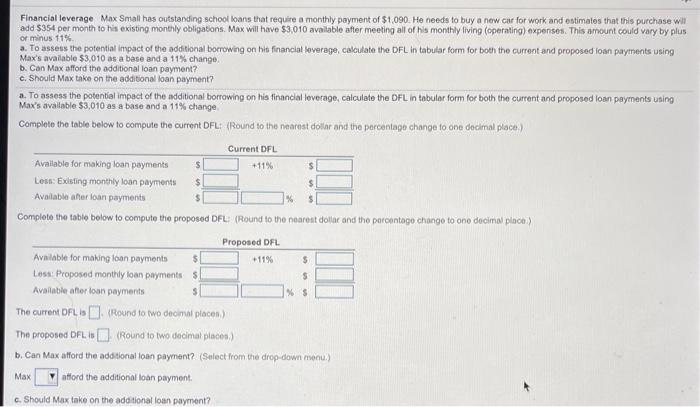

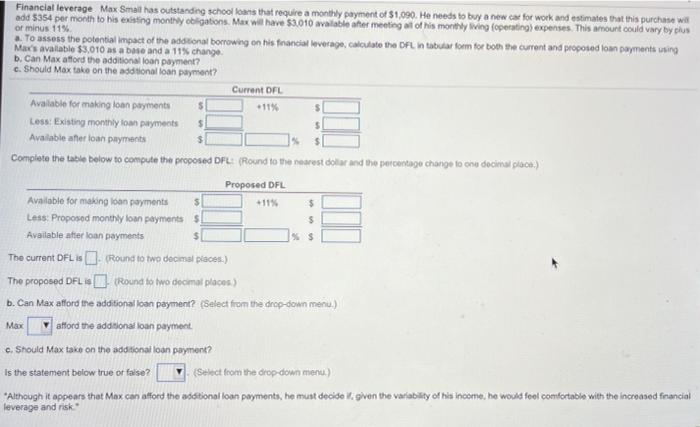

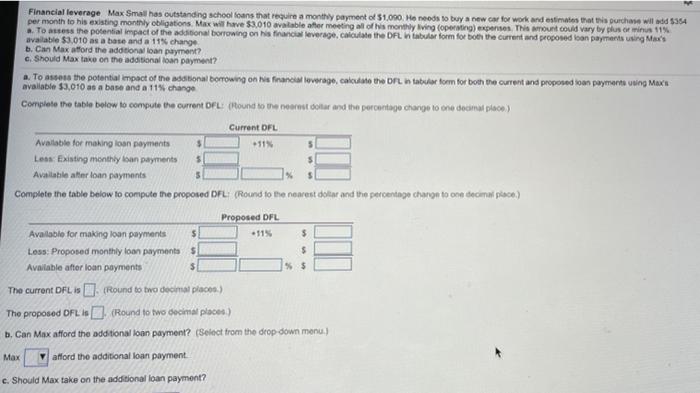

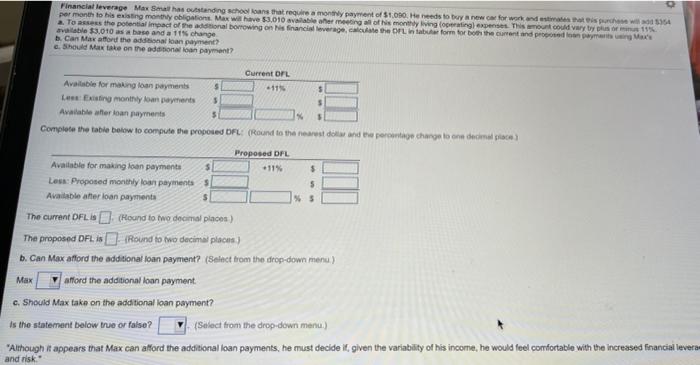

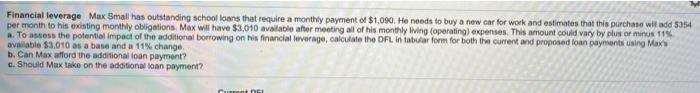

$ Financial leverage Max Small hos outstanding school loans that require a monthly payment of $1,090. He needs to buy a new car for work and estimates that this purchase wil add $354 per month to his existing monthly obligations. Max will have $3,010 available after meeting all of his monthly living (operating) expenses. This amount could vary by plus or minus 11% a. To assess the potential impact of the additional borrowing on his financial leverage calculate the DFL in tabular form for both the current and proposed loan payments using Max's available $3,010 as a base and a 11% change b. Can Max afford the additional loan payment? c. Should Max take on the additional loan payment? . To assess the potential impact of the additional borrowing on his financial leverage calculate the DFL in tabular form for both the current and proposed loan payments using Max's available $3,010 as a base and a 11% change Complete the table below to compute the current DFL (Round to the nearest dollar and the percentage change to one decimal place) Current DFL Available for making loan payments $ +11% $ Less: Existing monthly loan payments $ Available her loan payments $ Complete the table below to compute the proposed DFL (Round to the nearest dolls and the percentage change to ono decimal place) Proposed DFL Available for making loan payments +11% Losa: Proposed monthly loan payments $ Available after loan payments % The current DFL - (Round to wo decimat place) The proposed DF (Round to two decimal places) b. Can Max afford the additional loan payment? (Select from the drop-down menu.) Max afford the additional loan payment c. Should Max take on the additional loan payment? $ $ $ Financial leverage Max Small has outstanding school fons that require a monthly payment of $1,090. He needs to buy a new car for work and estimates that this purchase wa add $354 per month to his existing monthy obligations Max will have $3.010 available after meeting all of his montity wing operating) expenses. This wount could vary by bius To assess the potential impact of the notional borrowing on his fnancial leverage, calculate the DFL in tabular form for both the current and proposed loan payments using Max's available $3.010 as a base and a 11% change b. Can Max afford the additional loan payment? c. Should Max take on the additional loan payment? Current DFL Available for making loan payments S Less Existing monthly loan payments $ Available after loan payments $ Complete the table below to compute the proposed DFL: (Round to the nearest dolar and the percentage change to one decimal place.) Proposed DFL Available for making loan payments $ -11% $ Less: Proposed monthly loan payments S Available after loan payments $ The current DFL . . Round to two decimal places) The proposed DFL 6. (Round to two decimal places) b. Can Max afford the additional loan payment? (Select from the drop-down menu) afford the additional loan payment. c. Should Max take on the additional loan payment? Is the statement below true or false? v Select from the drop-down menu) *Although it appears that Max can afford the additional loan payments, he must decide given the variability of his income, he would feel comfortable with the increased financial leverage and risk $ $$ Max Financial leverage Max Small has outstanding school fans that require a monthly payment of $1,090. He needs to buy a new car for work and estimates that this purchase wild 5354 per month to his