Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Management 1. ABC Limited has four (4) investment projects with the following costs and expected rates of return. All projects are independent of each

Financial Management

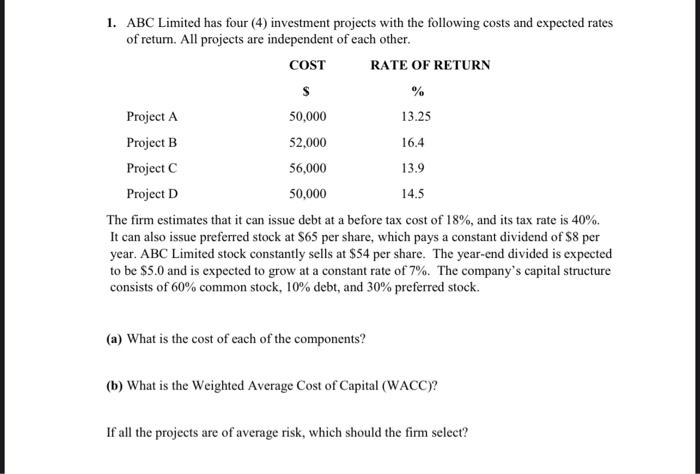

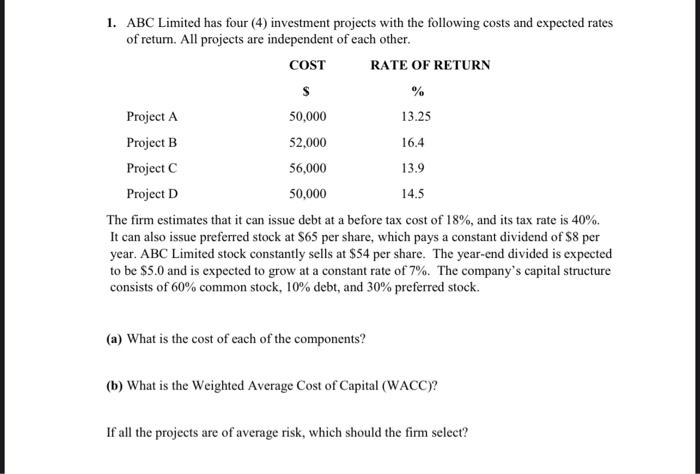

1. ABC Limited has four (4) investment projects with the following costs and expected rates of return. All projects are independent of each other. The firm estimates that it can issue debt at a before tax cost of 18%, and its tax rate is 40%. It can also issue preferred stock at $65 per share, which pays a constant dividend of $8 per year. ABC Limited stock constantly sells at $54 per share. The year-end divided is expected to be $5.0 and is expected to grow at a constant rate of 7%. The company's capital structure consists of 60% common stock, 10% debt, and 30% preferred stock. (a) What is the cost of each of the components? (b) What is the Weighted Average Cost of Capital (WACC)? If all the projects are of average risk, which should the firm select

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started