Financial Managment

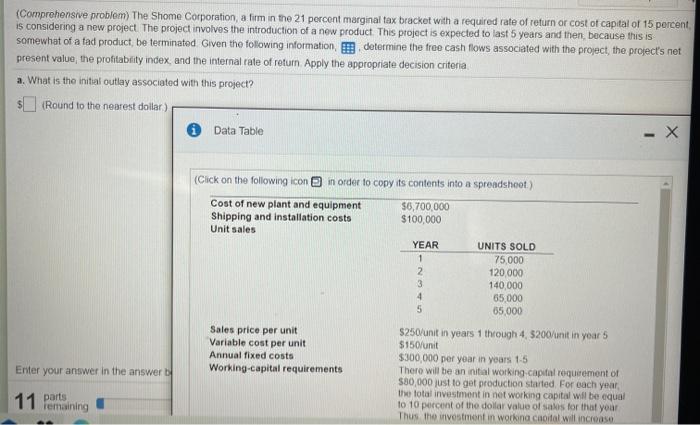

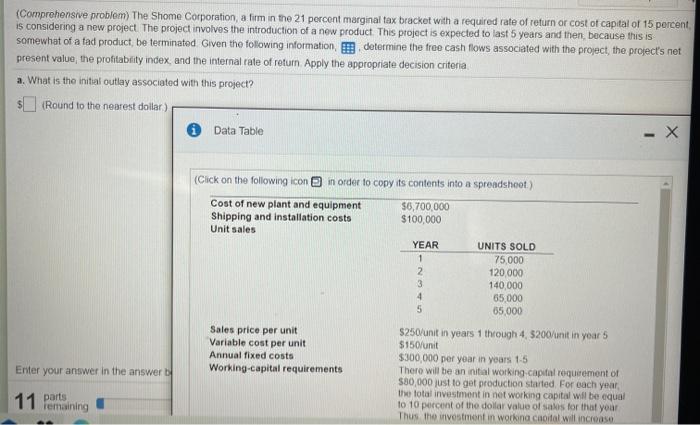

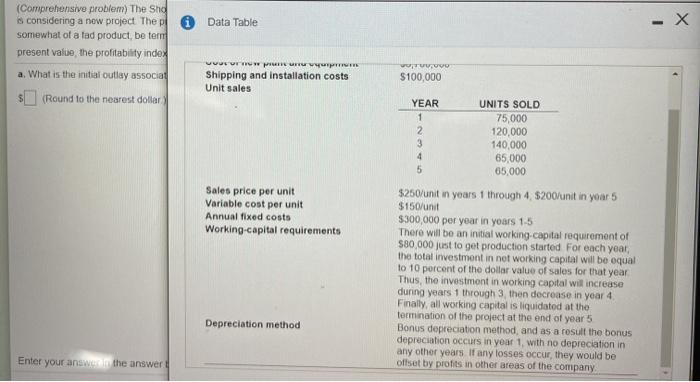

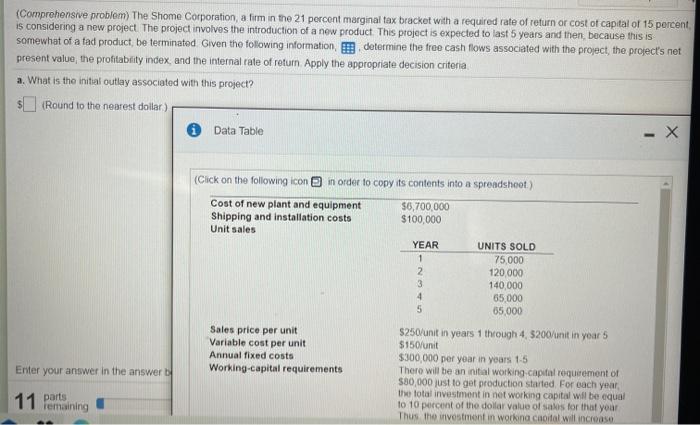

(Comprehensive problem) The Shome Corporation, a firm in the 21 percent marginal tax bracket with a required rate of return or cost of capital of 15 percent is considering a new project. The project involves the introduction of a new product. This project is expected to last 5 years and then because this is somewhat of a fad product, be terminated. Given the following information, determine the free cash flows associated with the project, the project's net present value the profitability index, and the internal rate of return Apply the appropriate decision criteria a. What is the initial outlay associated with this project? (Round to the nearest dollar) Data Table (Click on the following icon in order to copy its contents into a spreadshoot) Cost of new plant and equipment $0,700,000 Shipping and installation costs $100,000 Unit sales YEAR UNITS SOLD 1 75,000 2 120,000 3 140,000 4 65,000 5 65.000 Sales price per unit $250/unit in years 1 through 4, 5200/unit in years Variable cost per unit $150/unit Annual fixed costs $300,000 per year in years 1-5 Working-capital requirements There will be an initial working capital requirement of $80,000 just to get production started. For each year, the total investment in not working capital will be equal to 10 percent of the dollar value of sales for that your Thus the investment in working caoidal will increase Enter your answer in the answer 11 parts remaining * Data Table (Comprehensive problem) The Sho s considering a new project The p somewhat of a fad product, beter present value, the profitability index a. What is the initial outlay associat Uus puur Shipping and installation costs Unit sales wo. $100,000 (Round to the nearest dollar Sales price per unit Variable cost per unit Annual fixed costs Working-capital requirements YEAR UNITS SOLD 1 75,000 2 120,000 3 140,000 4 65,000 5 65,000 $250/unit in years 1 through 4 $200/unit in year 5 $150/unit $300,000 per year in yours 1-5 There will be an initial working-capital requirement of $80,000 just to get production started for each year, the total investment in not working capital will be equal to 10 percent of the dollar value of sales for that year Thus, the investment in working capital will increase during years 1 through 3 then decrease in year 4 Finally, all working capital is liquidatod at the termination of the project at the end of year 5 Bonus depreciation method, and as a result the bonus depreciation occurs in your 1, with no depreciation in any other years if any losses occur, they would be offset by profits in other areas of the company Depreciation method Enter your answer the