Question

Financial information related to Claudia Sales for the year to 30 April 2019 were 89m, yielding a gross profit of 8.7m and a profit before

Financial information related to Claudia

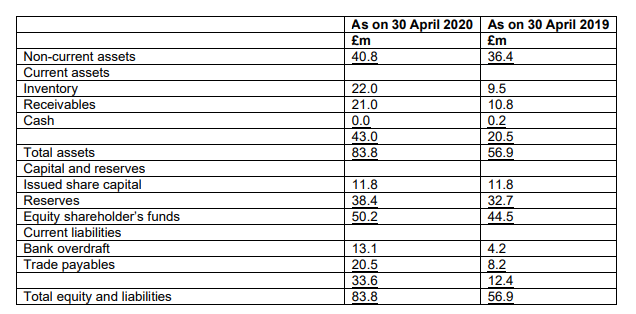

Sales for the year to 30 April 2019 were 89m, yielding a gross profit of 8.7m and a profit before tax (after finance costs) of 8.2m. At the beginning of the year to 30 April 2020, the company bought new manufacturing equipment and recruited six more sales staff. Sales for the year to 30 April 2020 were 131m, with an operating profit of 8.5m, and a profit before tax of 7m.

Task

a. Explain the cash conversion cycle and its significance in determining the working capital needed by a company.

b. Calculate the cash operating cycle of Claudia for the years ending 30 April 2019 and 2020.

c. Using additional calculations, with your results to part (b), discuss whether or not Claudia is overtrading.

d. Explain the different strategies a firm may follow to finance its working capital requirements.

e. Suggest ways in which Claudia might seek to resolve its current funding problems, and avoid the risks associated with overtrading.

As on 30 April 2020 As on 30 April 2019 m m 40.8 36.4 Non-current assets Current assets Inventory Receivables Cash 22.0 21.0 0.0 43.0 83.8 9.5 10.8 0.2 20.5 56.9 Total assets Capital and reserves Issued share capital Reserves Equity shareholder's funds Current liabilities Bank overdraft Trade payables 11.8 38.4 50.2 11.8 32.7 44.5 13.1 20.5 33.6 83.8 4.2 8.2 12.4 56.9 Total equity and liabilities As on 30 April 2020 As on 30 April 2019 m m 40.8 36.4 Non-current assets Current assets Inventory Receivables Cash 22.0 21.0 0.0 43.0 83.8 9.5 10.8 0.2 20.5 56.9 Total assets Capital and reserves Issued share capital Reserves Equity shareholder's funds Current liabilities Bank overdraft Trade payables 11.8 38.4 50.2 11.8 32.7 44.5 13.1 20.5 33.6 83.8 4.2 8.2 12.4 56.9 Total equity and liabilitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started