Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Management 7.32 MINICASE - 1 You have recently graduated from a business school and joined SMART INVEST as a finan- cial analyst. Your job

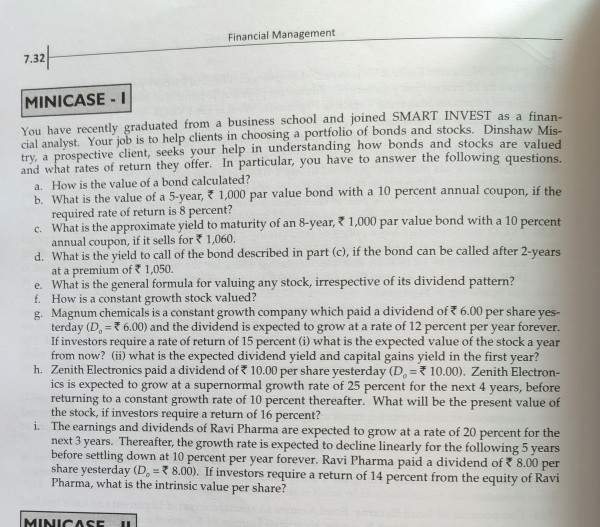

Financial Management 7.32 MINICASE - 1 You have recently graduated from a business school and joined SMART INVEST as a finan- cial analyst. Your job is to help clients in choosing a portfolio of bonds and stocks. Dinshaw Mis- try, a prospective client, seeks your help in understanding how bonds and stocks are valued and what rates of return they offer. In particular, you have to answer the following questions. a. How is the value of a bond calculated? b. What is the value of a 5-year, * 1,000 par value bond with a 10 percent annual coupon, if the required rate of return is 8 percent? c. What is the approximate yield to maturity of an 8-year, 1,000 par value bond with a 10 percent d. What is the yield to call of the bond described in part (c), if the bond can be called after 2-years at a premium of 1,050. e. What is the general formula for valuing any stock, irrespective of its dividend pattern? f. How is a constant growth stock valued? g. Magnum chemicals is a constant growth company which paid a dividend of ? 6.00 per share yes- terday (D, = 36.00) and the dividend is expected to grow at a rate of 12 percent per year forever. If investors require a rate of return of 15 percent (i) what is the expected value of the stock a year from now? (ii) what is the expected dividend yield and capital gains yield in the first year? h. Zenith Electronics paid a dividend of 10.00 per share yesterday (D. = 10.00). Zenith Electron- ics is expected to grow at a supernormal growth rate of 25 percent for the next 4 years, before returning to a constant growth rate of 10 percent thereafter. What will be the present value of the stock, if investors require a return of 16 percent? i. The earnings and dividends of Ravi Pharma are expected to grow at a rate of 20 percent for the next 3 years. Thereafter, the growth rate is expected to decline linearly for the following 5 years before settling down at 10 percent per year forever. Ravi Pharma paid a dividend of 8.00 per share yesterday (D. = 8.00). If investors require a return of 14 percent from the equity of Ravi Pharma, what is the intrinsic value per share? MINICASE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started