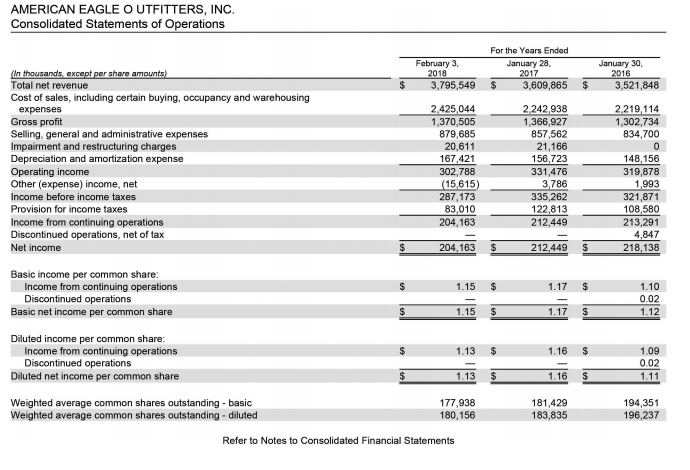

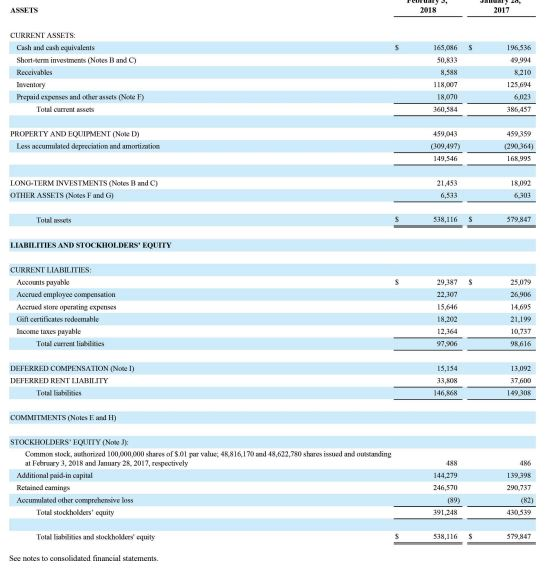

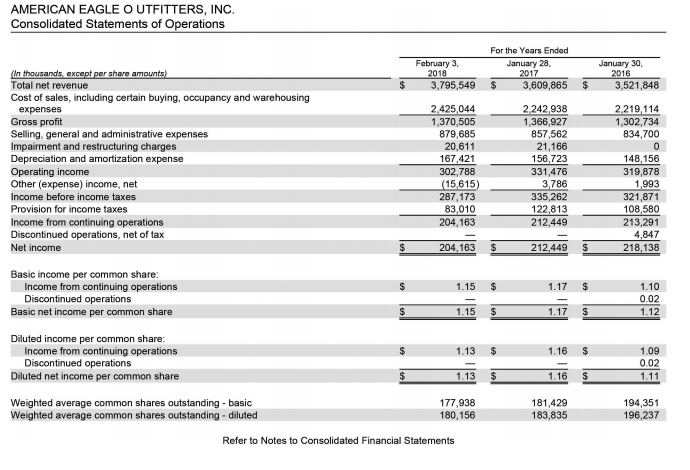

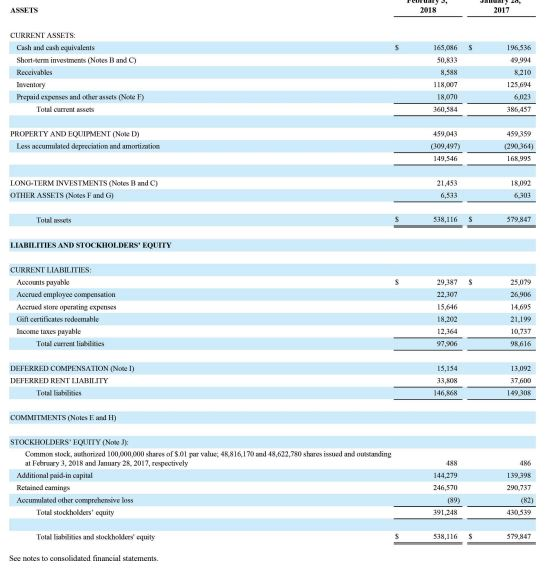

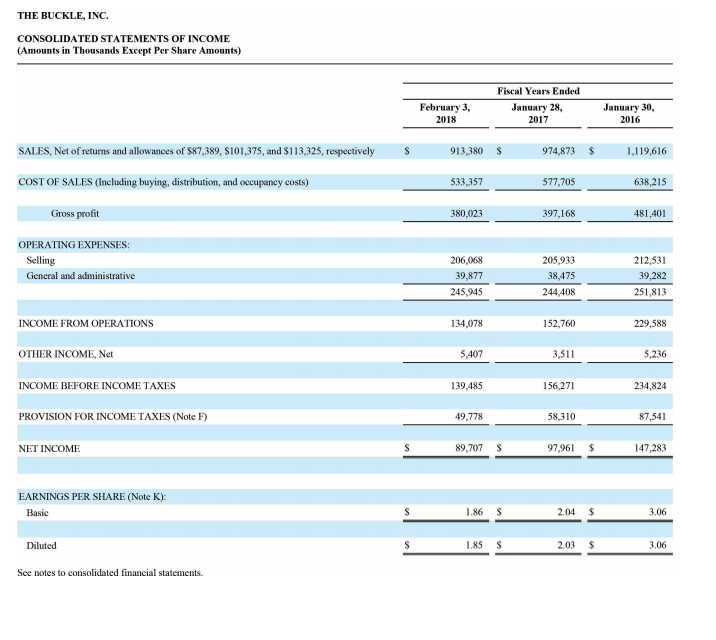

Financial information for American Eagles is presented in Appendix A, and financial information for Buckle is presented in Appendix B

Financial information for American Eagles is presented in Appendix A, and financial information for Buckle is presented in Appendix B

