January 28, 2017, 600,000 authorized, 249,566 issued and 180,135 outstanding. $0.01 par value common stock at January 30, 2016, 600,000 authorized, 249,566 issued and 194,516 outstanding, $0.01 par value common stock at January 31, 2015. The Company has 5,000 authorized, with none issued or outstanding. 50.01 par value preferred stock for all periods presented. 72,250 shares, 67,680 shares and 69,431 shares at February 3, 2018, January 28, 2017 and January 30, 2016 respectively. During Fiscal 2017, Fiscal 2016, and Fiscal 2015, 2,301 shares, 2,206 shares, and 1,500 shares, respectively, were reissued from treasury stock for the issuance of share-based payments Refer to Notes to Consolidated Financial Statements A-8 APPENDIX A American Eagle Outfitters, Inc., 2017 Annual Report AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Cash Flows February 2018 For the Years Ended January 28 2017 January 30 2010 204.163 $ 212.449 $ 218,138 14.847) 213.291 204,163 212.449 169.473 16.890 44,312 (5,616) 158,174 29.137 14,838 (835) 20.578 148.858 34 977 4.680 2.977 In thousands Operating activities Not income Gain from discontinued operations, net of tax Income from continuing operations Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization Share-based compensation Deferred income taxes Foreign currency transaction (gain) loss Loss on impairment of assets Gain on sale of assets Changes in assets and liabilities Merchandise Inventory Accounts receivable Prepaid expenses and other Other assets Accounts payable Unredeemed gift cards and gift certificates Deferred lease credits Accrued compensation and payroll taxes Accrued income and other taxes Accrued liabilities Total adjustments Net cash provided by operating activities from continuing operations Investing activities: Capital expenditures for property and equipment Acquisitions and purchase of long-lived assets in business combination Proceeds from sale of assets Acquisition of intangible assets Net cash used for investing activities from continuing operations Financing activities: Payments on capital leases and other Repurchase of common stock as part of publicly announced programs Ropurchase of common stock from employees Net proceeds from stock options exercised Excess tax benefit from share based payments Cash dividends paid Net cash used for financing activities from continuing operations Effect of exchange rates on cash Cash flows of discontinued operations Net cash used for operating activities Net cash used for investing activities Net cash used for financing activities Effect of exchange rates on cash Net cash used for discontinued operations Net increase (decrease) in cash and cash equivalents Cash and cash equivalents beginning of period Cash and cash equivalents and of period (35,912) 8,837 (399) 5.317 (16.663) (674) 984 1,289 565 2.000 100, 263 354 426 (53.613) 7.705) (332) (6.705) 52,347 4,465 (5.229) (25.809) (10.695) (15462 15.147 365,806 (9.422) (22.250) (10,093) (7.027) (10,017) (3.109) 755 (4.099) 34,234 (17,615) 14133 120.622 341,018 (109400) (101.404) (153.258) (10.442) 12,579 2382) (153, 501) 2.661 (172.150) 0528 (163.022) (4.375) (3384) (87.682) (12,513) 3.355 (7,635 (227.071) (5.163) 7.283 657 197237 (329 166 12.070 (7.032) 16,260 763 (90.680 185 064 1.038 180.540 (188,772) 1490 (6,805) 35,000 378612 413.613 16.805) (150,630) 410 697 260 067 118,546 260.067 378613 $ Refer to Notes to Consolidated Financial Statements February 3, 2018 January 28, 2017 ASSETS CURRENT ASSETS Cash and cash equivalents Short-term investments (Notes Band) Receivables Inventory Hepaid cxpenses and other assets (Note 1 Total current assets 165,0365 50.8.13 3,58 118.007 18.070 360 584 196516 49.994 8210 125.604 6,023 386457 PROPERTY AND EQUIPMENT (Note D) 1.ew secumulated thepreciation and amortization 459,00 (309497) 149.546 459,359 (290,164) 168.995 LONO-TERM INVESTMENTS (Notes Band) OTHER ASSETS (Notes and ) 21.450 6513 09 6303 Total wels 538,116 5 57987 LIABILITIES AND STOCKHOLDERS' FOUITY CURRENT LIABILITIES Accounts payable Accrued employee compensation Accrued store operating expenses Gill certificates redeemable Income we payable Total Cubdities 29,3875 22,507 15646 18.200 12.364 97.906 25.079 26.06 1469 21.100 10,717 9616 DEFERID COMPENSATION (Note DEFERRED RINTLANILITY Touille 15.194 33.0 146.68 13.092 37.100 100 COMMITMENTS (Notes and it) STOCKHOLDERS' TOUTTY) Common Mack, word 100.000.000 ures of spurv 46.816.170 and 48.672,780 shares indubitanding Mary, 2018 January 21, 2017, respectively Additional puid in capital Retained eaming Nocumulated other comprenne los Total Mockholderity 46 119.19 390,237 140219 346,570 (19) 391.245 100 53.116 5 573847 Totalities and sockholders' equity APPENDIX B The Buckle, Inc., 2017 