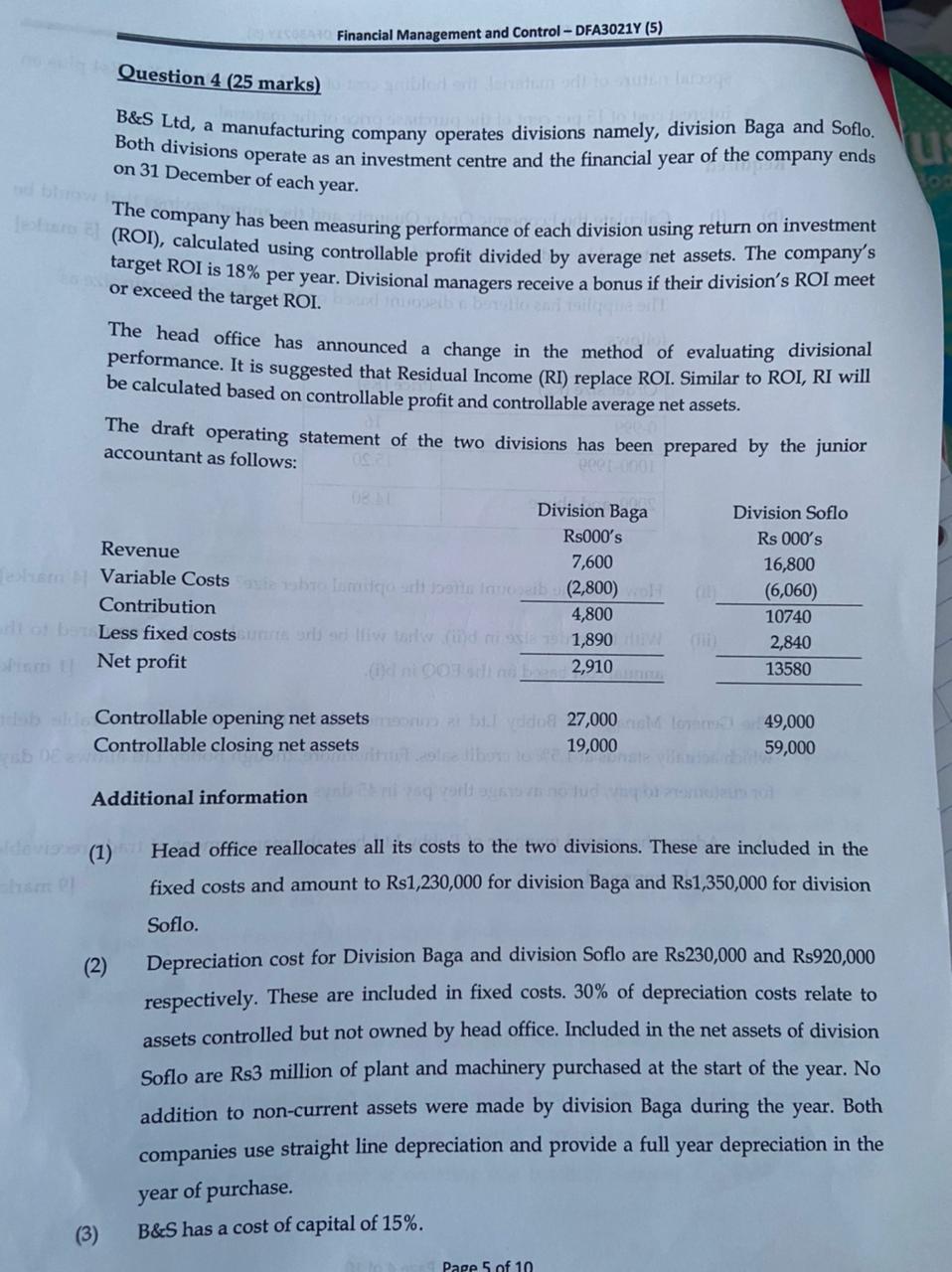

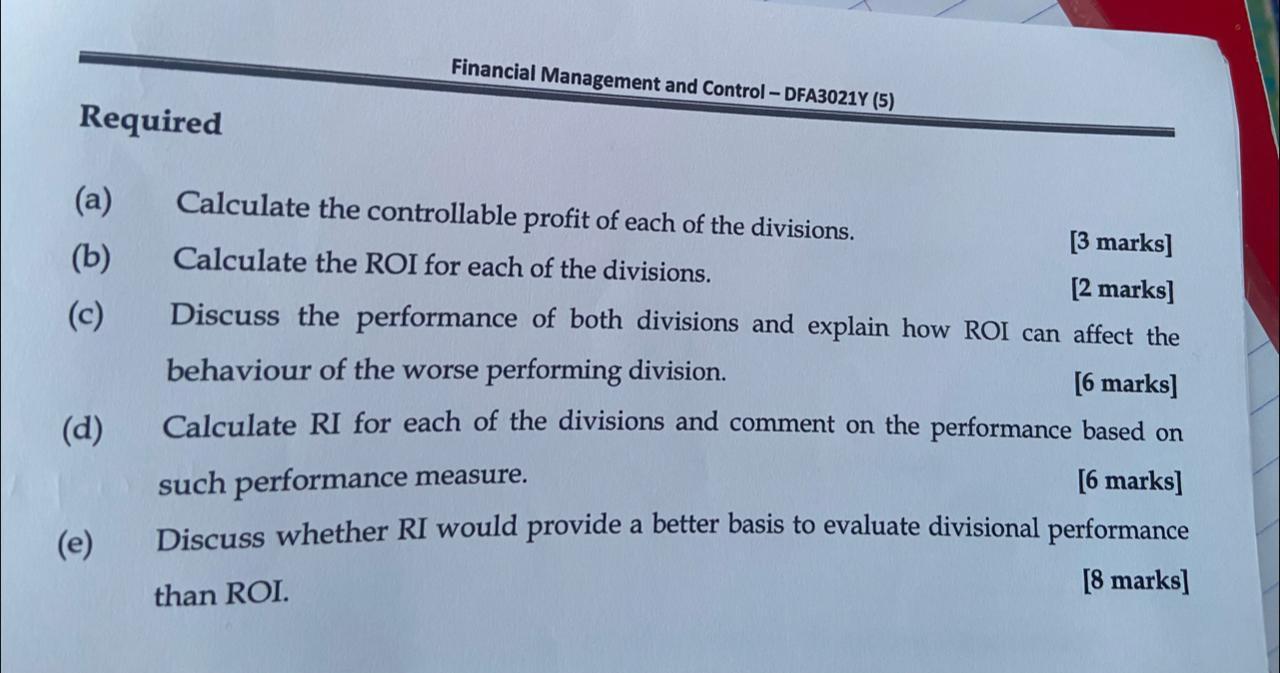

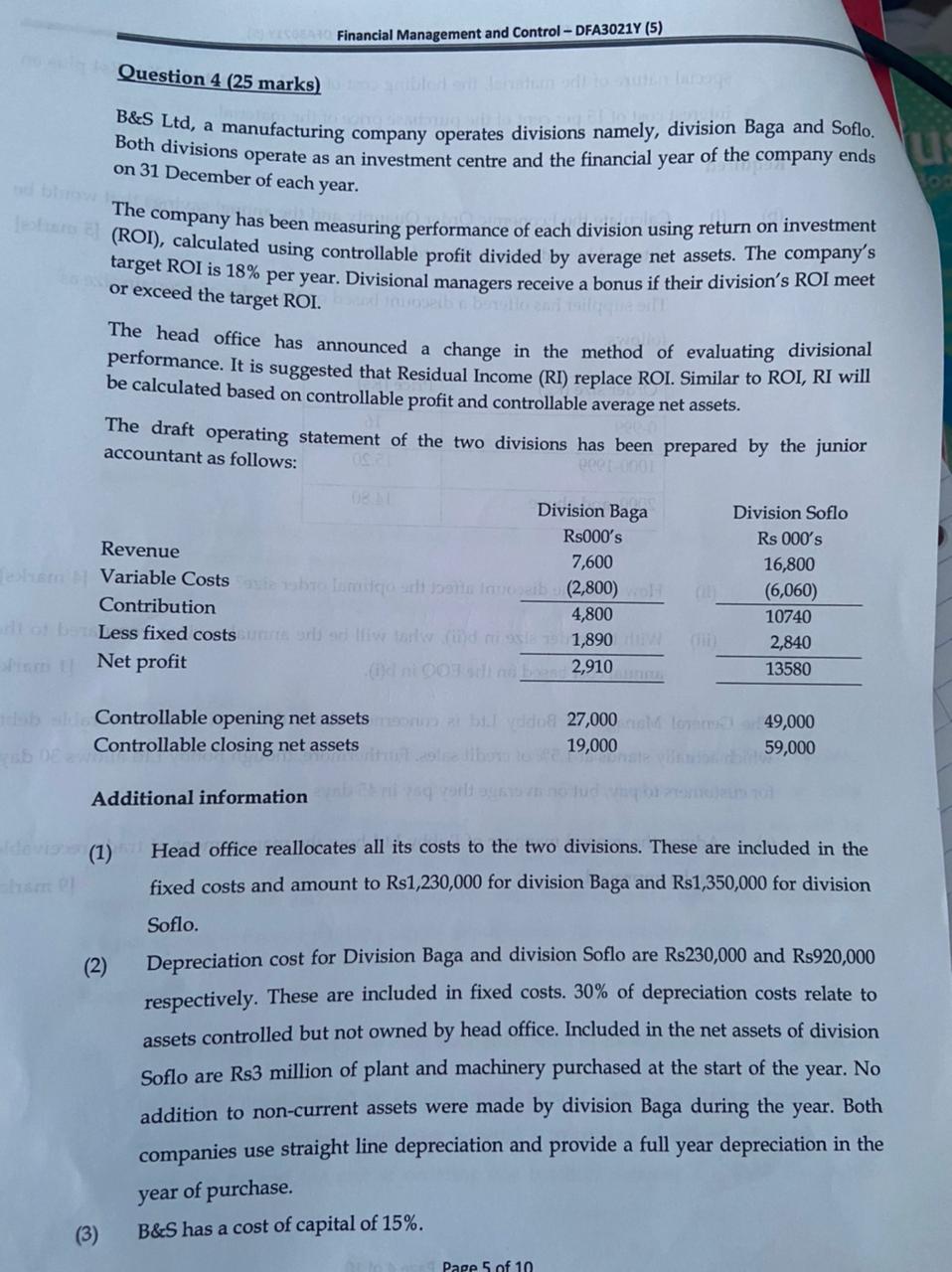

Financial Management and Control - DFA3021Y (5) Question 4 (25 marks) B&S Ltd, a manufacturing company operates divisions namely, division Baga and Soflo. Both divisions operate as an investment centre and the financial year of the company ends on 31 December of each year. The company has been measuring performance of each division using return on investment target ROI is 18% per year. Divisional managers receive a bonus if their division's ROI meet or exceed the target ROI.donal The head office has announced a change in the method of evaluating divisional performance. It is suggested that Residual Income (RI) replace ROI. Similar to ROI, RI will be calculated based on controllable profit and controllable average net assets. The draft operating statement of the two divisions has been prepared by the junior accountant as follows: S. DOO Division Baga Rs000's Revenue 7,600 Variable Costs about alib (2,800) Contribution 4,800 ob Less fixed costs and world 1,890 SimNet profit dni od 2,910 Division Soflo Rs 000's 16,800 (6,060) 10740 2,840 13580 bilControllable opening net assetsoorddo 27,000 to 49,000 Controllable closing net assets 19,000 59,000 Additional information da (1) (2) Head office reallocates all its costs to the two divisions. These are included in the fixed costs and amount to Rs1,230,000 for division Baga and Rs1,350,000 for division Soflo. Depreciation cost for Division Baga and division Soflo are Rs230,000 and Rs920,000 respectively. These are included in fixed costs. 