existing monthly obligations, Max will have $3.010 avatable after meeting of a monthly Iving (operating) expenses. This wount could vary by plus or minus 11% To uses the potential impact of the additional borrowing on his financial leverage calculate the DFL in tabular form for both the current and proposed loan payments using Max's available $3.010 as a base and a 11% change b. Can Max afford the additional loan payment? c. Should Max take on the additional loan payment? a. To see the potential impact of the additional borrowing on a financiar leverage, calculate the DPL tabular form for both the current and proposed toon paymarta using Max'a available $3,010 as a base and a 11% change Complete the table below to compute the current DFL: (Round to the nearest dotat and the percentage charge to na decimal place) Current DFL Available for making loan payments +11 Less Existing monthly loan payments 5 Available atter loan payments 5 Complete the table below to compute the proposed DFL (Round to the nearest dollar and the percentage change to one decimal place) Proposed DFL Available for making loan payments $ . 115 $ Loss: Proposed monthly foon payments 5 5 Available after loan payments $ %$ The current DFL 1. (Round to two decimal piacon.) The proposed DFL s). (Round to two decimal places) b. Can Max afford the additional loan payment? (Select from the drop-down menu.) Max Vafford the additional loan payment c. Should Max take on the additional loan payment? Financial leverage Max Smail has standing school tons that require a monthly payment of $1,090. He needs to buy now for work and the chose 164 per month to his existing monthly obligation Max will have $3.010 available hermeting all of his mothy living operating expenses. This mouto vary by us11 2. To assess the potential impact of the additional borrowing on his financial leverage calculate the OFL in tabut form for both the current and pred naman ang vable $3.010 as a base and a change b. Can Max afford the additional loan payment? c. Should Max take on the additional loan payment? Current OIL Available for making loan payments 5 11 5 Les Existing monthly loan payments 5 S Available after loan payments $ Complete the table below to compute the proposed DFL: (Round to the nearest dolls and the percentage change to one decimal place Proposed DFL Available for making loan payments +11% 5 Less: Proposed monthly loan payments 5 Available after loan payment %5 The current OFL.) (Hound to two decimal places) The proposed DFU 18. Round to two decimal places) b. Can Max afford the additional loan payment? (Select from the drop-down menu) Max afford the additional loan payment. c. Should Max take on the additional loan payment? Is the statement below true or false? (Select from the drop-down menu) "Although it appears that Max can afford the additional loan payments, he must decide it given the variability of his income, he would feel comfortable with the increased financial levera and risk Financial leverage Max Small has outstanding school loans that require a monthly payment of $1,090. He needs to buy a new car for work and estimates that this purchase will add 5354 per month to his existing monthly obligations Max will have $3,010 available after meeting all of his monthly living (operating) expenses. This amount could vary by plus or minus 115 a. To assess the potential impact of the additional borrowing on his financial leverage calculate the DFL in tabular form for both the current and proposed loan payments using Maxs available $3.010 as a base and a 11% change b. Can Max afford the additional loan payment? c. Should Max take on the additional loan payment? DEE