Answered step by step

Verified Expert Solution

Question

1 Approved Answer

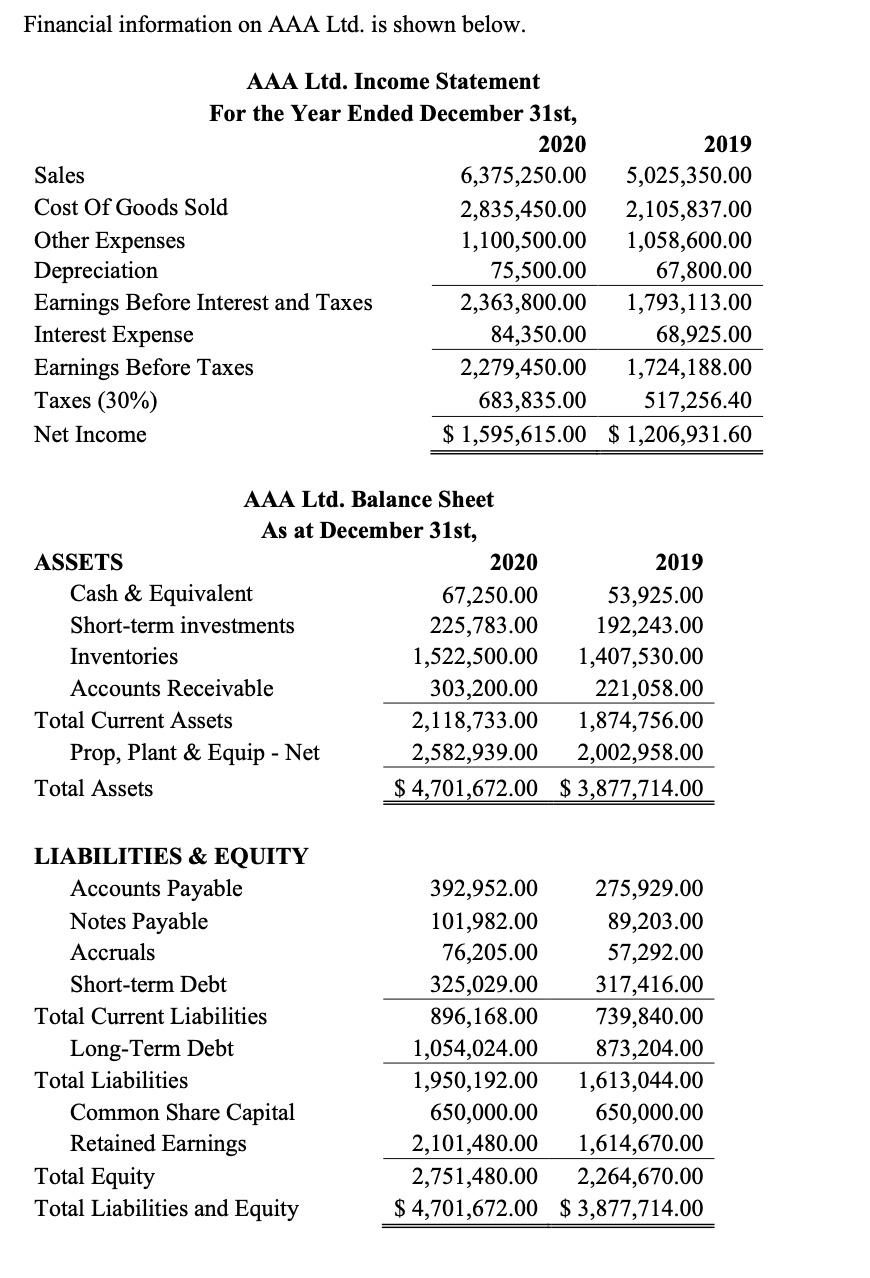

Financial information on AAA Ltd. is shown below. AAA Ltd. Income Statement For the Year Ended December 31st, 2020 2019 Sales 6,375,250.00 5,025,350.00 Cost

