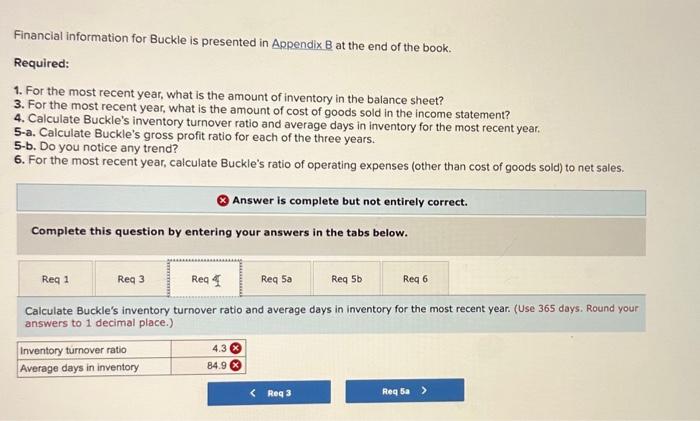

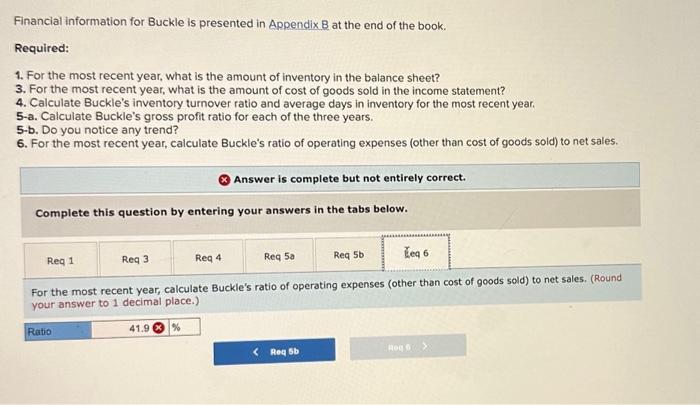

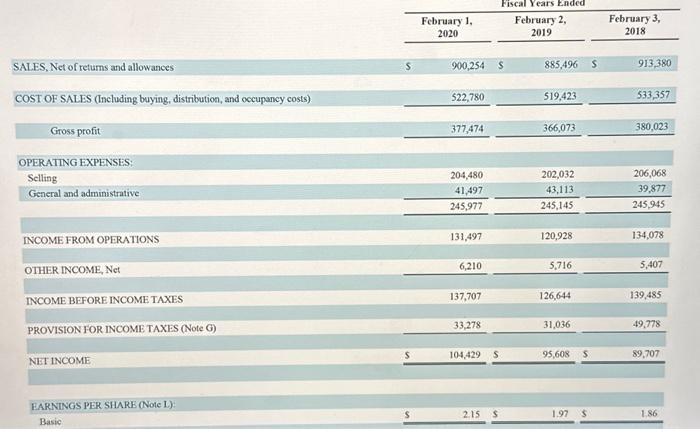

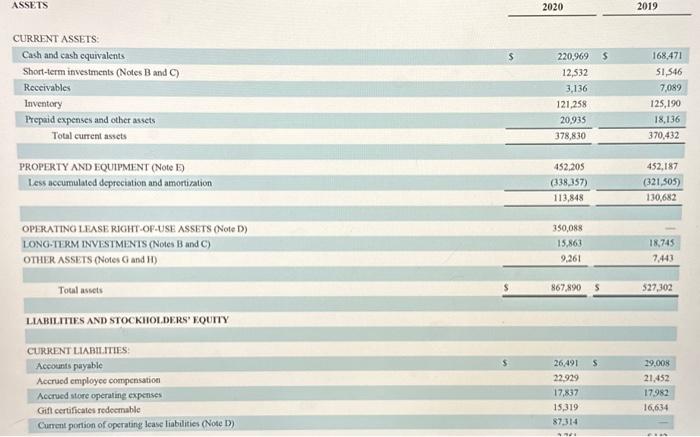

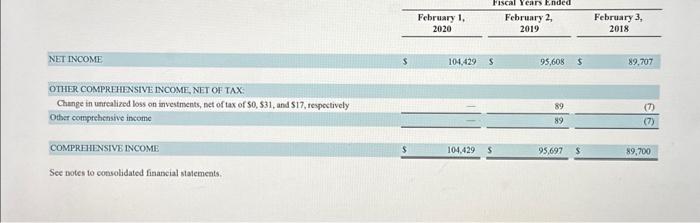

Financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate Buckle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate Buckle's gross profit ratio for each of the three years. 5-b. Do you notice any trend? 6. For the most recent year, calculate Buckle's ratio of operating expenses (other than cost of goods sold) to net sales. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Calculate Buckle's inventory turnover ratio and average days in inventory for the most recent year. (Use 365 days. Round your answers to 1 decimal place.) Financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate Buckle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate Buckle's gross profit ratio for each of the three years. 5-b. Do you notice any trend? 6. For the most recent year, calculate Buckle's ratio of operating expenses (other than cost of goods sold) to net sales. (*) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. For the most recent year, calculate Buckle's ratio of operating expenses (other than cost of goods sold) to net sales. (Round your answer to 1 decimal place.) \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{3}{*}{ SALES, Net of retums and allowanoes } & \multicolumn{5}{|c|}{ Fiscal Years Ended } \\ \hline & \multicolumn{2}{|c|}{\begin{tabular}{c} February 1, \\ 2020 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 2, \\ 2019 \end{tabular}} & \begin{tabular}{c} February 3, \\ 2018 \end{tabular} \\ \hline & S & 900,254 & s & 885,496 & s \\ \hline COST OF SALES (Including buying, distribution, and occupancy costs) & & 522,780 & & 519,423 & \\ \hline Gross profit & & 377,474 & & 366,073 & \\ \hline \multicolumn{6}{|l|}{ OPERATING EXPENSES: } \\ \hline Selling & & 204,480 & & 202,032 & \\ \hline \multirow[t]{2}{*}{ General and administrative } & & 41,497 & & 43,113 & \\ \hline & & 245,977 & & 245,145 & \\ \hline INCOME FROM OPERATIONS & & 131,497 & & 120,928 & \\ \hline OTHER INCOME, Net & & 6,210 & & 5,716 & \\ \hline NNCOME BEFORE INCOME TAXES & & 137,707 & & 126,644 & \\ \hline PROVISION FOR INCOME TAXES (Note G) & & 33,278 & & 31,036 & \\ \hline NET INCOME & & 104,429 & s & 95,608 & 5 \\ \hline \multicolumn{6}{|l|}{ EARNINGS PER SHARE (Note L): } \\ \hline Basic & $ & 2.15 & $ & 1.97 & 5 \\ \hline \end{tabular} ASSETS CURRENT ASSETS: \begin{tabular}{|c|c|c|c|c|} \hline Cash and cash equivalents & 5 & 220,969 & s & 168,471 \\ \hline Short-term