Answered step by step

Verified Expert Solution

Question

1 Approved Answer

financial management 6 A portfolio containing at least one pair of securities with a cormelation coefficient less than 1.0 but greater than O will have

financial management

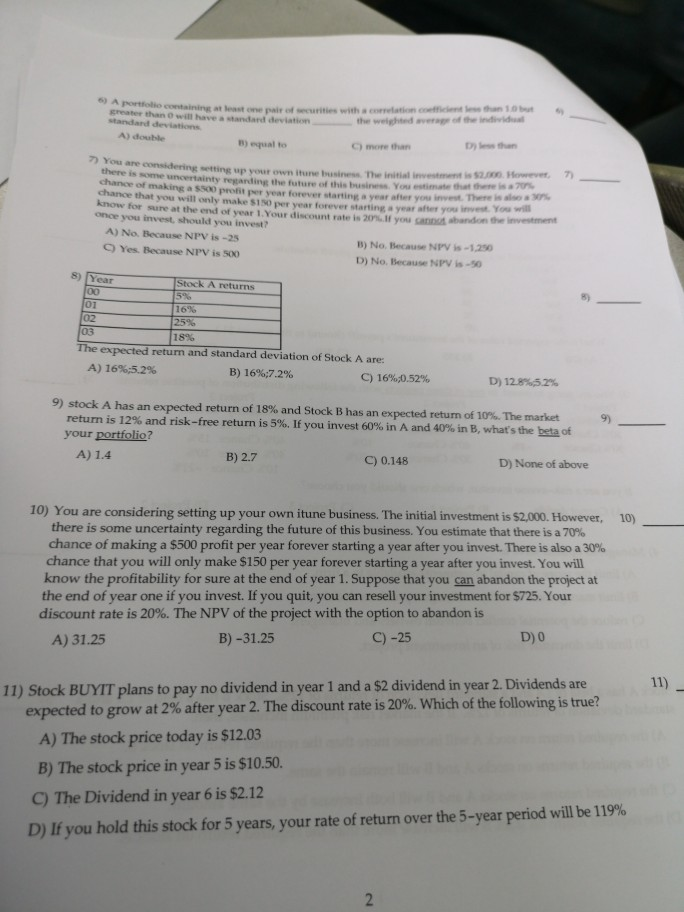

6 A portfolio containing at least one pair of securities with a cormelation coefficient less than 1.0 but greater than O will have a standard deviation standard deviations the weighted average of the individual A) double D) less than B) equal to C) more than 7 You are considering setting up your own itune business The initial investment is $2,000 However, 7) there is some uncertainty reganding the future of this businessYou estimate that thene is a 70% chance of making a $500 profit per year forever starting a year after you invest. There is also a 30% chance that you will only make $150 per year forever starting a year after you invest. You will know for sure at the end of year 1,Your discount rate is 20%1f you canot abandon the investment once you invest, should you invest? A) No. Because NPV is-25 B) No. Because NPV is-1250 9 Yes. Because NPV is 500 D) No. Because NPV is-50 8) Year Stock A returns 00 01 02 5% 16% 25% 03 18% The expected return and standard deviation of Stock A are A) 16% : 5.2%% B) 16% ;7.2 % C) 16 %,0.52 % D) 12.8 % 52 % 9) stock A has an expected return of 18 % and Stock B has an expected return of 10%. The market return is 12% and risk-free return is 5%. If you invest 60% in A and 40% in B, what's the beta of your portfolio? 9) A) 1.4 B) 2.7 C) 0.148 D) None of above 10) You are considering setting up your own itune business. The initial investment is $2,000. However, there is some uncertainty regarding the future of this business. You estimate that there is a 70% chance of making a $500 profit per year forever starting a year after you invest. There is also a 30% chance that you will only make $150 per year forever starting a year after you invest. You will know the profitability for sure at the end of year 1. Suppose that you can abandon the project at the end of year one if you invest. If you quit, you can resell your investment for $725. Your discount rate is 20%. The NPV of the project with the option to abandon is 10) D) 0 C) -25 B) -31.25 A) 31.25 11) Stock BUYIT plans to pay no dividend in year 1 and a $2 dividend in year 2. Dividends are expected to grow at 2% after year 2. The discount rate is 20%. Which of the following is true? 11) A) The stock price today is $12.03 B) The stock price in year 5 is $10.50. C) The Dividend in year 6 is $2.12 D) If you hold this stock for 5 years, your rate of return over the 5-year period will be 119% 2 6 A portfolio containing at least one pair of securities with a cormelation coefficient less than 1.0 but greater than O will have a standard deviation standard deviations the weighted average of the individual A) double D) less than B) equal to C) more than 7 You are considering setting up your own itune business The initial investment is $2,000 However, 7) there is some uncertainty reganding the future of this businessYou estimate that thene is a 70% chance of making a $500 profit per year forever starting a year after you invest. There is also a 30% chance that you will only make $150 per year forever starting a year after you invest. You will know for sure at the end of year 1,Your discount rate is 20%1f you canot abandon the investment once you invest, should you invest? A) No. Because NPV is-25 B) No. Because NPV is-1250 9 Yes. Because NPV is 500 D) No. Because NPV is-50 8) Year Stock A returns 00 01 02 5% 16% 25% 03 18% The expected return and standard deviation of Stock A are A) 16% : 5.2%% B) 16% ;7.2 % C) 16 %,0.52 % D) 12.8 % 52 % 9) stock A has an expected return of 18 % and Stock B has an expected return of 10%. The market return is 12% and risk-free return is 5%. If you invest 60% in A and 40% in B, what's the beta of your portfolio? 9) A) 1.4 B) 2.7 C) 0.148 D) None of above 10) You are considering setting up your own itune business. The initial investment is $2,000. However, there is some uncertainty regarding the future of this business. You estimate that there is a 70% chance of making a $500 profit per year forever starting a year after you invest. There is also a 30% chance that you will only make $150 per year forever starting a year after you invest. You will know the profitability for sure at the end of year 1. Suppose that you can abandon the project at the end of year one if you invest. If you quit, you can resell your investment for $725. Your discount rate is 20%. The NPV of the project with the option to abandon is 10) D) 0 C) -25 B) -31.25 A) 31.25 11) Stock BUYIT plans to pay no dividend in year 1 and a $2 dividend in year 2. Dividends are expected to grow at 2% after year 2. The discount rate is 20%. Which of the following is true? 11) A) The stock price today is $12.03 B) The stock price in year 5 is $10.50. C) The Dividend in year 6 is $2.12 D) If you hold this stock for 5 years, your rate of return over the 5-year period will be 119% 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started