Annual Report B-5 THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands Except Per Share Amounts) February 3, 2018 Fiscal Years Ended January 28, 2017 January 30, 2016 s 913,380 $ 974,8735 1.119.616 SALES, Nct of returns and allowances of 587,389, 5101,375, and $113,325, respectively COST OF SALES (Including buying, distribution, and occupancy costs) 533,357 577,705 638.215 Gross profit 380,023 397,168 481 401 OPERATING EXPENSES Selling General and administrativo 206,068 39,877 245,945 205933 38,475 244 408 212,531 39,282 251,813 INCOME FROM OPERATIONS 134,078 152,760 229,588 OTHER INCOME, Net 5,407 3,511 5,236 INCOME BEFORE INCOME TAXES 139,485 156.271 234,824 49,778 58.310 87 541 PROVISION FOR INCOME TAXES (Note 5) 97,961 89,7075 $ 147.263 NET INCOME EARNINGS PER SHARE (Note K) Basic 1.86 2015 3.06 1855 2.03 5 3.06 Diluted See notes to consolidated financial statements B-6 APPENDIX B The Buckle, Inc., 2017 Annual Report THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amounts in Thousands) February 3. 2018 Fiscal Years Ended January 28, 2017 January 30, 2016 NET INCOME 89,707 5 97.961 $ 147,283 221 98 OTHER COMPREHENSIVE INCOME, NET OP TAX: Change in unrealized Joss on investments, net of tax of $17, 5129 and 599, respectively Reclassification adjustment for losses included in net income, net of tax of 50, 517, and 50, respectively Other comprehensive income 28 249 (7) 98 89,700 s 99,210 147.381 COMPREHENSIVE INCOME Sce notes to consolidated financial statements, APPENDIX B The Buckle, Inc., 2017 Annual Report B-7 THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Amounts in Thousands Except Share and Per Share Amounts) Accumulated Other Comprehensive Number of Shares Additional Paid in Capital Commen Stock Retained Earnings 10 Total BALANCE, January 31, 2015 48,379,613 5 84 5 131,112 224,111 $ (429) 5 355275 147.30 14720 093,768) (93.708) 132.100 Net income Dividends paid on non stock. (51.94 pet share) Isance of son vested stock, stof forfestes Amortization of non-vested Mockas, net of forfeiture Income tax benefit related to resting of restricted shoes Commonweek purchased and retired Change in relied on investments, ac of tax 1-1 (1) 6197 774 6197 774 0219 (103,223) (1) 0.2189 20 98 BALANCEJ 20, 2016 48.42,110 5 434 $ 14.564 277.6365 412,60 031) 97,961 (340 97.961 (140) 191,670 Netcome Dividend paides common ack, 01.75 per share) meneteltek, stof forfeiture Amortization of non-vested socket of forfeitures Income tax benefit related to vesting of restricted Change in relied oss investment of tax Hedlanification djustment for included in income, et of tax (2) 130 (794) 3310 (70 221 321 24 5 28.623,780 5 139,395 $ 400.539 200,7375 BALANCE 28, 2017 19.707 (10) 19107 (133TO 193.100 Net Income Dividend paid cocok, 02.75 years) Iwance of nonveted rock, met pl fire Amortisation of great forfeiture Change in retired foon immens, net of 0) 43 (7) 0 5 4,116,1205 5 1469 34650 39.24 BALANCE. Fy 2013 See notes to consolidated financial statement CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) February 3, 2018 Fiscal Year Ended January 28, 2017 January 30, 2016 5 89,707 5 97.961 5 147,283 30,745 4,883 (340) 1,628 32,787 3,330 (3.260) 1,875 32,142 6,197 (1,217) 448 CASH FLOWS FROM OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash flows from operating activities Depreciation and amortization Amortization of non-vested stock grints, net of forfeitures Deferred income taxes Other Changes in operating assets and liabilities Receivables Inventory Prepaid expenses and other assets Accounts payable Accrued employee compensation Accrued store operating expenses Gift certificates redeemable Income taxes payable Deferred rent liabilities and deferred compensation (413) 7,687 (12,047) 4,584 (4.599) 951 (2,997) 1,662 (1,730) 3,853 22,872 7 (8,314) (6,220) 8,056 (1,659) (3,610) (1.812) (389) (19,615) 9,722 (182) (3,794) (3.345) (1.134) (4,441) (2,323) 119,721 148,866 159.322 Net cash flows from operating activities CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment Proceeds from sale of property and equipment Change in other assets Purchases of investments Proceeds from sales/maturities of investments (13.462) 263 92 (56,631) 52,441 31,663) 318 SO (41,621) 44.221 (34.578) 199 100 (29,714) 29,135 Net cash flows from investing activities (17.297) (28,665) (34,858) CASH FLOWS FROM FINANCING ACTIVITIES Purchases of common stock Payment of dividende (3,219) (93,768) (133.874) (84,850) Net cash flows from financing activities (133,874) (84.850) (96,987) NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (1450) 35351 27.477 CASH AND CASH EQUIVALENTS, Beginning of your 196,536 161.185 133,708 165,086 5 CASH AND CASH EQUIVALENTS, End of year 196,536 5 161.185