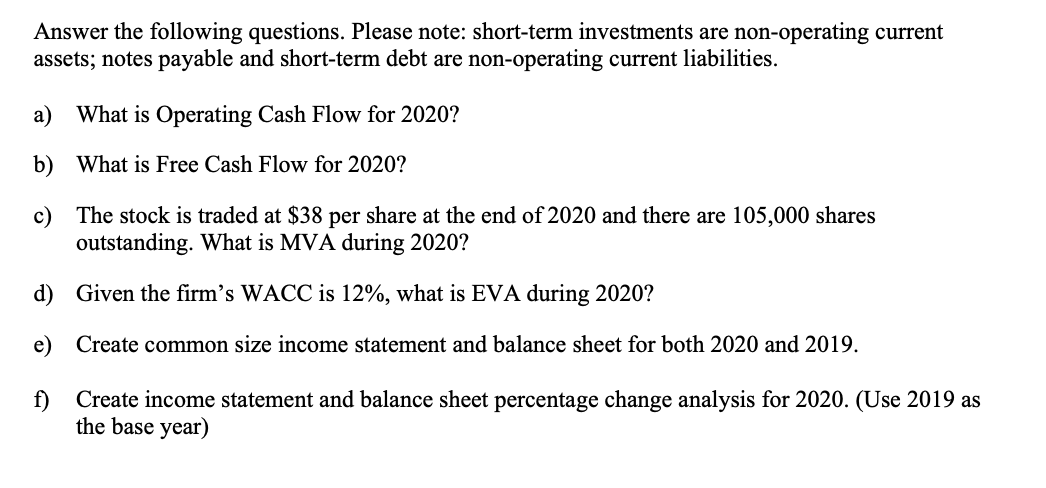

Financial information on AAA Ltd. is shown below. AAA Ltd. Income Statement For the Year Ended December 31st, 2020 2019 Sales 6,375,250.00 5,025,350.00 Cost Of Goods Sold 2,835,450.00 2,105,837.00 Other Expenses 1,100,500.00 1,058,600.00 Depreciation 75,500.00 67,800.00 Earnings Before Interest and Taxes 2,363,800.00 1,793,113.00 Interest Expense 84,350.00 68,925.00 Earnings Before Taxes Taxes (30%) Net Income 2,279,450.00 1,724,188.00 683,835.00 517,256.40 ASSETS $ 1,595,615.00 $ 1,206,931.60 AAA Ltd. Balance Sheet As at December 31st, Cash & Equivalent Short-term investments Inventories Accounts Receivable 2020 67,250.00 2019 53,925.00 225,783.00 192,243.00 1,522,500.00 1,407,530.00 303,200.00 221,058.00 2,118,733.00 1,874,756.00 Total Current Assets Prop, Plant & Equip - Net Total Assets LIABILITIES & EQUITY Accounts Payable Notes Payable 2,582,939.00 2,002,958.00 $ 4,701,672.00 $3,877,714.00 392,952.00 275,929.00 101,982.00 89,203.00 Accruals 76,205.00 57,292.00 Short-term Debt 325,029.00 317,416.00 Total Current Liabilities 896,168.00 739,840.00 Long-Term Debt 1,054,024.00 873,204.00 Total Liabilities 1,950,192.00 1,613,044.00 Common Share Capital 650,000.00 650,000.00 Retained Earnings 2,101,480.00 1,614,670.00 Total Equity 2,751,480.00 2,264,670.00 Total Liabilities and Equity $ 4,701,672.00 $ 3,877,714.00 Answer the following questions. Please note: short-term investments are non-operating current assets; notes payable and short-term debt are non-operating current liabilities. a) What is Operating Cash Flow for 2020? b) What is Free Cash Flow for 2020? c) The stock is traded at $38 per share at the end of 2020 and there are 105,000 shares outstanding. What is MVA during 2020? d) Given the firm's WACC is 12%, what is EVA during 2020? e) Create common size income statement and balance sheet for both 2020 and 2019. Create income statement and balance sheet percentage change analysis for 2020. (Use 2019 as the base year)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started