financial management!

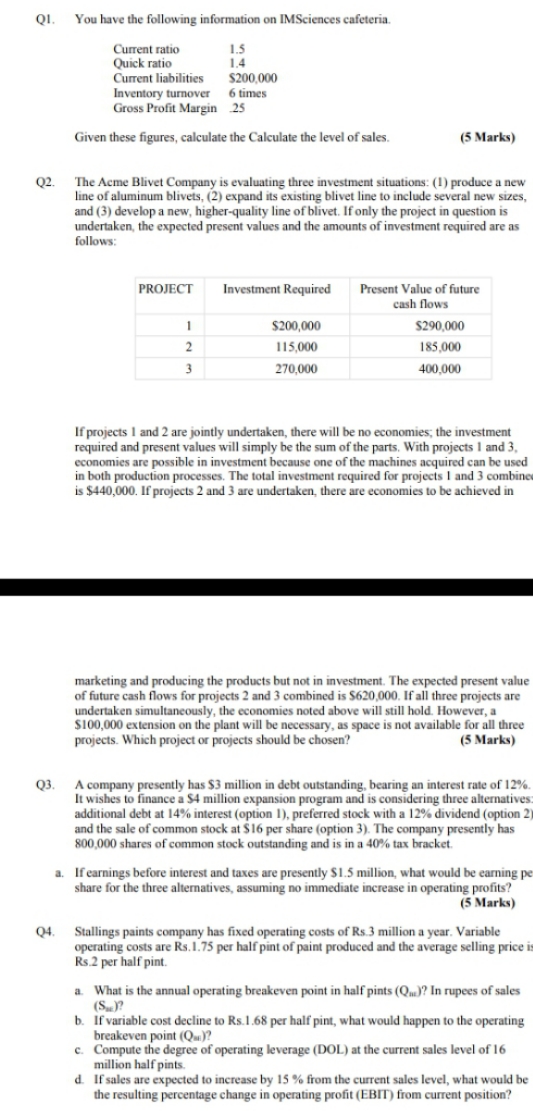

Q1. You have the following information on IMSciences cafeteria. Current ratio Quick ratio 1.5 1.4 Current liabilities $200,000 Inventory turnover 6 times Gross Profit Margin 25 Given these figures, calculate the Calculate the level of sales. (5 Marks) Q2. The Acme Blivet Company is evaluating three investment situations: (1) produce a new line of aluminum blivets, (2) expand its existing blivet line to include several new sizes, and (3) develop a new, higher-quality line of blivet. If only the project in question is undertaken, the expected present values and the amounts of investment required are as follows: PROJECT Investment Required Present Value of future cash flows $200,000 $290,000 115,000 185,000 270,000 400,000 If projects I and 2 are jointly undertaken, there will be no economies; the investment required and present values will simply be the sum of the parts, With projects 1 and 3, economies are possible in investment because one of the machines acquired can be used in both production processes. The total investment required for projects I and 3 combine is $440,000. If projects 2 and 3 are undertaken, there are economies to be achieved in marketing and producing the products but not in investment. The expected present value of future cash flows for projects 2 and 3 combined is $620,000. If all three projects are undertaken simultaneously, the economies noted above will still hold. However, a $100,000 extension on the plant will be necessary, as space is not available for all three projects. Which project or projects should be chosen? (5 Marks) Q3. A company presently has $3 million in debt outstanding, bearing an interest rate of 12%. It wishes to finance a $4 million expansion program and is considering three alternatives additional debt at 14% interest (option 1), preferred stock with a 12% dividend (option 2) and the sale of common stock at $16 per share (option 3). The company presently has 800,000 shares of common stock outstanding and is in a 40% tax bracket. a. If earnings before interest and taxes are presently $1.5 million, what would be earning p share for the three alternatives, assuming no immediate increase in operating profits? (5 Marks) Q4. Stallings paints company has fixed operating costs of Rs.3 million a year. Variable operating costs are Rs. 1.75 per half pint of paint produced and the average selling price i Rs.2 per half pint. a. What is the annual operating breakeven point in half pints (Q.)? In rupees of sales (S.)? b. If variable cost decline to Rs.1.68 per half pint, what would happen to the operating breakeven point (Qun)? c. Compute the degree of operating leverage (DOL) at the current sales level of 16 million half pints. d. If sales are expected to increase by 15 % from the current sales level, what would be the resulting percentage change in operating profit (EBIT) from current position