- Calculate American Eagles return on assets, profits margin, and asset turnover ratio for the year 2018 ( round your answers to 1 decimal place)

Return on Assets:

Profit Margin:

Asset Turnover:

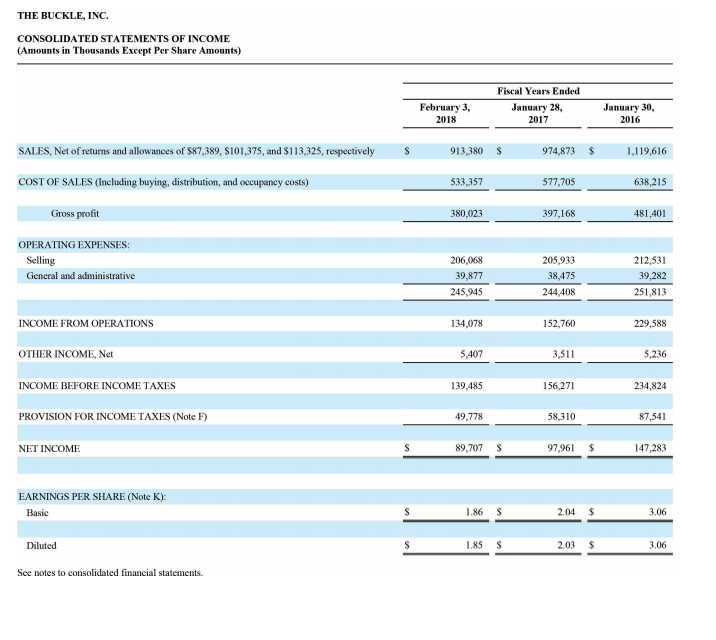

- Calculate buckles return on assets, profit margin and asset turnover ratio for the year 2018

Return on Assets:

Profit Margin:

Asset Turnover:

THE BUCKLE, INC CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands Except Per Share Amounts) Fiscal Years Ended February 3, 2018 January 28, 2017 January 30, 2016 SALES, Net of returns and allowances of $87,389, S101,375, and $113,325, respectively S 913,380 S 974,873$ 1,119,616 COST OF SALES (Including buying, distribution, and occupancy costs) 533,357 577,705 638,215 Gross profit 380,023 397,168 481,401 OPERATING EXPENSES: Selling General and administrative 206,068 39,877 245,945 205,933 38,475 244,408 212,531 39,282 251,813 INCOME FROM OPERATIONS 134,078 152,760 229,588 OTHER INCOME, Net ,407 3,511 5,236 INCOME BEFORE INCOME TAXES 139,485 156,271 234,824 PROVISION FOR INCOME TAXES (Note F) 49,778 58,310 87,541 NET INCOME 89,707 S 97,96 S 147,283 EARNINGS PER SHARE (Note K): Basic 186 S 2.04 3.06 Diluted 1.85 S 2.03 S 3,06 See notes to consolidated financial statements AMERICAN EAGLE O UTFITTERS, INC. Consolidated Statements of Operations For the Years Ended January 28, Fobruary 3 January 30, Total net revenue Cost of sales, including certain buying, occupancy and warehousing $3,795,549 3,609,865 $3,521,848 expenses Gross profit Selling, general and administrative expenses Impairment and restructuring charges Depreciation and amortization expense Operating income Other (expense) income, net Income before income taxes Provision for income taxes Income from continuing operations Discontinued operations, net of tax Net income 2425 044 1,370,505 879,685 20,611 167,421 302,788 (15,615) 287,173 83,010 204,163 2 242 938 1,366,927 857,562 21,166 156,723 331,476 3,786 335,262 122,813 212.449 1,302,734 834,700 148,156 319,878 ,993 321,871 108,580 213,291 4,847 218,138 204,163 $ 212449 S Basic income per common share: 1.17 $ Income from continuing operations Discontinued operations 0.02 1.12 Basic net income per common share 1.15 $ 1.17 $ Diluted income per common share: Income from continuing operations Discontinued operations Diluted net income per common share 1.09 0.02 1.11 1.16 $ Weighted average common shares outstanding-basic Weighted average common shares outstanding- diluted 177,938 180,156 181,429 183,835 94,351 196,237 Refer to Notes to Consolidated Financial Statements ASSETS 2018 2017 CURRENT ASSETS Cash and cash oquivalents Shotcrm investments Notes Band C) 65,086 S 50,833 18,007 18,070 Prepuid expemss and othur assets Nole F) Total current assets 386457 PROPERTY AND EQUIPMENT (Nolk D) 459.043 (309,497) (290 364) LONG TERM INVESTMENTS (Notes B and C OTHER ASSETS (Noees F and G) 21,453 6,333 18092 Total ts 338,16 s LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Accomts payabk Acenued employee compensation Acerued store operating expenses Gift certiticates redeemable scome taxes payable 29387 22,307 5.646 18.202 12,364 14.695 10,737 Total curret lisilaes DEFERRED COMPENSATION (Nose I) 13,092 3,808 146,868 Total Eshlitics COMMITMENTS (Noles E and H STOCKHOLDERS' EQUITY (Notw Jk Common slock, awhoriced 100,000,000 shares of S01 par value, 4881610 and 48,623,780 shes issued and oustanding at February 3, 2018 and January 28, 2017, respectively Additional paid-in capital Retained camings Accumalabed other comprehereive loss 188 486 290,737 (89) (82) Total stockholders' equity 391,248 Tolal shiies and stockhokders oquity 538,116 See notes to consolidated finncial statements

Financial information for American Eagles is presented in Appendix A, and financial information for Buckle is presented in Appendix B

Financial information for American Eagles is presented in Appendix A, and financial information for Buckle is presented in Appendix B