30% of depreciation costs relate to assets controlled but not owned by head office. Included in the net assets of division Soflo are Rs3 million of plant and machinery purchased at the start of the year. No addition to non-current assets were made by division Baga during the year. Both companies use straight line depreciation and provide a full year depreciation in the year of purchase. B&S has a cost of capital of 15%. (3) Pape 5 of 10 Financial Management and Control - DFA3021Y (5) Required (a) (b) (c) Calculate the controllable profit of each of the divisions. [3 marks] Calculate the ROI for each of the divisions. [2 marks] Discuss the performance of both divisions and explain how ROI can affect the behaviour of the worse performing division. [6 marks] Calculate RI for each of the divisions and comment on the performance based on [6 marks] such performance measure. Discuss whether RI would provide a better basis to evaluate divisional performance [8 marks] than ROI. (d) (e) Financial Management and Control - DFA3021Y (5) Question 4 (25 marks) B&S Ltd, a manufacturing company operates divisions namely, division Baga and Soflo. Both divisions operate as an investment centre and the financial year of the company ends on 31 December of each year. The company has been measuring performance of each division using return on investment target ROI is 18% per year. Divisional managers receive a bonus if their division's ROI meet or exceed the target ROI.donal The head office has announced a change in the method of evaluating divisional performance. It is suggested that Residual Income (RI) replace ROI. Similar to ROI, RI will be calculated based on controllable profit and controllable average net assets. The draft operating statement of the two divisions has