Answered step by step

Verified Expert Solution

Question

1 Approved Answer

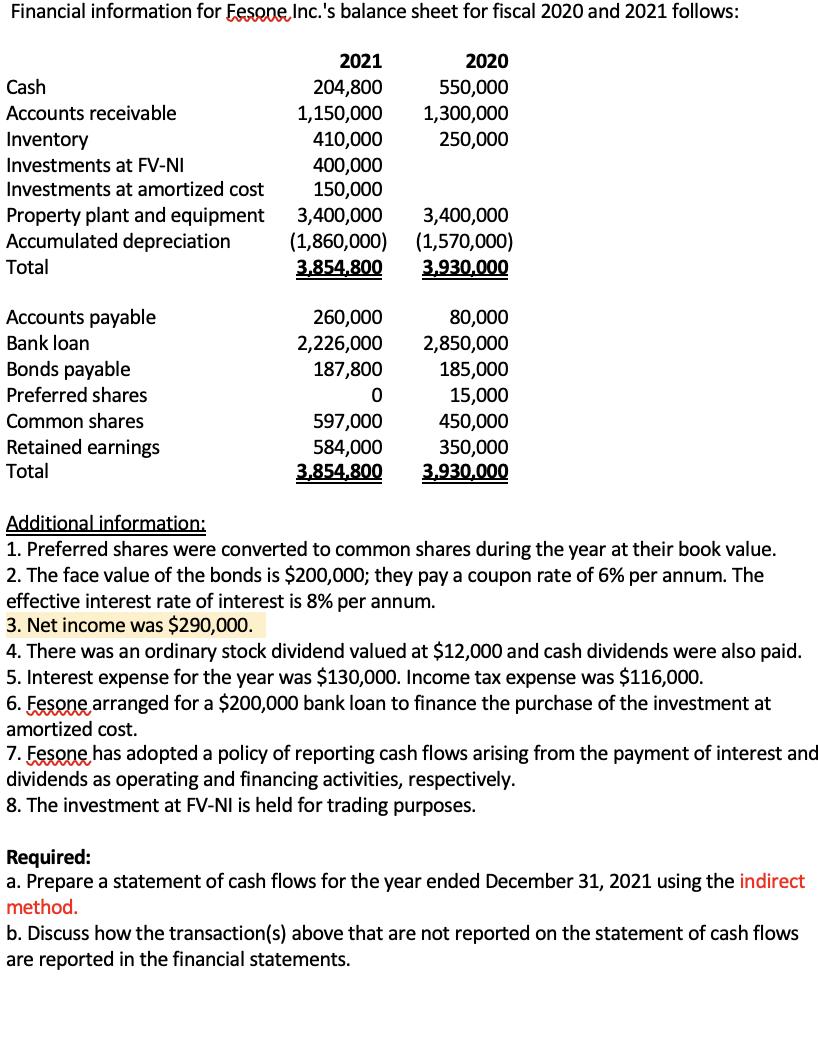

Financial information for Fesone Inc.'s balance sheet for fiscal 2020 and 2021 follows: 2021 2020 550,000 1,300,000 Cash 204,800 Accounts receivable 1,150,000 410,000 400,000

Financial information for Fesone Inc.'s balance sheet for fiscal 2020 and 2021 follows: 2021 2020 550,000 1,300,000 Cash 204,800 Accounts receivable 1,150,000 410,000 400,000 150,000 Inventory 250,000 Investments at FV-NI Investments at amortized cost Property plant and equipment Accumulated depreciation 3,400,000 (1,860,000) 3,400,000 (1,570,000) 3,930,000 Total 3,854,800 Accounts payable 260,000 80,000 Bank loan 2,226,000 187,800 2,850,000 Bonds payable 185,000 Preferred shares 15,000 Common shares 597,000 Retained earnings Total 584,000 3,854,800 450,000 350,000 3,930,000 Additional information: 1. Preferred shares were converted to common shares during the year at their book value. 2. The face value of the bonds is $200,000; they pay a coupon rate of 6% per annum. The effective interest rate of interest is 8% per annum. 3. Net income was $290,000. 4. There was an ordinary stock dividend valued at $12,000 and cash dividends were also paid. 5. Interest expense for the year was $130,000. Income tax expense was $116,000. 6. Fesone arranged for a $200,000 bank loan to finance the purchase of the investment at amortized cost. 7. Fesone has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating and financing activities, respectively. 8. The investment at FV-NI is held for trading purposes. Required: a. Prepare a statement of cash flows for the year ended December 31, 2021 using the indirect method. b. Discuss how the transaction(s) above that are not reported on the statement of cash flows are reported in the financial statements.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Please like the answer and keep supporting Thank you Statement of Cashflows Cash from Operati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started