investments (Notes B and C) & & 12,532 & & $1,546 \\ \hline Receivables & & 3,136 & & 7,089 \\ \hline Inventery & & 121,258 & & 125,190 \\ \hline Prepaid expenses and other assets & & 20,935 & & 18,136 \\ \hline Total current assets & & 378,830 & & 370,432 \\ \hline PROPERTY AND EQUIPMENT (Note E) & & 452,205 & & 452,187 \\ \hline \multirow[t]{2}{*}{ Less accumulated depreciation and amortiration } & & (338,357) & & (321,505) \\ \hline & & 113,848 & & 130,682 \\ \hline OPERATING LEASE RIGHT-OF-USE ASSETS ONote D) & & 350,088 & & - \\ \hline LONG-TERM INVESTMENTS (Notes B and C) & & 15,863 & & 18,745 \\ \hline \multirow[t]{2}{*}{ OTHER ASSETS (Notes G and H ) } & & 9.261 & & 7,443 \\ \hline & \$ & 867,890 & s & 527,302 \\ \hline \end{tabular} LURILTES AND STOCKIOL.DERS' EQUTY CURRENT LIABIIIIIES: \begin{tabular}{|c|c|c|c|c|} \hline Accounts payable & 5 & 26,491 & s & 29,008 \\ \hline Accrued employee compensation & & 22,929 & & 21,452 \\ \hline Accrued store operaling experises & & 17,837 & & 17982 \\ \hline Gifl certificates redecmable. & & 15,319 & & 16,634 \\ \hline Cument portion of opsrating lease liabilities (Note D) & & 87,314 & & = \\ \hline \end{tabular} NET INCOME OTHER COMPRFHENSIVE TNCOME, NET OF TAX: Change in unrealized loss on investments, net of tax of 50,531 , and 517 , respoctively Other cotrpretensive income COMPRHHENSIVE INCOME See botes to consolidated financial staiements. Financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate Buckle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate Buckle's gross profit ratio for each of the three years. 5-b. Do you notice any trend? 6. For the most recent year, calculate Buckle's ratio of operating expenses (other than cost of goods sold) to net sales. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Calculate Buckle's inventory turnover ratio and average days in inventory for the most recent year. (Use 365 days. Round your answers to 1 decimal place.) Financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate Buckle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate Buckle's gross profit ratio for each of the three years. 5-b. Do you notice any trend? 6. For the most recent year, calculate Buckle's ratio of operating expenses (other than cost of goods sold) to net sales. (*) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. For the most recent year, calculate Buckle's ratio of operating expenses (other than cost of goods sold) to net sales. (Round your answer to 1 decimal place.) \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{3}{*}{ SALES, Net of retums and allowanoes } & \multicolumn{5}{|c|}{ Fiscal Years Ended } \\ \hline & \multicolumn{2}{|c|}{\begin{tabular}{c} February 1, \\ 2020 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} February 2, \\ 2019 \end{tabular}} & \begin{tabular}{c} February 3, \\ 2018 \end{tabular} \\ \hline & S & 900,254 & s & 885,496 & s \\ \hline COST OF SALES (Including buying, distribution, and occupancy costs) & & 522,780 & & 519,423 & \\ \hline Gross profit & & 377,474 & & 366,073 & \\ \hline \multicolumn{6}{|l|}{ OPERATING EXPENSES: } \\ \hline Selling & & 204,480 & & 202,032 & \\ \hline \multirow[t]{2}{*}{ General and administrative } & & 41,497 & & 43,113 & \\ \hline & & 245,977 & & 245,145 & \\ \hline INCOME FROM OPERATIONS & & 131,497 & & 120,928 & \\ \hline OTHER INCOME, Net & & 6,210 & & 5,716 & \\ \hline NNCOME BEFORE INCOME TAXES & & 137,707 & & 126,644 & \\ \hline PROVISION FOR INCOME TAXES (Note G) & & 33,278 & & 31,036 & \\ \hline NET INCOME & & 104,429 & s & 95,608 & 5 \\ \hline \multicolumn{6}{|l|}{ EARNINGS PER SHARE (Note L): } \\ \hline Basic & $ & 2.15 & $ & 1.97 & 5 \\ \hline \end{tabular} ASSETS CURRENT ASSETS: \begin{tabular}{|c|c|c|c|c|} \hline Cash and cash equivalents & 5 & 220,969 & s & 168,471 \\ \hline Short-term investments (Notes B and C) & & 12,532 & & $1,546 \\ \hline Receivables & & 3,136 & & 7,089 \\ \hline Inventery & & 121,258 & & 125,190 \\ \hline Prepaid expenses and other assets & & 20,935 & & 18,136 \\ \hline Total current assets & & 378,830 & & 370,432 \\ \hline PROPERTY AND EQUIPMENT (Note E) & & 452,205 & & 452,187 \\ \hline \multirow[t]{2}{*}{ Less accumulated depreciation and amortiration } & & (338,357) & & (321,505) \\ \hline & & 113,848 & & 130,682 \\ \hline OPERATING LEASE RIGHT-OF-USE ASSETS ONote D) & & 350,088 & & - \\ \hline LONG-TERM INVESTMENTS (Notes B and C) & & 15,863 & & 18,745 \\ \hline \multirow[t]{2}{*}{ OTHER ASSETS (Notes G and H ) } & & 9.261 & & 7,443 \\ \hline & \$ & 867,890 & s & 527,302 \\ \hline \end{tabular} LURILTES AND STOCKIOL.DERS' EQUTY CURRENT LIABIIIIIES: \begin{tabular}{|c|c|c|c|c|} \hline Accounts payable & 5 & 26,491 & s & 29,008 \\ \hline Accrued employee compensation & & 22,929 & & 21,452 \\ \hline Accrued store operaling experises & & 17,837 & & 17982 \\ \hline Gifl certificates redecmable. & & 15,319 & & 16,634 \\ \hline Cument portion of opsrating lease liabilities (Note D) & & 87,314 & & = \\ \hline \end{tabular} NET INCOME OTHER COMPRFHENSIVE TNCOME, NET OF TAX: Change in unrealized loss on investments, net of tax of 50,531 , and 517 , respoctively Other cotrpretensive income COMPRHHENSIVE INCOME See botes to consolidated financial staiements