Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FINANCIAL MATH a) Ali plans to buy a house and borrow monies from CIMB Bank. The loan is repayable by an increasing annuity payable annually

FINANCIAL MATH

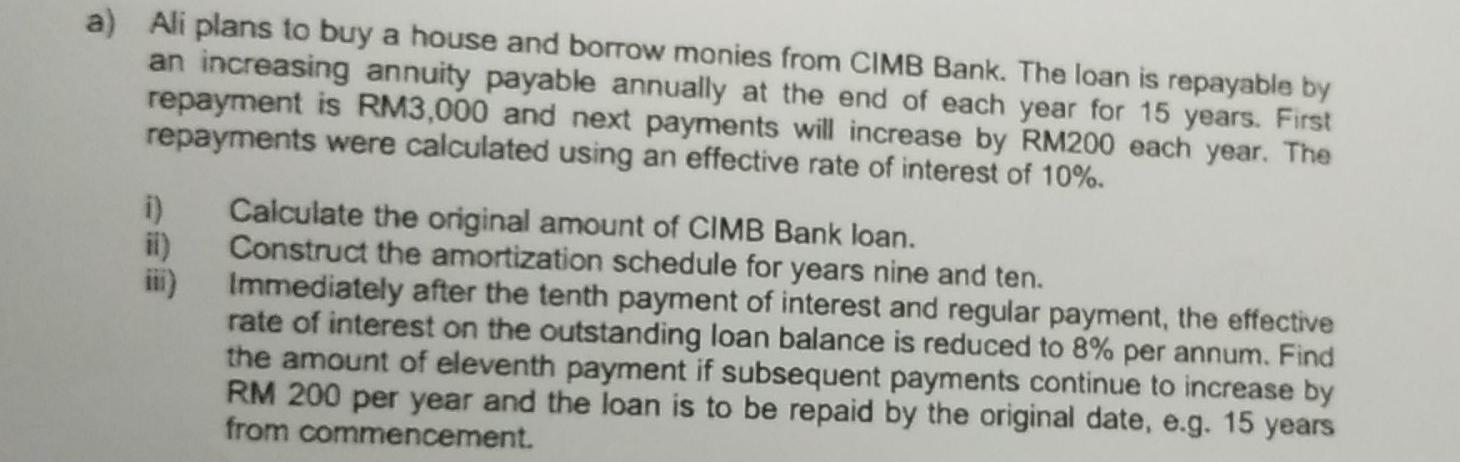

a) Ali plans to buy a house and borrow monies from CIMB Bank. The loan is repayable by an increasing annuity payable annually at the end of each year for 15 years. First repayment is RM3,000 and next payments will increase by RM200 each year. The repayments were calculated using an effective rate of interest of 10%. 1) ii) Calculate the original amount of CIMB Bank loan. Construct the amortization schedule for years nine and ten. Immediately after the tenth payment of interest and regular payment, the effective rate of interest on the outstanding loan balance is reduced to 8% per annum. Find the amount of eleventh payment if subsequent payments continue to increase by RM 200 per year and the loan is to be repaid by the original date, e.g. 15 years from commencementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started