been prepared by the junior accountant as follows: S. DOO Division Baga Rs000's Revenue 7,600 Variable Costs about alib (2,800) Contribution 4,800 ob Less fixed costs and world 1,890 SimNet profit dni od 2,910 Division Soflo Rs 000's 16,800 (6,060) 10740 2,840 13580 bilControllable opening net assetsoorddo 27,000 to 49,000 Controllable closing net assets 19,000 59,000 Additional information da (1) (2) Head office reallocates all its costs to the two divisions. These are included in the fixed costs and amount to Rs1,230,000 for division Baga and Rs1,350,000 for division Soflo. Depreciation cost for Division Baga and division Soflo are Rs230,000 and Rs920,000 respectively. These are included in fixed costs. 30% of depreciation costs relate to assets controlled but not owned by head office. Included in the net assets of division Soflo are Rs3 million of plant and machinery purchased at the start of the year. No addition to non-current assets were made by division Baga during the year. Both companies use straight line depreciation and provide a full year depreciation in the year of purchase. B&S has a cost of capital of 15%. (3) Pape 5 of 10 Financial Management and Control - DFA3021Y (5) Required (a) (b) (c) Calculate the controllable profit of each of the divisions. [3 marks] Calculate the ROI for each of the divisions. [2 marks] Discuss the performance of both divisions and explain how ROI can affect the behaviour of the worse performing division. [6 marks] Calculate RI for each of the divisions and comment on the performance based on [6 marks] such performance measure. Discuss whether RI would provide a better basis to evaluate divisional performance [8 marks] than ROI. (d) (e)