Question

Financial markets & institutions practice exam, using associated econominc theory would be very much appreciated. Have not been able to crack the terminology surrounding this.

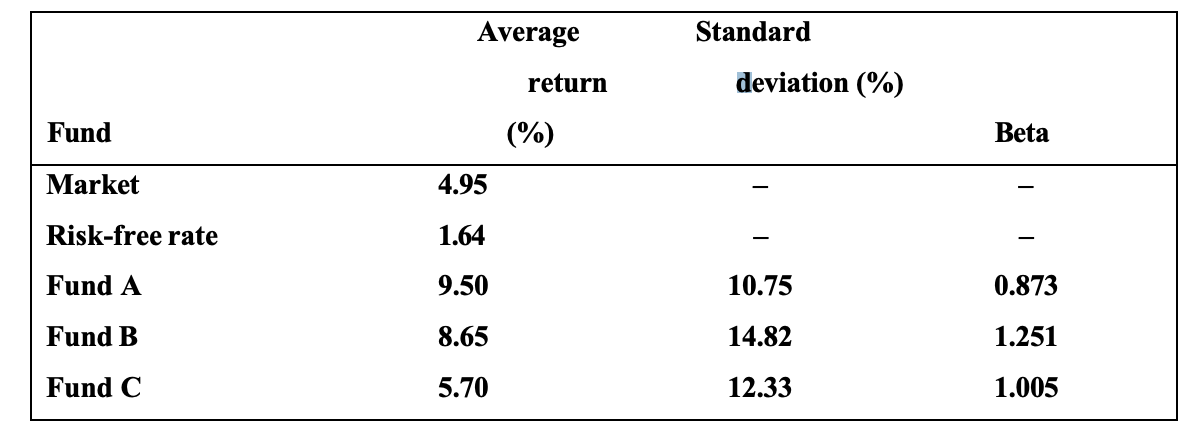

Financial markets & institutions practice exam, using associated econominc theory would be very much appreciated. Have not been able to crack the terminology surrounding this. Thank you in advance, thumbs up and review on answerer to come if adequate answer with actual detail :) Q4. Fund Management a) Managed funds are often categorised by the type of investments purchased by the fund. These include capital stable funds, balanced growth funds and managed capital growth funds. For each of these funds, discuss the types of investments the fund might accumulate and explain the purpose of the investment strategies. If Jaleel is identified as a risk-averse investor, which type of fund would you recommend Jaleel to consider investing in? (4 marks) b) The following information on the performance of three funds A, B and C in Australia. Calculate the Coefficient of variation, Sharpe and Jensen Indices of performance for these funds and interpret the results. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started